The dollar is slipping from its highs, Treasury yields are inching lower, and stock market indices are retrenching as investors trim exposures to the technology sector amid an ongoing retreat from speculative asset classes. With US markets closed Thursday for the Thanksgiving holiday and likely thinly-populated on Black Friday, traders are working to compress position adjustments into the first three days of the week, and price action is accelerating across the foreign exchange markets, extending a broader rise in measures of implied volatility.

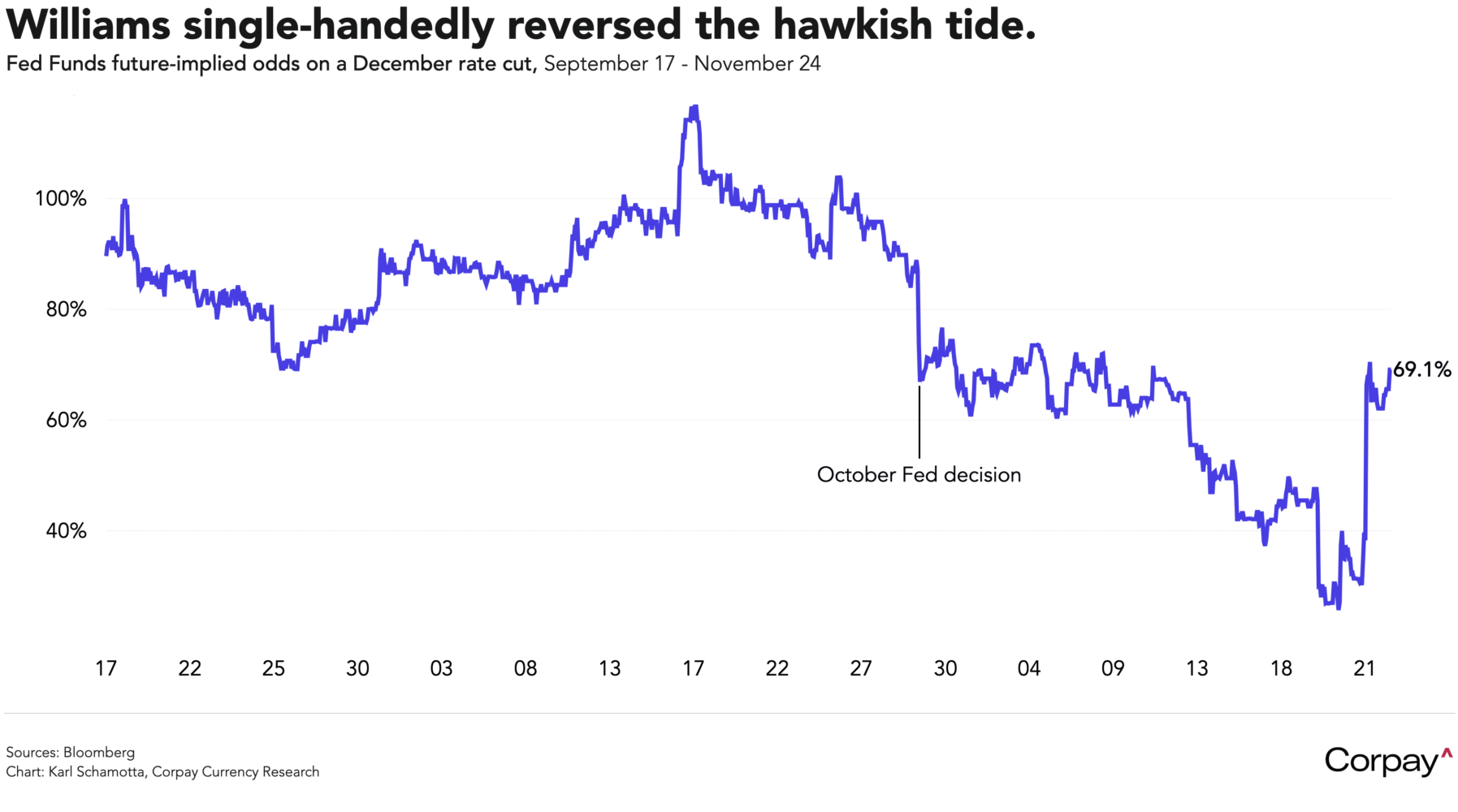

Expectations for a cut at the Federal Reserve’s December meeting jumped spectacularly on Friday morning, weakening the dollar relative to most of its major counterparts. Market-implied odds on a move leapt to more than 65 percent from less than 35 percent when New York Fed President John Williams said “I still see room for a further adjustment in the near term to the target range for the federal-funds rate to move the stance of policy closer to the range of neutral”. Williams is considered an intellectual heavyweight and one of the most influential members of the central bank’s rate-setting committee, often foreshadowing shifts in the consensus and ultimately voting with Chair Powell.

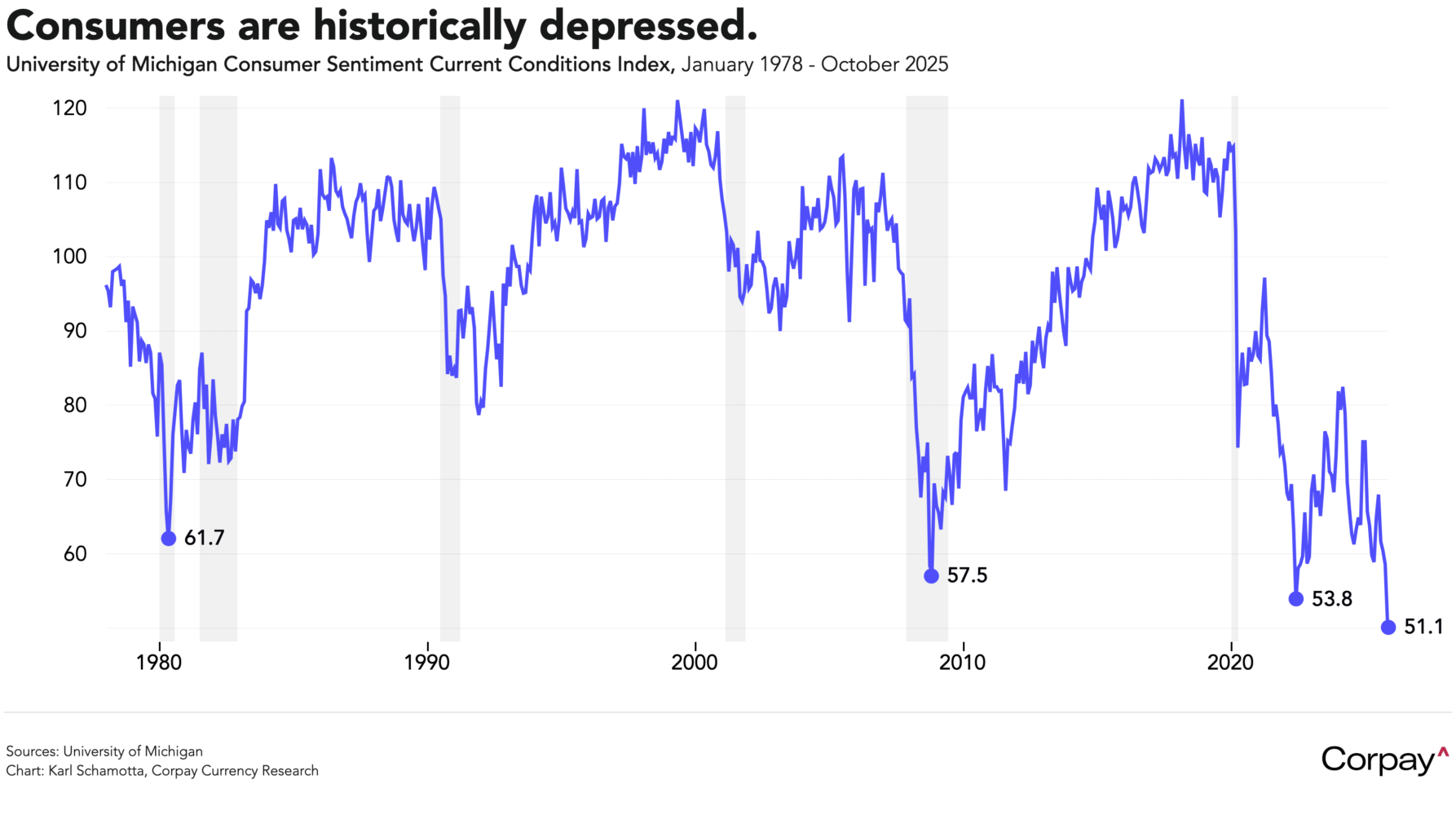

Releases throughout the week illustrated the contradictions embedded in the US economy. Minutes from the Fed’s October meeting skewed distinctly hawkish, with “many” officials favouring a pause in the central bank’s rate cutting campaign. Corporate results from the likes of Walmart and Nvidia underscored resilient profits, but renewed anxiety over stretched valuations sparked a broad market selloff. The long-delayed September non-farm payrolls report showed job creation holding at solid levels, even as labour-force gains pushed unemployment higher. S&P Global’s composite purchasing managers’ index pointed to a second consecutive month of faster private-sector growth in November, helped by an ebbing in policy uncertainty and rising expectations for further monetary easing. And the University of Michigan’s survey revealed households taking their bleakest view of current conditions in the index’s history.

We think markets now have it—roughly—right. Tariffs are clearly exerting upward pressure on select categories, and services costs are rising too briskly, but the overall inflation picture remains comparatively benign. Labour markets look calm on the surface, yet job creation is slowing and underlying demand is softening. Tomorrow’s September retail sales report should confirm a cooling in consumer spending, and Wednesday’s Beige Book is likely to capture a pervasive sense of caution among the households and businesses that drive the economy. Against this backdrop, a risk-management cut—perhaps accompanied by a relatively-hawkish jawboning effort from Chair Powell—appears a reasonable base case for the December meeting.

The British pound is drifting lower ahead of Wednesday’s long-awaited Autumn budget, a set piece that could, in theory, prompt markets to rethink the Bank of England’s easing trajectory—or, more dramatically, to question the government’s commitment to fiscal discipline. A sharper-than-anticipated pivot toward consolidation, featuring broader tax rises or spending cuts, could push gilt yields lower and weigh on the currency. Conversely, a package that inadvertently heightens inflation risks could lift short-dated yields and offer the pound support by dampening expectations for early rate cuts. Still, we think the scope for surprises is limited: memories of the Liz Truss debacle remain all too vivid, and Chancellor Rachel Reeves has taken pains to manage market expectations in advance. After weeks of fiscal jitters across UK-specific asset classes, the release itself could prove somewhat anti-climatic.

Here in Canada, the loonie remains technically oversold after the September retail sales report showed volumes contracting -0.3 percent in the third quarter, weighing on forecasts ahead of this week’s gross domestic product release. Friday’s update is seen averting fears of a technical recession—with the economy expanding at a notch above stall speed—but isn’t expected to knock the Bank of Canada off the sidelines as it prepares to leave rates on hold for an extended period. The currency’s selloff could continue, but we think current valuations look attractive for Canadian dollar buyers, and suspect that longer-term risks are skewed toward some upside.

Lastly, Japanese yen traders are on intervention watch as the dollar exchange rate drifts toward the 160 mark and policymakers amp up their jawboning efforts. Long-dated government bond yields are holding near their highest levels since 1999 as Sanae Takaichi’s new government prepares to unveil a larger-than-expected spending package, and selling pressure on the currency has intensified, but the finance ministry is clearly growing restive and could step in at any time. “The government will take appropriate action against disorderly FX moves, including those driven by speculation,” said Finance Minister Satsuki Katayama on the weekend, suggesting—to us, at least—that the Bank of Japan could seize on low liquidity conditions at some point this week to make its move. We nonetheless expect the currency to continue its downward drift until policymakers begin delivering rate hikes.