• Mixed markets. US equities end a bit higher overnight, while bond yields eased & the USD rose. AUD & NZD gave back ground over the past 24hrs.

• Macro news. US/China reportedly set to hold trade talks. US Fed ‘cautious’. No change in rates. There is a lot of uncertainty about the outlook.

• Market trends. After a strong run AUD & NZD may ease back further near-term. This reflects the potential for the USD to tick up a little more.

Global Trends

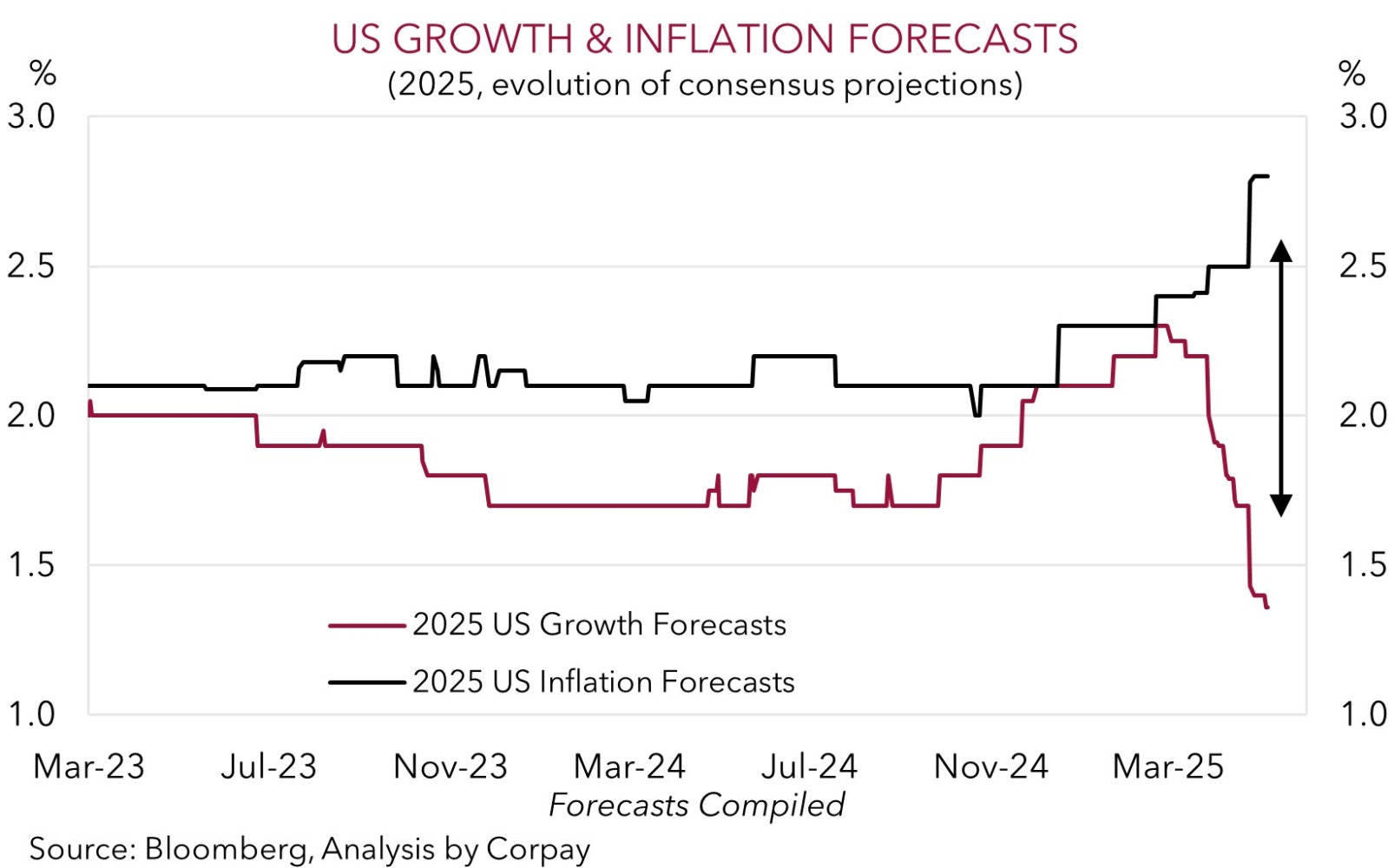

A couple of push-pull forces have washed through markets over the past few days. On the one hand, further signs of a potential de-escalation in the US/China trade war supported risk sentiment. Trade talks between US Treasury Bessent, the US Trade Representative and officials from China are reportedly due to take place this weekend. On the other hand, the US Federal Reserve met this morning and provided a sobering update which leant against market expectations looking for near-term interest rate cuts. Policy settings weren’t changed, as was predicted, while Fed Chair Powell stressed the uncertainty about the outlook caused by government policy and patience when it comes to future interest rate adjustments. According to Chair Powell “if the large increases in tariffs” are “sustained” they are “likely to generate a rise in inflation, a slowdown in economic growth, and an increase in unemployment”. As our chart shows, consensus expectations have been shifting towards this more ‘stagflationary’ environment.

In terms of markets, US equities were whipped around but ended the session in positive territory with the S&P500 rising 0.4%. Elsewhere, US bond yields drifted lower to where they were tracking earlier in the week. The benchmark US 10yr rate shed ~3bps (now ~4.27%). Base metals and energy prices declined with copper losing ~3% and WTI crude oil dropping under US$58/brl. In FX, the USD index edged higher with EUR (now ~$1.1308) and GBP (now ~$1.3294) weakening, and USD/JPY nudging up to ~143.80. The NZD (now ~$0.5940) and AUD (now ~$0.6425) have fallen back to where they were trading on Monday. Because of their positive correlation to Asian currencies the AUD and NZD were also weighed down yesterday by the weaker CNH which was driven by Chinese policymakers moves aimed at cushioning the blow from tariffs. The PBoC announced a 0.5% cut to its reserve requirement ratio (which will free up liquidity) and a 10bp reduction in its policy rate.

Looking ahead, the Bank of England is expected to cut interest rates by 25bps tonight (9pm AEST), while in the US weekly initial jobless claims are due (10:30pm AEST). On net, as outlined a few days ago, we believe that over the short term the beleaguered USD has scope to claw back lost ground. However, we don’t think the rebound should extend that far. We remain of the view that the US’ growth challenges stemming from higher import costs and policy uncertainty should see the USD trend lower over the medium-term.

Trans-Tasman Zone

The uptick in the USD generated by the ‘cautious’ rhetoric about policy easing from the US Fed, and softer CNH on the back of Chinese stimulus steps has seen the AUD and NZD give back some ground (see above). At ~$0.5940 the NZD is hovering near its 1-month and 1-year averages, while the AUD (now ~$0.6425) is a bit under its 1-year average.

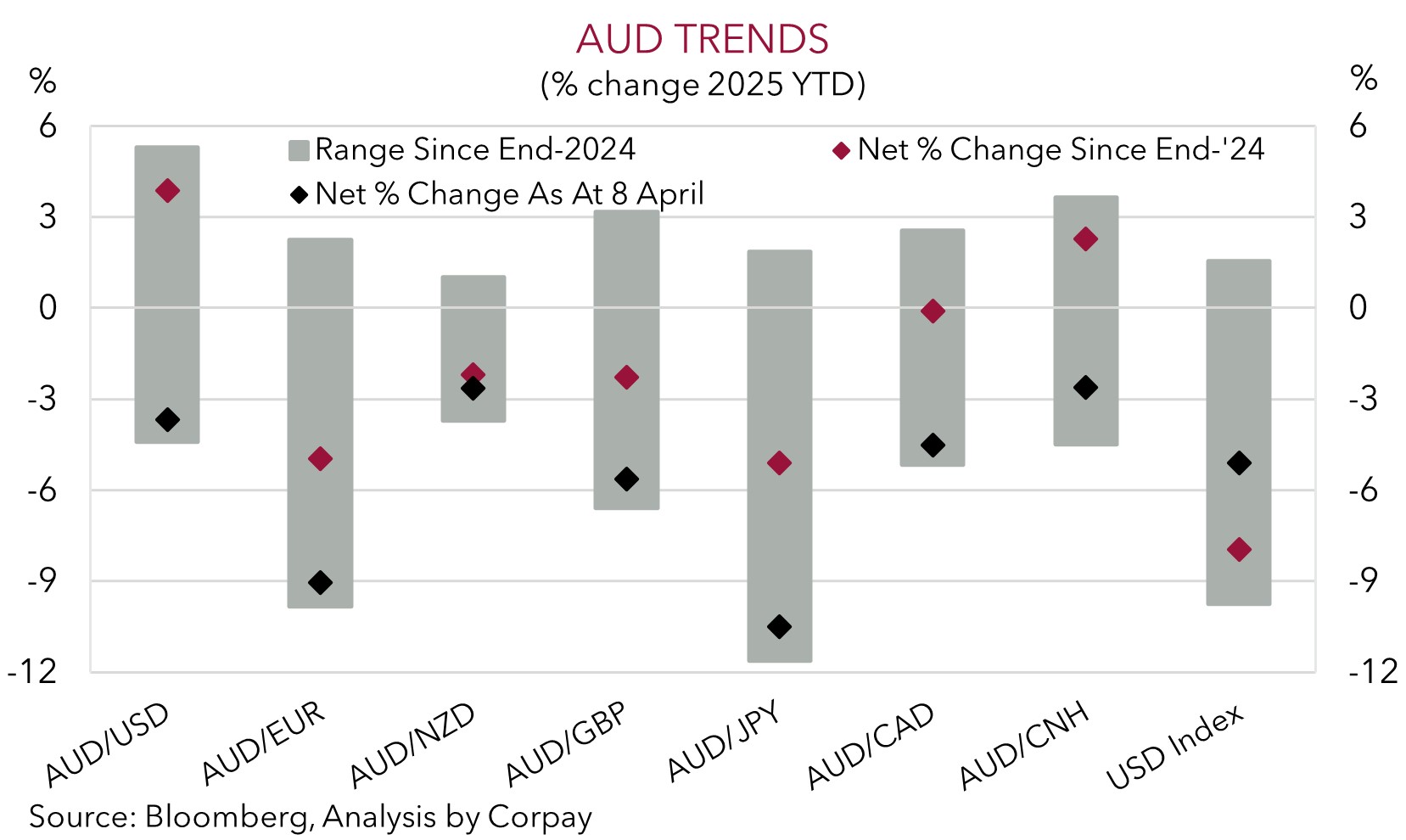

The AUD has also slipped back on most of the major crosses over the past 24hrs with falls of ~0.2-0.9% recorded against the EUR, JPY, GBP, CAD and CNH. By contrast AUD/NZD has tread water just north of ~1.08. The Q1 NZ jobs report released yesterday was a mixed bag compared to expectations, but on balance it showed conditions are still ‘loose’, reinforcing the case for further RBNZ interest rate cuts over coming months.

As outlined over the past few days the AUD has rebounded sharply over recent weeks with it now ~8.6% above its early-April tariff shock low. This has largely been due to a weaker USD. However, as mentioned above, we believe the risks reside with the USD recouping a bit more lost ground over the near-term. If realised this can exert some more downward pressure on the AUD and NZD. That said, we think this could be a short-term phenomenon with retracements in the AUD unlikely to be too deep and/or last too long. In our opinion, the USD should depreciate over the medium-term as the economic impacts of US tariffs and higher import costs crimp growth and push up unemployment. This in time should compel the US Fed to lower interest rates further, which in turn can weigh on the USD and support other currencies like the AUD. Added to that, we believe the AUD may outperform other currencies such as the EUR, NZD, and CNH because of diverging trends between the RBA and other central banks, the resilience in the Australian economy/jobs market, and moves by authorities in China to offset pain felt in its export sector via steps to boost domestic activity. This is where Australia’s key commodity exports are plugged into.