• Upbeat vibes. US equities rose while bond yields dipped. USD softer. Run of weak US data supported the case for another US Fed rate cut in December.

• RBNZ meeting. NZD ticks up ahead of RBNZ decision. Another cut expected with markets looking for a 25bp move. Is the easing cycle almost over?

• AU CPI. First full monthly CPI report out. Data could be volatile the next few months. Will it reinforce the case for the RBA to hold steady from here?

Global Trends

The more upbeat sentiment across markets continued overnight with a mix of macro and geopolitical news in the spotlight. US and European equities rose with the major indices up ~0.7-1.0%, while US bond yields slipped back with rates falling ~3-4bps across the curve. In FX the USD index weakened with EUR (now ~$1.1565) and GBP (now ~$1.3162) firmer and USD/JPY losing a bit of altitude (now ~156.10), although it remains near the upper end of its multi-month range. The AUD consolidated a little above its 1-year average (now ~$0.6468) ahead of today’s monthly CPI inflation data (11:30am AEDT), and NZD ticked up (now ~$0.5619) with the RBNZ widely expected to cut interest rates again later today (12pm AEDT). Elsewhere, oil prices declined (WTI crude -1.7% to ~US$58/brl) with signs of progress in Russia/Ukraine peace talks a factor at play.

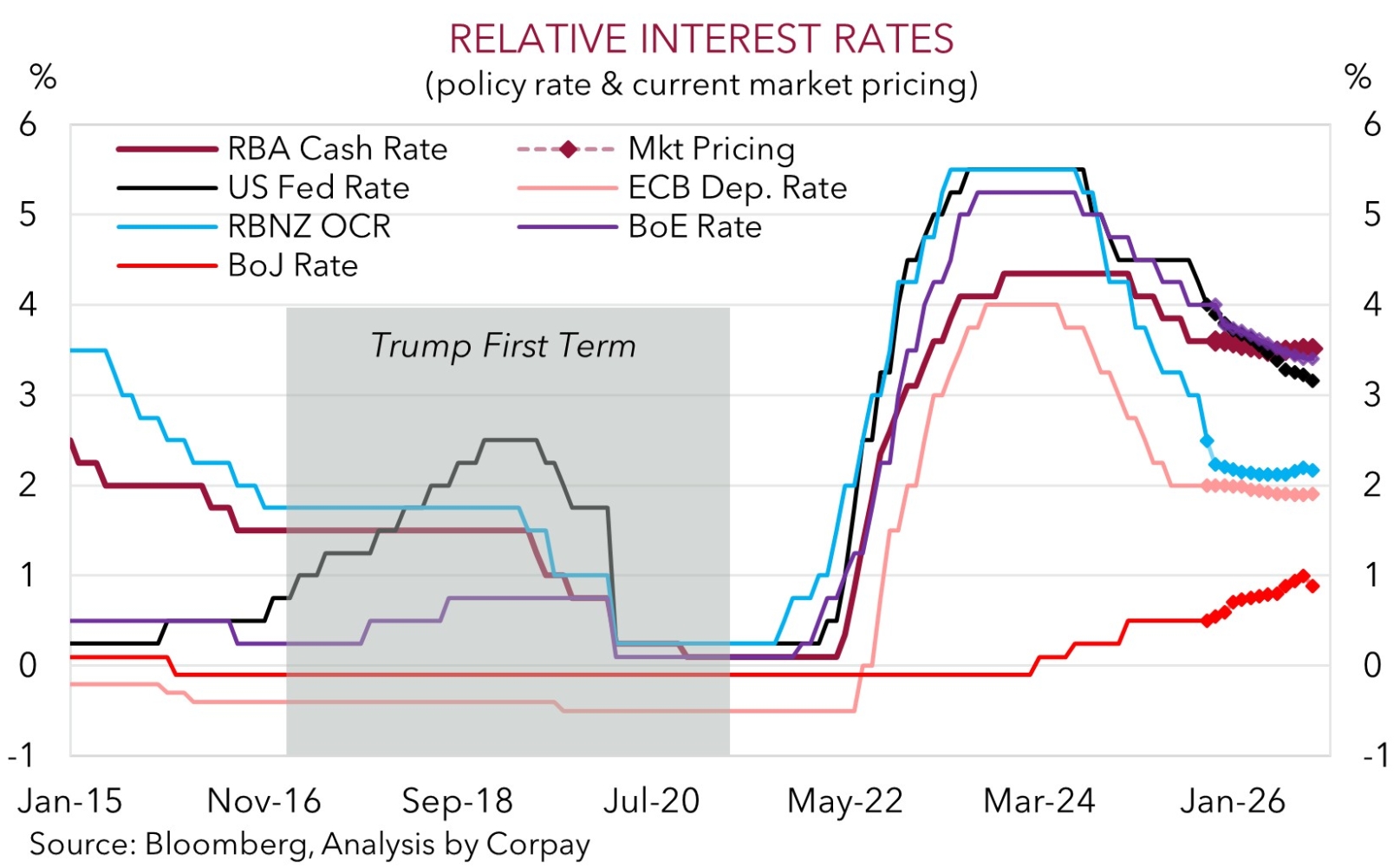

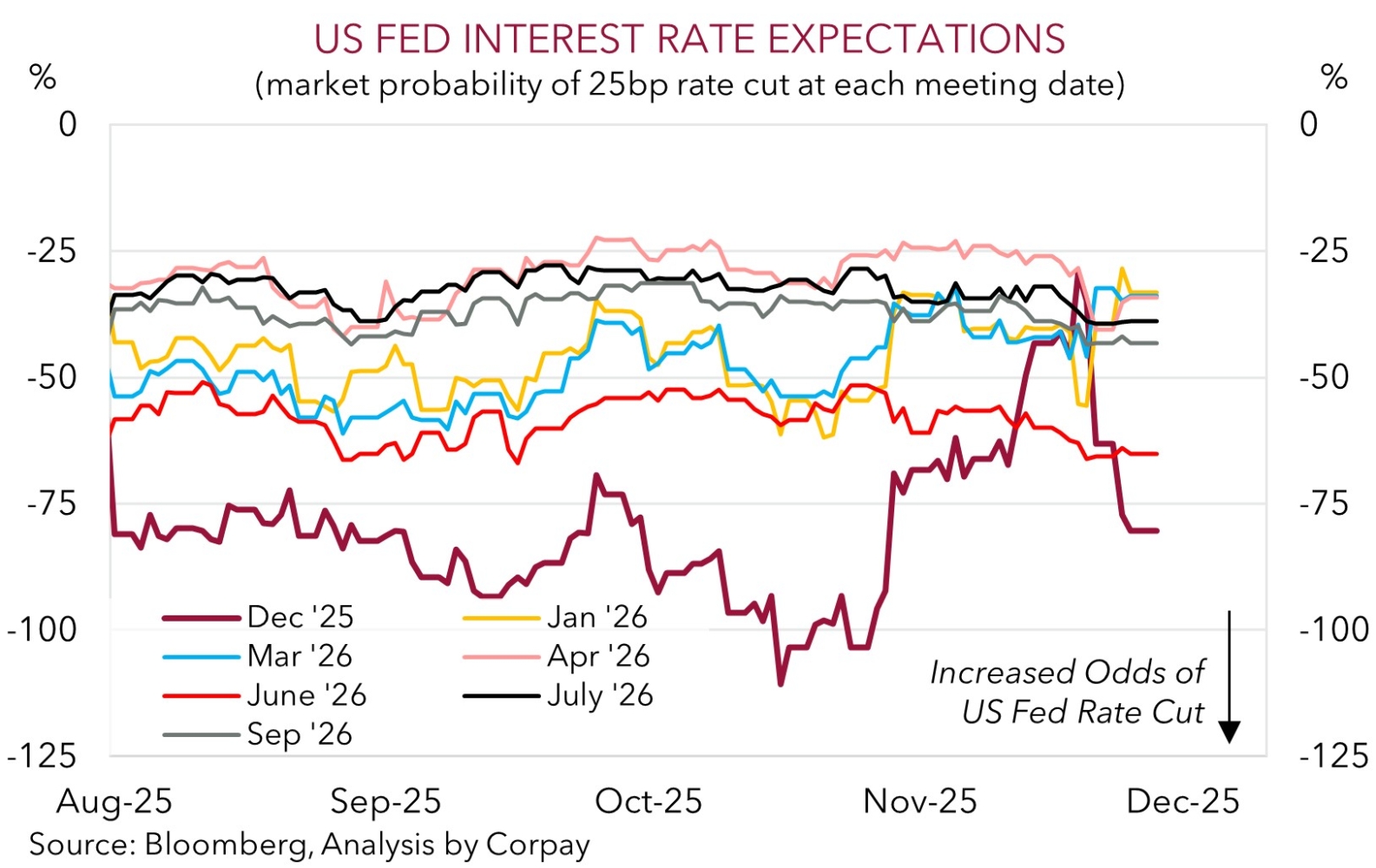

Heighted expectations the US Fed might lower interest rates again at its mid-December meeting have underpinned the recent market moves. A few choice words from a couple of US Fed heavyweights over the past week about the prospect of a ‘near-term’ reduction were compounded overnight by softer US economic data. The government shutdown delayed US retail sales and producer price inflation figures for September showed sluggish consumer spending (the ‘control group’ which feeds into US GDP fell 0.1%) and contained upstream price pressures (core PPI held steady at 2.9%pa). Added to that, the Richmond Fed manufacturing index contracted and US consumer confidence tumbled to its lowest point since April when the trade tariffs and acute market volatility first hit. Odds of the US Fed cutting interest rates by another 25bps in December have jumped to ~80%, up from a ~30% chance a week or so ago.

Tonight, the UK budget is released (11:30pm AEDT). Given the UK’s underlying fiscal challenges there is a chance the budget, if it shows a sizeable increase in the nation’s debt trajectory, causes a burst of intra-day volatility in UK bond yields and/or GBP. In the US, weekly jobless claims and durable goods orders (a proxy for business investment) are due (12:30am AEDT) ahead of the Thanksgiving holiday period (Thurs/Fri) which may impact market liquidity and trading conditions later in the week. On net, we remain of the view that the slowing momentum in the US economy, widening cracks in the jobs market, and outlook for US Fed rate cuts could see the USD lose some ground over the period ahead.

Trans-Tasman Zone

The improvement in risk appetite (as illustrated by the uptick in equities the past few sessions) and softer USD on the back of heightened expectations of a mid-December US Fed rate cut have generated some support for the AUD and NZD recently (see above). At ~$0.6468 the AUD is tracking a bit north of its 1-year average while the NZD (now ~$0.5619) has also nudged up, though it remains down near the lower end of its multi-month range. On the crosses, the modest rebound in the JPY has exerted a little downward pressure on AUD/JPY, however at nearly ~101 we still think it is looking too high compared to underlying drivers such as relative yield spreads. Elsewhere, AUD/EUR has slipped back under ~0.56 while AUD/GBP (now ~0.4914) also weakened overnight.

During today’s Asian session the AUD and NZD will have domestic events to contend with. Across the Tasman the RBNZ is meeting (12pm, press conference 1pm AEDT). Because of the weakness in NZ’s economy another interest rate reduction is looked for. The debate is on how big it might be? Most economists and interest rate markets are factoring in a 25bp reduction, but there is always a chance the RBNZ delivers a larger 50bp cut as it did at its last meeting. Outcomes compared to expectations drive markets. On the assumption the RBNZ lowers the cash rate by only 25bps to 2.25% we believe the NZD may edge higher over the near-term in a “sell the rumor, buy the fact” type scenario as markets start to wonder if the easing cycle is at or nearing its end.

In Australia, the first full monthly CPI inflation report is out (11:30am AEDT). Up until now the monthly CPI series has been a partial indicator. The new full monthly series will have teething issues and might be volatile for a time because of seasonal-adjustment quirks. That said, we believe the data should again show the underlying inflation pulse remains sticky with annual core CPI running towards the higher end of the RBA’s 2-3% target band. This type of result could, in our view, reinforce the view that the RBA may not lower interest rates again this cycle. Markets are now only discounting another ~12bps of RBA easing by mid-2026. In the short-run, we think more bursts of headline driven AUD volatility are possible, particularly over the US Thanksgiving holiday period. But barring a sharp sustained deterioration in risk sentiment we feel the underlying improvement in US/China trade relations, more favourable yield spreads between Australia and other nations, and/or firmer growth in China as stimulus measures gain traction might help the AUD climb gradually higher over coming months.