• Holding. Despite some swings in other asset classes net moves in FX have been modest. JPY outperformed. AUD still hovering near the top of its range.

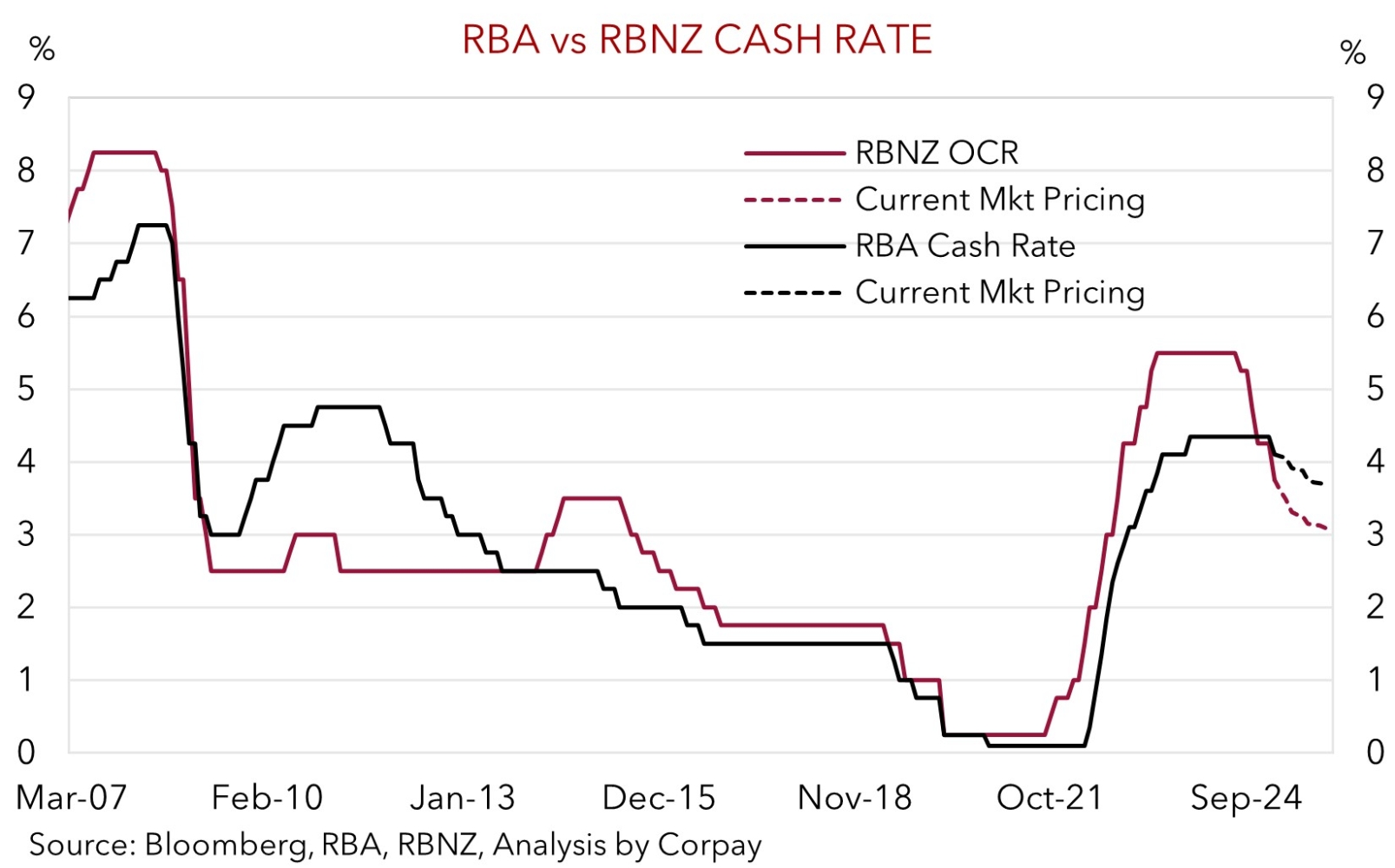

• RBNZ cuts. Another 50bp rate cut by the RBNZ yesterday. More easing is projected. This contrasts the RBA. We expect AUD to outperform the NZD.

• AU jobs. Labour force data due today. Another solid set of figures anticipated. If realised, this will support the RBA’s ‘hawkish’ guidance about more rate cuts.

Global Trends

Mixed fortunes across asset markets overnight as geopolitical and economic news pushed and pulled on sentiment, especially in Europe. In contrast to the consolidation in the US stockmarket and slight dip in US bonds, European equities fell back (EuroStoxx600 -0.9%) and yields rose ~4-8bps across the region. US President Trump’s labelling of Ukraine President Zelenskiy as a “dictator” dampened risk appetite. As did ‘hawkish’ comments from the ECB’s Schnabel who noted policymakers should “now” start to debate a “pause” to rate cuts. In response, traders pared back some of their longer-dated ECB rate cut expectations. Less than 3 more ECB rate reductions are now factored in by year-end. A re-acceleration in UK CPI, with core inflation quickening to 3.7%pa (a high since April 2024), also raised a few more concerns about whether the global disinflation trend is stalling.

That said, FX moves have been modest. The USD index consolidated with small falls in the EUR (now ~$1.0424) and GBP (now ~$1.2583) offset by a firmer JPY (USD/JPY declined to ~151.50). JPY continues to garner support from Bank of Japan rate hike expectations. Yesterday the BoJ’s Takata stated that it is important to continue considering gradual rate rises to contain inflation risks. Closer to home, USD/SGD held steady (now ~1.3428) towards the lower end of its 2-month range. NZD (now ~$0.5703) whipped around a bit intra-day post the RBNZ’s latest 50bp rate cut as traders tweaked their assumptions about how far and fast the central bank will move from here. And the AUD continues to tread water in a narrow range centered on $0.6350.

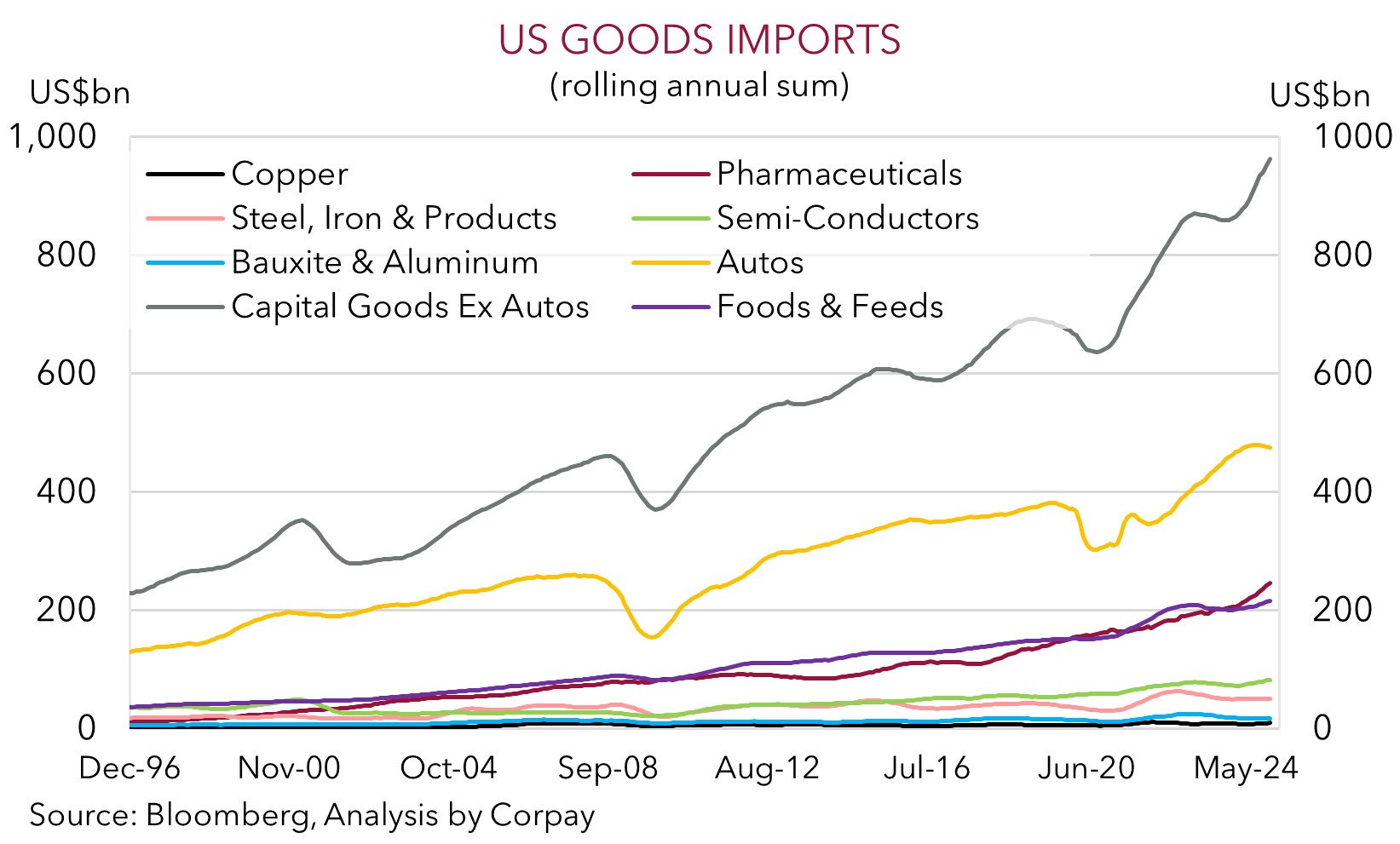

In addition to the macro and political issues mentioned above, US trade policy is still lurking in the background. Yesterday, President Trump warned that tariffs of “around 25%” could be imposed on car, semi-conductor, and pharmaceutical imports in early April. As our chart shows, these are some of the largest, and economically significant, categories of US imports. Nations like Mexico and Canada ship across the greatest share of autos, India and China send generic drugs, and Taiwan is a key player in the semi-conductor space. However, given integrated supply chains and high dependence on imports by US producers (and consumers) large tariffs being imposed on these products could heighten growth risks for the US. More tariff announcements may generate bursts of volatility down the track, in our opinion. But on balance, as we have seen recently, the tariff reality might not be as harsh or implemented as quickly as what many anticipated. In our judgement, this suggests the USD is biased to gradually lose ground over the medium-term as more of the built up Trump risk premium is unwound.

Trans-Tasman Zone

AUD/USD has again oscillated in a tight ~0.5% range centered on ~$0.6350 over the past 24hrs, inline with the modest net moves in the USD (see above). The AUD has been a bit more mixed on the crosses with a slight ~0.1-0.3% uptick coming through against the EUR, GBP, CAD, and CNH. By contrast, AUD/JPY has gone the other way (-0.4% to ~96.14) with the JPY an FX outperformer.

Locally, the January labour force report is due today (11:30am AEDT). The Australian jobs market has surprised over the past year with jobs still being created and unemployment low in the face of slower GDP growth and higher interest rates. This reflects the support provided by solid government spending and still high level of activity across the labour-intensive services sectors. Another solid set of figures is anticipated with consensus looking for a 20,000 gain in employment and for the unemployment rate to nudge up to 4.1%. This type of result would support the RBA’s ‘hawkish’ guidance regarding the timing and speed of additional rate cuts. This in turn may generate support for the AUD, particularly against currencies such as the EUR, NZD, CAD, and CNH that are facing growth challenges and direct tariff risks, or where more aggressive rate cuts are still looked for.

Across the Tasman, the NZD swung around a little yesterday in the wake of the RBNZ meeting, though on net it is little changed from this time yesterday (now ~$0.5703). As expected the RBNZ cut the Official Cash Rate by another 50bps. This was the 3rd straight meeting the RBNZ delivered an outsized rate cut. The rapid-fire adjustment, aimed at reviving NZ growth after a torrid spell induced by the RBNZ’s past aggressive rate hikes, has lowered the OCR to 3.75%. Outside of the GFC, the 175bps worth of rate cuts delivered by the RBNZ over the past 7 months has been the most abrupt policy U-turn in several decades. And the RBNZ gave strong signals it isn’t done yet. The RBNZ’s updated projections have the OCR falling to ~3.1% by Q4 ’25 with Governor Orr stating more traditional 25bp cuts at the April and May meetings are assumed. We would argue that the risks are skewed to the RBNZ delivering even more interest rate relief over time. We believe the increasingly negative NZ-US yield differentials and challenges NZ may face in funding its external imbalance (the NZ current account deficit is ~6.5% of GDP) should constrain NZD upside potential. Moreover, over the medium-term, the diverging economic and policy trends between Australia and NZ, should see further gains in AUD/NZD (falls in NZD/AUD). We are projecting AUD/NZD to rise to ~1.13 by mid-2025 (NZD/AUD falling to ~0.8850) (for more see Market Musings: AUD/NZD: RBNZ downshift continues).