• Positive tone. Improved risk sentiment overnight with equities rising, bond yields falling, & the USD weaker. AUD/USD rebounded.

• US data. US job openings weaker than expected. Cracks in the US jobs market are widening. US Fed looks set to lower rates over the next few meetings.

• AU GDP. Growth stronger than forecast. Private sector activity picked up. RBA Gov. Bullock indicated if this continues “may not” need as many rate cuts.

Global Trends

A bit of a reversal of fortunes overnight with the previous sessions modest bout of risk aversion unwinding. European and US equities rose with the tech-focused NASDAQ (+1%) outperforming the broader S&P500 (+0.5%) and EuroStoxx600 (+0.7%) due somewhat to a jump in Alphabet after a favourable antitrust ruling. Bond yields back peddled with long-end rates in the UK (the epicenter of yesterday’s turbulence) declining ~5-9bps. In the US yields fell ~2-4bps with the benchmark 10yr rate hovering near 4.22% (a little below its 1-year average). In FX, the improved market tone and lower yields dragged on the USD. EUR ticked higher (now ~$1.1662), as did GBP (now ~$1.3441), while USD/JPY eased a touch (now ~148.08). Closer to home, the NZD rose (now ~$0.5878) with the AUD also edging higher (now ~$0.6543) thanks in part to relative strength on the major cross-rates.

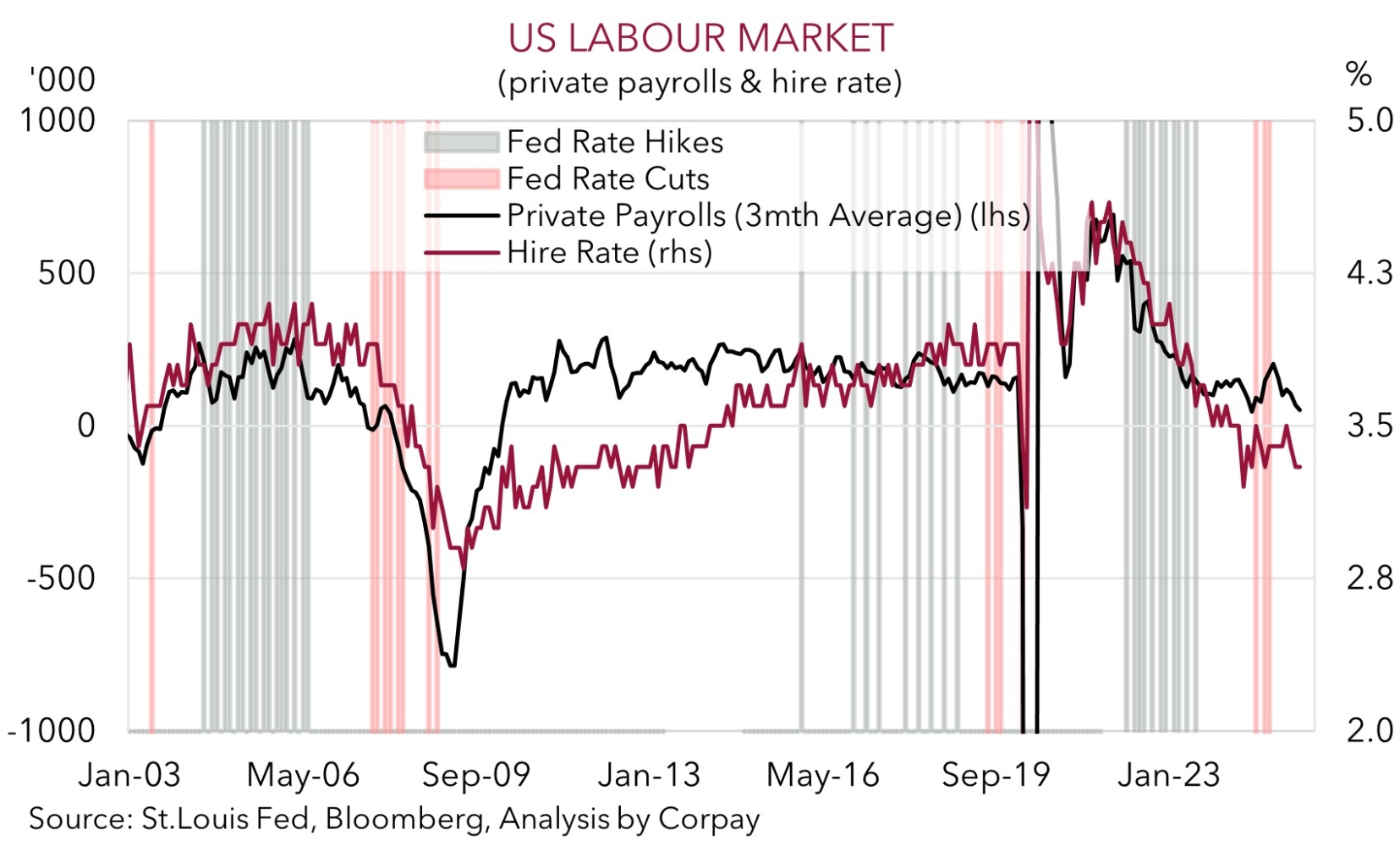

More signs that the cracks in the US jobs market are widening underpinned the overnight moves. Job openings fell to the lowest level in 10 months in July. As a result, for the first time since COVID, there are fewer job openings than unemployed people in the US. The step down in openings in the retail sector may have been because businesses are looking to control costs in response to tariffs. More broadly, the layoff and quit rates remain low, indicating limited churn in the US labor market, while the below average hiring rate suggests jobs growth may slow further over coming months (see chart below). Markets continue to factor in a steady stream of interest rate cuts by the US Fed. A move in mid-September is assigned a ~95% chance with 5 rate reductions baked in by next September.

Macro wise the US should remain in focus over the next few days. Tonight ADP employment (10:15pm AEST), initial jobless claims (10:30pm AEST), the services ISM survey (12am AEST) and a speech by NY Fed President Williams (1:30am AEST) are due. Tomorrow night the monthly non-farm payrolls report is released. The mix of slowing immigration and weaker hiring trends suggests employment growth in the US has lost steam and that unemployment could rise over the next few months. Consensus is looking for non-farm payrolls to come in at a tepid 75,000 in August and for the unemployment rate to nudge up to 4.3%. We believe this type of outcome and/or other signs momentum in the US economy is stalling might reinforce views looking for the Fed to restart its easing cycle in September. In turn, we think this could keep the USD on the backfoot.

Trans-Tasman Zone

The improvement in risk sentiment overnight stemming from the pullback in bond yields and the softer USD has boosted the AUD and NZD (see above). At ~$0.5878 the NZD is back around its 1-year average while the AUD (now ~$0.6543) is tracking near the upper-end of its multi-week range. Relative strength on the cross-rates also provided the AUD with a helping hand. The AUD has ticked up by ~0.1-0.4% versus the EUR, JPY, NZD, CAD, and CNH over the past 24hrs. AUD/NZD (now ~1.1131) is close to the top of its ~6-month range, with the more positive economic and interest rate trends in Australia compared to NZ providing underlying support.

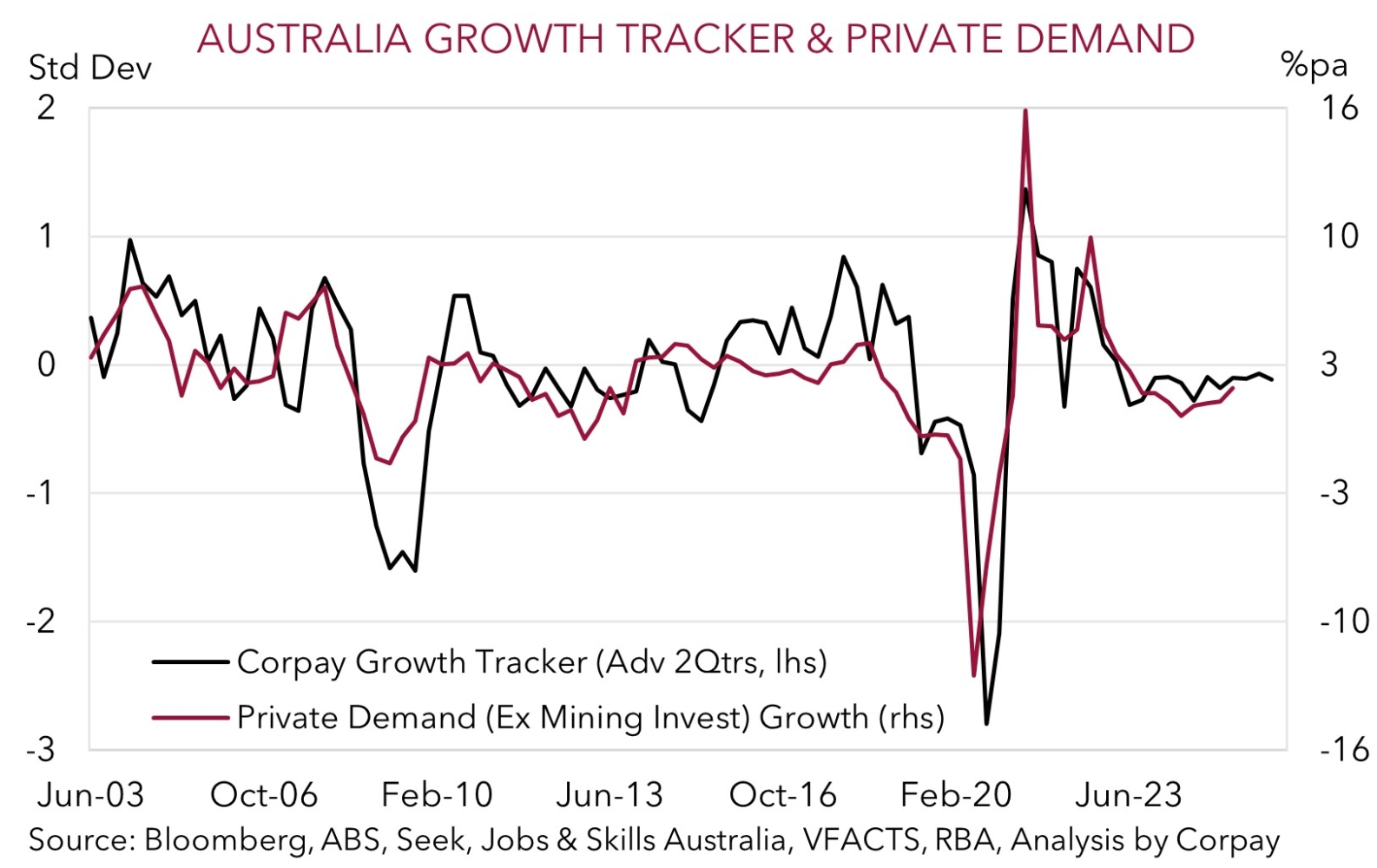

Australian economic news has also helped the AUD edge higher. Q2 GDP was better than anticipated with the economy expanding by 0.6% in the June quarter. As a result, the annual pace of growth accelerated to 1.8%pa. The market and RBA had penciled in ~1.6%pa. Under the hood, domestic demand was the main driver, led by household and government spending. Our composite leading indicator points to a further uptick in private sector activity over the next few quarters as the turnaround in real incomes, past RBA rate cuts, and positive wealth effects related to rising property/equity prices work their way through the system. The domestic economic story supports our long held view that the RBA may only deliver a bit more interest rate relief over the next year. Markets agree with the next RBA rate cut now not fully priced in until December while another move after that is no longer completely discounted. Indeed, when speaking last night RBA Governor Bullock noted that spending has been “a little stronger” than predicted and if that keeps going there “may not need” to be as many rate cuts.

More modest bursts of data driven AUD volatility is possible over the near-term. However, over the longer-term (i.e. next 3-12 months) we believe the AUD might grind higher. We think the AUD should be supported by a combination of a softer USD as US Fed rate cuts re-commence (probably in mid-September), measured approach from the RBA, upturn in Australian economic activity, and/or signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds across its export sector.