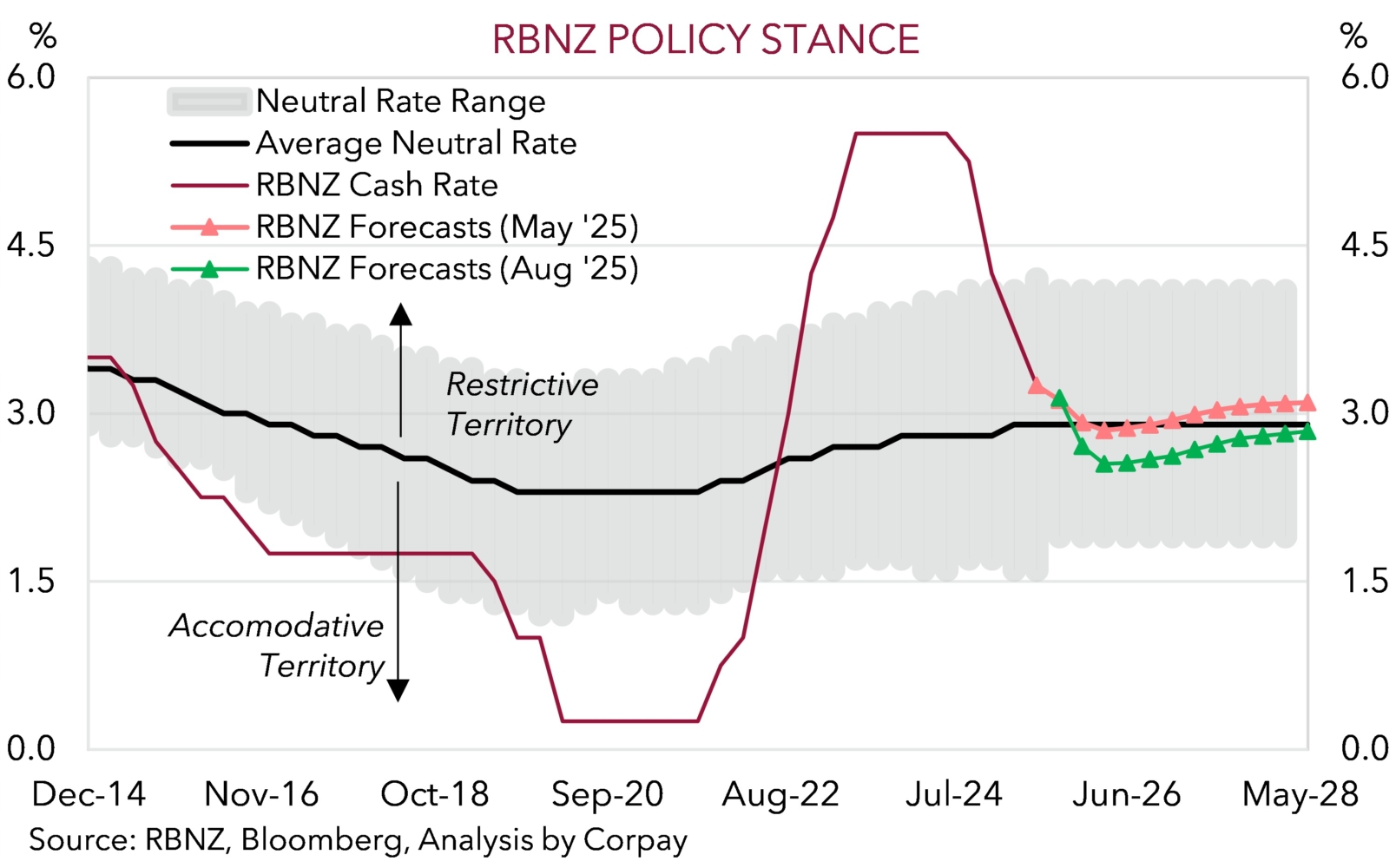

After holding steady last time out the Reserve Bank of New Zealand once again spread its ‘dovish’ wings at today’s policy meeting. As expected, the RBNZ announced another 25bp cut which lowered the Official Cash Rate to 3%, however the updated assessment of the economic landscape was more downbeat and opened the door to settings being moved into ‘accommodative’ territory over future meetings (chart 1).

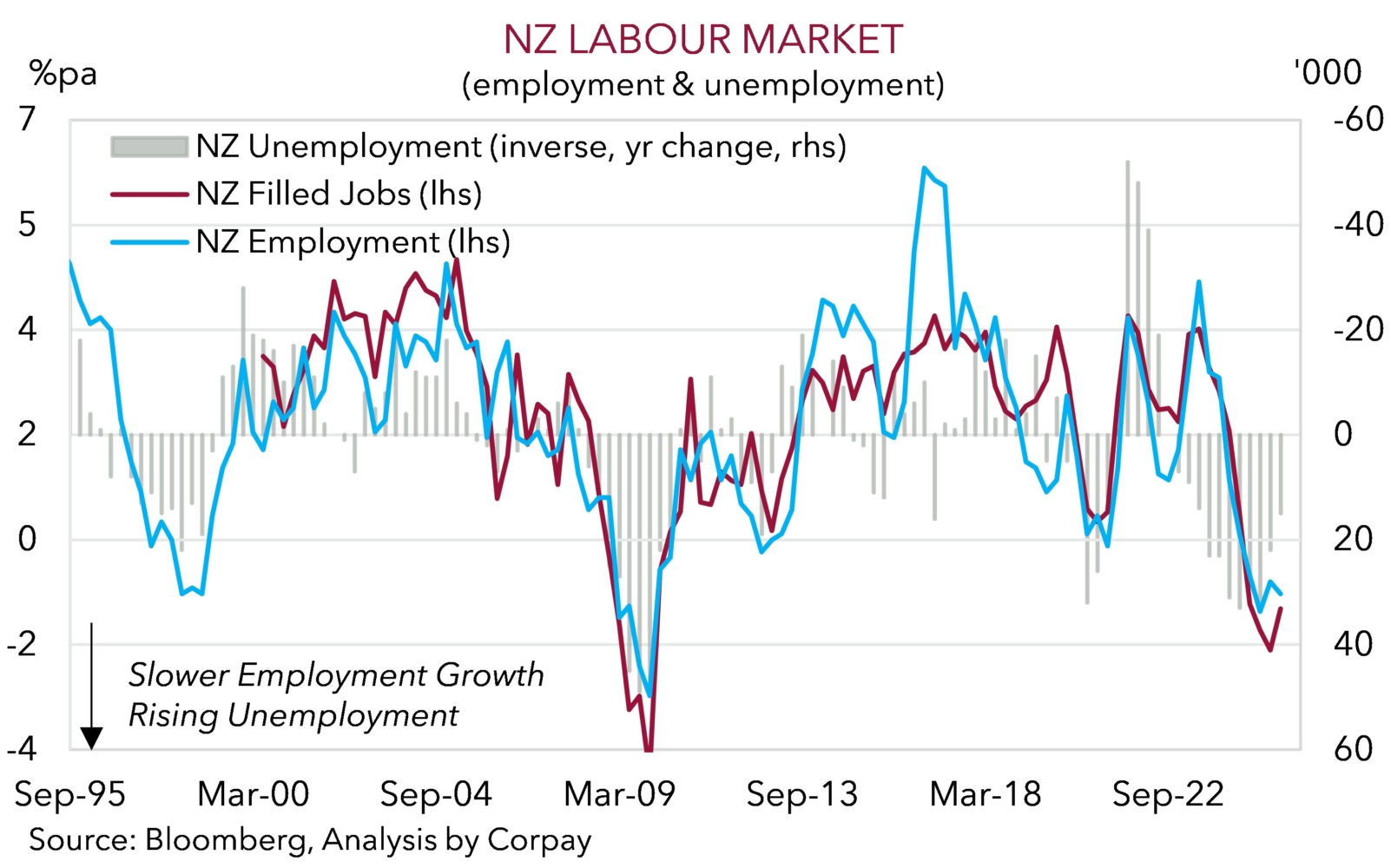

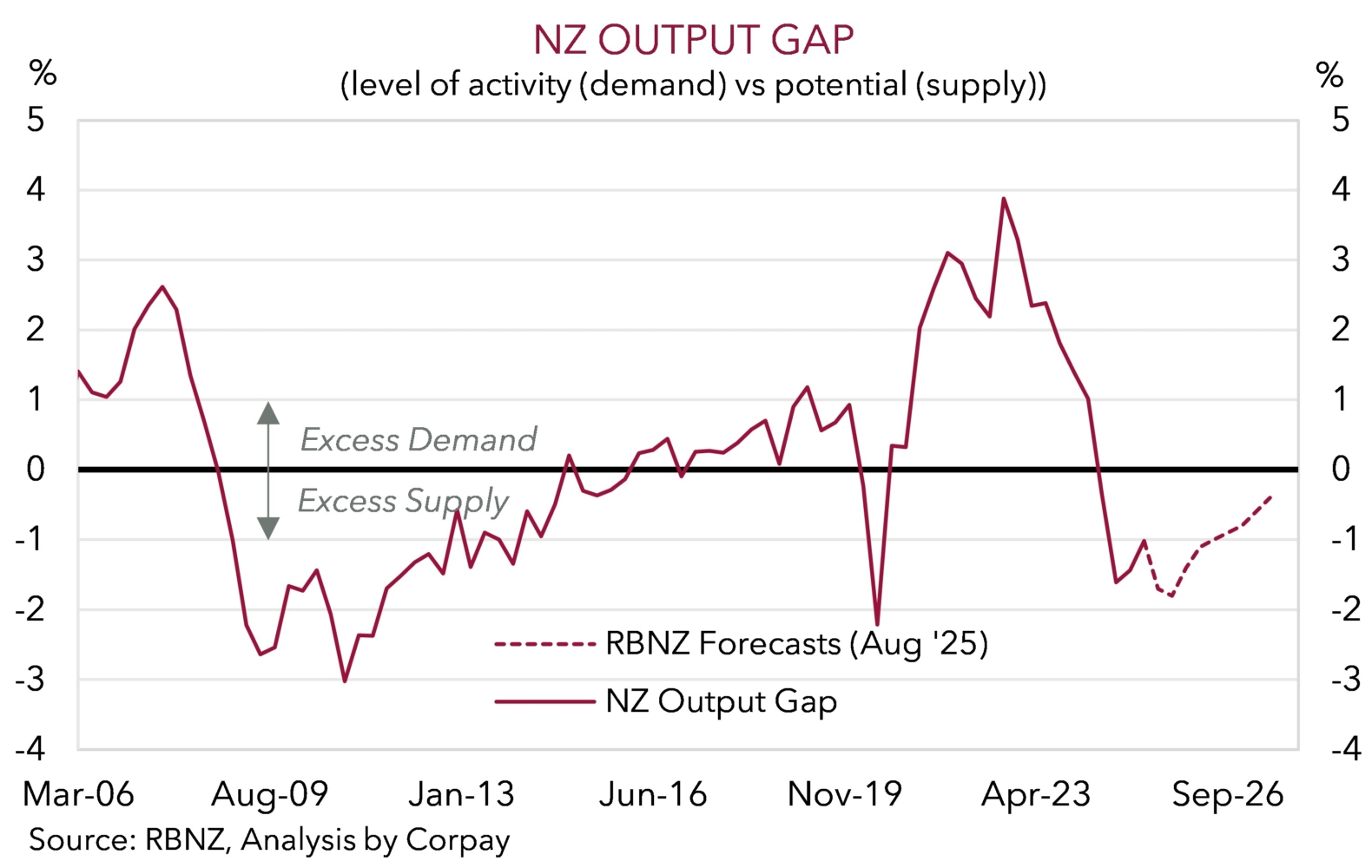

The sluggish performance of the NZ economy remains front of mind with the RBNZ noting the “recovery stalled in the second quarter of this year”. NZ economic growth is forecast to improve but remain below potential until H2 2026. According to the RBNZ, due to NZ’s economic struggles (such as the weaker jobs market) and rejigged judgement that “if medium-term inflation pressures continue to ease”, there “is scope to lower the OCR further” (chart 2).

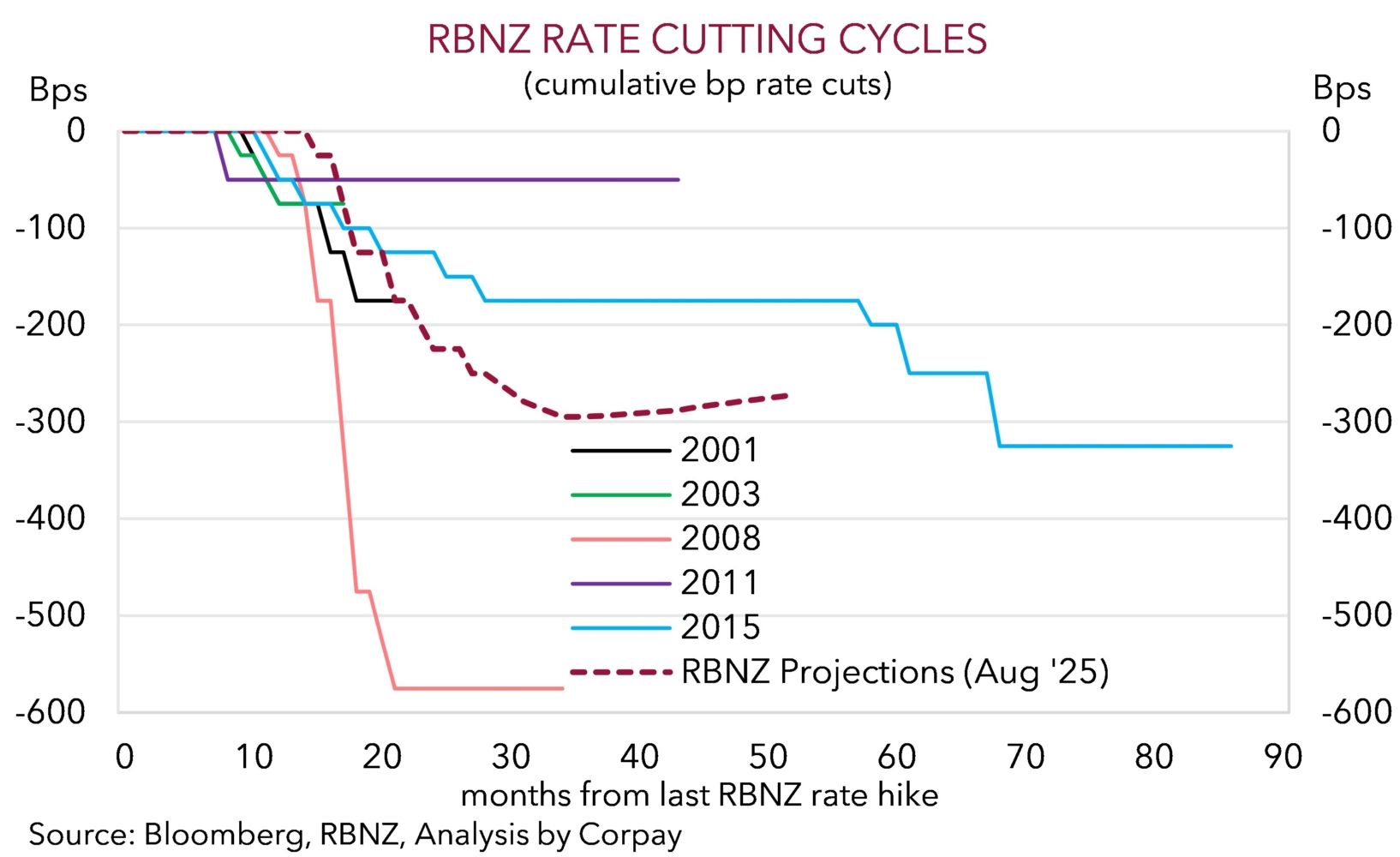

This was reflected in the latest projection path with the RBNZ indicating ~2 more rate cuts are in the pipeline by Q1 2026 as policymakers try to reinvigorate momentum and absorb the excess slack that exists (chart 3). Indeed, if that wasn’t enough of a ‘dovish’ twist the record of today’s meeting also noted that some members of the committee were pushing for a larger 50bp reduction to be delivered to ward off a potential self-reinforcing negative loop on domestic consumption from the uncertain global backdrop.

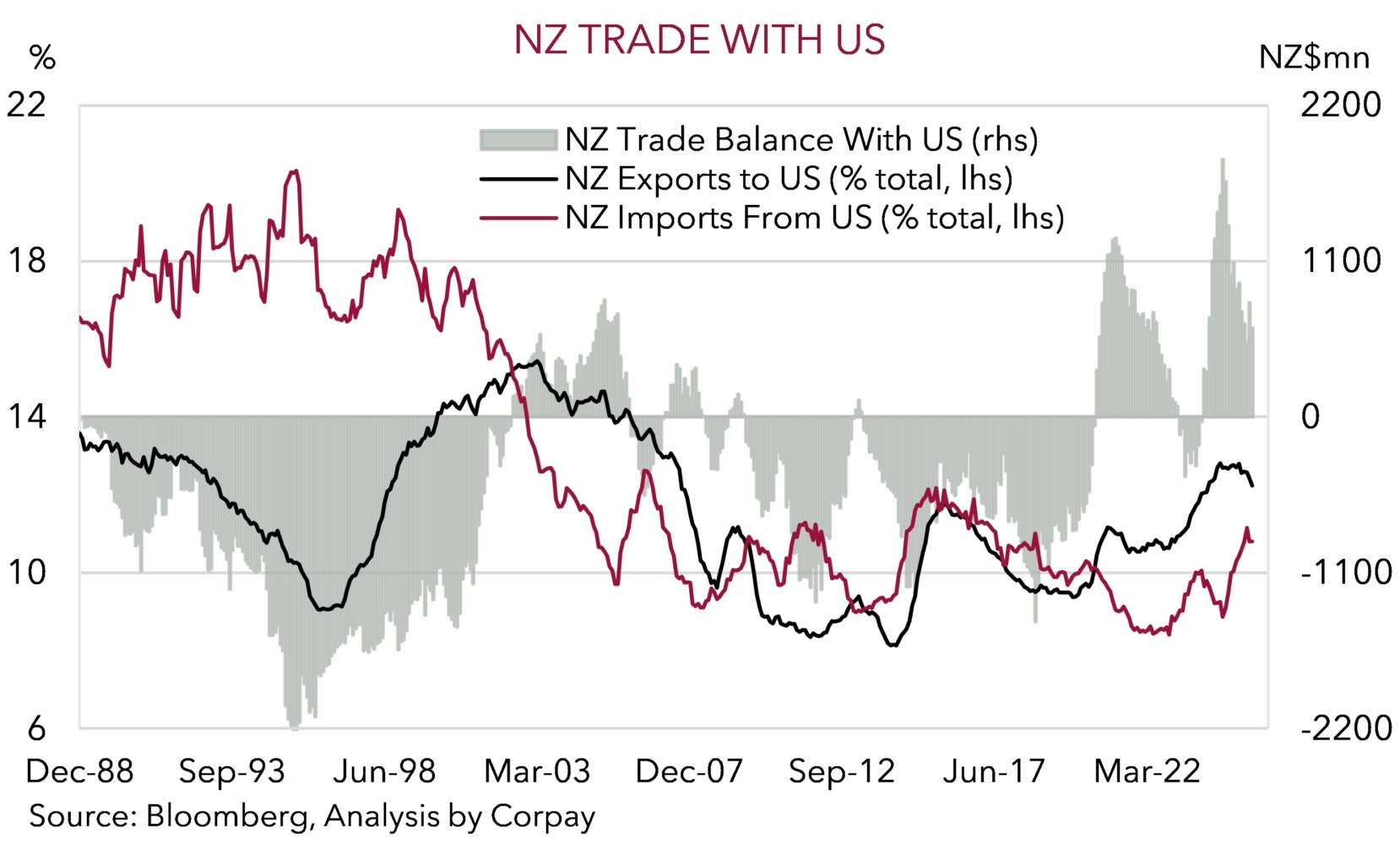

As shown, outside of the GFC, the 250bps worth of rate cuts pushed through by the RBNZ since last August has been the most abrupt policy U-turn in several decades (chart 4). And there is more to come. We believe the challenges faced by the NZ economy risk the RBNZ having to deliver even more support than it thinks. The long shadow cast across the private sector from the high/restrictive monetary policy settings put in place by the RBNZ in the years after COVID are being compounded by disruptions to global trade. This is something the small open NZ economy is exposed to, especially as a decent chunk of NZ’s trade is directly with the US (~12% of NZ exports are sent to the US) (chart 5).

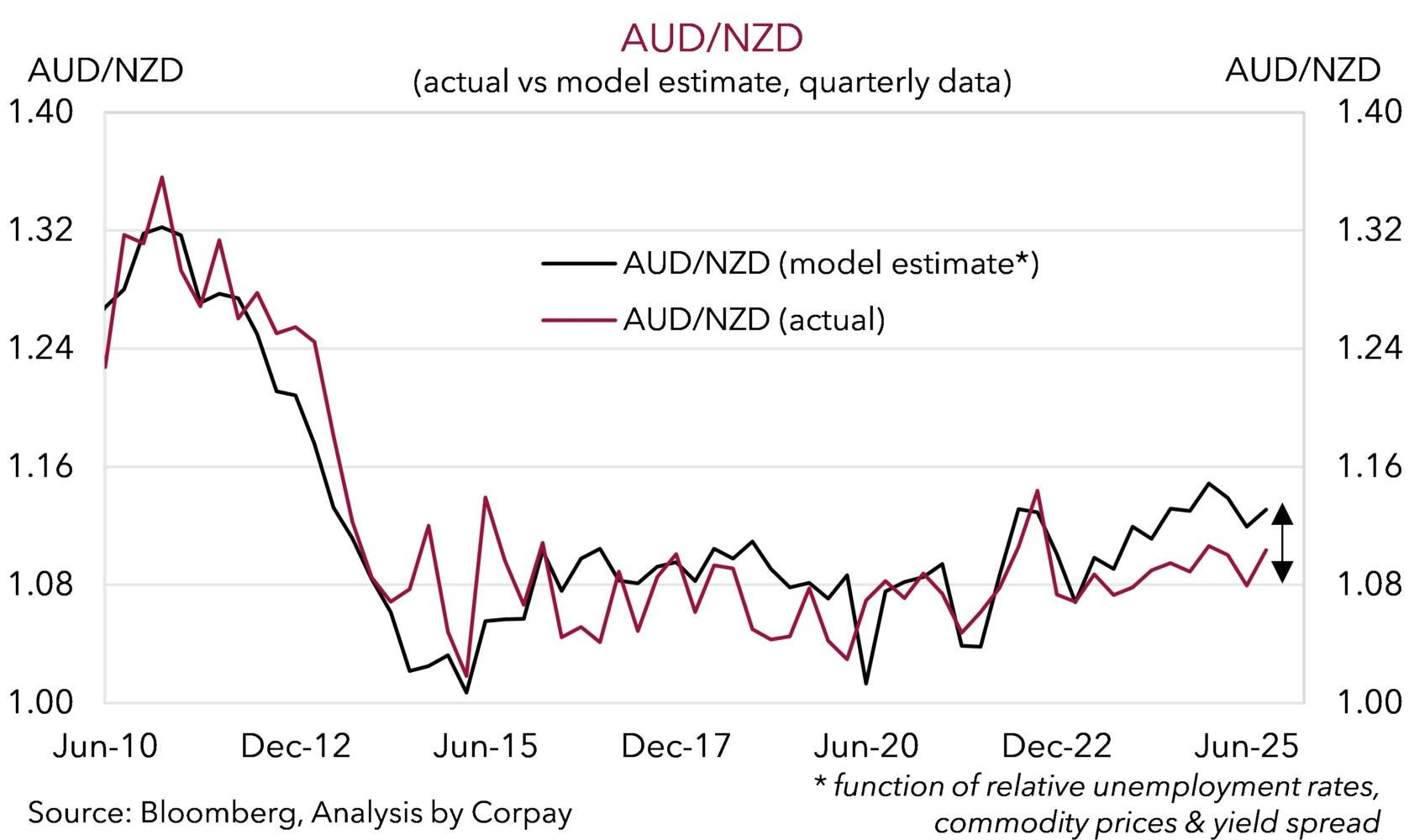

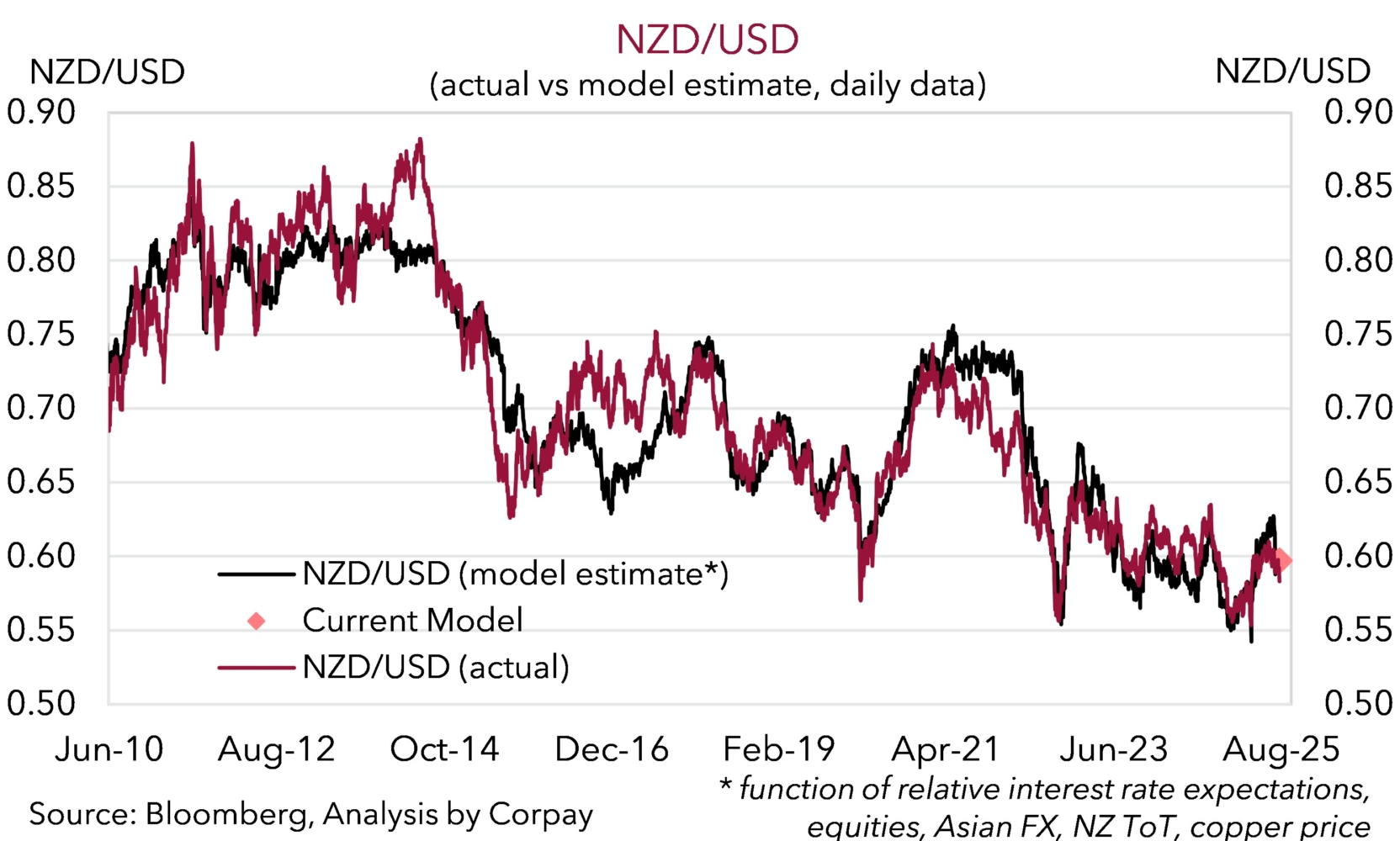

The dovishness in the RBNZ’s communications and repricing in NZ interest rate expectations has exerted downward pressure on the NZD. At ~$0.5835 NZD/USD is around the bottom end of the range it has occupied since mid-April, while AUD/NZD (now ~1.1035) has jumped up to its highest point since March (NZD/AUD has dropped to ~0.9062). We believe NZD/USD is facing more near-term headwinds, not just as markets react to the shift in RBNZ thinking but also from the USD side of the equation with US Fed Chair Powell’s Jackson Hole speech looming on the horizon (Fri night AEST). That said, with NZD/USD close to where are modelling suggests ‘fair value’ currently sits we feel further falls may be slower to come through and/or limited (chart 6).

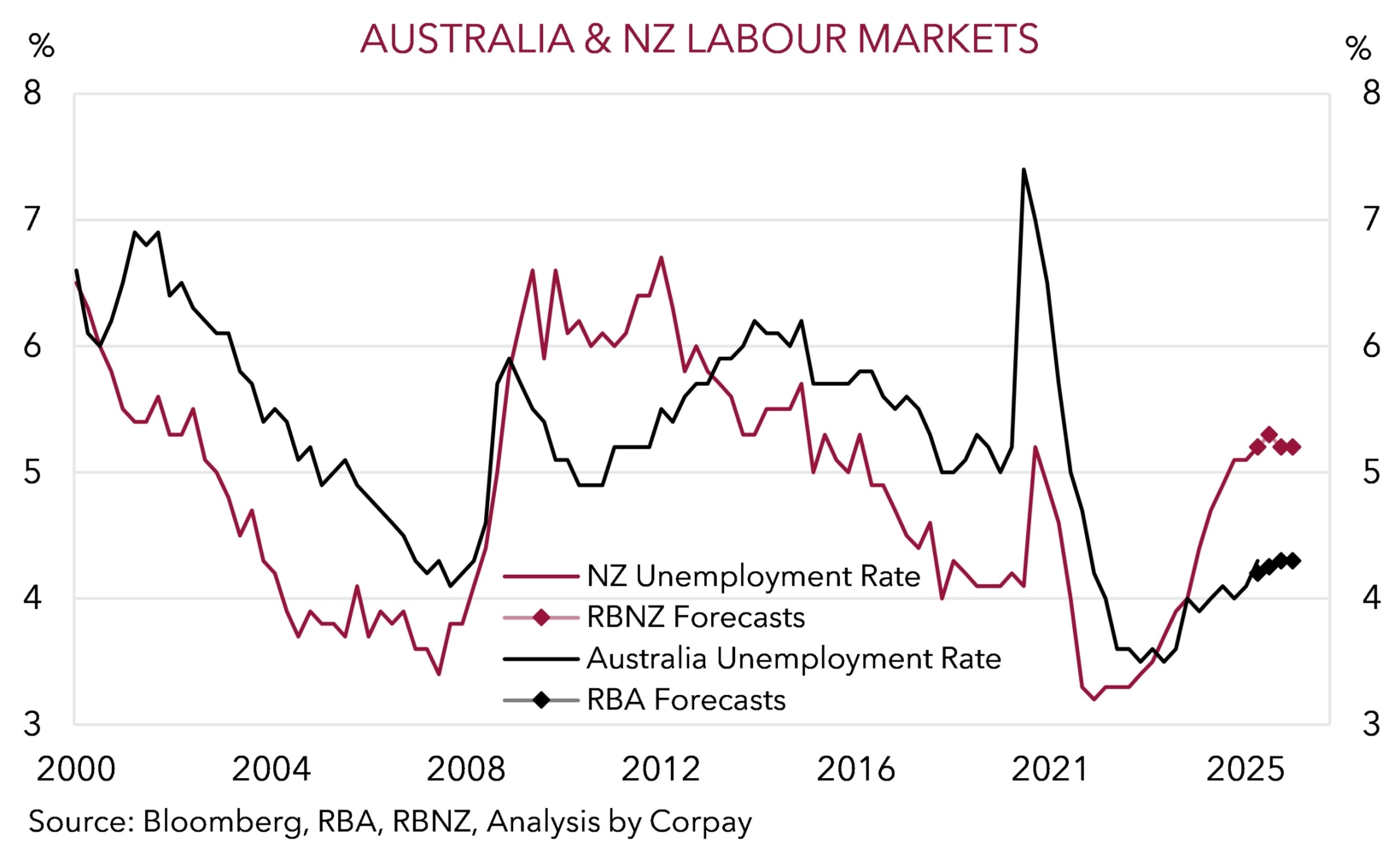

However, we do think the ongoing macro divergence between Australia and NZ (as illustrated by the widening unemployment rate gap) and more cautious approach being taken by the RBA during its easing cycle should support a further drift higher in AUD/NZD over the period ahead (lower NZD/AUD) (chart 7). Our modelling suggests AUD/NZD is a bit too low (NZD/AUD a little too high) based on where a range of fundamental drivers are tracking (i.e. fair value is estimated to be ~1.12 (or ~0.89 for NZD/AUD)) (chart 8).