A global selloff in long-term government bond markets is extending this morning amid a wholesale reappraisal of sovereign debt and inflation risks. Thirty-year securities are coming under the heaviest pressure, with US Treasury yields hovering near 5 percent, Japanese ultra-long bonds holding near record highs*, and British gilts offering their highest rates since 1998. Shorter-dated yields remain comparatively stable, but curves are steepening across the advanced economies as investors demand higher premiums for holding long-term debt.

We think technical factors are at work, to some extent. After a later-summer lull, bond markets have been flooded with new issuance in recent days, and investors are struggling to choke it down. This is likely to ease over the coming weeks.

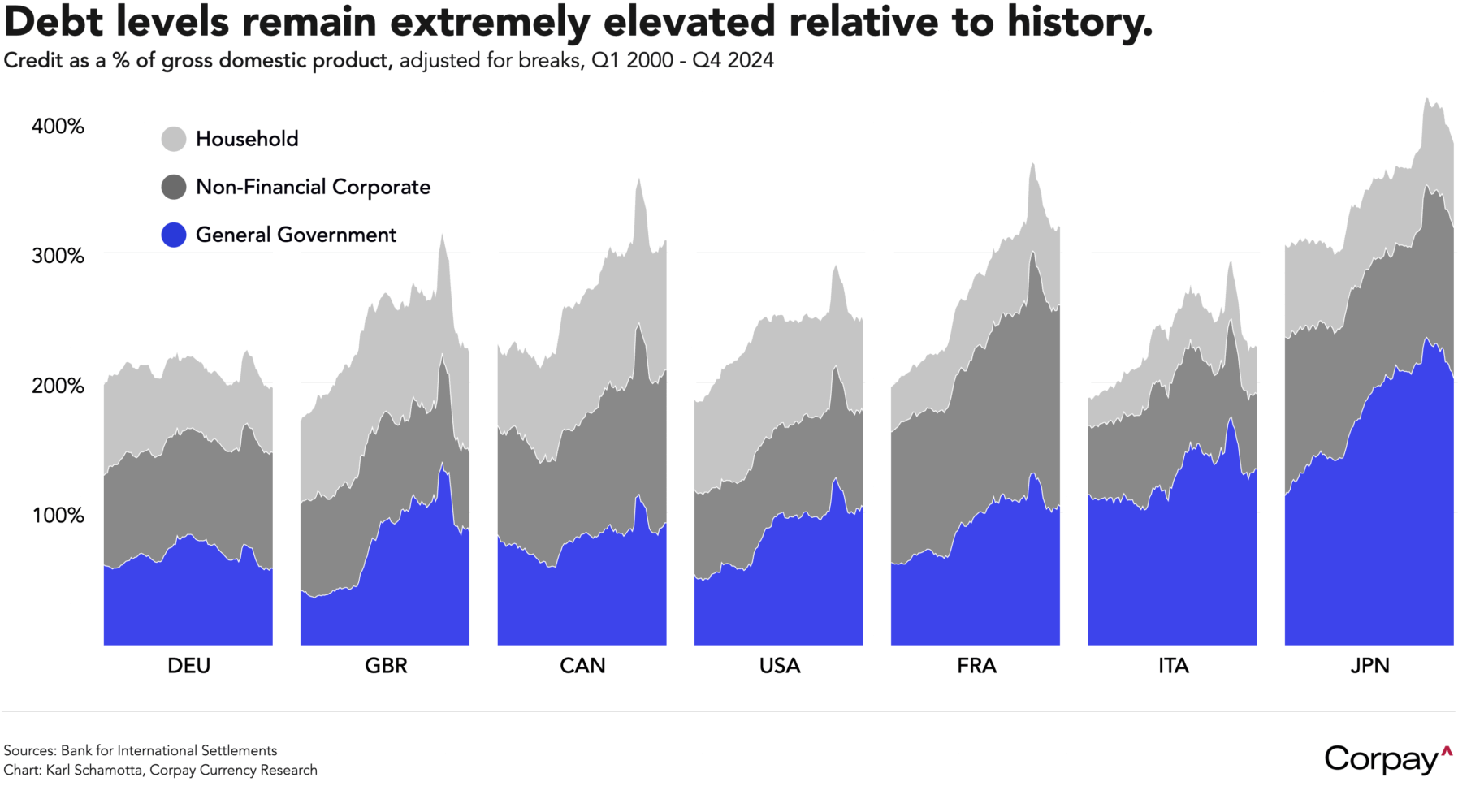

But deeper strains are emerging. With the Trump administration stepping up its attacks on the Federal Reserve, price pressures building amid a global retreat from free trade, and governments displaying no interest in reining in spending, markets are growing fearful that a period of “fiscal dominance”—in which central banks are forced to keep interest rates artificially low in order to restrain borrowing costs—is getting underway, threatening to unleash another bout of above-target inflation. Across the advanced economies, debt-to-gross domestic product ratios have fallen from their post-pandemic highs**, yet remain at extremes not seen since the Second World War, and could rise in the years ahead if productivity gains fail to offset deteriorating demographics. After decades of quiescence, today’s debt-driven market themes could prove surprisingly durable.

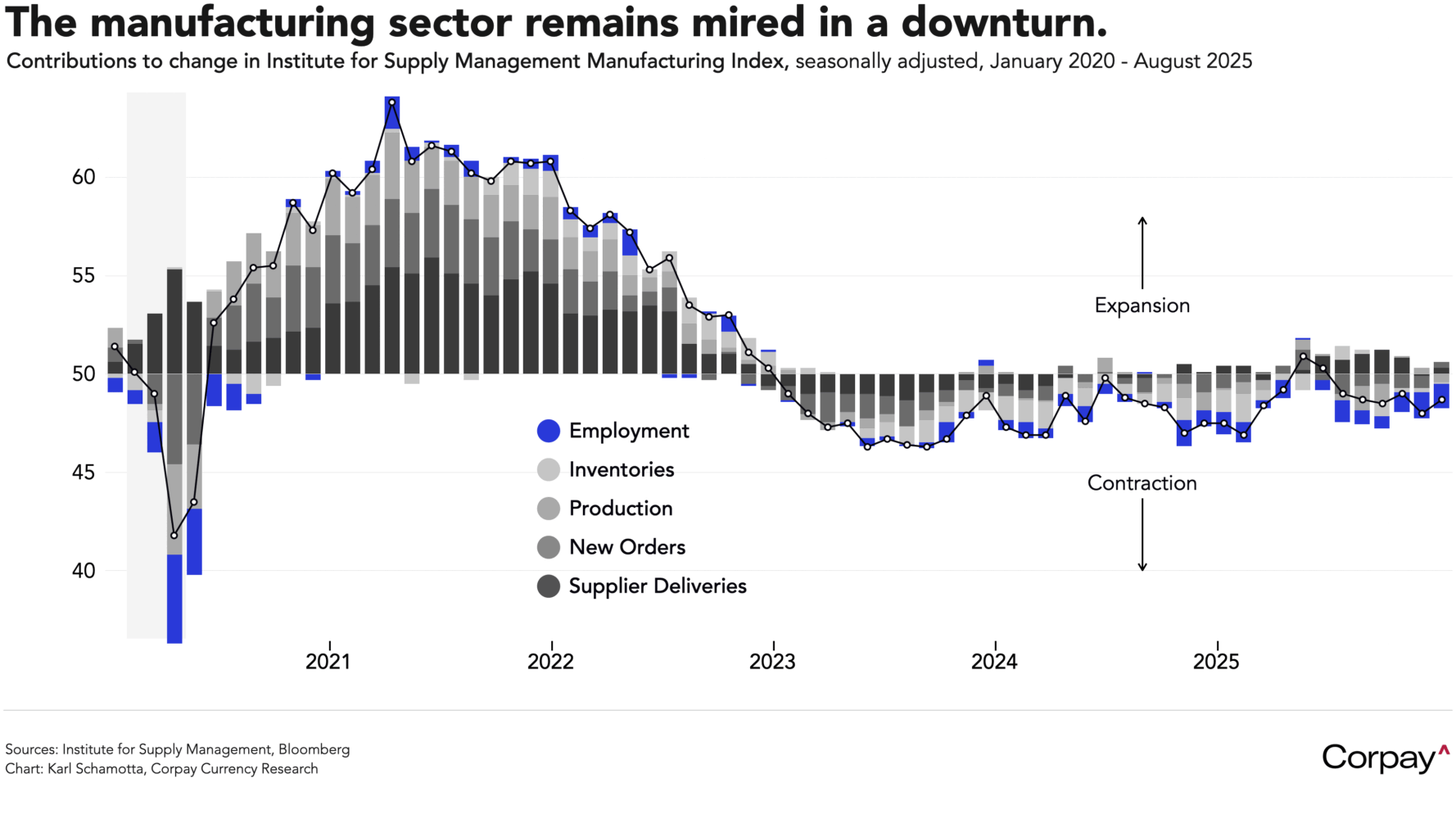

Stagflation fears intensified in US markets during yesterday’s session after the Institute for Supply Management’s survey showed manufacturing activity shrinking for a sixth month, even as price pressures grew. The headline purchasing manager index inched up to 48.7 in August from 48.0 in the prior month, but remained below the 50 threshold that separates expansion from contraction, while a modest improvement in the new orders index was offset by a decline in production. Susan Spence, Chair of the Survey Committee, noted that for every optimistic response regarding new orders, there were “2.5 comments expressing concern about near-term demand, primarily driven by tariff costs and uncertainty,” with some calling the current business environment “much worse than the Great Recession” in 2008. In a sign that inflation could rise once early-year inventories are wound down, the prices-paid index eased only marginally to 63.7 from 64.8 the prior month, remaining historically elevated.

Two releases today—the Job Openings and Labor Turnover report and the Fed’s Beige Book survey—could trigger modest repositioning shifts ahead of Friday’s non-farm payrolls report. Economists think the ratio of vacancies to unemployed softened again in July as businesses turned more cautious, but few expect to see a change in the layoff and discharge rate as slow-to-hire, slow-to-fire dynamics remain intact. The quits rate—an indicator of overall worker confidence—is also seen holding steady. The Fed’s compendium of anecdotes could show a slight brightening in spirits for August, but sentiment is also likely to remain well below historical norms as businesses brace for more margin compression ahead.

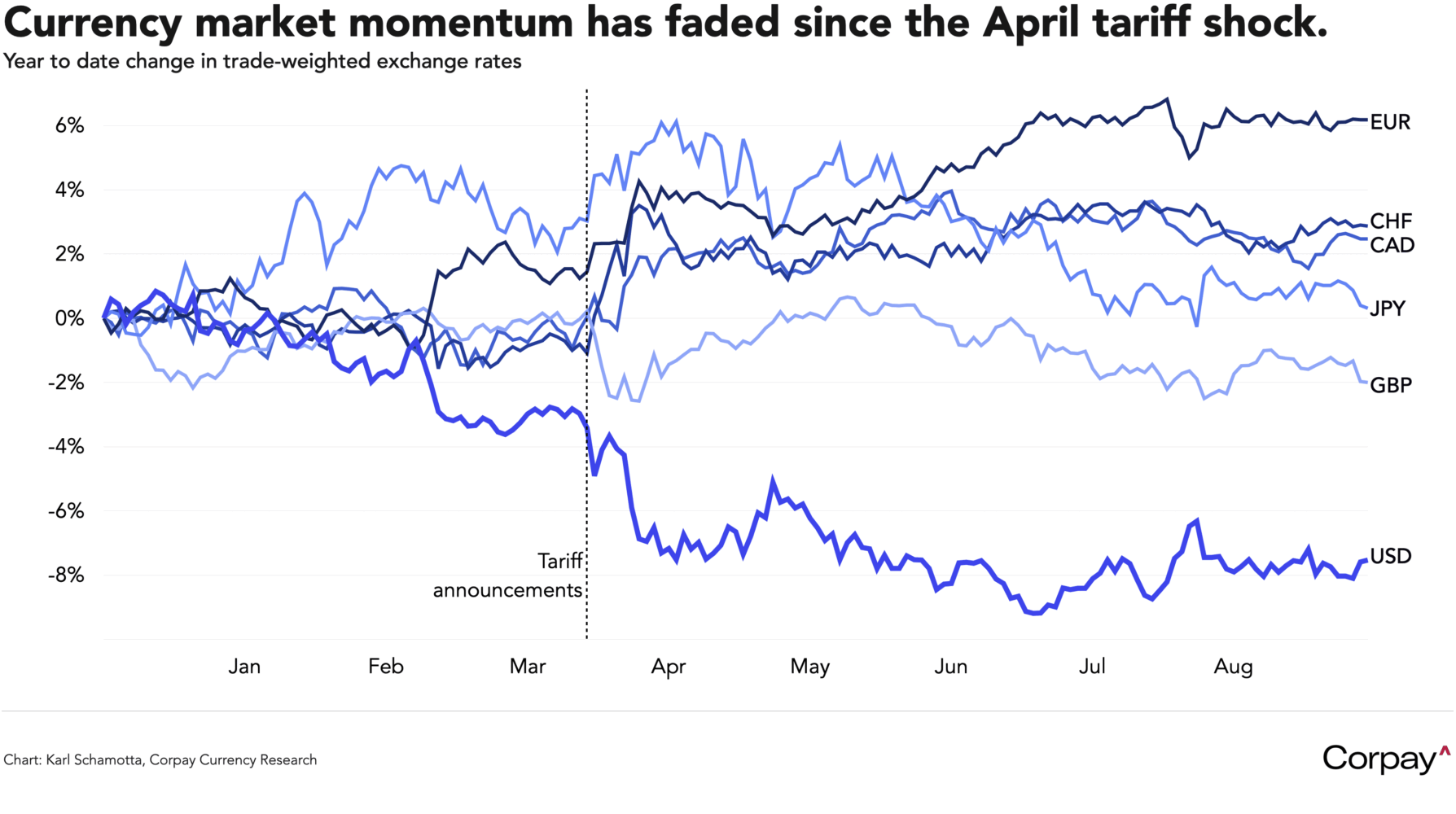

Currency markets—which, it should be noted, have remained essentially rangebound since April’s tariff-led dollar shock—seem vulnerable to a reacceleration in the coming weeks as traders pivot toward new directional narratives. With major questions yet to be resolved around US economic fundamentals, trade policy impacts, and the broader geopolitical environment, we expect to see traders respond with alacrity to incoming news flow, and suspect that volatility assumptions are poised to ratchet higher off their summer lows. Against that backdrop, we cannot rule out a rebound in the dollar, paired with a return to risk-off dynamics in broader markets, with commodity-linked currencies and carry trade recipients—like the Mexican peso—exposed to negative moves.

*30-year Japanese government bonds began trading in 1999.

**Inflation erodes the value of debt while increasing measured gross domestic product.