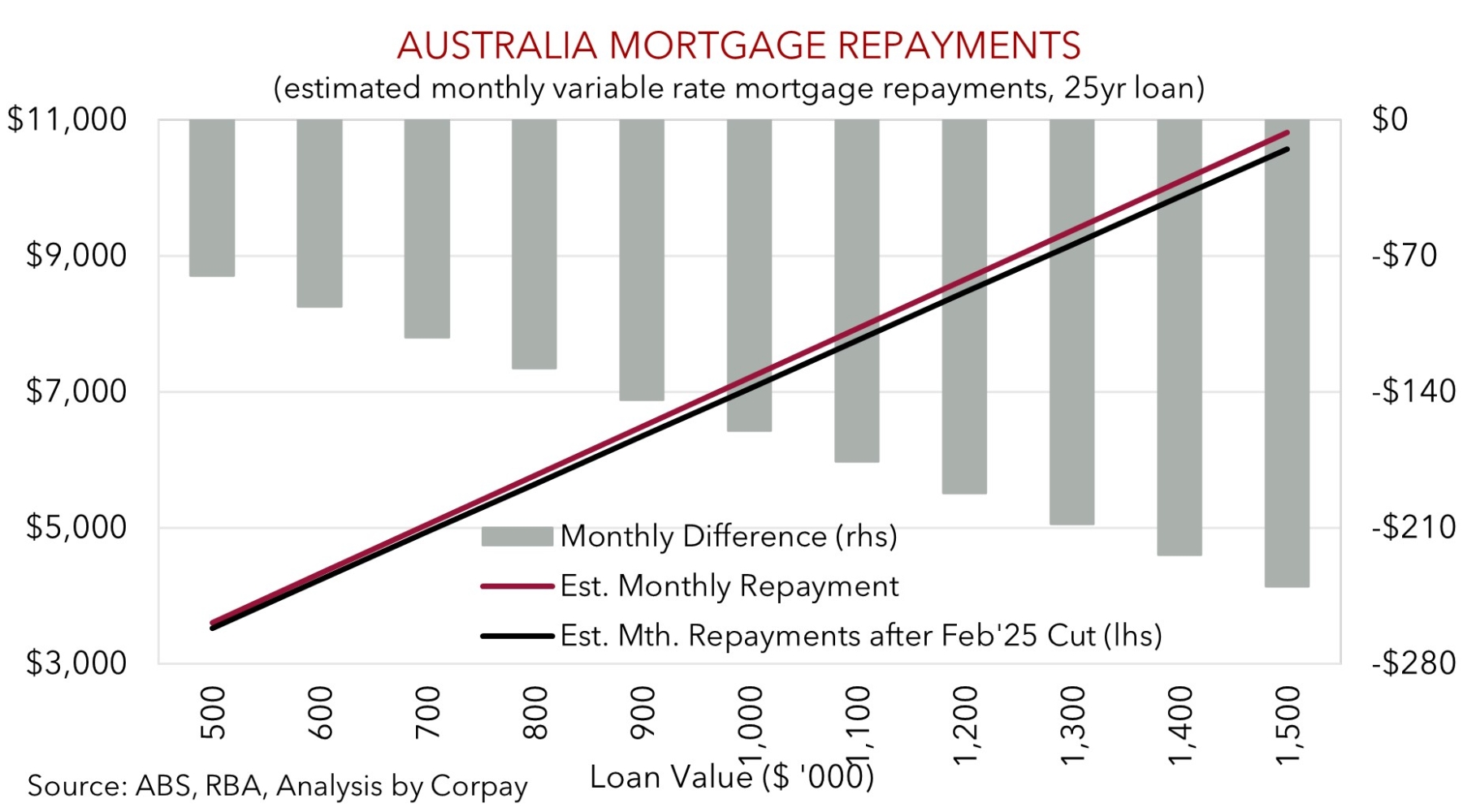

After delivering a string of rate hikes over 2022/23 and holding steady since November 2023 as it battled against inflation the RBA announced a bit of interest rate ‘relief’ at today’s meeting. The RBA cut the official cash rate by 25bps, lowering it to 4.1%. This was largely expected with it being ~90% priced in before the meeting, and with 30 of 34 economists surveyed forecasting it. The move will provide some income support for indebted mortgage holders and interest rate sensitive businesses. But it isn’t a large jolt. On our figuring, a 0.25% reduction lowers the monthly repayment on a $600,000 25yr mortgage by ~$95.

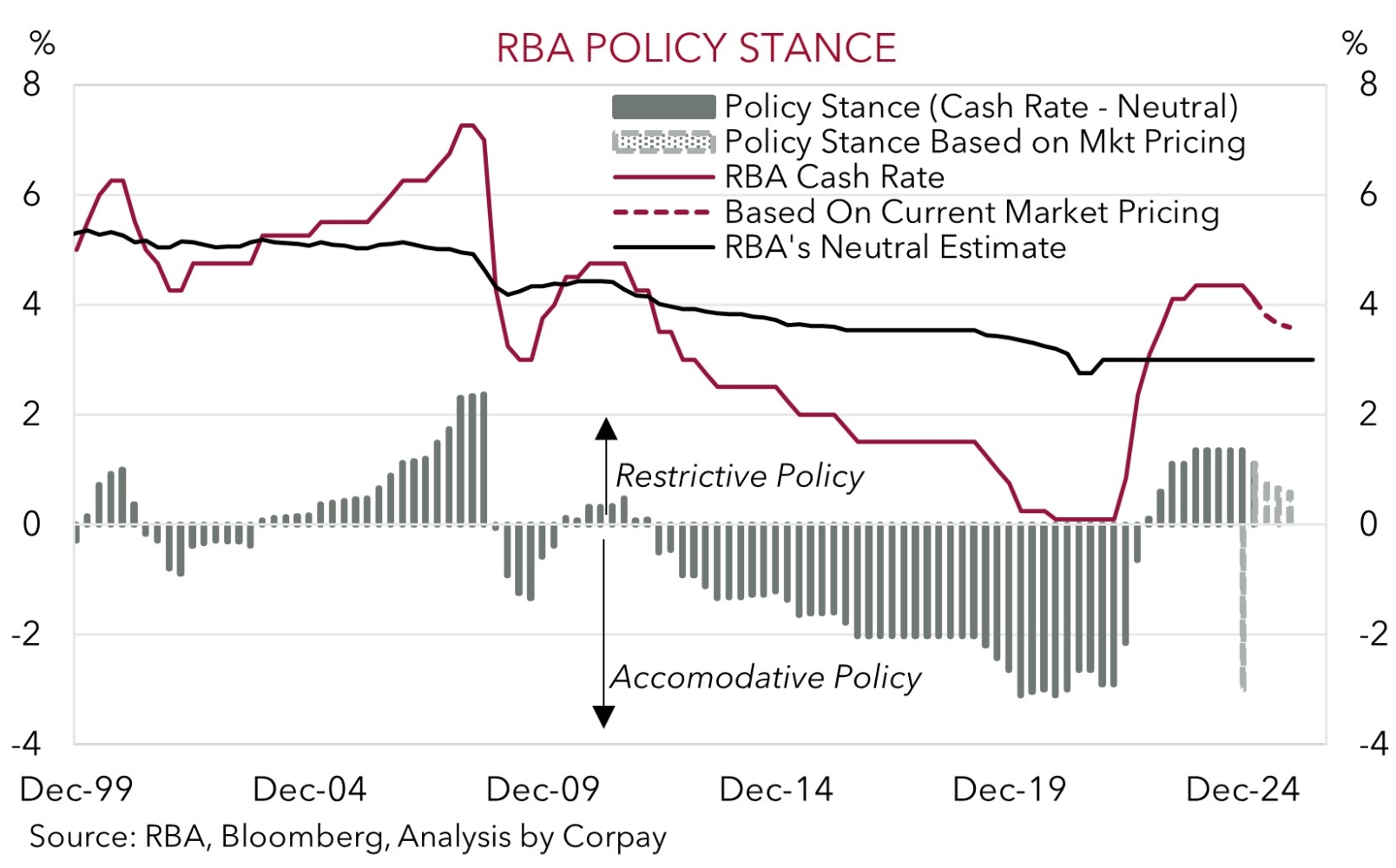

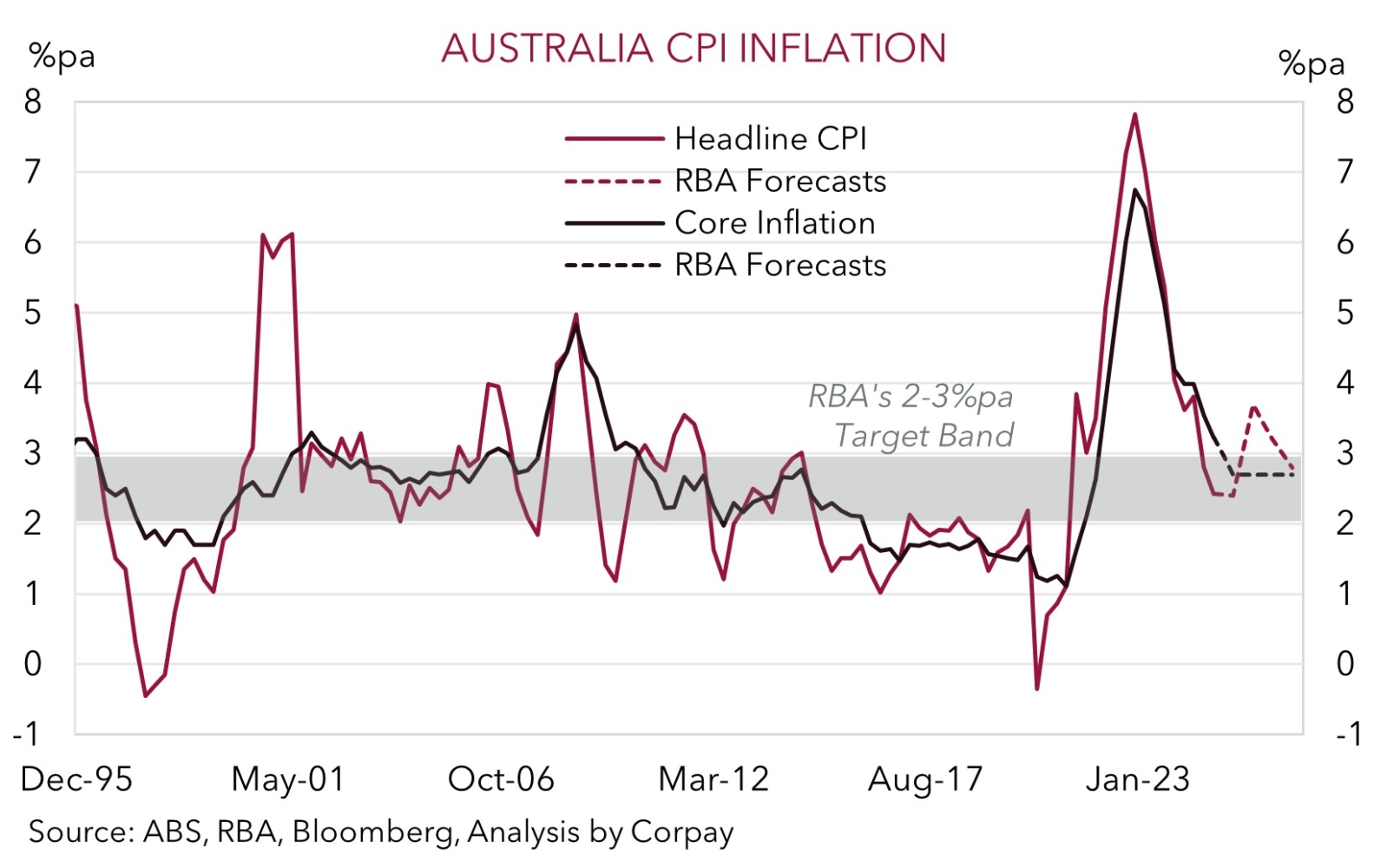

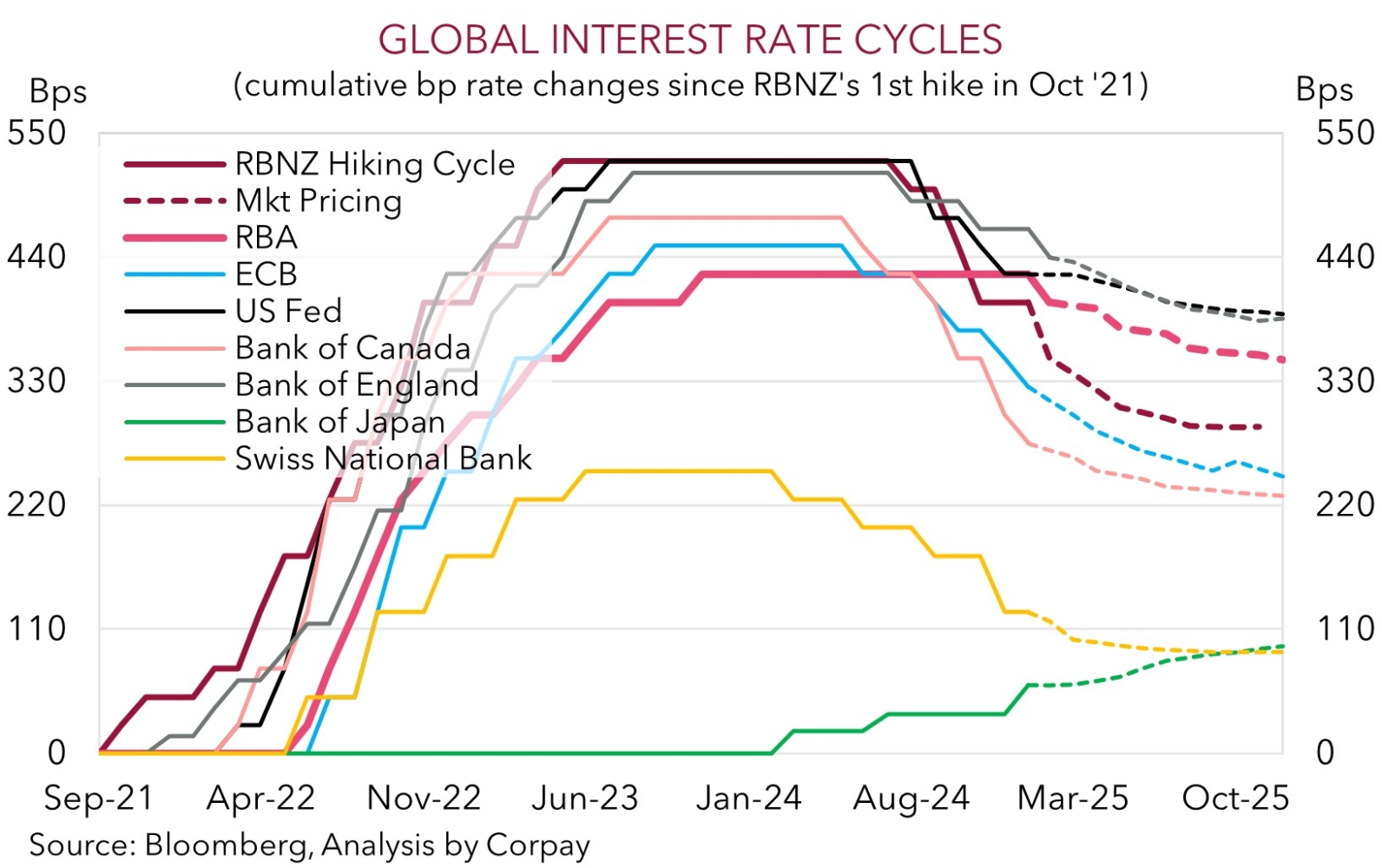

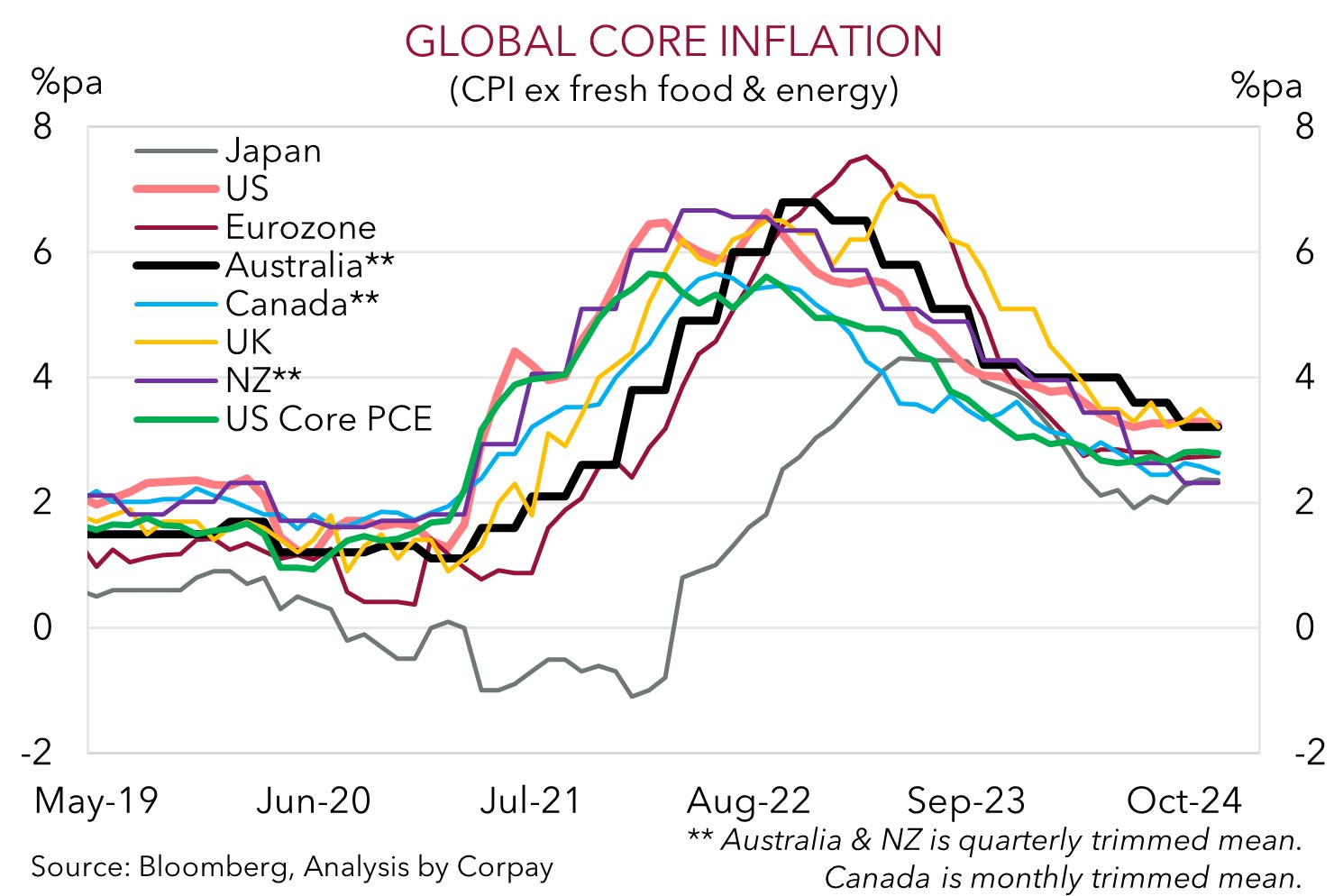

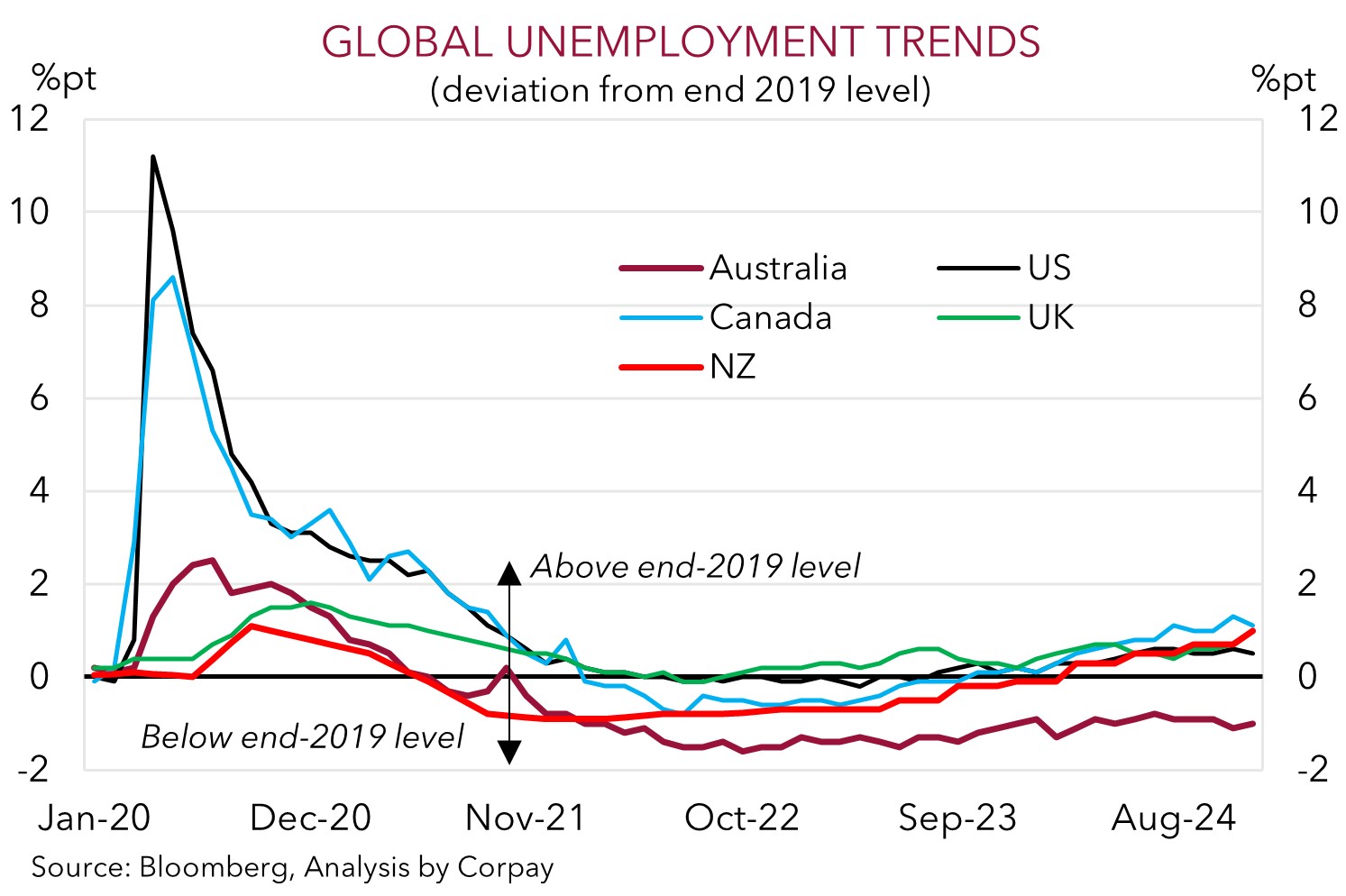

What happens next is up in the air. The underlying tone and commentary from the RBA was rather measured. A deep sharp drop in interest rates shouldn’t be anticipated, in our opinion (charts 1 and 2). According to the RBA, recent developments give the Board “more confidence” inflation is heading “sustainably” towards the middle of the 2-3% target band. But “upside risks” remain, especially as the labour market looks set to be “somewhat tighter than previously thought”. The RBA is now projecting unemployment to peak at just 4.2%, a fraction above where it now sits and below estimates of ‘full employment’, with GDP growth momentum also expected to improve over the next few quarters as the squeeze on household budgets lessens. In turn, core inflation projections have been nudged up a touch (core inflation is now forecasted to ease and level off at around 2.7%pa, above the midpoint of the RBA’s target) (chart 3).

Based on the backdrop and balance of risks the RBA “remains cautious on prospects for further policy easing”. From here the RBA will pay attention to global events and the state of play in the local economy as it navigates the tricky terrain. But nothing is set in stone. Indeed, as Governor Bullock stressed today’s move “wasn’t a lay down misere” and does “not imply that further cuts are coming”. This is inline with our long-held assessment that the RBA, which lagged the global hiking cycle in an effort to cushion the potential blow on the jobs market, should also move in small slow steps as it shifts policy back towards ‘neutral’ (chart 4). This is particularly the case, in our view, given underlying inflation pressures continue to linger in pockets of the Australian economy, more so than in other nations which experienced greater pain in their respective labour markets (charts 5 and 6). Our baseline outlook is that the RBA delivers another 2-3 rate cuts over the coming year as it gradually reduces the degree of policy restrictiveness, assuming underlying inflation continues to cool and a little more slack emerges in the jobs market.

In terms of the AUD, we believe the relative ‘hawkish’ guidance when it comes to future steps in this easing cycle, should be supportive in the short-term. Markets are driven by outcomes compared to what is priced in, and FX is a relative price. With this in mind we would note that a modest and elongated RBA rate cutting cycle is already discounted by financial markets. Moreover, the RBA remains on a different policy path to many of its peers. There are likely to be further bumps and renewed bouts of intermittent AUD volatility in the months ahead as US tariff measures are implemented and global risks are navigated. However, on net, we continue to feel downside potential in the AUD should be constrained, and that a further modest grind higher can come through.

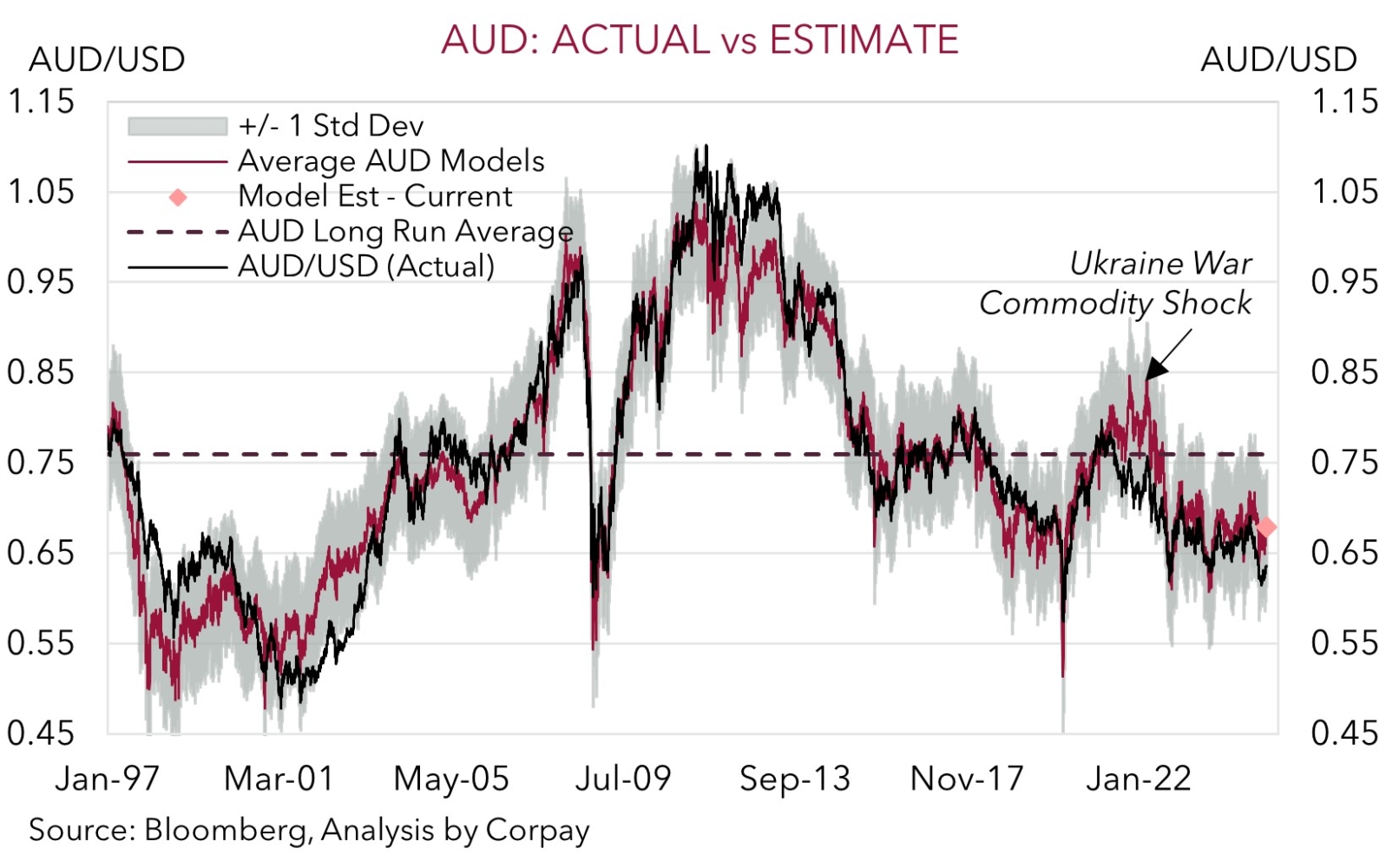

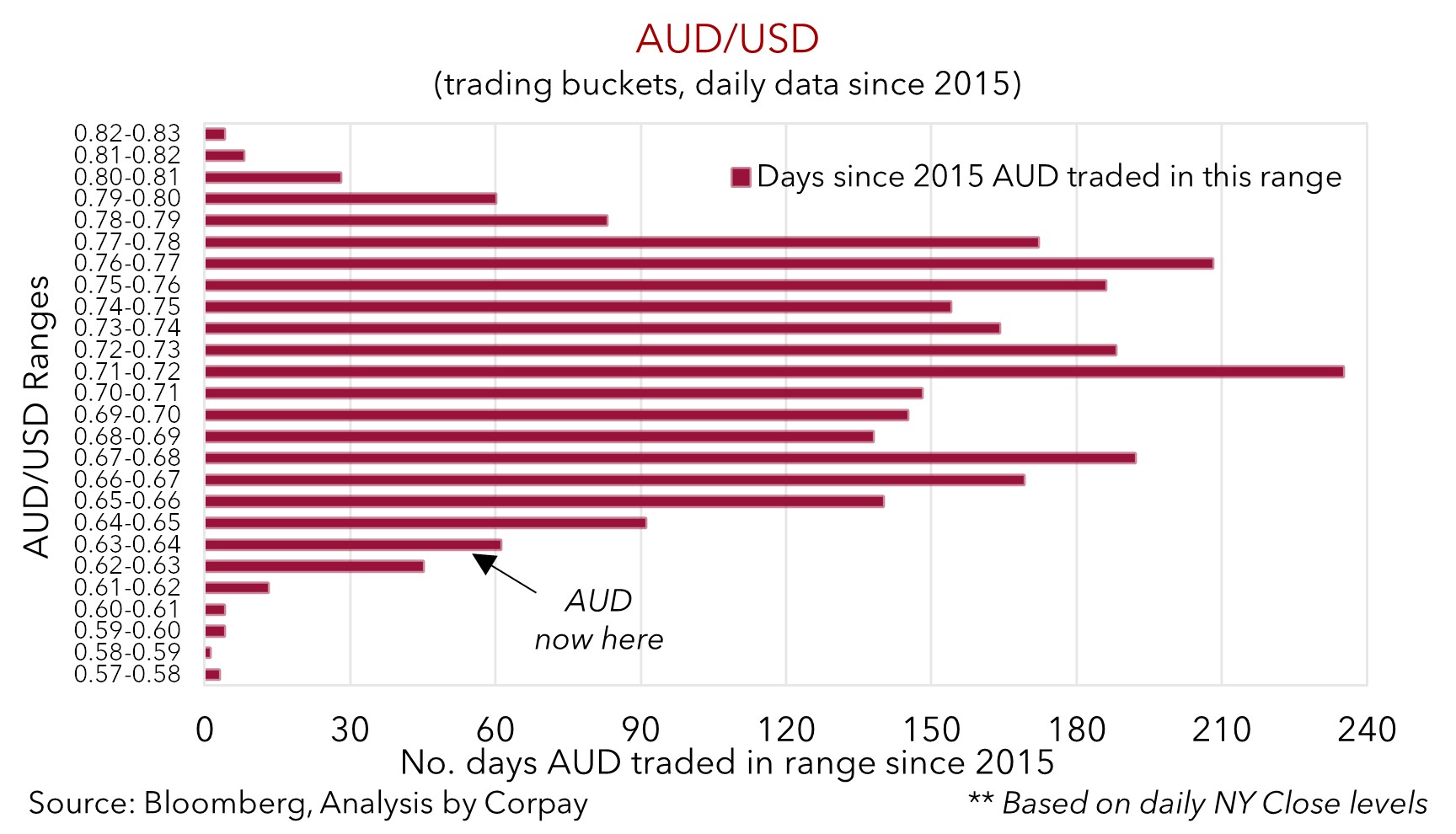

This is because: (a) the AUD is still tracking at a discount to fundamentals (it is ~3-4 cents below our ‘fair value’ models) (chart 7); (b) sentiment is bearish (‘net short’ AUD positioning, as measured by CFTC futures, is elevated); and (c) the AUD has not sustainably traded below where it is over the past decade (the AUD has only been sub-$0.63 ~3% of the time since 2015). Added to that, when it comes to trade tariffs, much like during US President Trump’s first term, we believe export headwinds in China are likely to be offset via steps to bolster commodity-intensive infrastructure investment (this is where Australia’s exports are plugged into). Australia’s export basket also looks rather tariff-insulated given its minimal manufacturing and with Australia being one of the few nations the US runs a trade surplus with (i.e. the US exports more to Australia than it imports from Australia). This, in our judgement, should help the AUD outperform currencies like the EUR, CAD, NZD, and CNH over the medium-term.