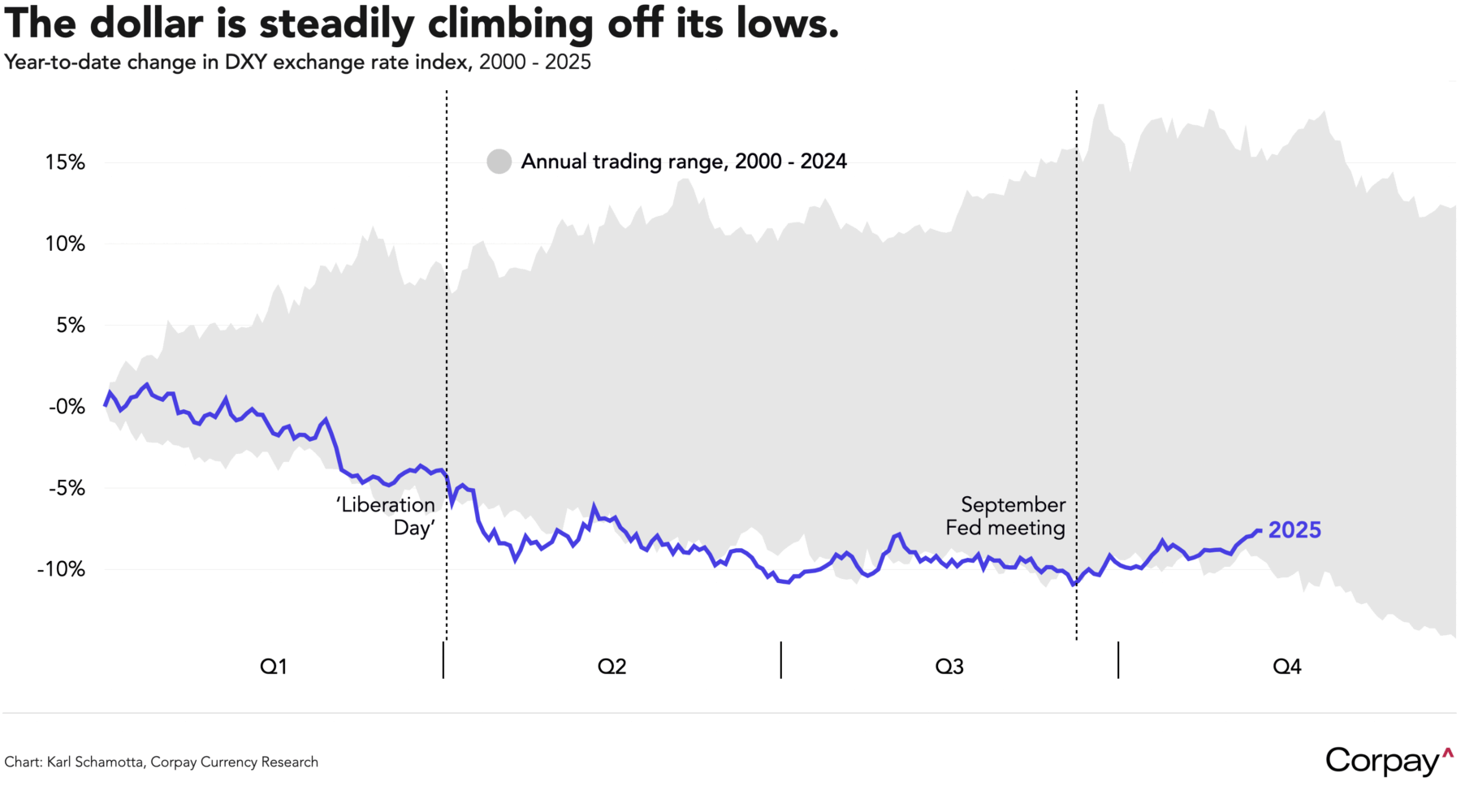

Currency markets are stabilising this morning as a global selloff eases and the US government shutdown enters a record-breaking 36th day. Asset prices tumbled across the financial landscape yesterday as concern over rarefied valuations intersected with expectations for a slower Federal Reserve easing cycle, but steep losses in the technology sector now appear to be reversing, demand for safe-haven Treasuries is slackening, and risk appetite is—hesitantly—returning in foreign exchange markets. The dollar is trading on a slightly firmer basis along with its safe-haven counterparts, the British pound is enjoying a modest rebound after falling into oversold territory ahead of tomorrow’s Bank of England decision, the euro is following suit, and high-beta currencies like the Aussie, kiwi, and loonie remain on the defensive.

Private sector employment rose more than expected last month, adding to the dollar’s gains. The ADP national employment report—which measures trends across the payroll processor’s private sector and tends to have a weak correlation with the Bureau of Labor Statistics non-farm payrolls report—showed 42,000 jobs created in October, up sharply from September’s revised -29,000 loss, and well above the 25,000 expected by economists.

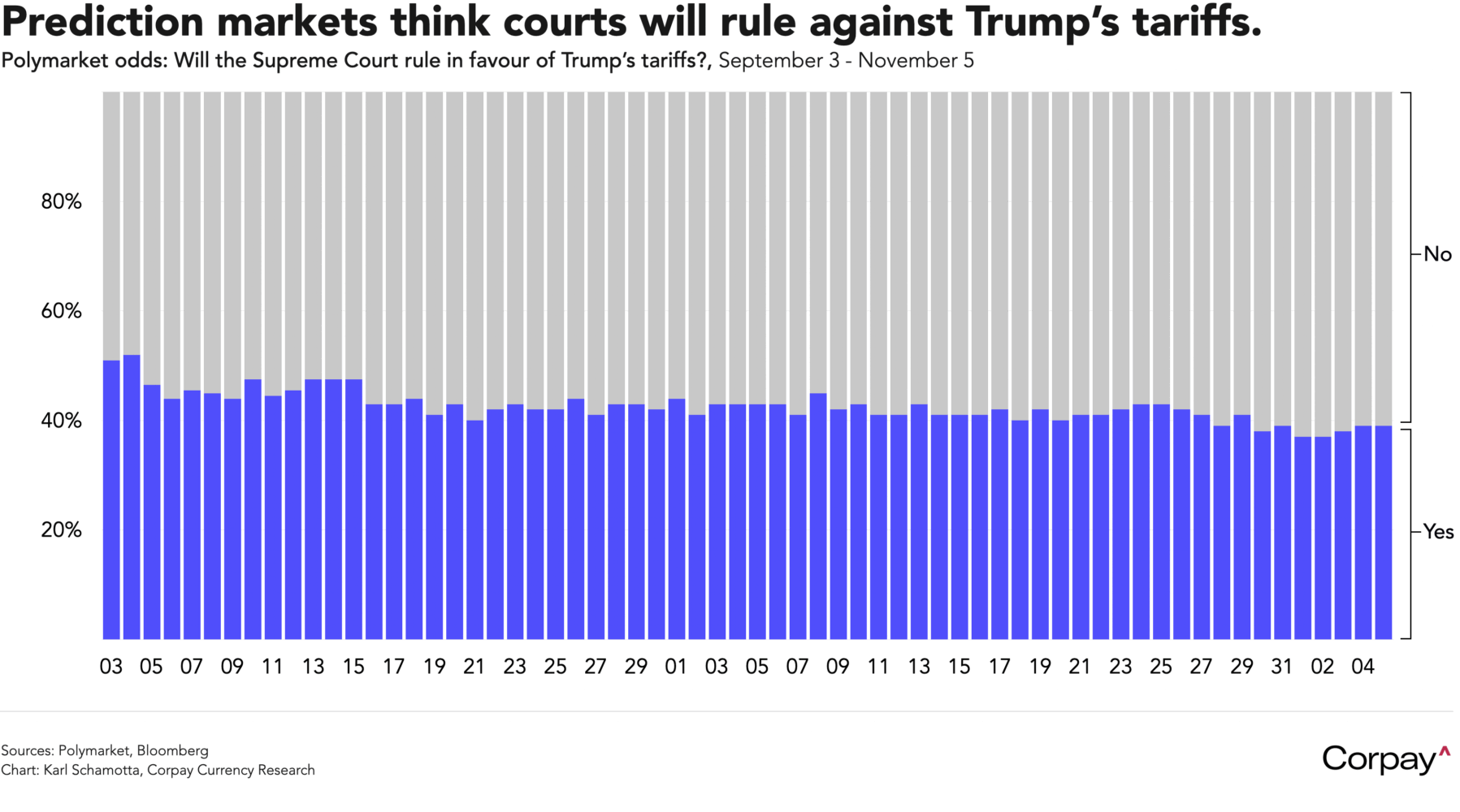

The noise volume could increase in the coming hours. At 10:00, the Institute for Supply Management’s services survey will shed light on conditions in the largest sector in the US economy, with the current activity and new orders sub-indices closely scrutinised for any evidence of a slowdown that could force the Fed to ease more quickly. And also at 10:00, the Supreme Court is due to hear arguments on whether Donald Trump exceeded his legal authority in levying taxes against imports from most countries without Congress’s approval. Prediction markets expect the justices to reject the administration’s arguments—Polymarket is currently putting just 39-percent odds on a Trump victory—but most observers think this will ultimately prove a relatively minor stumbling block in the president’s push to increase tariffs on a wider scale.

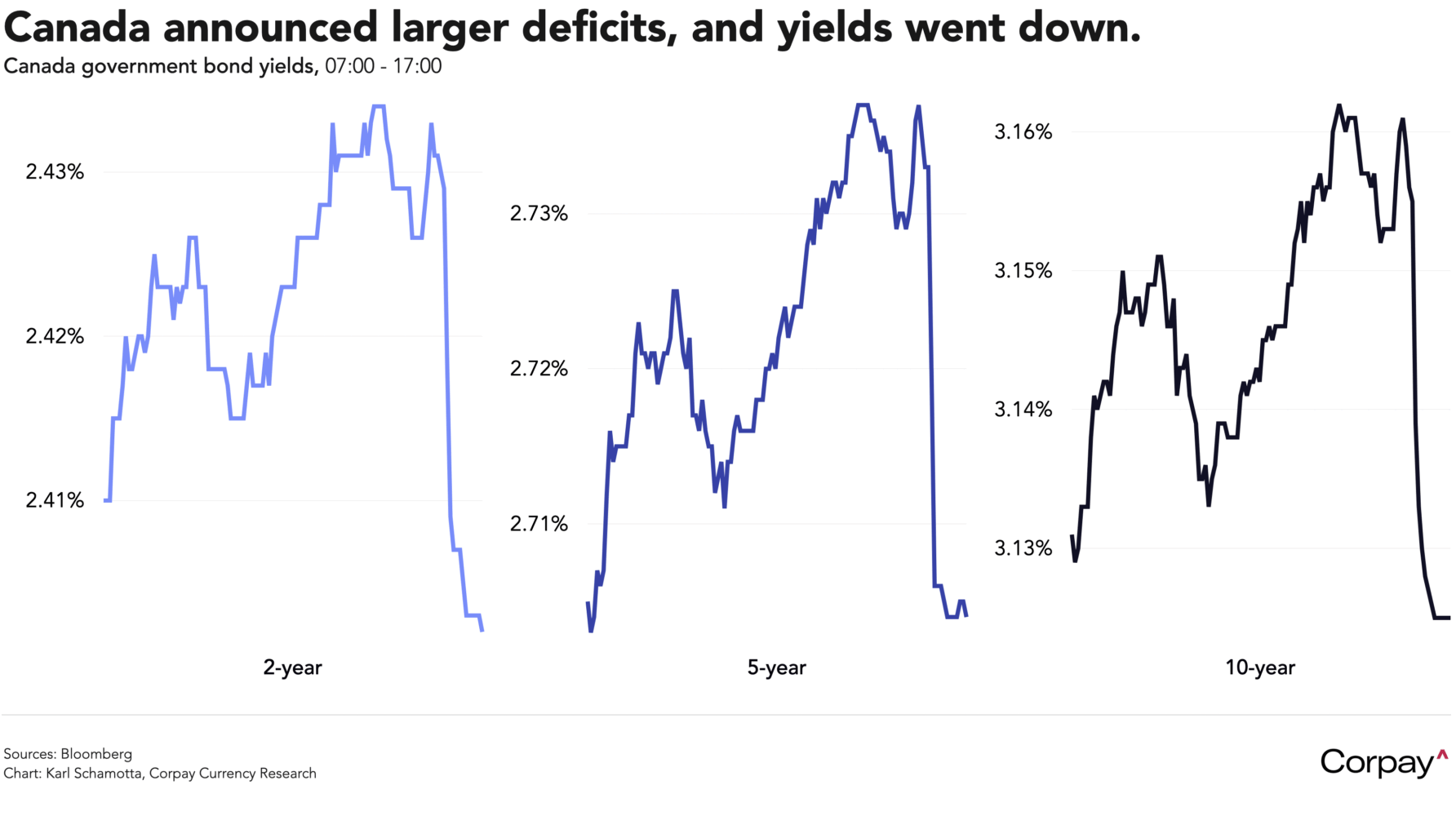

Canada’s highly anticipated 2025 budget left markets underwhelmed. After a drawn-out teaser campaign that featured words like “generational” and “transformative,” Mark Carney’s government ultimately delivered a plan that avoided administering major shocks. In a welcome shift away from the previous administration’s focus on adding to the public service and expanding social spending, Finance Minister François-Philippe Champagne’s proposal prioritised defence spending, infrastructure investment, and light tax relief. However, this recalibration comes with widening deficits. Under updated projections, the fiscal shortfall for the 2025-26 year will almost double to $78.3 billion from $36.3 billion in the prior year, and will remain elevated for years to come.

The Canadian dollar moved by less than 10 pips in the hours after the budget’s release, and yields moved down, suggesting that investors had been bracing for something more dramatic. Rumours on Bay Street circulating ahead of the update had pointed to more decisive public service cuts, wider tax reforms, and a current-year deficit amounting to more than $100 billion.

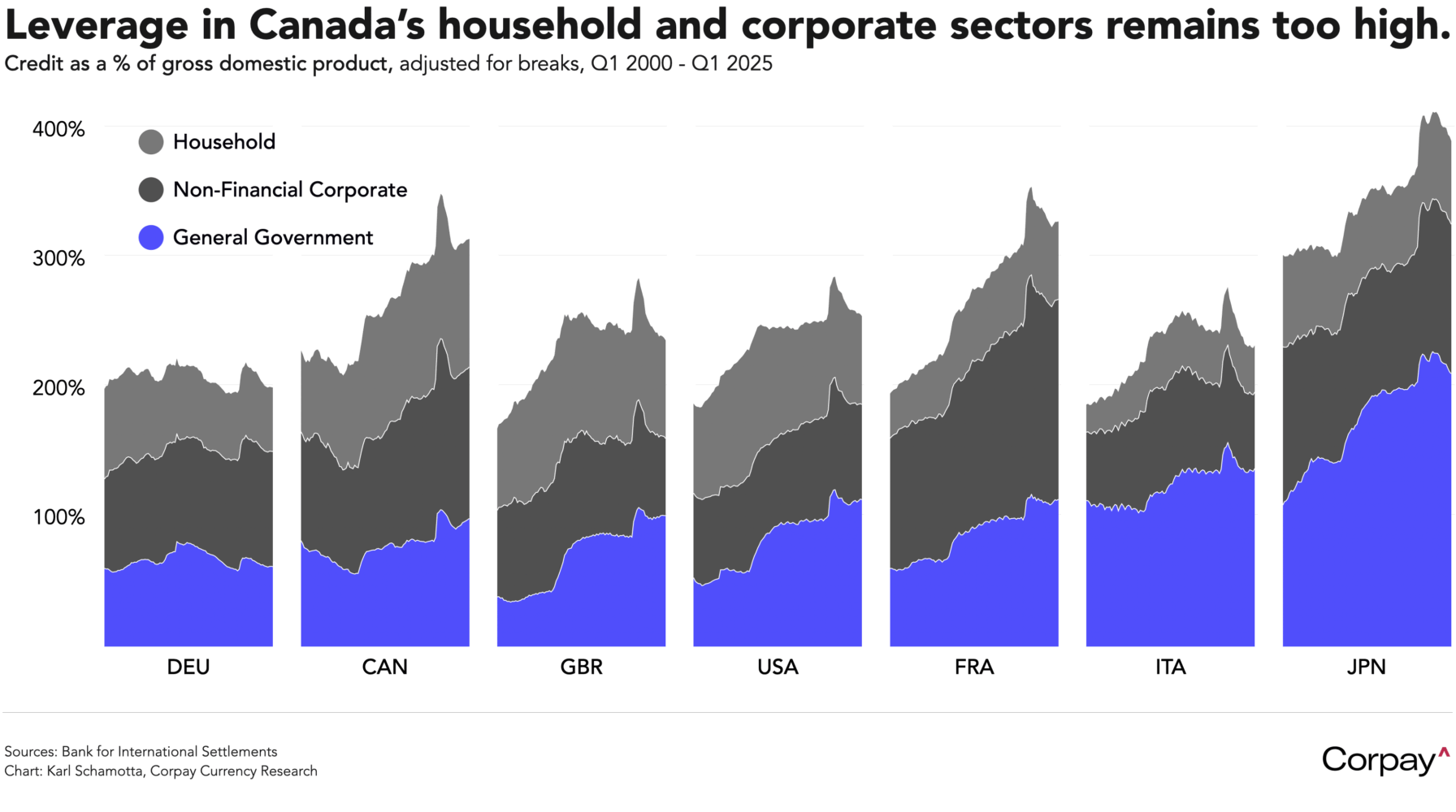

Forgive us for sounding repetitive on this theme, but global investors do not see Canada’s fiscal trajectory as terribly worrisome. On a consolidated basis (including federal and provincial debt), the country’s general government-to-gross domestic product ratio compares favourably to its advanced-economy counterparts, and is set to rise at a pace that is slightly slower than many of its peers (and far slower than the US). In the competition for global capital flows, the Canadian government isn’t likely to lose the cleanest-dirty-shirt contest any time soon. The private sector, in contrast, remains deeply indebted by global standards, and has struggled to bear rising carrying costs in recent years. We think that to an important extent, weakness in the Canadian economy and the loonie in the last year has been driven by a correction in long-standing household and corporate credit excesses, not by Donald Trump’s trade hostilities or the government’s often-feckless borrowing campaigns.