• FX consolidation. In contrast to the dip in US equities & yields the USD tread water. AUD near ~$0.66. Fed Chair Powell notes the “challenging situation”.

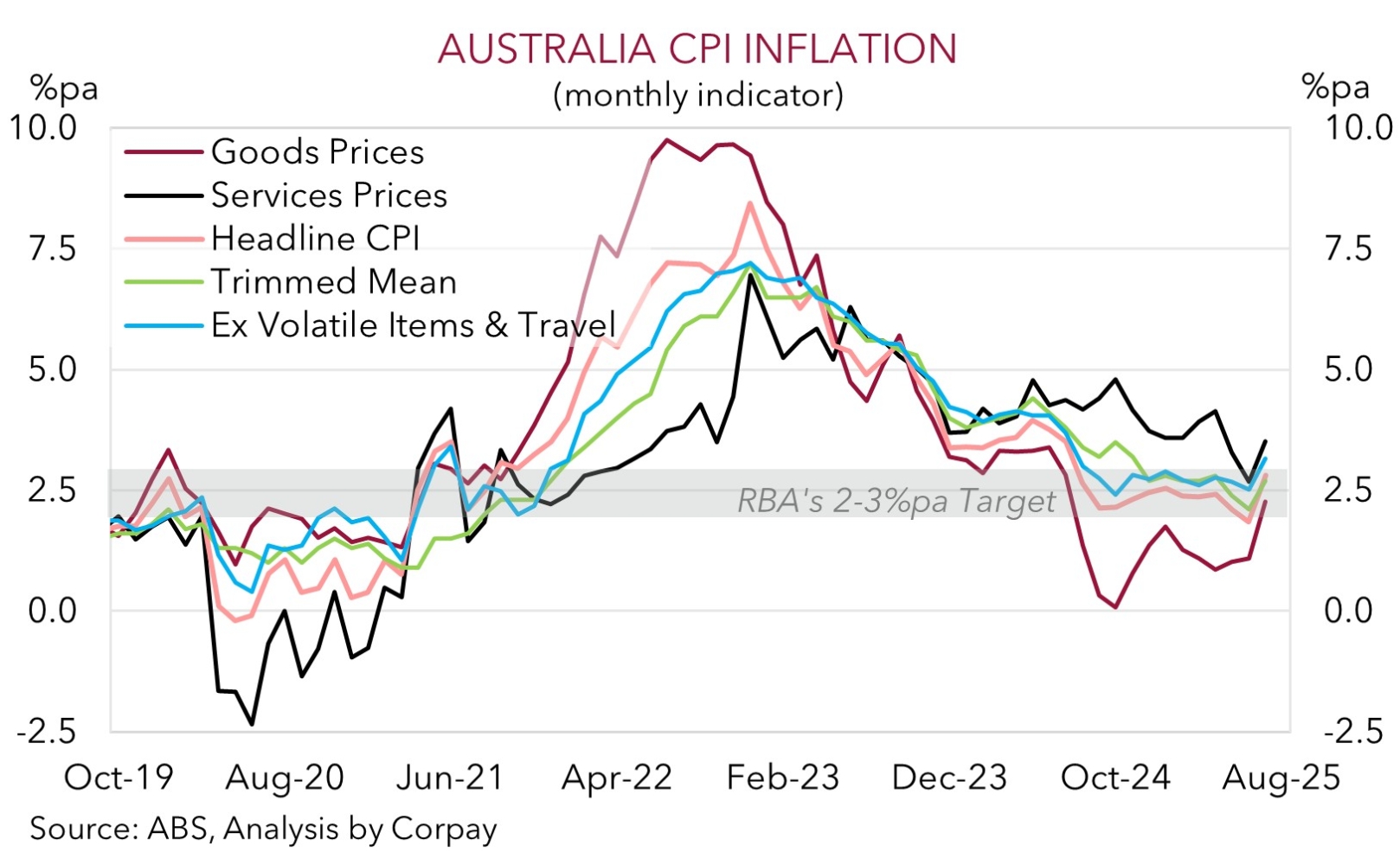

• AU CPI. Monthly CPI indicator due today. Base effects & leading indicators point to a pick up in inflation. RBA looks set to remain on a different path to its peers.

Global Trends

Steady as she goes, at least in FX, with the major currencies treading water over the past few sessions after last week’s US Fed induced burst of volatility. EUR (the major USD alternative) is tracking just above ~$1.18, USD/JPY (the 2nd most traded pair) is hovering close to its 3-month average (now ~147.59), and GBP (now ~$1.3524) remains within 2% of its multi-year peak. Closer to home the NZD (now ~$0.5859) is around its 1-year average and the AUD (now ~$0.66) is tracking towards the upper end of the range occupied since last November. By contrast, after a strong run US equities gave back a bit of ground overnight (S&P500 -0.6%, NASDAQ -1%), though they are not that far from record levels. Bond yields also dipped with US rates shedding ~2-4bps across the curve.

Macro wise, the latest batch of global business PMIs showed some divergence across regions and sectors. In Europe, manufacturing fell back into ‘contractionary’ territory, while services improved thanks to trends in Germany. In the UK, there was a loss of momentum as both services and manufacturing declined compared to last month. It was a similar story in the US where services and manufacturing remain in ‘expansion’ but growth decelerated. Weaker export demand stemming from the US’ trade tariffs, reduced activity, and the prospect for further job losses were pointed to as reasons for the softer results across the Europe and US.

On the policy front, a few US Fed members, including Chair Powell, spoke. Chair Powell delivered a measured address, like last week’s comments where he noted the “challenging situation” posed by downside employment risks and upside inflation risks. While Chair Powell avoided signaling the next move he did once again flag that policy is “modestly restrictive” implying the Fed has room to move rates lower to combat negative labour market impulses. Interest rate markets are pricing in a ~92% chance the US Fed delivers another 25bp rate cut in late-October with a high chance of another move in December also baked in. In total, markets are discounting between 4 and 5 more interest rate reductions in the US over the next year.

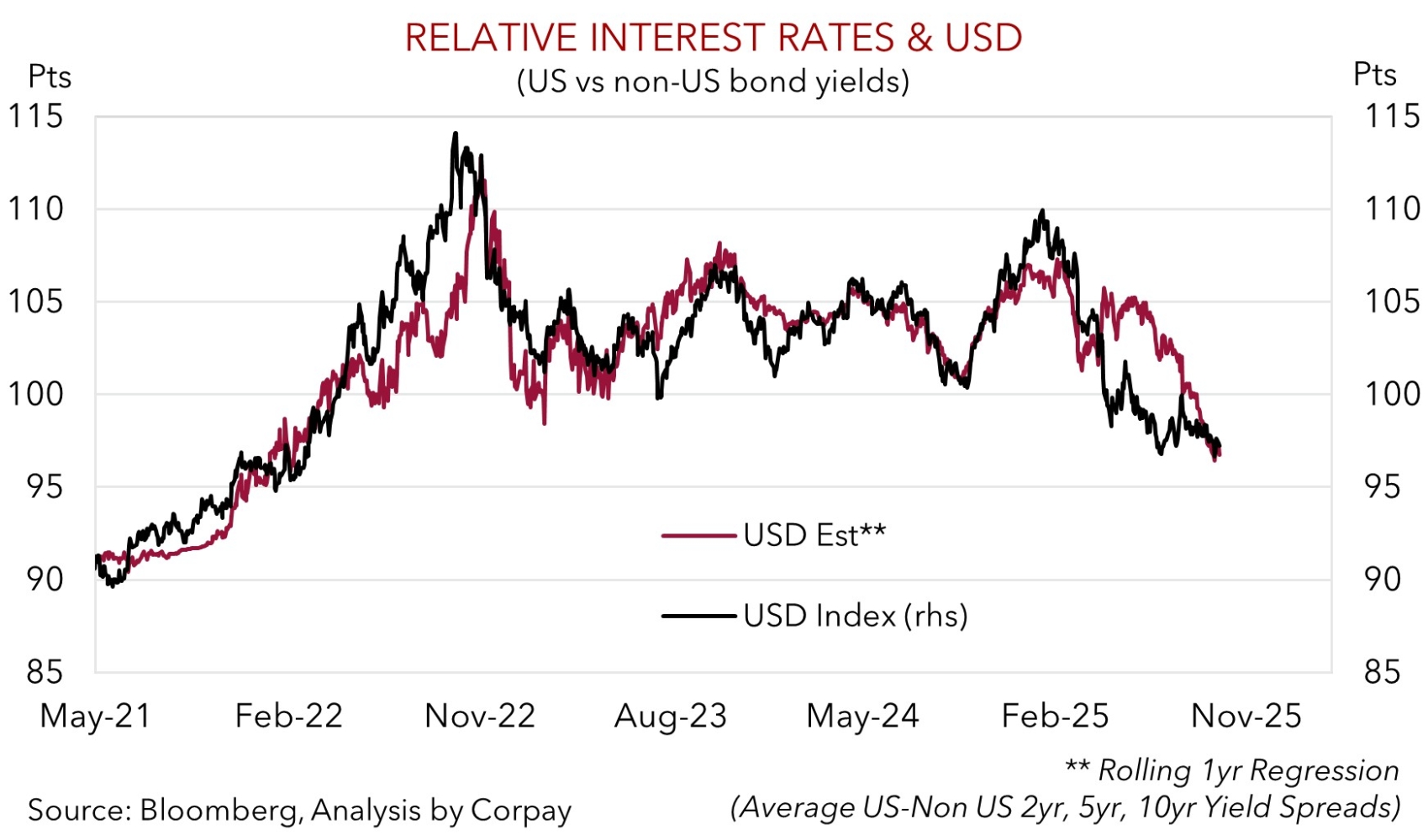

Looking ahead, US durable goods orders (a proxy for business investment) (Thurs) and the PCE deflator (the Fed’s preferred inflation gauge) (Fri) are due later this week. On balance, we expect the USD to continue to consolidate over the near-term. As shown in the chart below, the USD index is close to where our short-run interest rate based regression model suggests it should be. That said, over coming months we believe the combination of slower US growth, lower US interest rates, and/or reduced inflows into US assets should see the USD’s downtrend re-assert itself.

Trans-Tasman Zone

It has been a quiet few sessions in FX markets with the USD consolidating after last week’s rebound stemming from the US Fed not matching ‘dovish’ expectations (see above). At ~$0.5859 the NZD is close to its 1-year average with the outlook for more aggressive RBNZ rate cuts also creating headwinds. Markets are factoring in a ~30% chance the RBNZ delivers a larger 50bp reduction on 8 October with ~71bps of further easing discounted by next April. The AUD (now ~$0.66) is where it was tracking earlier this month, ~1.6% from the peak hit during the volatility around last weeks US Fed announcement. That said, while cross-rates such as AUD/EUR (now ~0.5586), AUD/JPY (now ~97.41) and AUD/GBP (now ~0.4880) consolidated overnight, AUD/NZD ticked up further (now ~1.1265) with relative fundamentals and interest rate expectations firmly in Australia’s favour, in our opinion.

Today the monthly Australian CPI indicator is due (11:30am AEST). This is a partial indicator, however several of the ‘services’ components that are updated once per quarter will be released in the August data. We believe base effects in a few components, particularly around things like electricity subsidies, point to a further re-acceleration in headline inflation (mkt 2.9%pa from 2.8%pa), and pose upside risks to core inflation. In our view signs of firmer Australian inflation pressures could bolster views the RBA remains on a different path to its global counterparts and that further rate reductions should be gradual/limited. The next RBA rate cut now isn’t fully discounted until December with another move after that almost factored in by next June.

On balance, some short-term volatility in the USD and AUD/USD is possible as the incoming Australian and US data impacts relative policy expectations. However, after its recent US Fed-induced retracement we believe the AUD should be supported around current levels. Over the medium term (i.e. next ~3-12 months) we continue to see the AUD edging higher. We think the AUD can be underpinned by a mix of a weaker USD as the US Fed lowers interest rates, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds, firmer momentum in Australia’s economy, and ongoing cautious approach from the RBA.