• Headline swings. US CPI hotter than expected. Interest rate markets adjust. Jump up in the USD didn’t last as positive geopolitical news hit the wires.

• FX moves. EUR rebounded on reports talks to end the Ukraine war may take place. USD/JPY rose. AUD & NZD recovered lost intra-day ground.

• Volatility. We think more short-term bursts of headline driven FX volatility are likely as the macro & geopolitical issues play out.

Global Trends

There was another burst of volatility across markets overnight, particularly in FX, as sentiment and the USD were pushed and pulled by US economic developments and geopolitical news. On the macro-front US CPI was hotter than predicted in January with headline and core inflation re-accelerating. Details showed strength in a few services prices and used cars. It isn’t unusual for consumer prices to strengthen in January due to seasonality in various categories, but this was a bit more than anticipated with core inflation quickening to 3.3%pa, around where it has been stuck for several months. As Fed Chair Powell noted in his second day of Congressional testimony we are “not there on inflation” and as a result “we want to keep policy restrictive for now”. Though he also tried to convey a measure approach by stressing policymakers “don’t get excited about one or two good readings” so they also won’t “get excited about one or two bad readings”.

That said, interest rate markets were quick to adjust with expectations for the next US Fed rate cut pushed out. Another full rate cut isn’t factored in until December, with the next move after that not priced in until late-2026. This flowed through to bonds with US yields rising ~8-10bps across the curve. The benchmark US 10yr rate (now ~4.63%) is back up where it was tracking a few weeks ago. The upswing in yields weighed a bit on US equities (S&P500 -0.2%), though after initially spiking higher the USD index slipped back later in the session as positive geopolitical news hit the wires. According to US President Trump’s post on Truth Social he and Russian President Putin had agreed to open talks to end the war in Ukraine. The subsequent rebound in the EUR (now ~$1.0397) dragged on the USD, which is on net little changed from this time yesterday. Elsewhere, the more positive geopolitical risk tone and higher US yields supported USD/JPY (now ~154.37). And after swinging around in a ~1.2% range over the past 24hrs the NZD (now ~$0.5648) and AUD (now ~$0.6289) are only a fraction below where they were early yesterday.

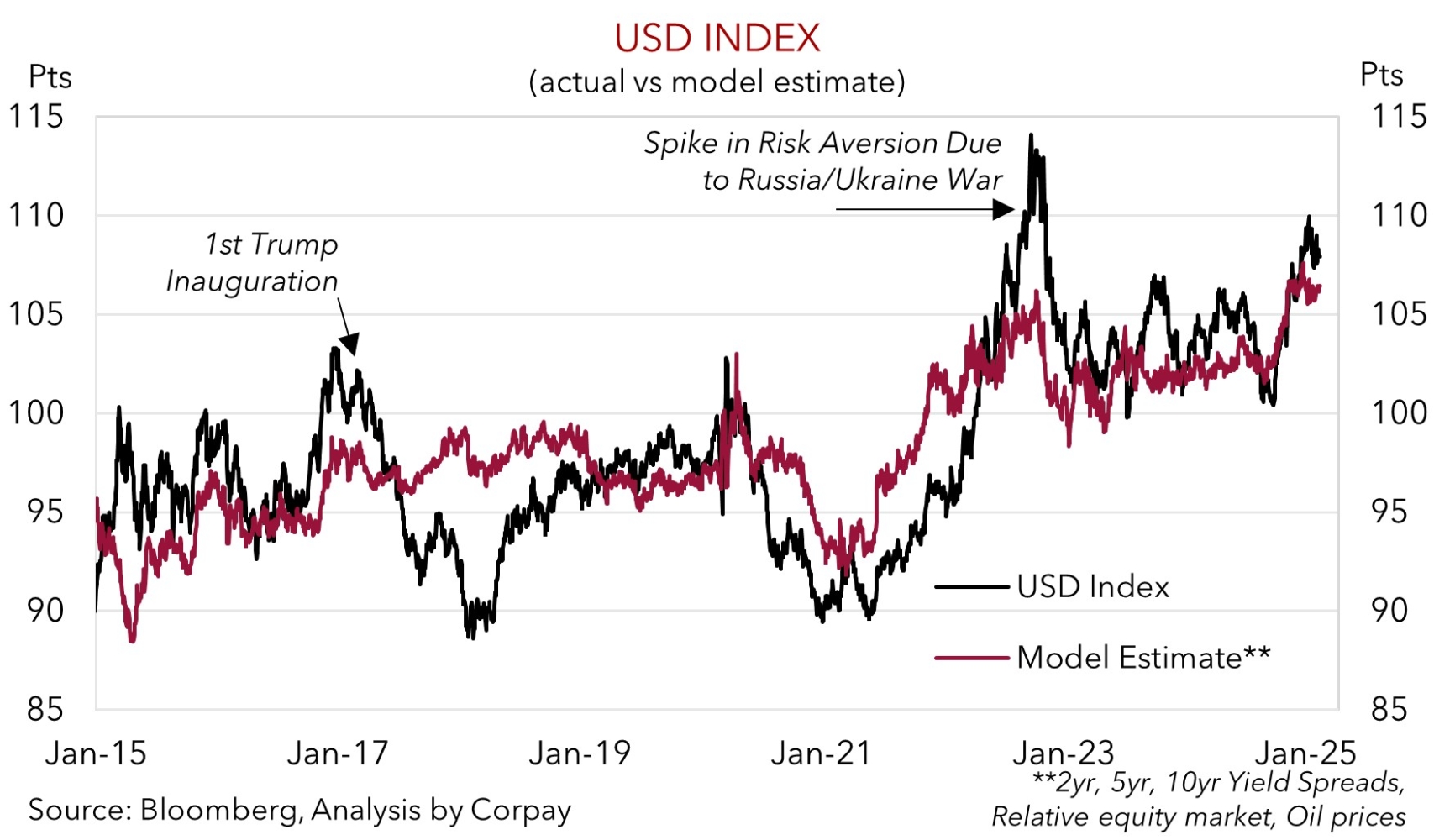

Looking ahead, more headline driven volatility is likely with the US yet to deliver on its threat of announcing “reciprocal tariffs”. We think the probability of more US trade tariffs being imposed is a factor that can keep the USD supported. This is being compounded by US economic impulses and higher US interest rates. However, as our chart shows, with sentiment/positioning already ‘bullish’ and the USD tracking above our ‘fair value’ models we believe it may be more of a case of the USD holding up at lofty levels rather than strengthening further.

Trans-Tasman Zone

The overnight USD gyrations stemming from stronger US CPI data and reports of a potential end to the Ukraine war generated a burst of NZD and AUD volatility (see above). On net, the NZD (now ~$0.5648) and AUD (now ~$0.6289) are only slightly lower than where they were this time yesterday, but this masks the underlying swings that came through. Both traded in a ~1.2% range, slightly bigger than average.

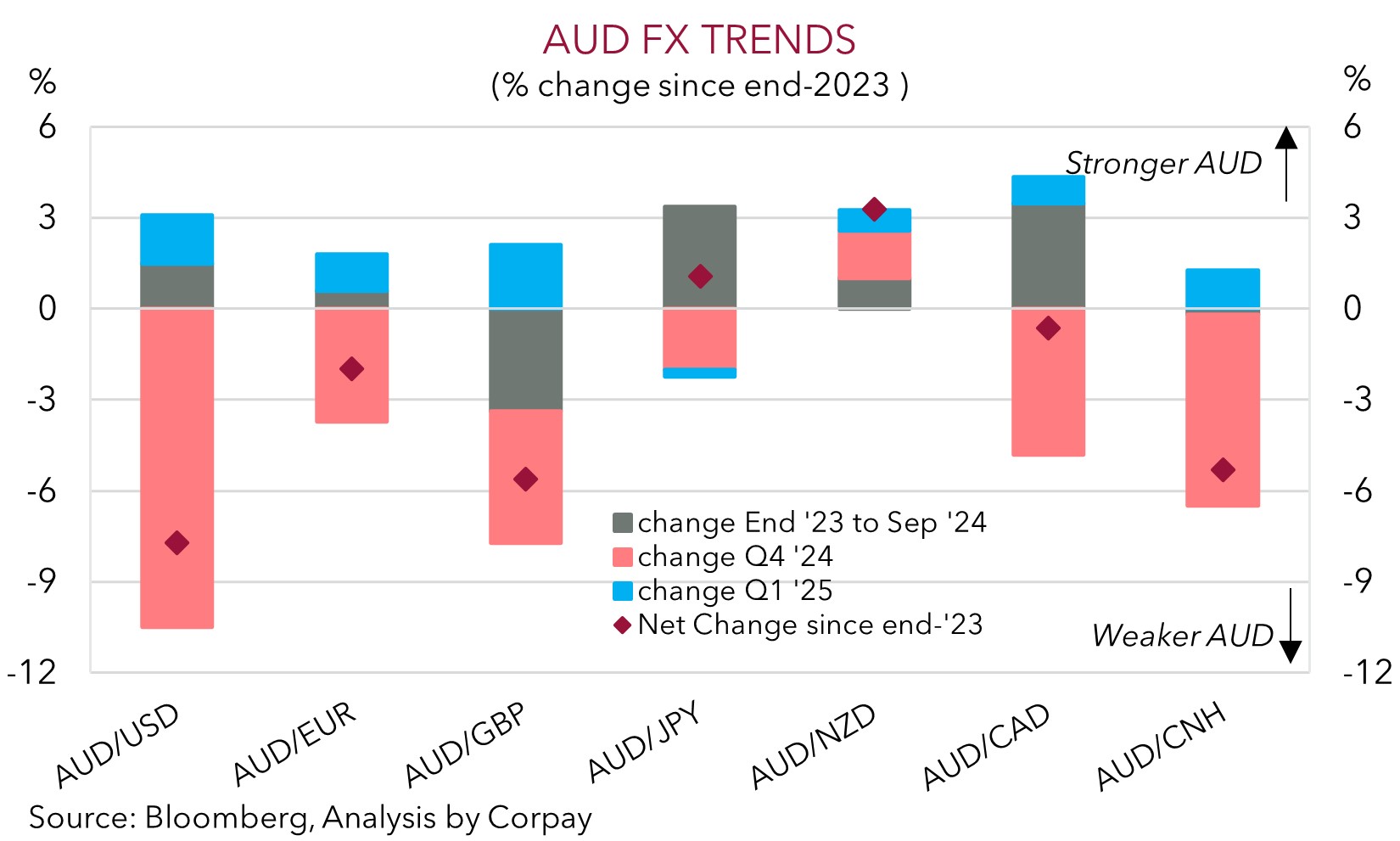

On the crosses, the AUD has been mixed. The more upbeat geopolitical situation combined with higher global bond yields has helped AUD/JPY extend its upswing. At ~97.08 AUD/JPY is at a 2-week high. Elsewhere, the rebound in the EUR on the back of the Russia/Ukraine reports exerted a little downward pressure on AUD/EUR. Though at ~0.6049 it remains in positive territory for the year-to-date, and close to its 1-year average.

As outlined the past few weeks we think there will continue to be bursts of short-term volatility stemming from US tariff news and/or geopolitical developments. Hence, intra-day ranges are likely to be wider than what people have gotten used. Since the late-1980s the average daily trading range in the AUD has been ~1%. In the last 2-years the AUD’s daily trading range has only been bigger than average about ~1/3 of the time.

That said, while volatility may continue, what’s important for markets isn’t if something is ‘good’ or ‘bad’ but rather if it is ‘better’ or ‘worse’ than what is factored in. Given this framework we continue to believe downside potential in the AUD should be constrained. This is because: (1) the AUD is trading at a discount to fundamentals (it is ~4 cents below our ‘fair value’ models); (2) sentiment is bearish (‘net short’ AUD positioning, as measured by CFTC futures, is elevated); (3) an RBA rate cutting cycle looks well priced (a move next Tuesday is ~90% discounted); and (4) the AUD has not sustainably traded below where it is over the past decade (the AUD has only been sub-$0.6250 ~1.5% of the time since 2015). Added to that, when it comes to trade tariffs, as discussed above, we feel a lot of positives are already baked into the USD, and much like during President Trump’s first term, any tariff induced export pain in China is likely to be offset via steps to bolster commodity-intensive infrastructure investment (this is where Australia’s exports are plugged into). And despite some of the domestic media hype Australia’s export basket also appears rather tariff-insulated given its minimal manufacturing and with Australia being one of the few nations the US runs a trade surplus with (i.e. the US exports more to Australia than it imports from Australia). This, in our assessment, should help the AUD outperform currencies like the EUR, CAD, NZD, and CNH over the period ahead.