• Jitters return. Post-US Fed optimism faded. Equities slipped back. USD index rose. NZD & AUD depreciated. AUD near ~$0.63, its March average.

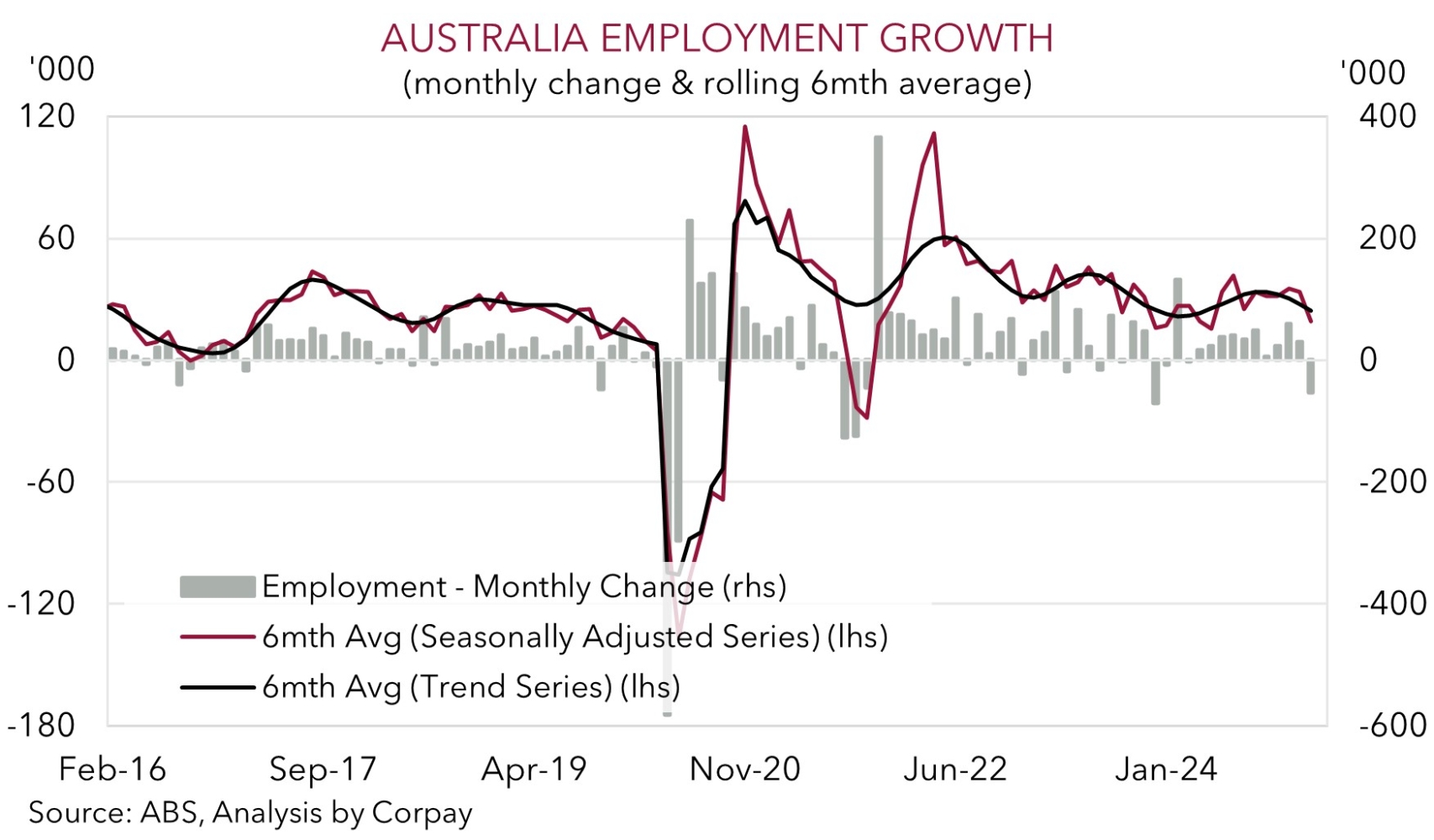

• AU jobs. February figures had more noise than signal. Employment fell but unemployment held steady. RBA shouldn’t jump at one month’s data.

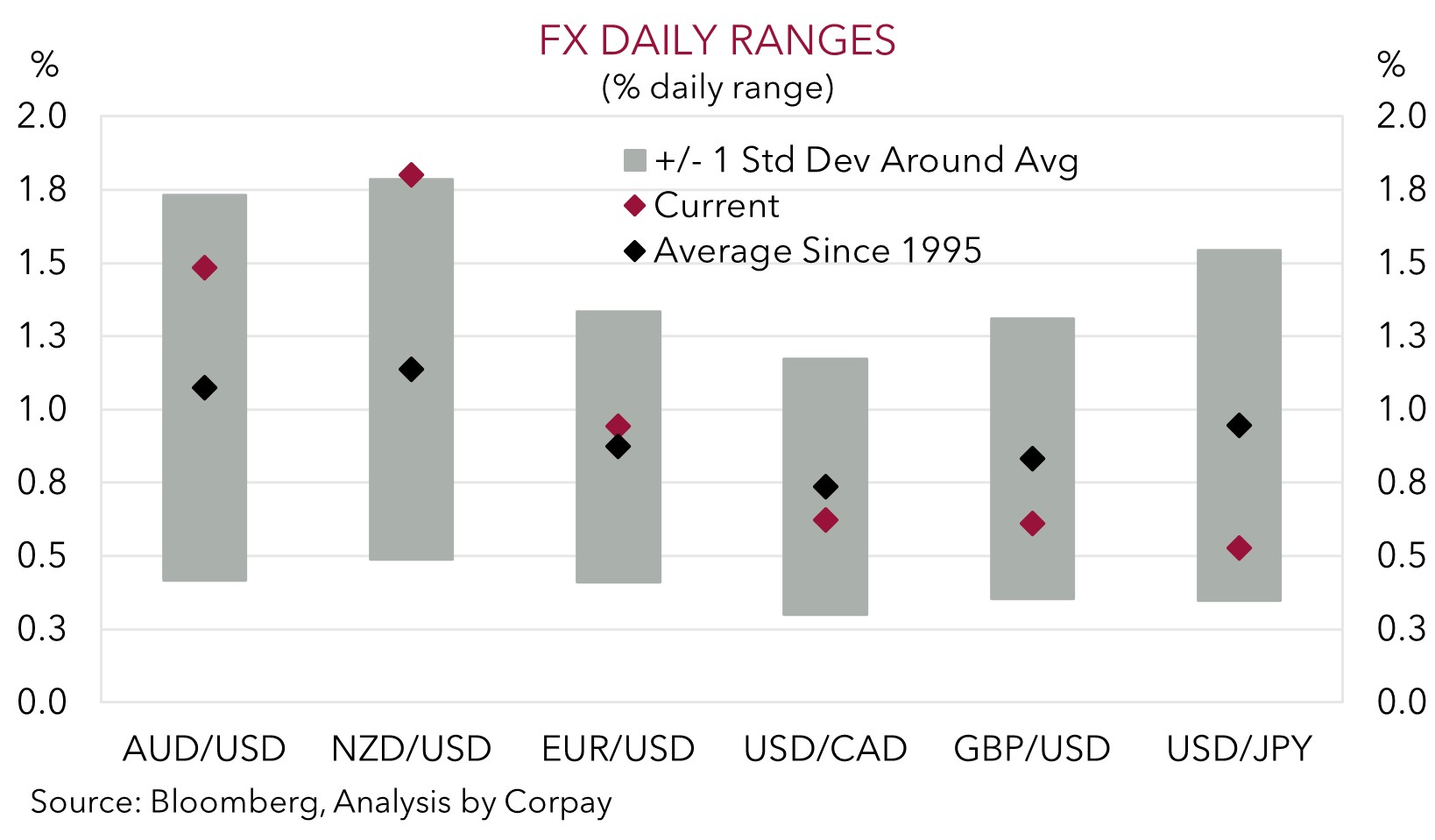

• Trading ranges. Yesterdays intra-day swing in AUD & NZD was larger than average. More vol. likely as the US’ 2 April ‘reciprocal tariff’ day nears.

Global Trends

The burst of market optimism, particularly in equities and cyclical currencies, after yesterday’s US Fed meeting when Chair Powell outlined that the tariff impact on inflation could be “transitory”, faded overnight. The major European and US stock markets slipped back by ~0.2-1.2%, with underperformance in Asia also unhelpful (Hong Kong’s Hang Seng index tumbled 2.2%). US bond yields ticked a bit lower with the benchmark US 10yr rate tracking below its 1-year average (now ~4.24%).

In FX, the USD index benefitted from the renewed jitters with EUR (the major USD alternative) falling towards ~$1.0850 (a 1-week low). USD/JPY tread water under ~149 and GBP consolidated around ~$1.2966. As expected, the Bank of England kept interest rates on hold at 4.5%. The BoE reiterated that rates are on a “gradually declining path”, but caution is needed given fast-moving global events and uncertain impact they may have on growth and inflation. Markets are only fully pricing in the next BoE interest rate reduction by August, with another move after that discounted by February. Elsewhere, NZD (now ~$0.5757) and AUD (now ~$0.6300) lost ground with nerves about the global outlook re-emerging. The latter was also weighed down by the negative surprise in the latest Australian jobs figures (see below), though even a positive surprise in Q4 NZ GDP couldn’t prop up the NZD with global forces in the driver’s seat.

As illustrated by the choppiness in markets over the past few weeks sentiment remains fragile and can turn quickly in either direction. The outlook is uncertain, and we think there could be more bursts of volatility over the short-term, particularly in and around the announcement of US ‘reciprocal’ tariffs which are due to be unveiled on 2 April. Renewed bouts of market turbulence may generate some intermittent USD strength. But, over the medium-term we remain of the opinion that the USD should trend lower as growth differentials between the US and other major nations converge, and as a loosening in US labour market conditions brings interest rate cuts by the US Fed back on the agenda. Markets are factoring in the next Fed move by July with three cuts assumed by January.

Trans-Tasman Zone

The turn in sentiment on the back of renewed uncertainty supported the USD overnight and exerted downward pressure on cyclical assets like equities, the NZD, and the AUD (see above). At ~$0.5757 the NZD is down close to where it started the week, while the AUD (now ~$0.6300) is broadly inline with its March average. Notably, the NZD fell despite yesterday’s better than expected Q4 NZ GDP data, although the AUD did underperform against the other major currencies with the softer Australian jobs report a factor. AUD declined by ~0.4-0.9% versus the EUR, JPY, GBP, CAD, and CNH over the past 24hrs.

In terms of Australian employment we think the February data had more noise than signal. Employment fell 52,800 in the month with the sizeable drop in the participation rate helping keep the unemployment rate steady at 4.1%. Indeed, if you look under the hood the number of unemployed people declined with the ABS noting fewer older workers returned to work in February. These factors suggest there could have been more older workers voluntarily choosing to exit the jobs market rather than there being a deterioration in overall conditions. We don’t believe the RBA will jump at one data point. Policymakers prefer to look at the smoother “trend” series which strips out monthly volatility. On this basis employment rose in February and unemployment is still at ‘tight’ levels. In our opinion, the RBA should hold firm in early April with the 20 May gathering the next ‘live’ meeting for another rate cut.

On net, as we have repeatedly stressed, more bouts of AUD volatility should be anticipated as 2 April approaches. This is when the US will make its broader ‘reciprocal tariff’ announcements. As our chart above shows, yesterday’s intra-day swing in the AUD was slightly larger than the long-run average. Participants may have forgotten about the AUD’s volatility given it has only experienced above average daily trading ranges about ~1/3 of the time over the past two-years.

However, over the medium-term we continue to believe there is more upside than downside potential for the AUD. A decent amount of negativity still looks factored in with the AUD running ~4 cents below our ‘fair value’ models. The AUD has also not traded much below where it is over the past decade (AUD has only closed below $0.63 ~3% of the time since 2015). Structural dynamics that supported the AUD down here (i.e. Australia’s improved capital flow trends and higher terms of trade) remain. As mentioned before, we also think any tariff induced export pain in China should be offset via measures aimed at boosting commodity-intensive infrastructure investment. This is AUD supportive given this is where Australia’s key exports are plugged into. A stronger EUR stemming from increased European fiscal spending and JPY due to BoJ rate hikes may also be indirect AUD supports via drags created on the USD.