• Push-pull. Pockets of vol. in some asset classes. US equities eased, bond yields consolidated & USD tread water. AUD & NZD held steady.

• US CPI. US Gov. shutdown ongoing. But US CPI will be released Friday night. Diverging trends between ‘goods’ & ‘services’ prices. USD vol. likely.

• AU macro. RBA Gov. Bullock speaks tomorrow. Q3 CPI due next week. Firmer inflation pressures may temper enthusiasm about RBA rate cuts.

Global Trends

There were pockets of volatility across some asset classes overnight on the back of some news headlines. But on net the moves were rather modest. Reports the Trump Administration is weighing up more restrictions on software exports to China added to underlying nervousness about the trade situation. This coupled with softer guidance about the outlook and/or underwhelming earnings reports from a few large US corporates including Tesla exerted downward pressure on US equities. The S&P500 (-0.5%) and tech-heavy NASDAQ (-0.9%) lost ground, though both remain within striking distance of their respective record highs.

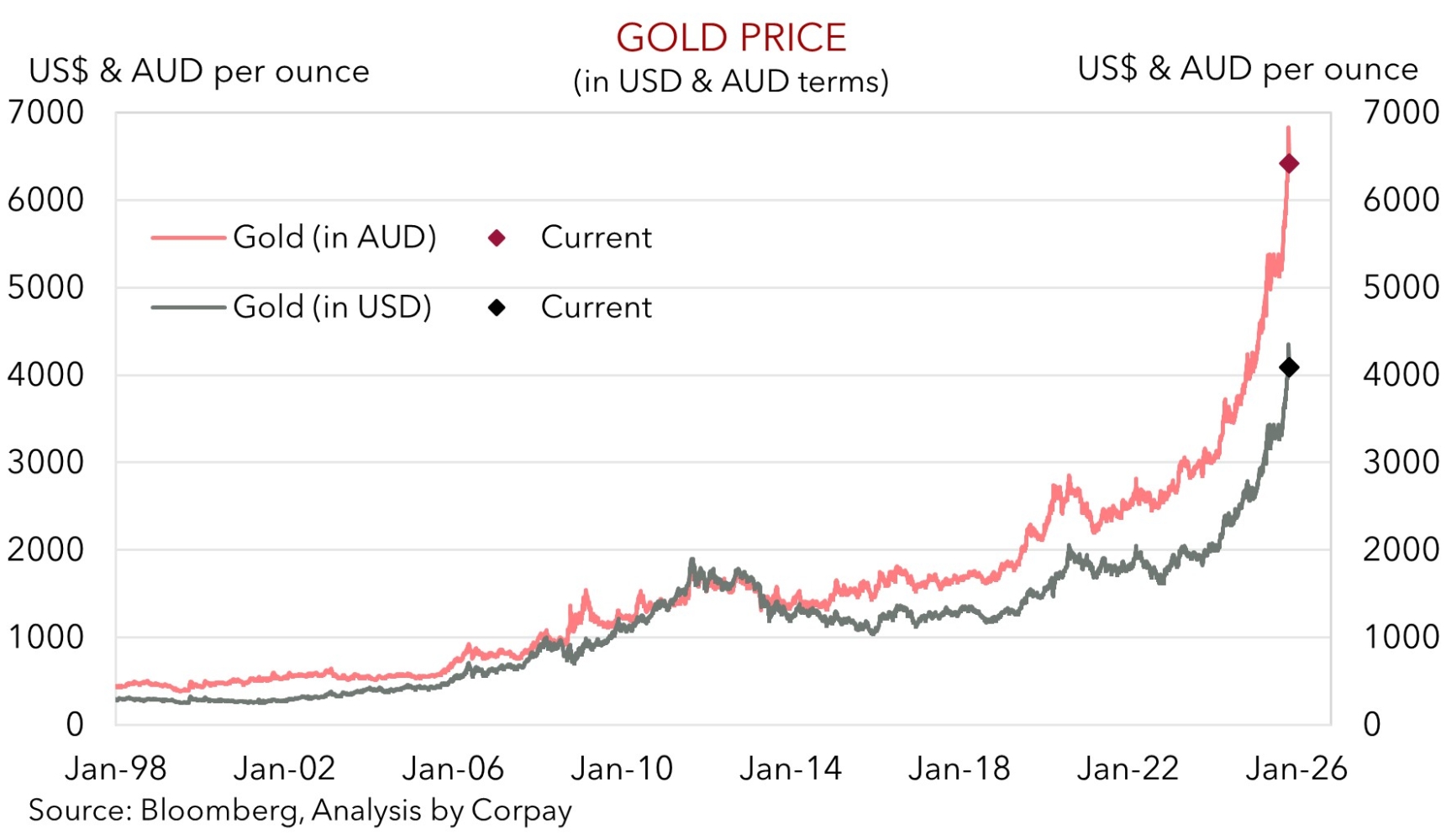

Bond yields consolidated with the benchmark US 2yr (now ~3.44%) and 10yr (now ~3.95%) rates hovering near the bottom of their multi-month ranges. FX moves were limited with the USD index treading water. EUR ticked up (now ~$1.1612), USD/JPY held steady at levels that look somewhat stretched compared to factors such as yield spreads (now ~151.97), and GBP eased a fraction (now ~$1.3358) after softer that forecast UK CPI figures opened the door a bit to further Bank of England policy easing. The NZD (now ~$0.5739) and AUD (now ~$0.6488) were little changed. Across commodities, WTI crude oil increased ~3%, but at ~$59.25/brl prices are close to 4-year lows. Gold fell again, although the dip was far smaller than the over 5% drop recorded yesterday which was the largest one-day decline since 2013. That said, as our chart shows, this comes after a parabolic rise with gold still in positive territory for the month and ~57% higher year-to-date.

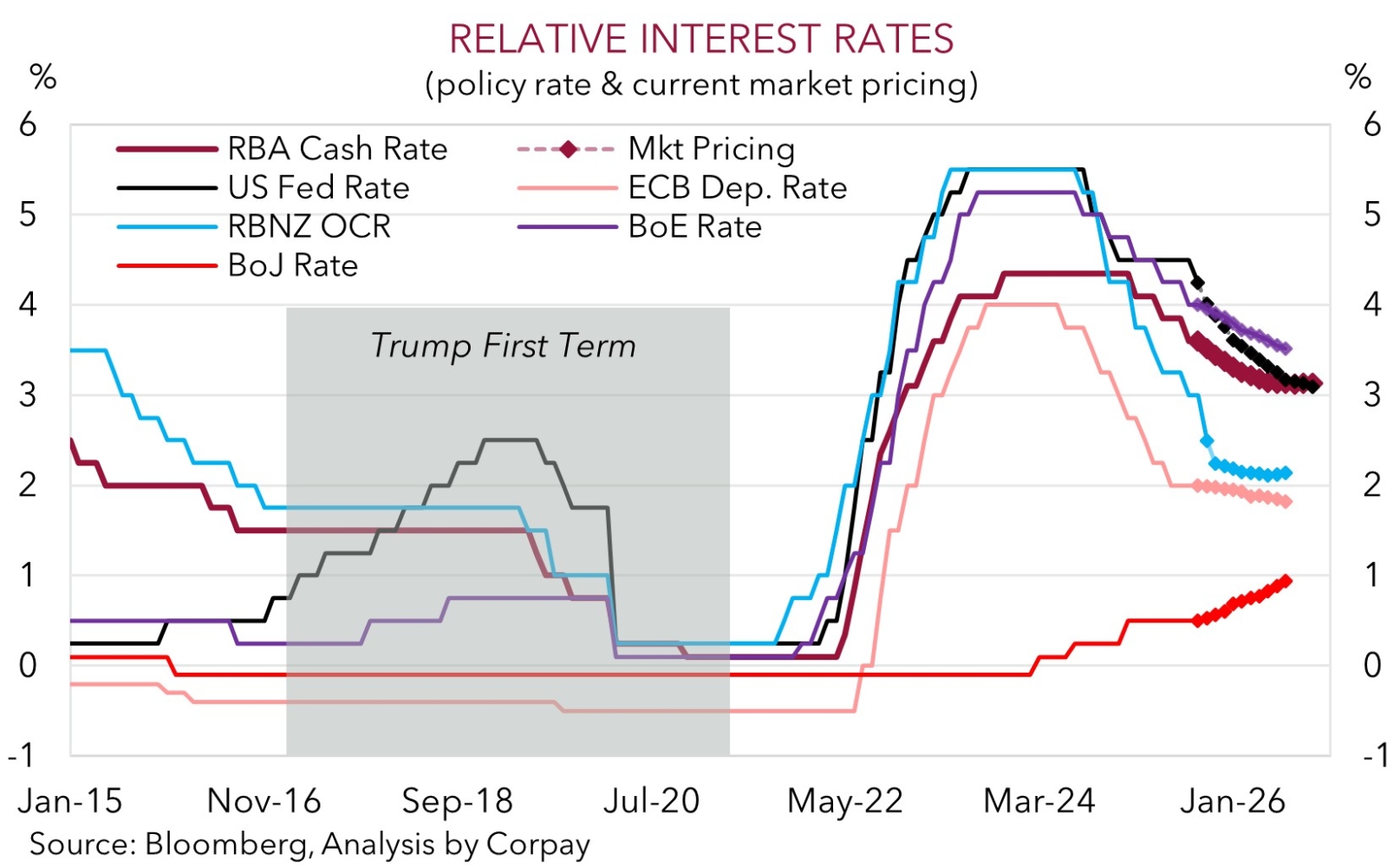

The US Government Shutdown remains in place with the current iteration now the second longest in history. The shutdown has played havoc with official US government statistics with several major releases put on ice. But with CPI inflation an important input into Social Security cost-of-living adjustments staff have been recalled to release the delayed September data later this week (Friday night AEDT). We believe more tariff related impacts might show up in US ‘goods’ prices, however softness in a few ‘services’ areas may be a more powerful force that sees core inflation undershot consensus projections. ‘Goods’ prices account for ~19% of the US CPI basket, while ‘services’ equate to ~60%. If realised, we believe this can reinforce the case for the US Fed to deliver another rate cut next week and more easing over future meetings given the US labour market wobbles. This in turn could exert downward pressure on the USD, in our view.

Trans-Tasman Zone

The isolated pockets of headline driven volatility across some asset markets overnight didn’t flow through to FX (see above). The consolidation in the USD has seen the AUD (now ~$0.6488) and NZD (now ~$0.5739) tread water over the past 24hrs. Both remain slightly below their respective 1-month averages. The AUD has also held fairly steady on the major cross-rates. AUD/GBP has nudged up a fraction (+0.1%) on the back of the softer UK CPI result while AUD/EUR (-0.1%) and AUD/CAD (-0.2%) have eased a bit. Elsewhere, AUD/CNH (now ~4.62) is tracking near its 1-year average, and AUD/NZD (now ~1.1306) remains towards the upper end of its cyclical range with relative economic and interest rate trends still in Australia’s favour, in our opinion.

Locally, RBA Governor Bullock is due to speak tomorrow. Interest will be on whether she provides a view on the recent uptick in Australian unemployment. As outlined earlier this week, we think markets may have jumped to aggressively to the volatile jobs data and are pricing in too high a chance of a RBA rate cut in November (the market is assigning it a ~60% probability). In our assessment, while Australian labour market conditions are cooling broader measures still don’t show a significant loosening with the average of the unemployment rate over Q3 broadly in line with the RBA’s ~4.3% projection. Moreover, based on the partial monthly indicator Q3 inflation (due 29 October) may come in north of the RBA’s forecasts. We think confirmation in the upcoming quarterly CPI that the inflation pulse remains firm could temper the markets enthusiasm about near-term RBA rate cuts, which if realised may give the AUD a helping hand.

Ahead of the Australian quarterly CPI the AUD (and NZD) will also have to contend with the delayed US inflation data (released Friday night AEDT). As discussed above, we believe US core inflation risks undershooting consensus forecasts because of softer ‘services’ prices. If this ends up being the case we think expectations looking for a series of US Fed interest rate cuts should be reinforced and this in turn might generate some renewed downward pressure on the USD.