After defying expectations by holding interest rates steady in July the RBA (finally) announced some more ‘relief’ for indebted households/businesses at today’s meeting. The RBA lowered the cash rate by 25bps to 3.60% with the Board voting unanimously (i.e. 9-0) in favour of the move. This is the 3rd reduction since February and was widely anticipated given the RBA noted last time that the decision to stand still was one of “timing not direction”.

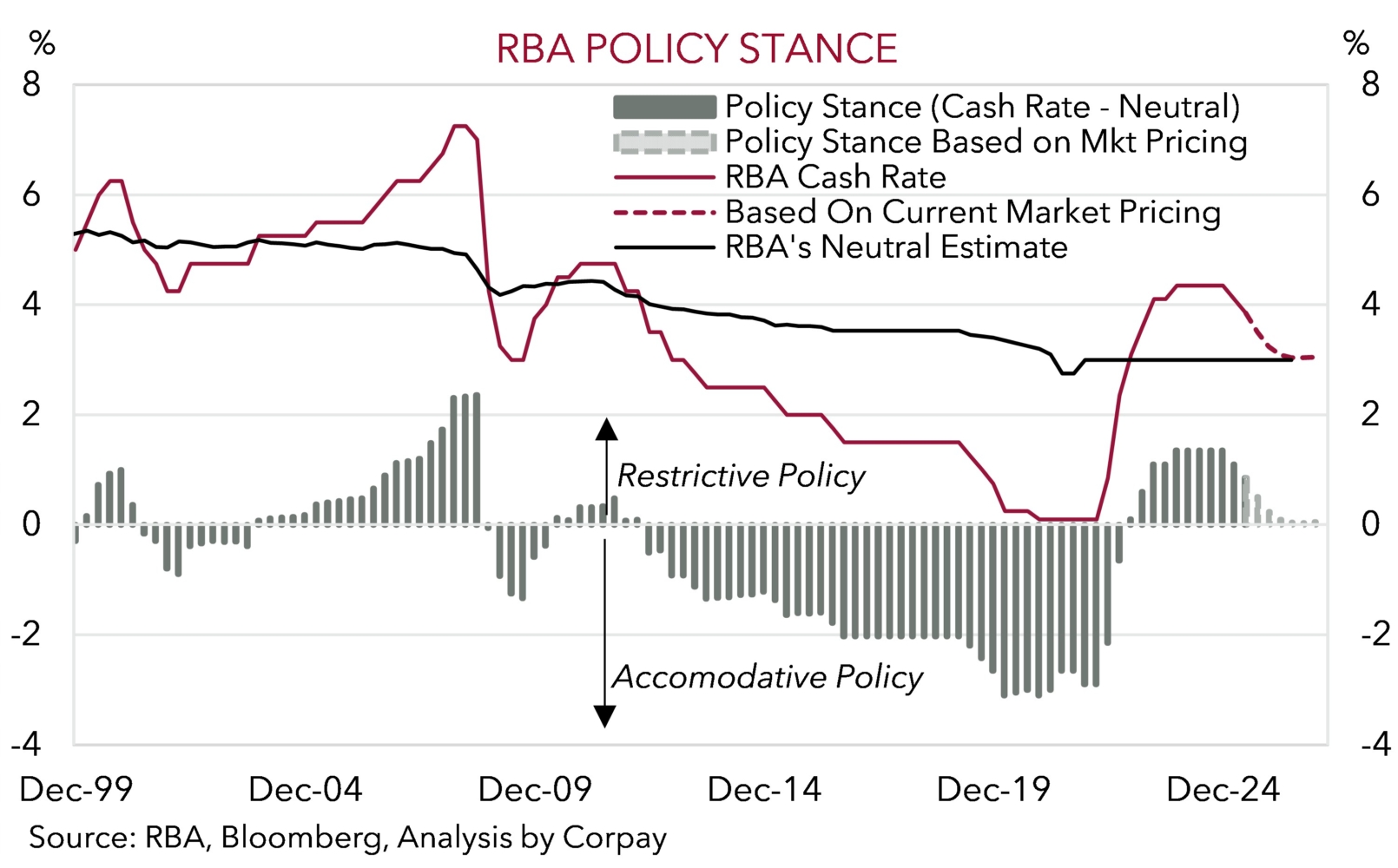

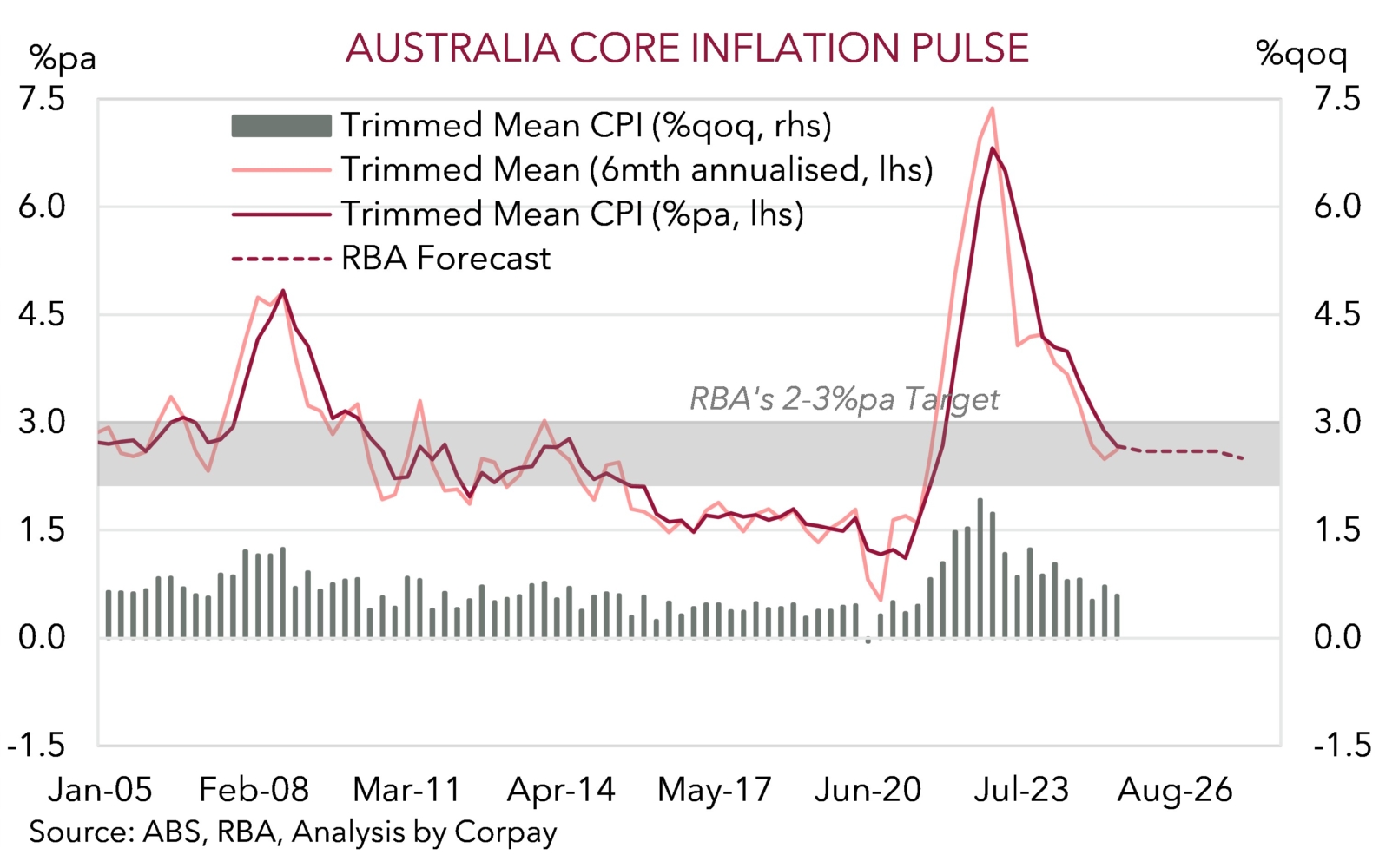

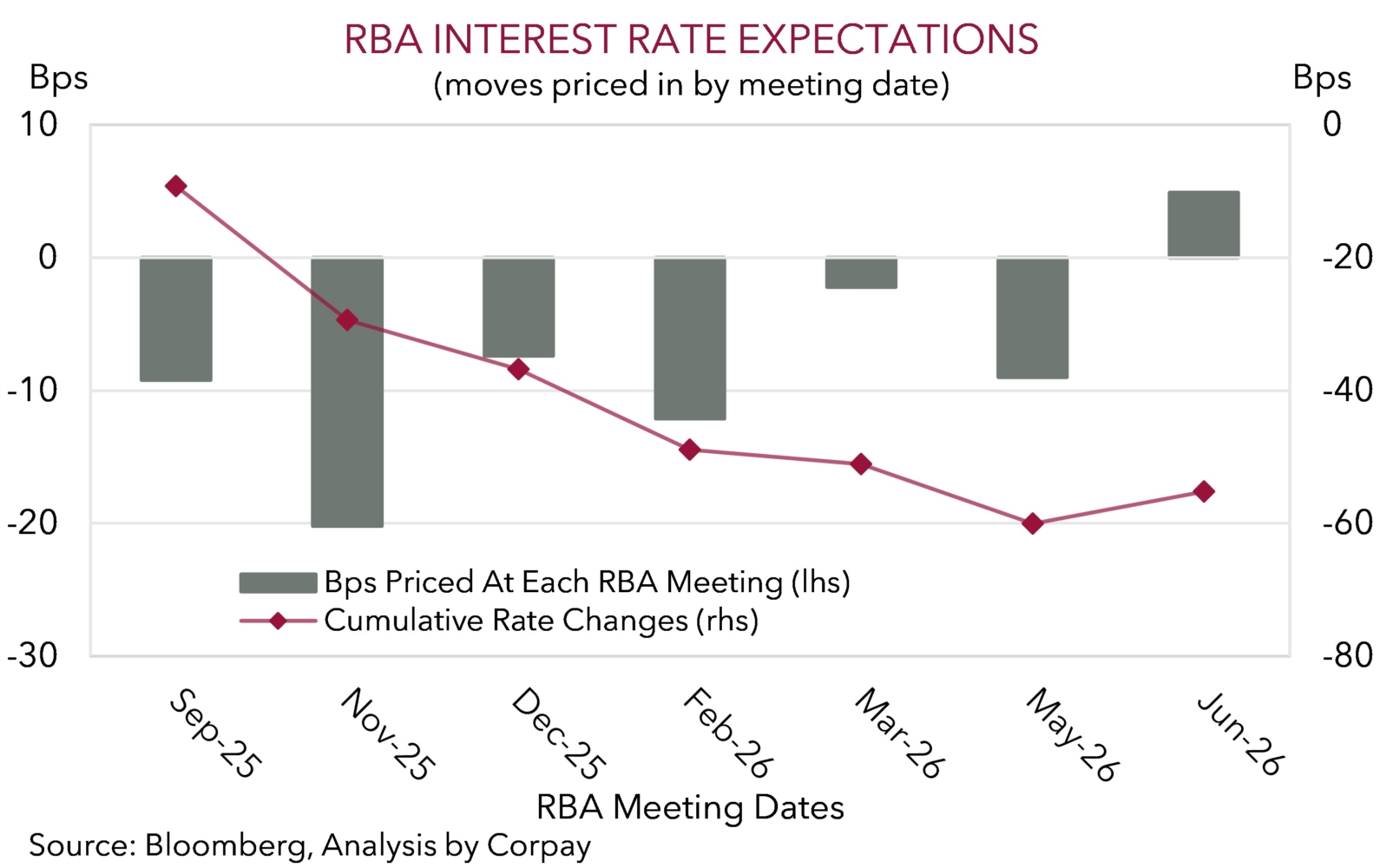

In our opinion, domestic inflation and labour market trends point to a further recalibration lower in interest rates towards “neutral” (which in our judgement is a cash rate close to ~3%) over the period ahead (chart 1) as the RBA strives to keep CPI low/stable and employment positive. The greater uncertainty, as it has been this easing cycle, is around the pace of the RBA’s moves not the direction of travel especially considering the bank’s updated forecasts show core inflation ticking down to the middle of its 2-3% target even with a technical assumption of the cash rate declining to ~3% incorporated (chart 2).

We feel the ‘gradual’ approach taken thus far is likely to be maintained as the RBA navigates the domestic crosscurrents and tricky global terrain. Indeed, according to the RBA it “remains cautious about the outlook” and “attentive to the data and the evolving assessment of risks” in its decisions with Governor Bullock adding things will be taken “meeting by meeting”. Barring a negative labour market jolt and/or an exogenous growth shock we believe this could see the RBA bypass its late-September meeting and wait until its next quarterly update in early-November to lower interest rates again (chart 3).

The slightly more ‘dovish’ tinges in some of the RBA’s commentary/projections have reinforced expectations looking for a few more interest rate cuts to be delivered over the next year. Interest rate markets are pricing in the cash rate falling to ~3% by next May. This has taken a bit of heat out of the AUD (now ~$0.6500) and we think there are more downside risks in the near-term due to our thoughts the beaten down USD might recapture lost ground if the incoming US data (particularly the CPI inflation report and retail sales) exceeds predictions which in turn sees markets pare back built up US Fed rate cut bets. This would also be inline with the usual seasonal headwinds the AUD tends to face at this time of year. As mentioned in our other research the AUD has declined in 21 of the last 28 Augusts due to the USD favourable swings in global capital flows during the Northern Hemisphere summer holiday period.

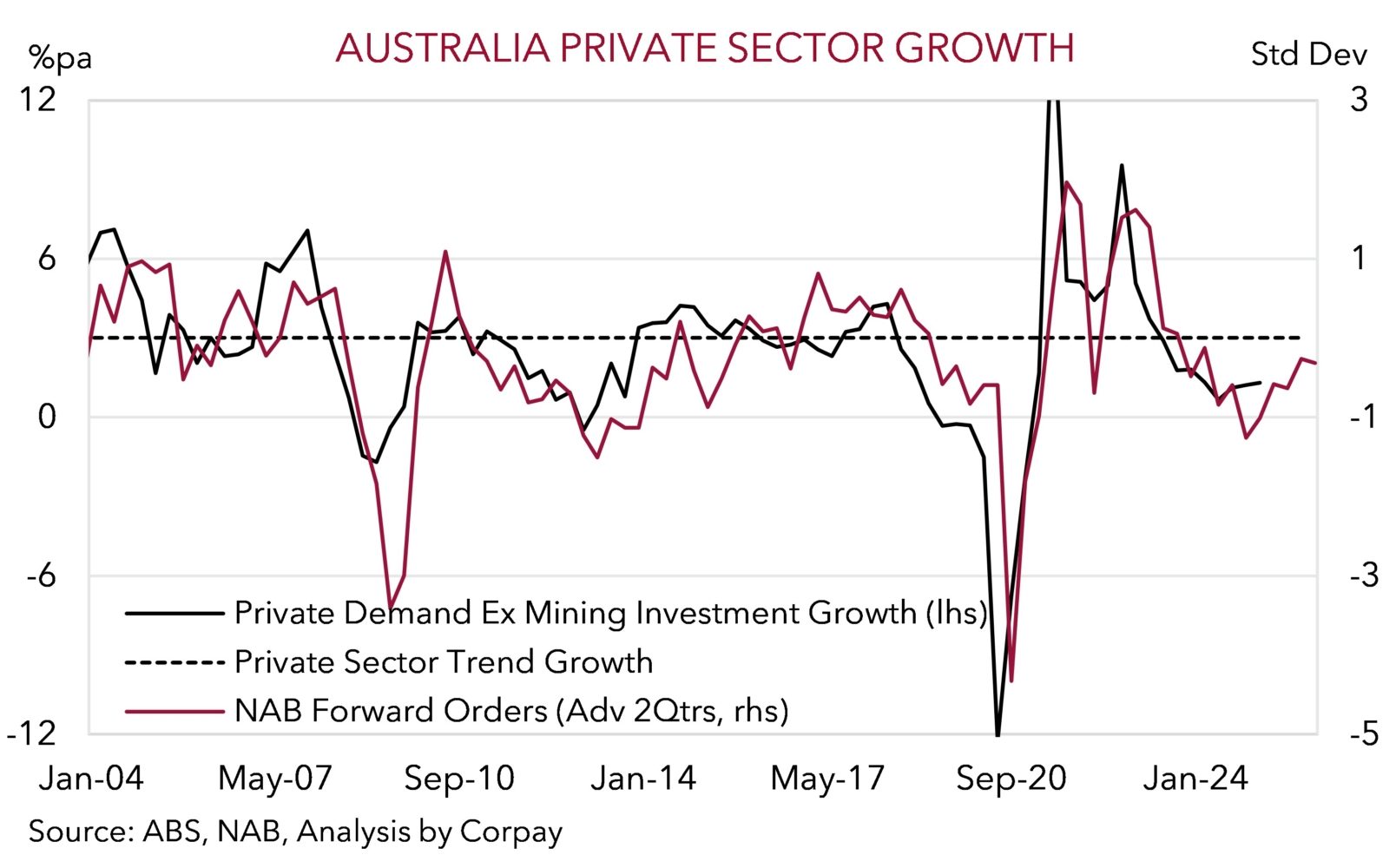

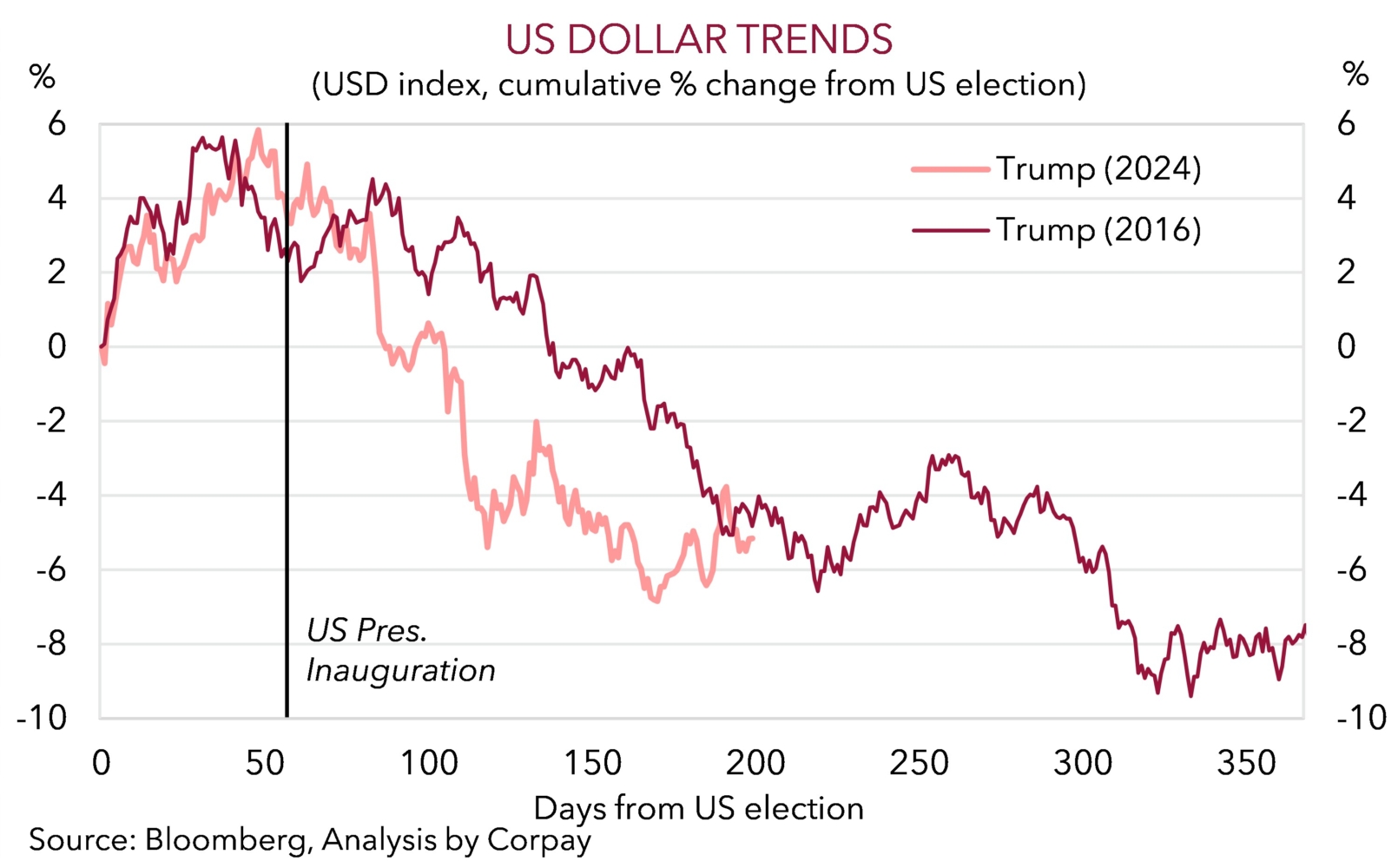

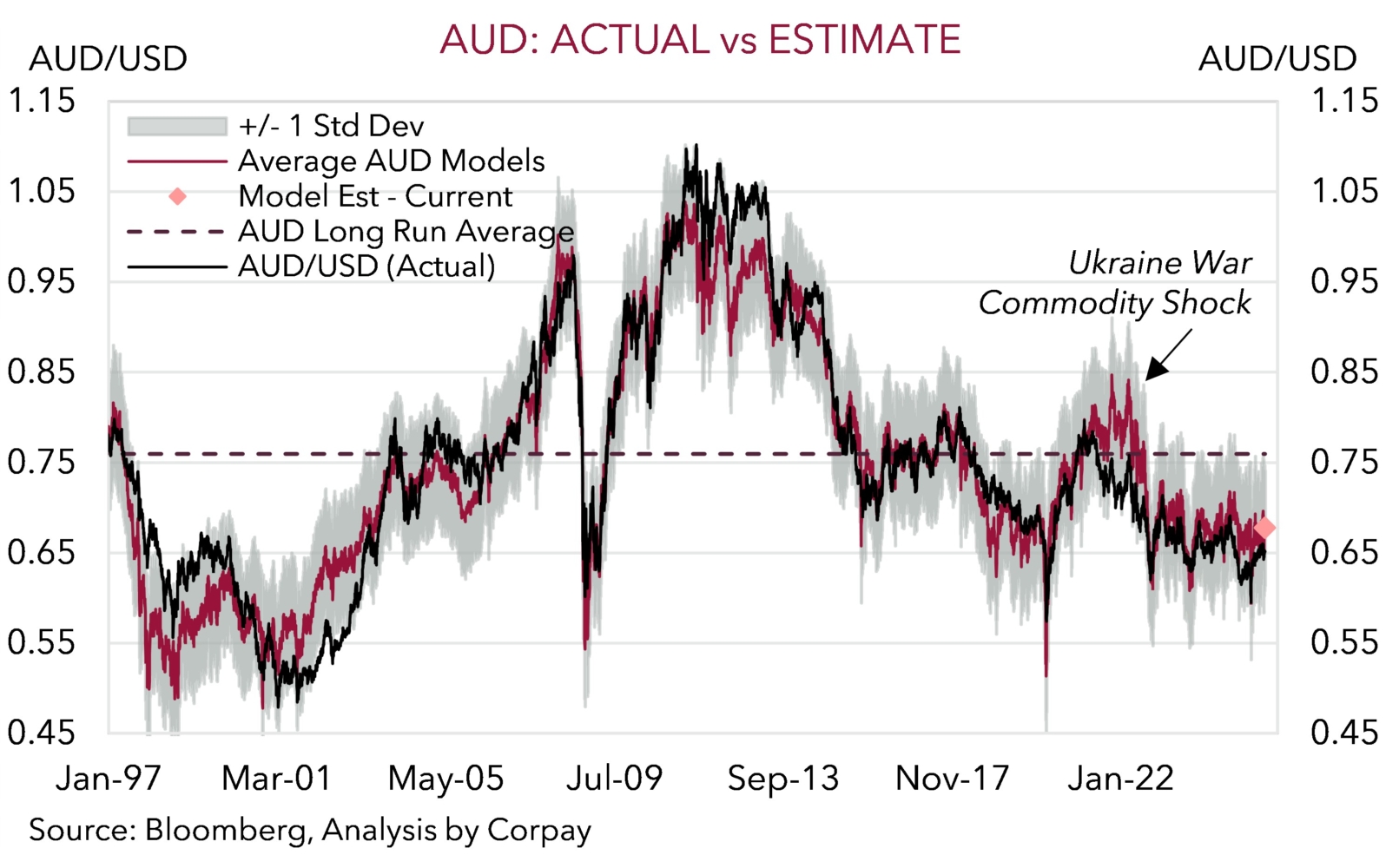

However, we continue to think that this short-run choppiness shouldn’t be sustained and that over the longer-run (i.e. the next 6-12 months) the AUD is poised to climb higher. This is the signal coming from our suite of models that are suggesting the AUD’s current ‘fair value’ is a little north of ~$0.67 (chart 4). On the one hand, we expect the AUD to be supported by a cyclical improvement in Australia’s growth pulse and ‘gradual’ RBA easing. Leading indicators such as forward orders suggest private sector activity may re-accelerate over the back end of 2025 (chart 5) with the cashflow boost to households from lower mortgage repayments helpful for consumption. On our figuring, the 75bp reduction in interest rates so far this year means monthly repayments on a ~$700,000 mortgage are ~$330 lower compared to where they were at the end of 2024. Added to that, steps by authorities in China to offset export sector headwinds via stimulus measures aimed at underpinning domestic activity (the areas Australia’s key exports are plugged into) should also give the AUD a helping hand. As should a weaker USD which we think is likely to unfold as the impacts of higher tariffs/import prices ripple through the US economy/jobs market and the US Fed re-starts its interest rate cutting cycle later this year. This next leg down in the USD (step up in the AUD) could mirror the path taken in the latter stages of the first year of President Trump’s first term (chart 6).