• Improved sentiment. US regional bank share prices bounce back. Data also shows that the US labour market remains tight.

• Fed rate expectations. Markets continue to forecast rate cuts by the US Fed from Q3 2023. We think this is misplaced. US CPI released this week.

• AUD recovery. Positive risk appetite has supported the AUD. Consumer and business confidence, and the Federal Budget are the local focal points.

After some tremors earlier in the week, risk sentiment improved on Friday. Following the sharp falls over previous sessions, US regional banking stocks rebounded strongly, with the banks in focus (PacWest Bancorp and Western Alliance Bancorp) jumping up by 82% and 49% respectively. The bounce in the banks, coupled with strong earnings by Apple and some other companies boosted US equities (S&P500 +1.8%, helping to trim its weekly loss to just 0.8%). Another strong US labour market report also supported risk appetite (see below) and helped push up US bond yields across the curve. The US 2-year yield rose 12bps, closing the week at ~3.91%, while the US 10-year yield is hovering just under 3.45%. Elsewhere, oil prices lifted (WTI crude increased ~4% to ~US$71.30/brl), industrial metals like copper edged up ~1%, while in FX the USD Index remained range bound with EUR tracking near ~1.10 and USD/JPY nudging back up towards ~135. The broader backdrop helped the AUD add to recent gains, with AUD/USD back above its 200-day moving average (~$0.6728).

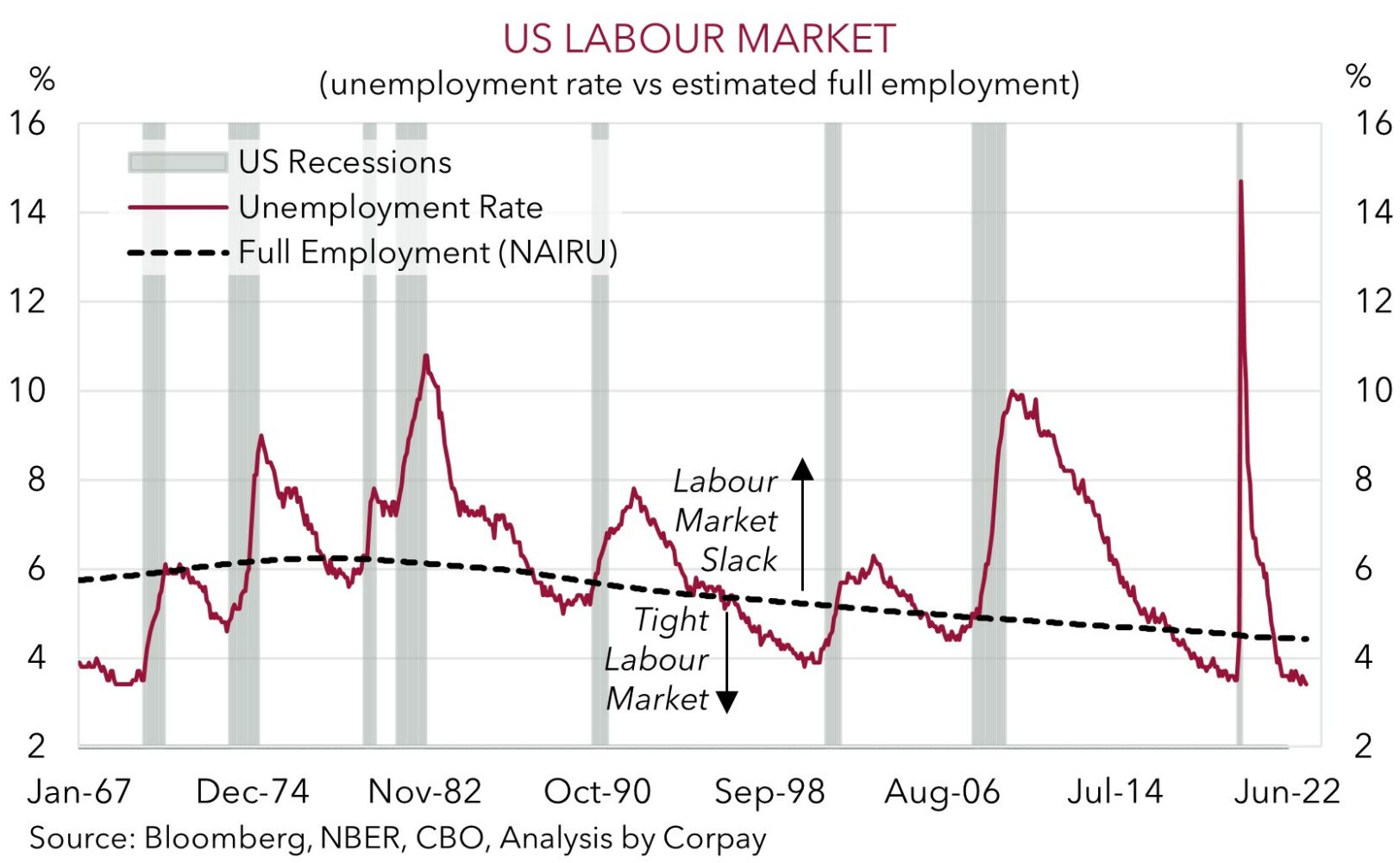

The latest data showed that the US labour market remains tight. Non-farm payrolls increased by 253,000 in April, average hourly earnings (a monthly wage gauge) reaccelerated to 4.4%pa, and the unemployment rate dipped back down to 3.4%. As our chart shows, this is the equal lowest US unemployment rate since 1969. Markets were buoyed by the data as it shows that the US economy is still holding up, but in our view, the data also means wage growth and in turn core inflation could remain uncomfortably high for some time. This suggests the US Fed may have more work to do over coming months and that the markets ‘hopeful’ expectations factoring in a ‘pause’ and rate cutting cycle from September are misplaced, in our opinion.

The macro focus in the US this week will be on the Fed’s Senior Loan Officers Survey (Tues AEST) and the latest CPI inflation data (Weds AEST). Given concerns about a potential credit crunch on the back of the regional banking sector developments the Senior Loan Officers Survey, which normally isn’t a major market mover, could be looked at closely to see if lending standards have tightened. We think indications that conditions haven’t deteriorated substantially, and signs that US core inflation remains ‘sticky’ around ~5.5%pa could see US interest rate expectations adjust upward, and this could give the USD some renewed support.

Global event radar: US CPI (Weds), Bank of England Meeting (Thurs), US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD corner

The AUD added to its recent gains on Friday, with the more positive risk appetite (equities, oil, and base metals were higher) more than offsetting the rebound in US bond yields. As a result, AUD/USD has ticked above its 200-day moving average (~$0.6728), while the AUD also outperformed the EUR, GBP, JPY, and CNH to differing degrees.

As outlined, while markets (and the AUD) were boosted by improvement in sentiment towards the US regional banks and another strong US labour market report, in our view, these developments also suggest expectations looking for the US Fed to start cutting rates by Q3 2023 are unlikely to materialise. An easing in banking sector concerns should see the focus move back on to the US’ inflation pulse,. The still tight labour market conditions mean wage growth and core inflation could stay uncomfortably high and that policy will need to stay ‘restrictive’ for an extended period. The Fed’s Senior Loan Officers Survey (Tues morning AEST) and the latest US CPI inflation data (Weds AEST) are released this week. In our view, signs that lending standards haven’t deteriorated significantly combined with still elevated US core inflation could see future US rate cut bets pared back, and this could see the USD rebound pushing the AUD back down.

Locally, the latest reading of business conditions (11:30am), consumer confidence (Tues), and the Federal Budget (Tues night) are this weeks focal points. While the Federal Budget gets a lot of media coverage, it tends not to move the needle for the AUD in the short-term. Data-wise, given the RBA’s rate hike cycle, especially last week’s surprise move, we think business and consumer sentiment are at risk of weakening. If realised, this could reinforce expectations that the RBA is at the end of the road, and we think this could also help cap the AUD’s recovery.

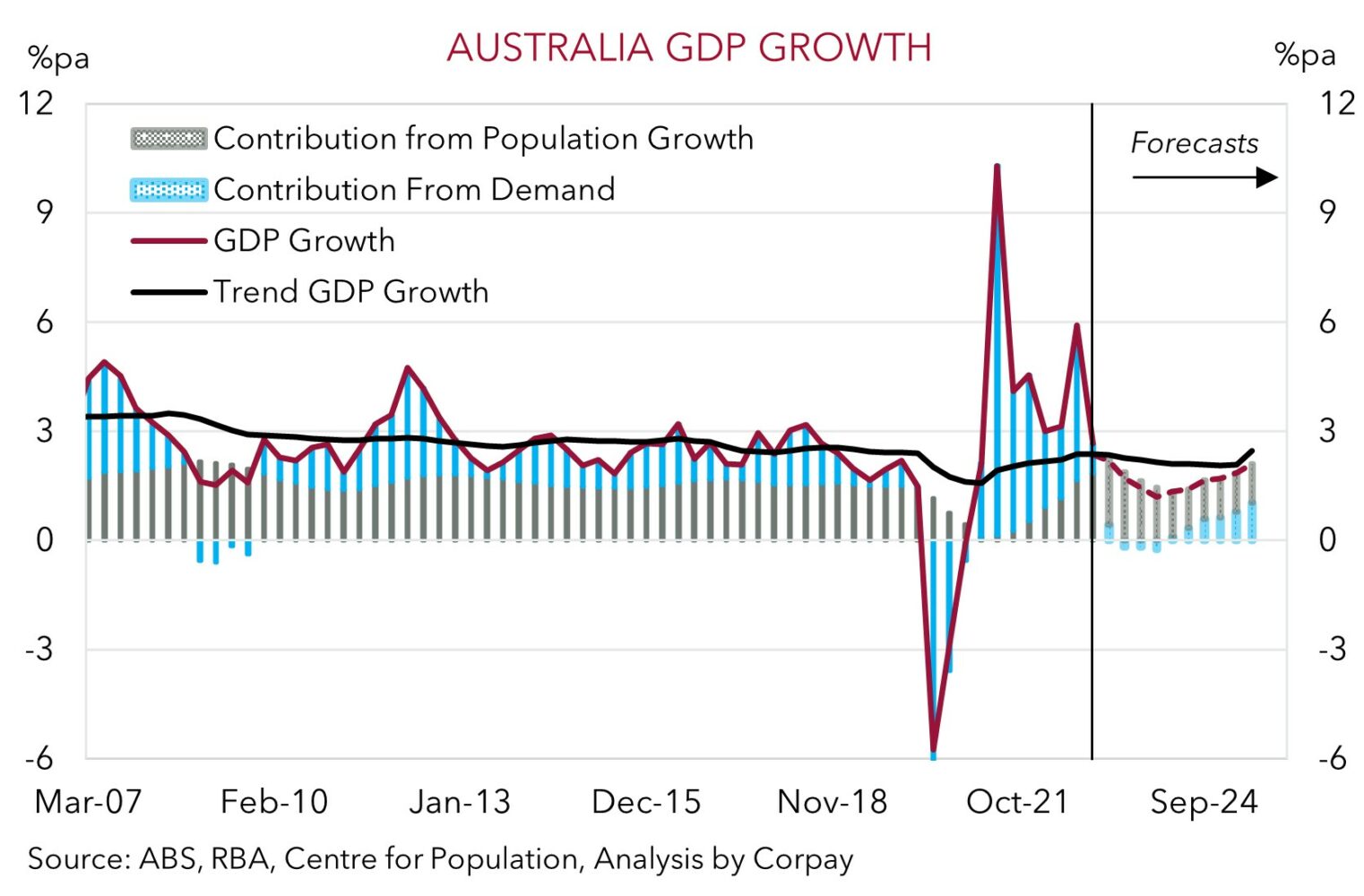

Given interest rate changes work with a lag, the economic challenges are just beginning. On the back of the jump up in interest rates Australian economic growth is expected to slow materially over coming quarters. The RBA is now forecasting growth of just 1.2% in 2023, however this also incorporates a higher population. Given it is a volume measure, a bigger population supports topline GDP, but as our chart shows, once these impacts are stripped out, GDP growth per capita (a better gauge of living standards) looks set to be negative and quite weak for some time.

AUD event radar: US CPI (Weds), Bank of England Meeting (Thurs), US Retail Sales (16th May), China Activity Data (16th May), AU Wages (17th May), AU Jobs Report (18th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Eurozone PMIs (23rd May), RBNZ Meeting (24th May), US PCE Deflator (26th May), China PMIs (31st May).

AUD levels to watch (support / resistance): 0.6595, 0.6684 / 0.6789, 0.6830

SGD corner

USD/SGD consolidated near ~$1.3260 on Friday, with EUR/SGD tracking around ~1.46. The more positive risk sentiment and bounce back in US regional banking stocks helped offset the strong US labour market report and upswing in US bond yields (see above). As discussed above, we think the ongoing tightness in the US labour market means thoughts that the US Fed could start cutting interest rates by September 2023 are misplaced. The tightness in the labour market and elevated wage growth is likely to keep inflation well above the Fed’s target for some time, and this suggests the risks remain skewed to the Fed having to do more in the near-term and/or needing to keep rates quite high for an extended period of time.

The focus this week in the US (and for the USD) will be on the Fed’s Senior Loan Officers Survey and the latest CPI inflation data. In our opinion, signs in the SLO that credit standards haven’t tightened significantly over recent months, and that core US inflation is uncomfortably high and is not showing meaningful improvement, could see future US rate cut expectations trimmed back, and this could provide the USD (and USD/SGD) a bit of a boost over coming sessions.

SGD event radar: US CPI (Weds), Bank of England Meeting (Thurs), US Retail Sales (16th May), China Activity Data (16th May), Japan GDP (17th May), Japan CPI (19th May), Fed Chair Powell Speaks (20th May), Singapore CPI (23rd May), Eurozone PMIs (23rd May), US PCE Deflator (26th May), China PMIs (31st May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3338, 1.3377