• Quiet start. US equities rose a bit overnight, while US bond yields & the USD eased. AUD & NZD near top of their respective multi-month ranges.

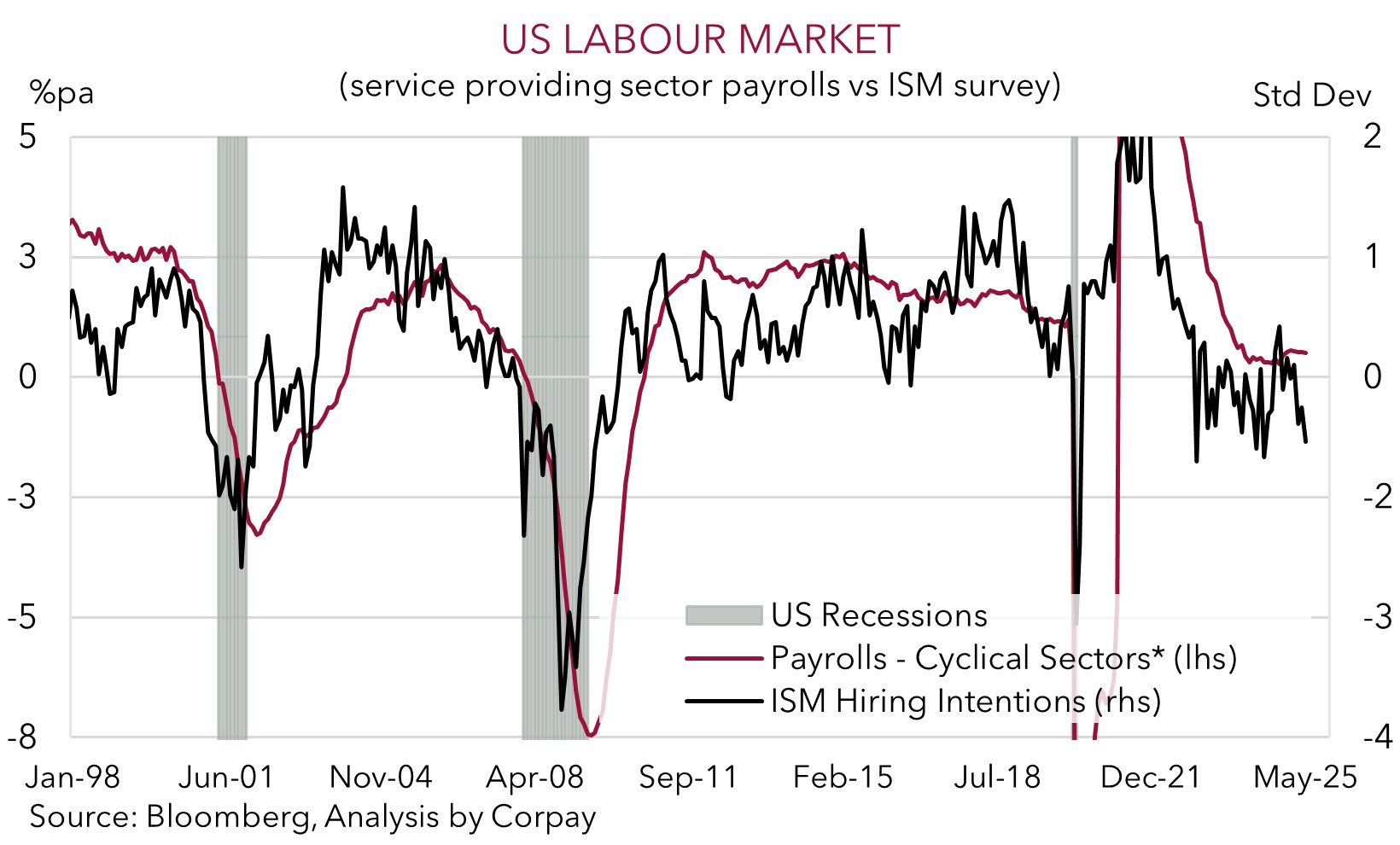

• Macro trends. US jobs report released last Friday. Topline figures mask weakness under the hood. Indicators point to softer trends forming.

• Event Radar. US/China trade talks taking place. In the US, inflation is a focus (Weds). Will the US CPI show tariff impacts on ‘goods’ prices?

Global Trends

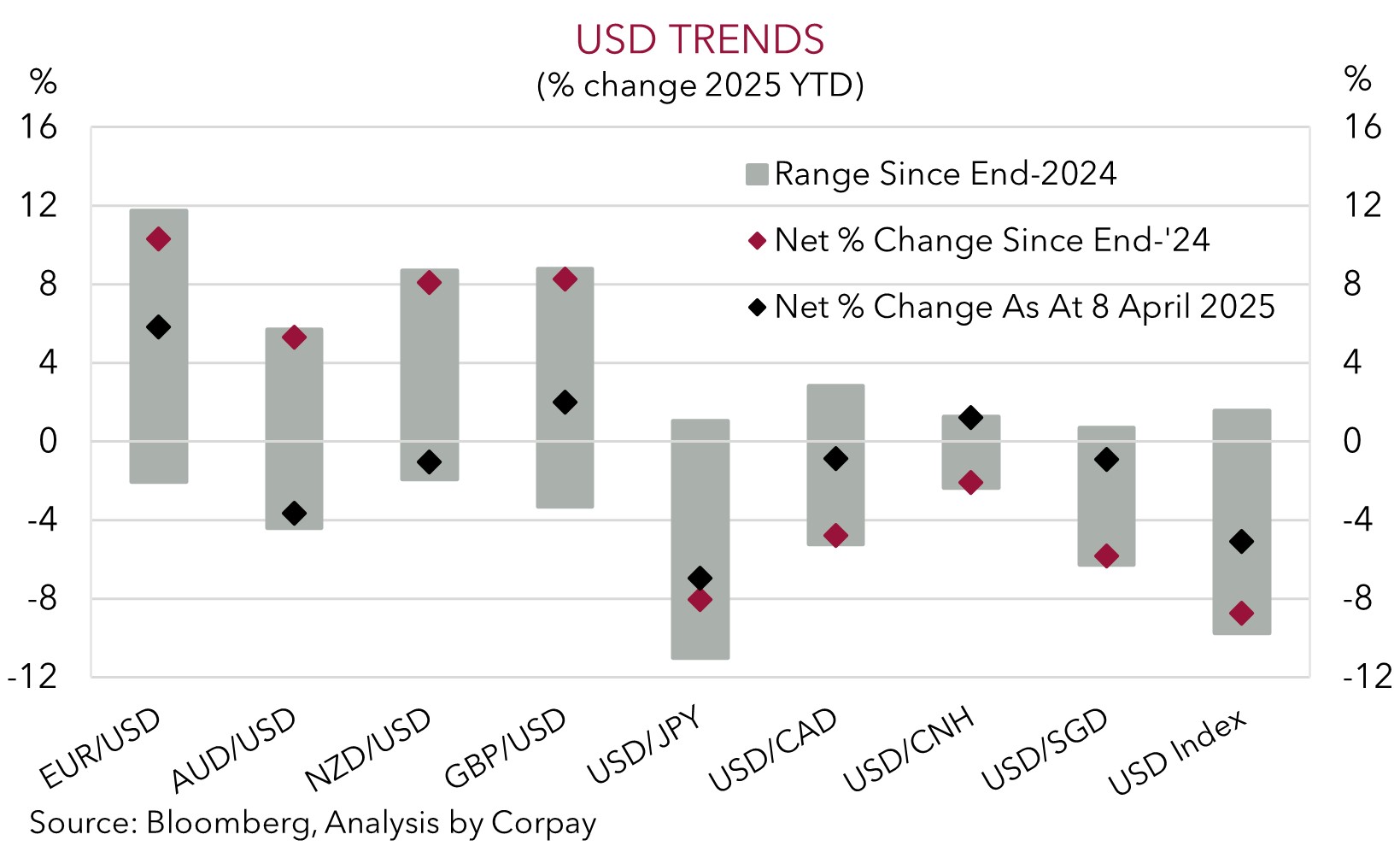

It has been a quiet start to the new week across markets. US equities ended the overnight session a bit higher (S&P500 +0.1%), while US bond yields slipped back ~3bps and the USD index eased. EUR edged higher (now ~$1.1422) to be just over 1% from its cyclical peak, GBP nudged up (now ~$1.3550), and USD/JPY consolidated (now ~144.60). Closer to home, the NZD rose towards the top of its multi-month range (now ~$0.6045), as did the AUD (now ~$0.6517).

Attention is on the latest US-China trade talks in London, and reports are that the “fruitful” discussions will continue tomorrow. That said, this could just be another step along the negotiation path. Export controls appear to be more in focus than trade tariffs this time. According to White House economic advisor Hassett US export controls on semi-conductors might be tweaked and China may approve export licences for important rare-earth related products. More media soundbites are likely over coming days as the talks wind up. So far, the mood music has been positive.

In terms of economic trends, the monthly US jobs report was released last Friday. The monthly employment figures were a little stronger than predicted with non-farm payrolls growing by 139,000 in May. But if you take a step back from the month-to-month volatility there are signs coming through that uncertainty it starting to bite and broader labour market conditions are cooling. There were sizeable downward revisions to the previous few months jobs growth, the US unemployment rate held steady at 4.2% somewhat because people exited the labour force, and forward indicators such as business hiring intentions point to weakness in ‘cyclical’ private sectors over the months ahead (see chart).

We believe widening cracks in the US labour market and softer economic activity should see the US Federal Reserve re-start its interest rate cutting cycle later this year. We think this can drag down the USD over the medium-term. However, over the short-run, we feel there is a risk the beaten down USD claws back ground. In the US this week CPI and PPI inflation are due (Weds and Thurs night AEST). This will be the last CPI report before the US Fed’s 19 June meeting. The CPI and PPI data will be closely watched for any tariff impacts. Retailer anecdotes suggest there were some price rises from mid-May. This could show up across various ‘goods’ products. In our judgement, a positive US inflation surprise might generate knee-jerk USD support.

Trans-Tasman Zone

A slightly softer USD has helped the NZD and AUD edge a bit higher at the start of the week (see above). At ~$0.6045 the NZD is near the top of the range it has occupied since mid-October, while the AUD (now ~$0.6517) is close to 6-month highs. The AUD is also a little firmer on most of the major cross-rates with gains of ~0.1-0.3% recorded versus the EUR, JPY, GBP, CAD, and CNH. At ~4.6805 AUD/CNH is within striking distance of its year-to-date peak and is broadly inline with its 1-year average.

As outlined last week and illustrated in our chart below, AUD and NZD have snapped back sharply from their respective April ‘Liberation Day’ lows. The NZD is ~10.2% above its April trough, as is the AUD which is around levels last traded in early-December. It is a quiet week in Australia and NZ in terms of economic releases. Offshore, focus will be on developments in the latest round of US/China trade talks, as well as US CPI inflation (Weds night AEST).

We think the US CPI may generate a burst of market and AUD volatility. On balance, we believe the US data could show early signs of the tariff impact on US goods prices, which if realised may support the USD and in turn exert a bit of downward pressure on the AUD and NZD in the short-term. That said, even if US inflation positively surprised, we doubt any knee-jerk USD strength would last too long or extend too far. The inflation effects from tariffs are generally a short-run level adjustment in prices, not the source of ongoing price pressures. Moreover, we remain of the opinion that various Trump Administrations policies could act to constrain US growth and/or dampen investor confidence in holding US financial assets. In time, we think this may see the USD steadily weaken, and this can help the AUD trend higher over the coming year.

Also helpful for the AUD’s longer-term outlook are steps being taken by authorities in China to boost domestic activity, particularly commodity intensive infrastructure investment. As is the resilience of the Australian jobs market and core inflation dynamics. In our judgement this suggests the market may have reached peak RBA ‘dovishness’ given ~3 more 25bp rate cuts are baked in by year-end. A relatively more ‘cautious’ approach from the RBA would be AUD supportive, especially on the crosses.