• Mixed signals. US equities rose on Friday. Bond yields ticked up. Limited net moves in FX. AUD & NZD tracking above their 1-year averages.

• RBA focus. After surprising by holding rates steady in July, RBA expected to cut this week. Given inflation & job trends will the RBA turn more ‘dovish’?

• Event Radar. In addition to the RBA the latest jobs figures are out this week. In the US CPI inflation & retail sales are due, as is the China data batch.

Global Trends

A mixed performance across markets at the end of last week, with limited new news flow coming through to shake things up. US equities extended their climb higher with the tech-focused NASDAQ (+1%) reaching a fresh record high and the broader S&P500 (+0.8%) not that far from its historic peak. Elsewhere, bond yields ticked up with US rates rising 3-4bps across the curve. The announcement that President Trump had nominated the Chair of the White House Council of Economic Advisers Stephen Miran to temporarily fill the vacant seat on the Federal Reserve Board had little impact on interest rate expectations given markets are already baking in close to a ~90% chance of a rate cut in the US at the September meeting and a couple of reductions by Q1. In FX, the USD index nudged up a little, although it wasn’t enough to unwind previous falls with the USD still declining ~1% over the week. EUR is tracking close to ~$1.1650 and USD/JPY (now ~147.75) is just below its year-to-date average. The NZD (now ~$0.5950) and AUD (now ~$0.6520) consolidated slightly north of their respective 1-year averages.

There is no major international data due over the next 24hrs so it could be a quiet start to the week. That said, there are several potential flashpoints on the horizon. In the US, CPI inflation (Tues night AEST), producer prices (Weds night AEST), retail sales and import prices (both Fri night AEST) are on the schedule, as is the monthly China data batch (Fri AEST), UK (Thurs) and Japan (Fri ) Q2 GDP. Presidents Trump and Putin are meeting in Alaska on Friday, and the US/China ‘trade truce’ is set to expire (Tues), though based on recent rhetoric this looks likely to be extended. Closer to home, the RBA is expected to cut interest rates (Tues) with the latest wages (Weds) and jobs (Thurs) figures also out.

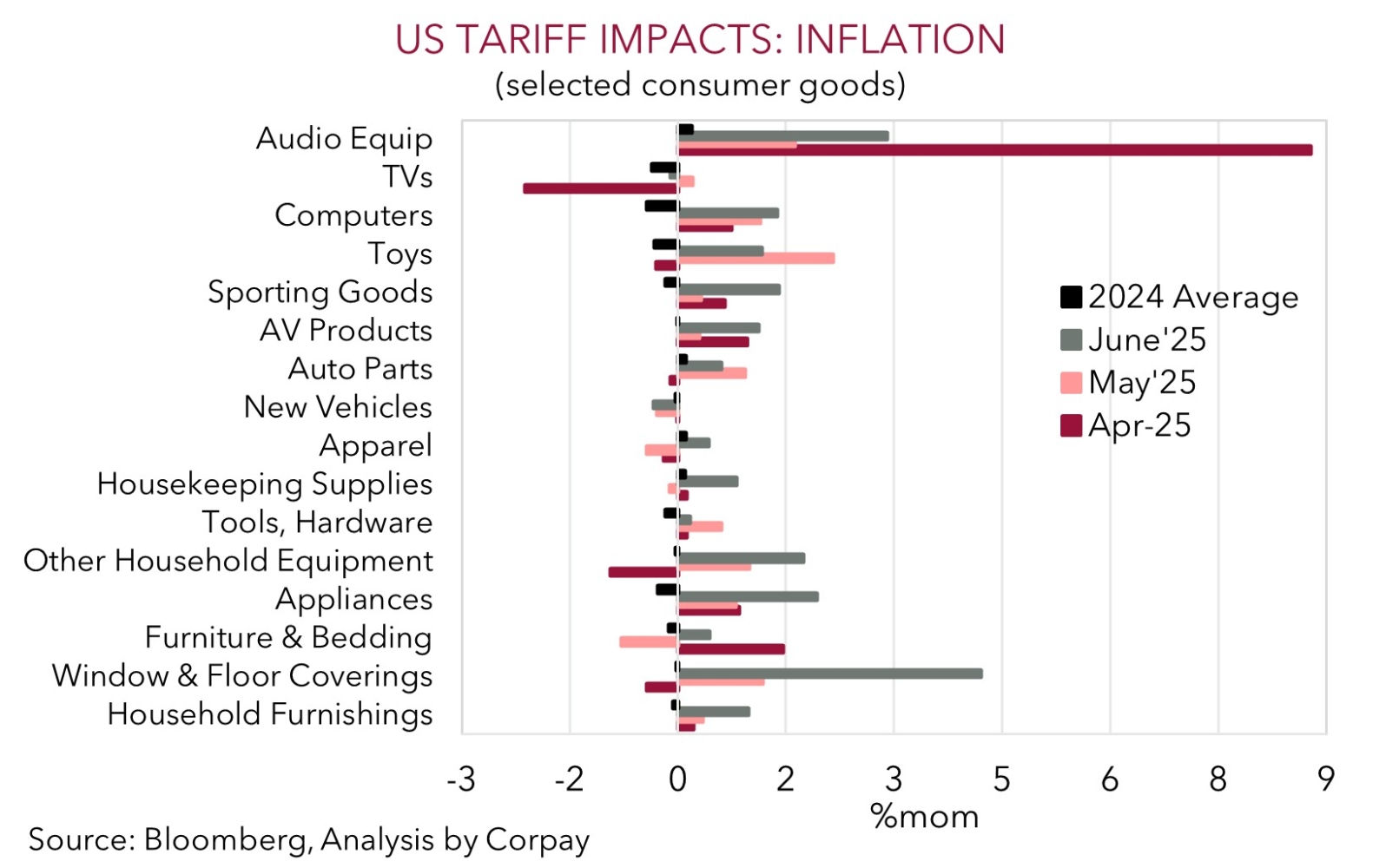

US consumer and producer inflation reports will be watched closely for greater tariff impacts on prices with various consumer goods showing effects the past few months. The retail sales data will provide a guide on how household spending (the engine room of the US economy) is holding up. On balance, we think that with a few US Fed rate cuts over the next year well discounted the USD might rebound over the short-run if this week’s US data exceeds predictions and pricing for a series of Fed moves is pared back.

Trans-Tasman Zone

The limited macro newsflow kept FX markets contained at the end of last week with the AUD (now ~$0.6520) and NZD (now ~$0.5950) treading water just above their respective 1-year averages (see above). That said, it was still a positive week with the softer USD helping the AUD and NZD edge up ~0.7% over the past few sessions. Indeed, the AUD ticked up a little on most of the major crosses on Friday with gains of ~0.1% recorded against the EUR, NZD, CAD, and CNH, and a larger rise posted versus the JPY (+0.5%).

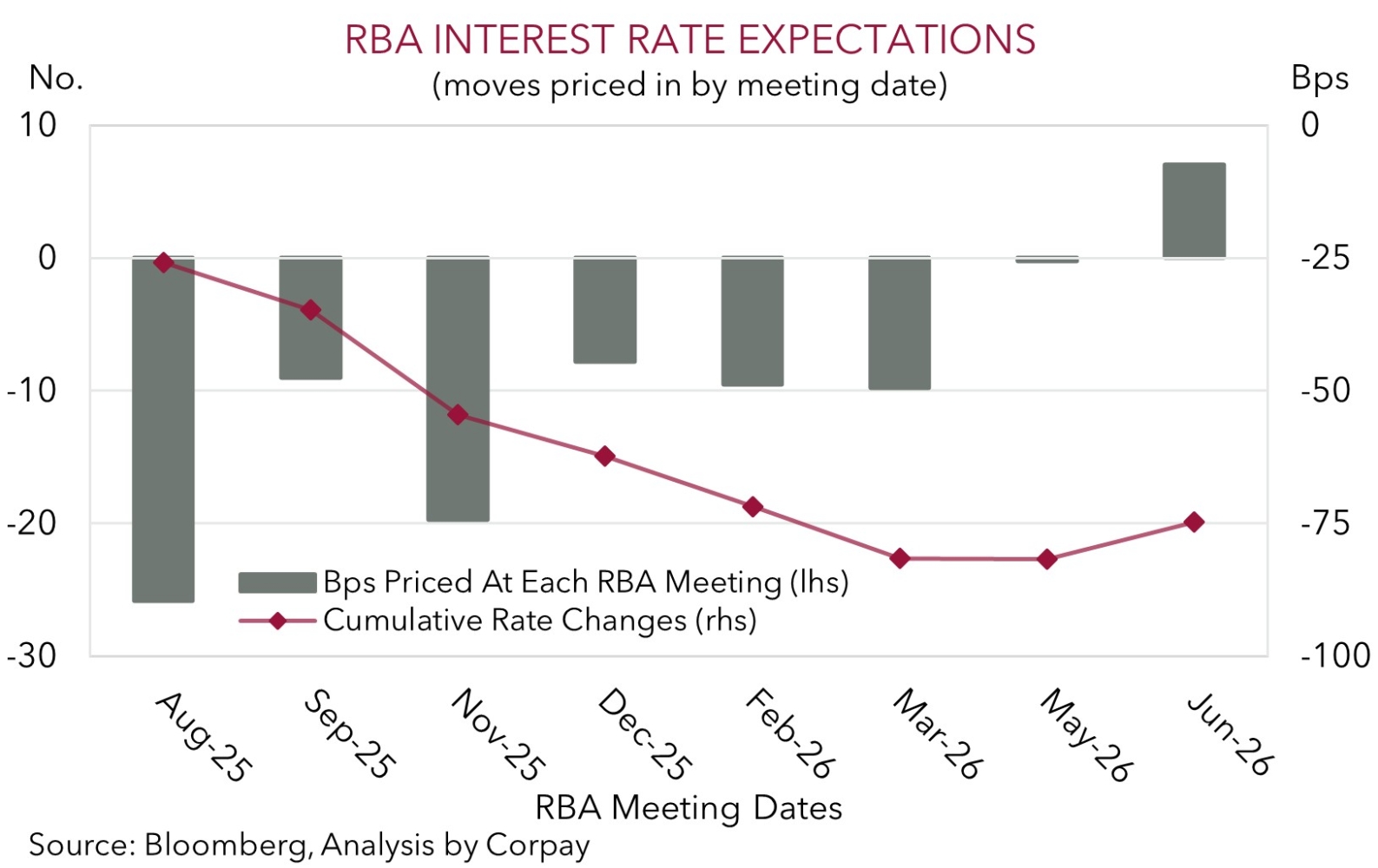

Looking ahead, in addition to the key US data releases like CPI inflation (Tues night AEST), PPI inflation (Weds night AEST), and retail sales (Fri night AEST), and the China activity indicators (Fri), the AUD will also be influenced by the RBA decision (Tues) and latest wages (Weds) and jobs (Thurs) figures. After surprising the market by keeping interest rates on hold in July the RBA is expected to finally come through and deliver a 25bp reduction this week. Interest rate markets are assigning it a ~102% chance with all economists surveyed also penciling it in after the run of weaker inflation and employment data.

The RBA has been taking a slow and ‘cautious’ approach to its easing cycle. We think this type of messaging should be retained, although we believe there could be a bit more of a ‘dovish’ lean due to the potential for the RBA to lower its inflation forecasts and project a slightly higher unemployment. In our view, this type of mix, combined with softer wages and/or a sluggish jobs market may bolster expectations for further RBA rate reductions over late-2025/early-2026. This in conjunction with our thoughts that the beaten down USD might recoup some lost ground over the near-term (see above) could drag on AUD/USD. This wouldn’t be unusual for this time of year. As mentioned previously August tends to be a more negative time for the AUD (the AUD has weakened in 21 of the past 28 August’s).