• US CPI. Not as bad as feared US inflation supported sentiment overnight. US equities rose, as did US rate cut expectations. USD softer. AUD rebounded.

• RBA change. RBA finally delivered another 25bp rate cut yesterday. A few more moves look to be in the pipeline based on the RBA’s new forecasts.

• Data flow. AU wages out today & jobs report due tomorrow. China data released on Friday. US producer prices & retail sales on the radar later this week.

Global Trends

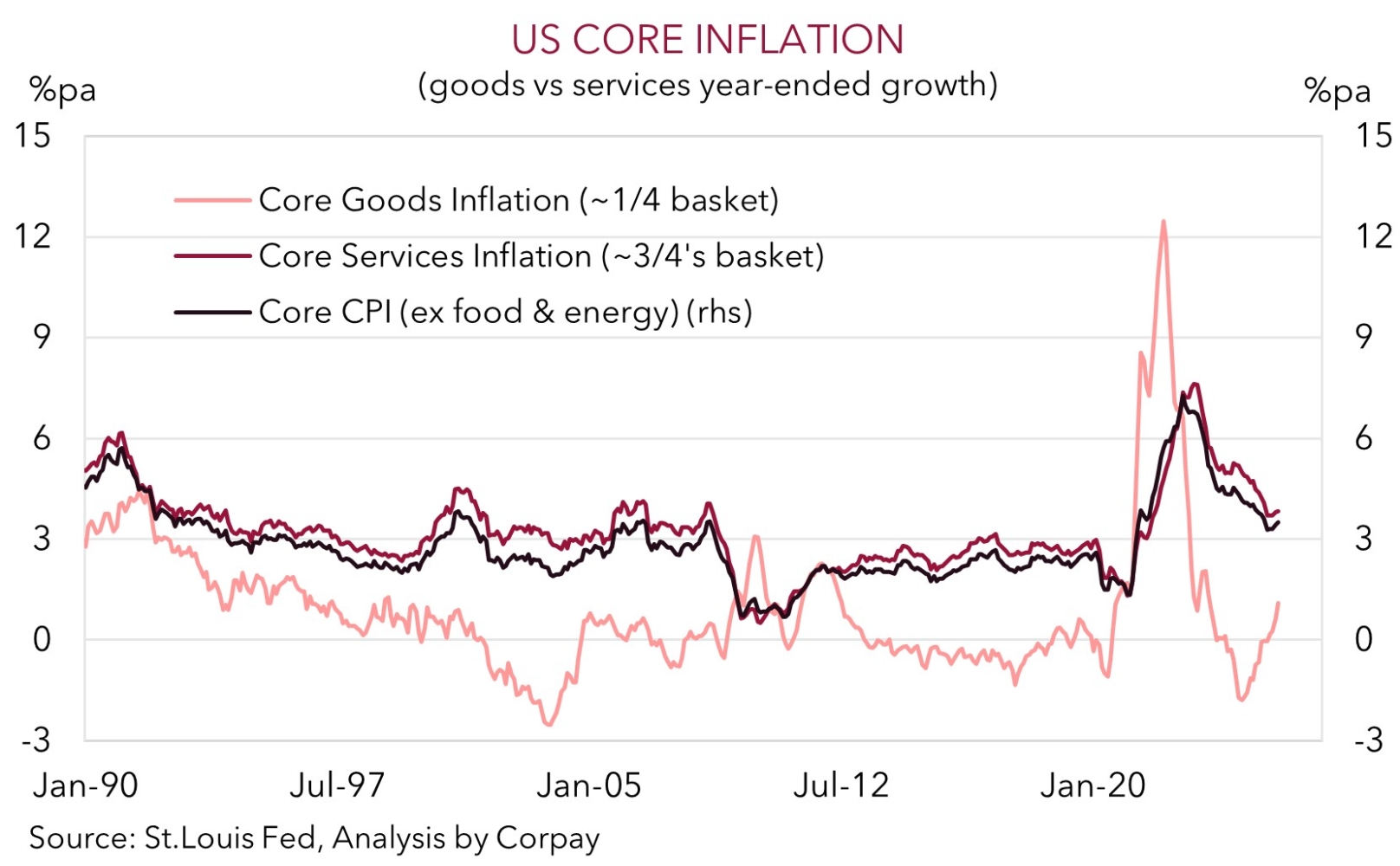

The latest read on US CPI inflation was in focus overnight and another ‘not as bad as feared’ report supported risk sentiment with the USD also losing some ground intra-session. In terms of the data, US headline inflation ticked down to 2.7%pa while core CPI (i.e. ex food and energy) accelerated to 3.1%pa. However, within that, myopic markets ignored firmer ‘services’ prices and lasered in on the still modest lift in ‘goods’ prices with the pass-through from tariffs remaining rather contained. On the one hand, the potential jump up in a wide range of ‘goods’ prices may be delayed by the repeated changes to tariff policy over the past few months and as firm’s draw down on pre-tariff inventories. On the other hand, the muted spillover could reflect a weaker economy and less demand which is limiting how much US businesses can raise prices. Time will tell, though we still think there could be bursts of ‘goods’ related US inflation over the next few months as new stock hits the docks and finds its way to the shops.

That said, more short-sighted markets have taken the US CPI figures as another sign the US Fed might not wait much longer before it re-starts its interest rate cutting cycle. The odds of a move by the US Fed in mid-September have risen to ~96% with 4 rate cuts now fully baked in by next June. This supported US equities with the S&P500 (+1.1%) and tech-focused NASDAQ (+1.4%) hitting record highs. US 2yr bond yields dipped ~4bps as the shift in US Fed expectations washed through and the USD weakened a bit. EUR (the major USD alternative) rose (now ~$1.1676), as did GBP (now ~$1.3501), and USD/JPY eased (now ~147.83). The AUD whipped around over the past 24hrs with the knee-jerk fall after yesterday’s RBA interest rate cut unwinding overnight (now ~$0.6530).

Also weighing on investors’ minds and exerting downward pressure on the USD is the potential politicization of various US institutions. Firstly, President Trump’s nominee to be the next head of the Bureau of Labour stats discussed the prospect of suspending the monthly jobs report “until it is corrected”. Secondly, in a social media post President Trump renewed criticism of US Fed chair Powell and mentioned there could be a lawsuit over the blowout in building renovations. Over the near-term we believe there may be some more choppiness in the USD as US producer price inflation (Thurs night AEST) and retail sales (Fri night AEST) are released. But over the medium-term we remain of the view that the USD could depreciate due to a mix of weaker US growth, US Fed rate cuts and/or reduced capital inflows into US assets stemming from the macro/political developments.

Trans-Tasman Zone

Domestic and global crosscurrents generated a bit of AUD volatility over the past 24hrs with the initial dip in the wake of yesterday’s RBA decision unwinding overnight on the back of positive risk sentiment and weaker USD (see above). On net, the AUD (now ~$0.6530) is a little higher than where it was tracking this time yesterday, as is the NZD (now ~$0.5955). By contrast, the AUD has been more mixed on the crosses with modest gains versus the CAD (+0.2%) and CNH (+0.1%) offset by falls against the EUR (-0.2%) and GBP (-0.3%).

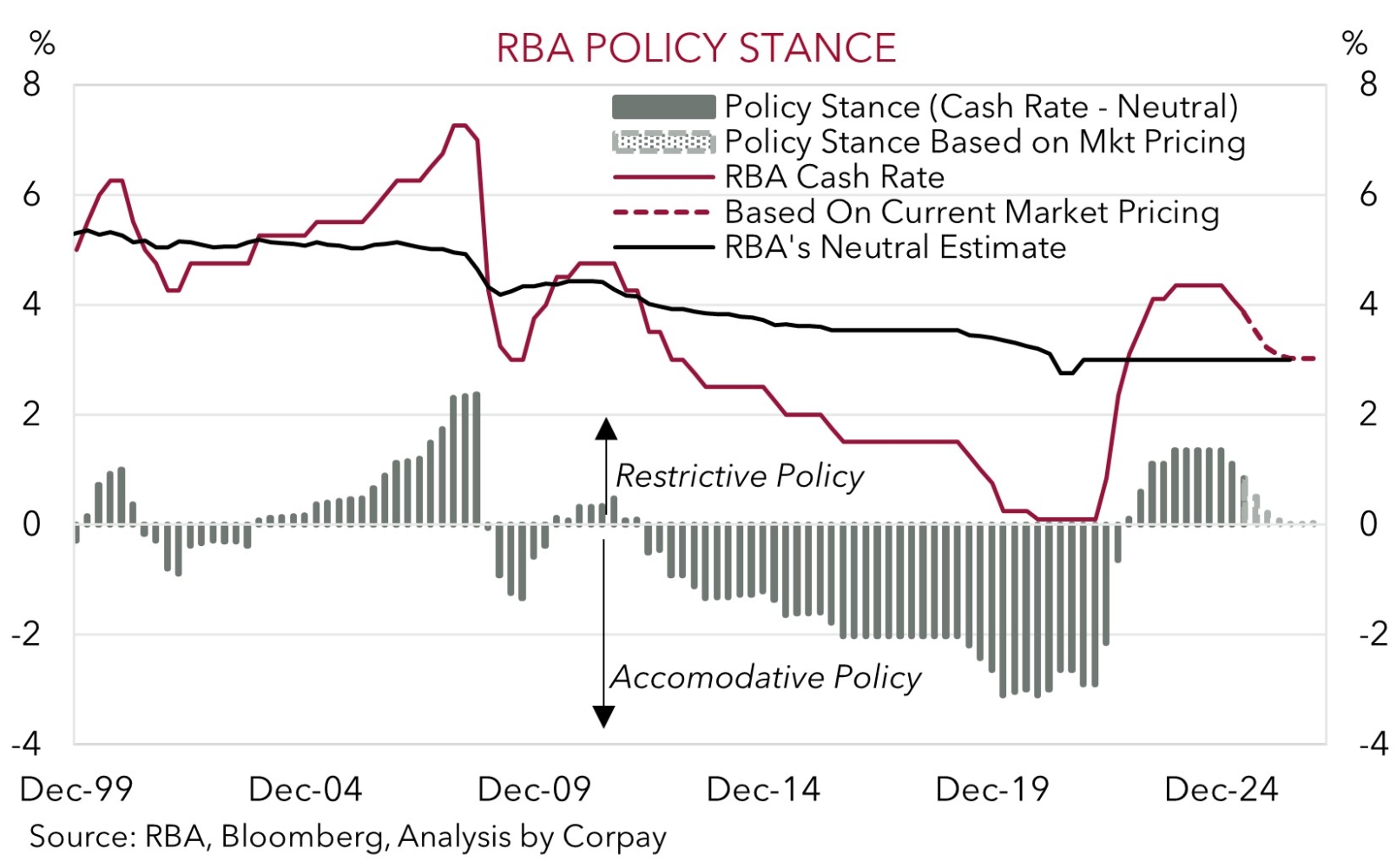

With respect to the RBA, after defying expectations by holding steady in July the cash rate was lowered by 25bps to 3.60% yesterday with the Board voting unanimously (i.e. 9-0) in favour of the move. This is the 3rd reduction since February and was widely anticipated given the RBA noted last time that the decision to stand still was one of “timing not direction”. In our opinion, domestic inflation and labour market trends point to a further recalibration lower in interest rates towards “neutral” (which in our judgement is a cash rate close to ~3%). This is something the RBA also thinks is probably in the pipeline based on its updated forecasts showing inflation heading sustainably to the middle of its 2-3% target and with Governor Bullock noting the projections “are conditioned on a few more cuts”.

Locally, Q2 wages are due today (11:30am AEST) and the volatile monthly jobs data is out tomorrow. Offshore, the China activity data is released on Friday, while in the US producer price inflation (Thurs night AEST) and retail sales (Fri night AEST) are on the schedule. The data is likely to generate some push-pull forces on the AUD in the near-term which we believe could see it oscillate around its 50-day moving average (~$0.6520).

However, we continue to think that this short-run choppiness shouldn’t be sustained and that over the longer-run (i.e. the next 6-12 months) the AUD is poised to climb higher. This is the signal coming from our suite of models that are suggesting the AUD’s current ‘fair value’ is a little north of ~$0.67. We expect the AUD to be supported by a cyclical improvement in Australia’s growth pulse and ‘gradual’ RBA easing. Leading indicators such as forward orders suggest private sector activity may re-accelerate over the back end of 2025. Added to that, steps by authorities in China to offset export sector headwinds via stimulus measures aimed at underpinning domestic activity (areas Australia’s key exports are plugged into) could also give the AUD a helping hand. As should a weaker USD which we feel is likely to unfold as the impacts of higher tariffs/import prices ripple through the US economy/jobs market and the US Fed re-starts its interest rate cutting cycle later this year.