• Upbeat tone. US equities end the week & month on positive footing. USD ticked higher. AUD & NZD drifted back. AUD a bit firmer on a few cross-rates.

• RBA meeting. Given CPI RBA expected to hold (Tues). Near-term inflation forecasts to be revised up. Will RBA close the door on more cuts?

• Event radar. In addition to the RBA, NZ jobs report due (Weds). In the US, official data may be delayed, so things like ADP employment are in focus.

Global Trends

It was a relatively quiet end to last week and October with modest net moves across most major markets on Friday . Solid corporate earnings helped US equities end the month on a positive note with the S&P500 edging up (+0.3%) and posting its 6th straight monthly gain. Other global equities were mixed with Japan’s Nikkei jumping 2.1% to a fresh record while European stocks closed modestly lower. Elsewhere, there were small moves in bonds with US and European yields drifting back ~1-3bps after the post US Fed lift the day before. In FX, the USD index nudged up a bit further with EUR (the major USD alternative) slipping down to the lower end of its 3-month range (now ~$1.1533). GBP remains on the backfoot (now ~$1.3132, levels last traded in mid-April), and USD/JPY consolidated around multi-month highs (now ~154). Closer to home, the NZD eased (now ~$0.5727), as did the AUD albeit to a lesser extent (now ~$0.6547).

Macro wise, CPI data for the Eurozone and the forward-looking Tokyo report didn’t shift the central bank pricing needle. Headline inflation in the Eurozone is hovering just above 2%pa, while the firmer Tokyo measure suggests the Bank of Japan still has more work to do to tame price pressures. In China the official PMIs pointed to slower momentum in October, although the Golden Week National Day holiday period looks to have created distortions. A few US Fed members also spoke. Kansas Fed’s Schmid, who voted against a rate cut last week, outlined lingering concerns about inflation, as did a couple of non-voting members (Dallas President Logan and Cleveland President Hammack). The comments highlight the division among Fed policymakers given the push-pull forces at play in the US.

Offshore, the US government shutdown is still in place. If it extends a few more days it will be the longest on record. As a result, official US statistics remain on ice with a second payrolls report (originally due this Friday) likely to be delayed. Consequently, private data such as the manufacturing ISM (tonight 2am AEDT), the services ISM index, and ADP employment (both Wednesday night AEDT) take on added significance in trying to gauge the pulse of the US economy. In our opinion, some signs of stability may give the USD a little more support in the short-run. However, we remain of the view that slower economic activity and widening cracks in the US jobs market because of higher import costs should see the US Fed deliver further interest rate cuts which in turn could see the USD downtrend re-assert itself over the medium-term.

Trans-Tasman Zone

The uptick in the USD in the wake of last Thursday’s US Fed meeting and subsequent adjustment in interest rate expectations exerted a bit more downward pressure on the AUD and NZD at the end of last week (see above). At ~$0.5727 the NZD is near the lower end of its 6-month range, while the AUD (now ~$0.6547) is still north of its 1-month and 6-month averages. Relative strength on a few of the major cross-rates is giving the AUD a helping hand. The AUD ticked up ~0.1-0.2% versus the EUR, NZD, CAD and CNH on Friday. In level terms AUD/EUR (now ~0.5678) has nudged up towards the top of the range occupied since mid-June, AUD/CNH (now ~4.6638) is above its 1-year average, and AUD/NZD (now ~1.1430) is tracking near its cyclical peak due to relative economic/interest rate trends remaining in Australia’s favour. The quarterly NZ jobs report is due this Wednesday.

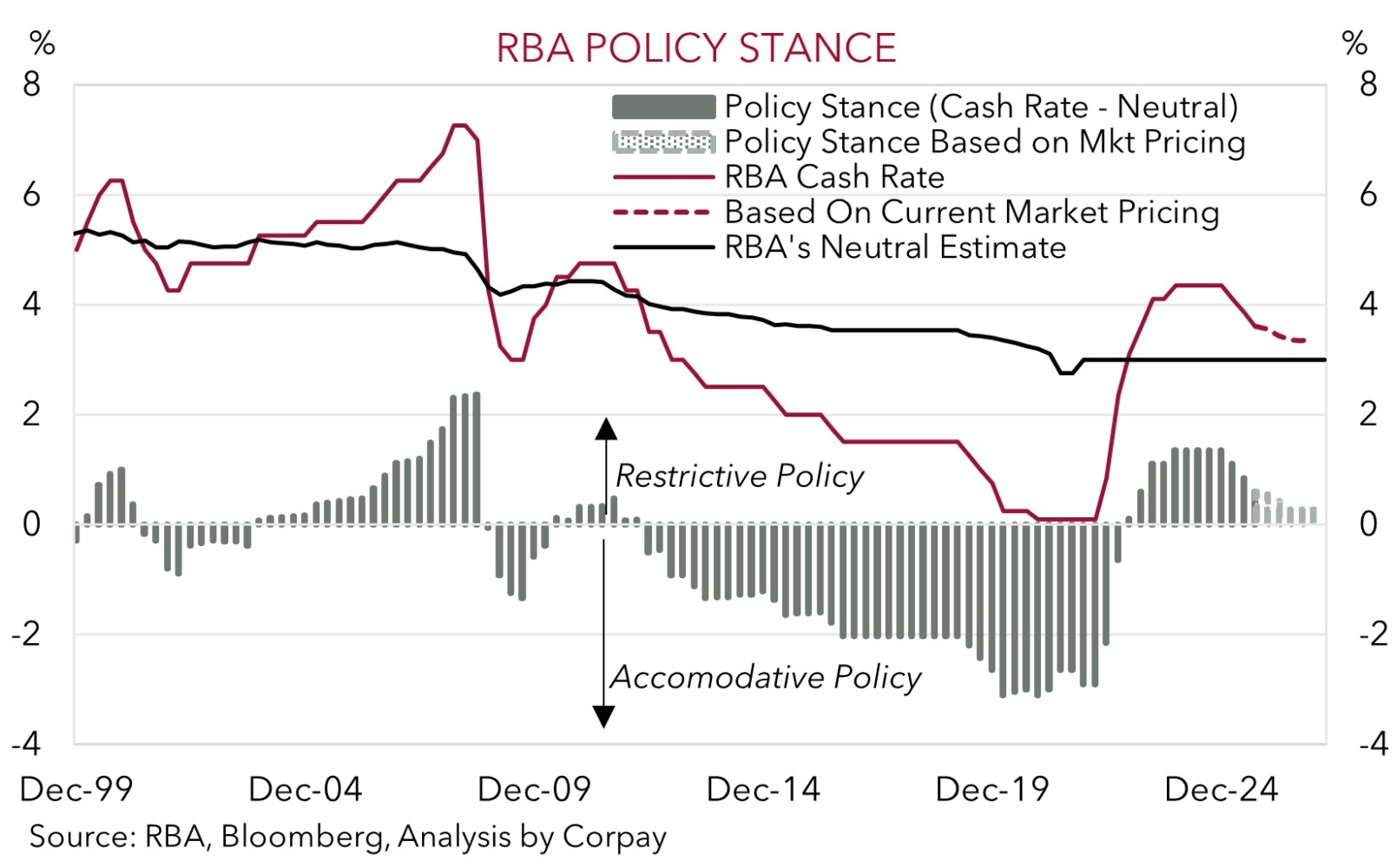

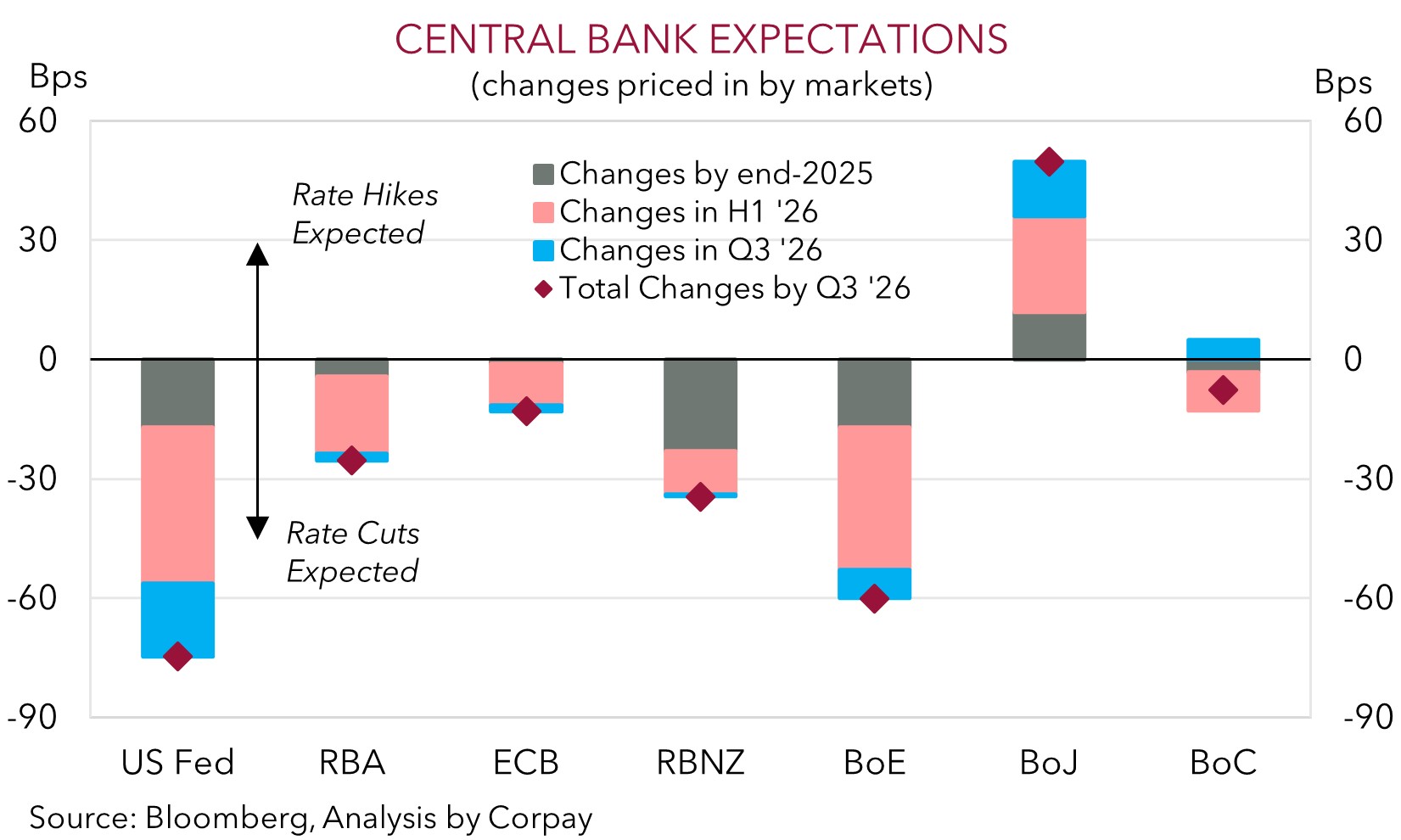

Locally, the RBA meeting is a focal point (Tuesday afternoon AEDT). Following the much stronger than anticipated Q3 CPI data the RBA looks set to keep the cash rate steady at 3.6%, with a unanimous vote. Indeed, interest rate markets are factoring in a very small chance of an interest rate change this week with only 1 out of 34 economists surveyed penciling in a cut. On the assumption the RBA holds attention will be on its updated guidance and thinking about the policy/economic outlook. We believe the tone could be more ‘hawkish’ given Australia’s inflation pulse. While we don’t feel Governor Bullock will close the door to more rate cuts down the track, we think she could allude to it if things play out as per the RBA’s updated forecasts. The RBA staff will need to upgrade near-term forecasts for inflation. And although they should still show inflation getting down to the middle of the 2-3% target over the medium-term this may be a mechanical result of slower growth and/or higher unemployment generated by a technical input assuming minimal, if any, further rate cuts. Interest rate markets are currently only discounting close to another full RBA rate cut by next September.

Markets seldom move in straight lines and more pockets of headline/data driven AUD volatility should be anticipated over the period ahead. But on balance, as per our long-held view, we continue to project the AUD grinding up into year-end (i.e. towards ~$0.67-0.68) on the back of improvement in US/China trade relations, diverging policy trends between the RBA and other central banks such as the US Fed, more favourable yield spreads, upbeat risk sentiment, and/or firmer growth in China as its stimulus push gains traction.