• Negative vibes. Wobbles across risk markets with US equities slipping back overnight. Higher US yields supported the USD. AUD under pressure.

• Macro trends. Bank of Canada cut rates by another 50bps. Global PMIs due today. US Fed easing expectations have been pared back.

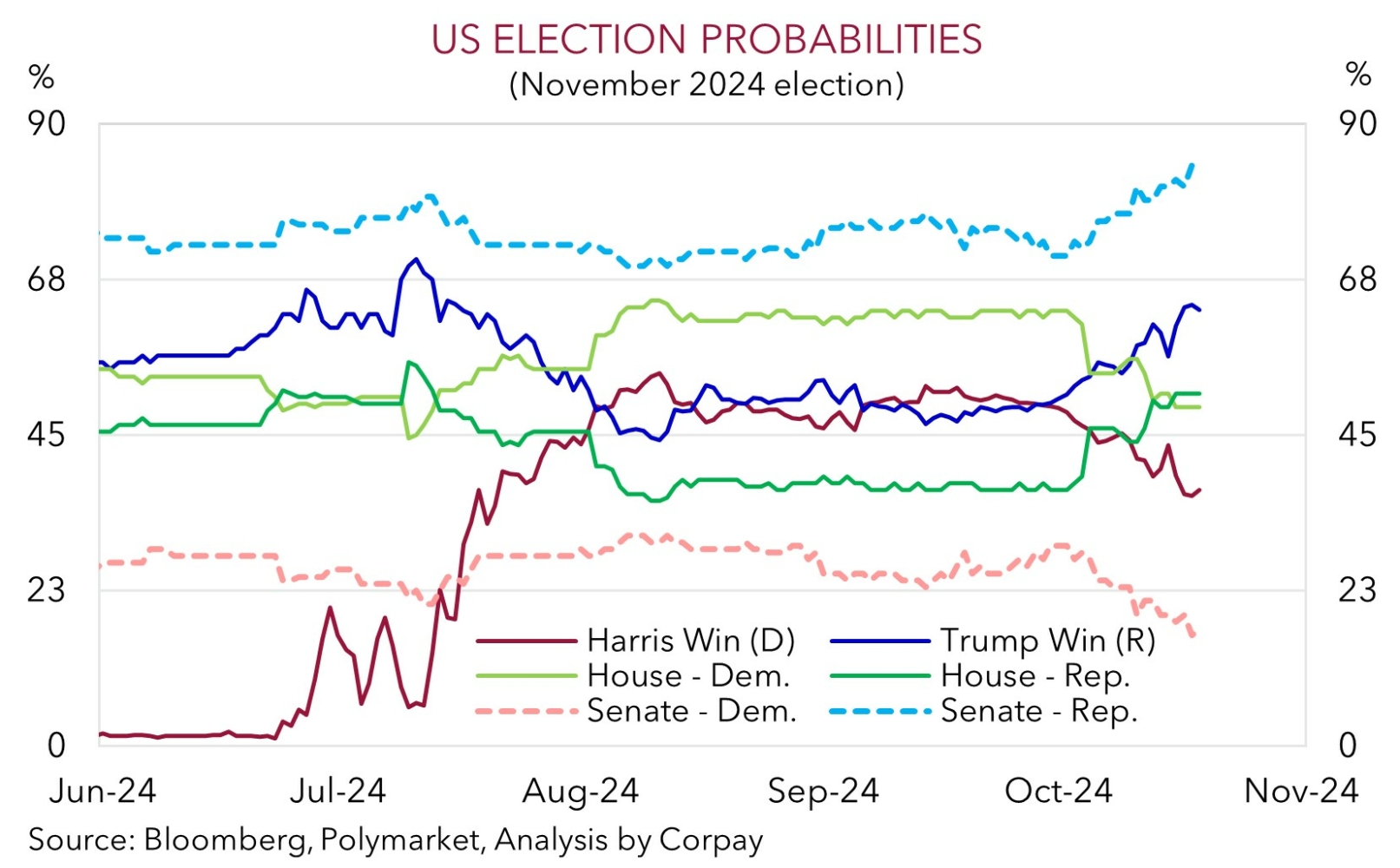

• US election. Presidential election fast approaching. Odds of a Trump win & Republican sweep on the rise. This is also boosting the USD.

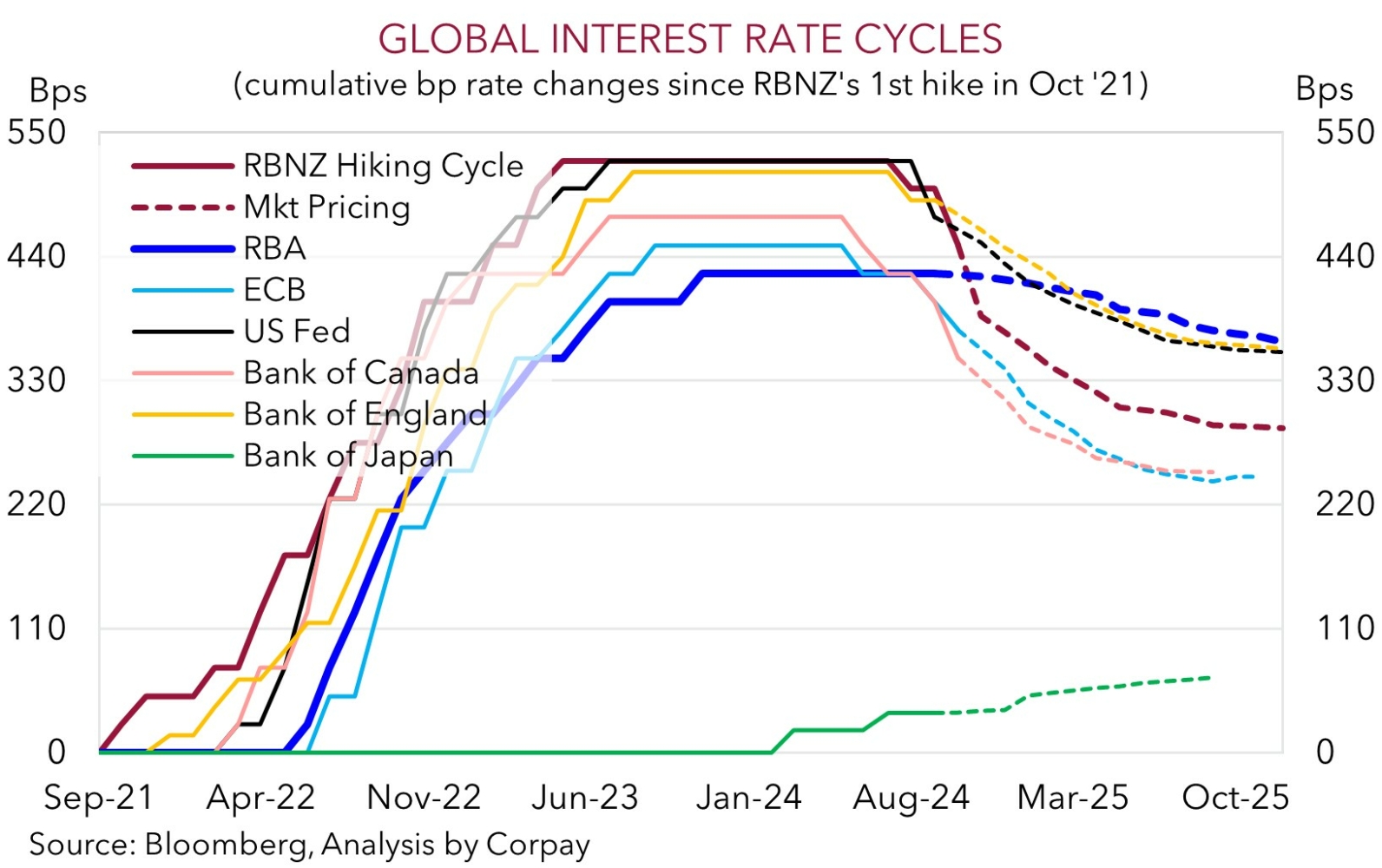

A few wobbles across markets overnight. Base metal and energy prices slipped back, and a selloff in tech stocks weighed on the US equity market with the NASDAQ (-1.6%) underperforming the broader S&P500 (-0.9%). Although some perspective is needed. The dip comes after a stellar run. The S&P500 (which is ~38% higher than a year ago) is still at the upper end of its historic range, and has risen in 9 of the past 10 weeks. A paring back of rapid policy easing bets by the US Federal Reserve and upswing in bond yields are factors which have taken some of the air out of equities. US bond yields ticked up ~4-5bps with the benchmark 10yr rate (now ~4.24%) at its highest since late-July. A 25bp rate cut by the US Fed in early-November (a few days after the US Presidential Election) is still well priced, however by mid-2025 only ~106bps of easing is discounted (down from ~180bps a month ago).

In FX, the USD remains firm. EUR is on the backfoot (now ~$1.0785, the bottom of its multi-month range), GBP lost ground (now ~$1.2928), and the interest rate sensitive USD/JPY appreciated (now ~152.70, a ~3-month high). USD/CAD also edged a little higher (now ~1.3840). As anticipated the Bank of Canada delivered a 50bp rate cut, lowering the policy rate to 3.75% (down from a peak of ~5%). The larger step is aimed at supporting growth and propping up the labour market with inflation back near target. The BoC expects to lower rates further if the economy evolves inline with its projections. Markets are assuming rates trough at ~2.8% in July. Elsewhere, the backdrop has seen USD/SGD’s revival extend (now ~1.3230) and the downward pressure on NZD (now ~$0.6005) and AUD (now ~$0.6635) maintained. In a speech this morning RBNZ Governor Orr indicated low and stable inflation is in sight, and that the cash rate will continue to become ‘less restrictive’ in time.

The fast-approaching 5 November US election is also casting a shadow over markets. The factoring in of a greater risk premium is at play given what the election could mean for the outlook. Former President Trump’s platform of large-scale tariffs, curbing immigration, and greater fiscal spending, as well as geopolitical unease, may mean inflation is higher than it otherwise would be, with the uncertainty a headwind for global growth. As our chart shows, odds of a Republican sweep of the White House and Congress are rising. If realised, this would mean its policies would be more easily implemented. In our opinion, the looming US event risk and shifting election probabilities could see the USD add to its gains over the period ahead. More signs of relative US strength in today’s global PMIs may be an additional USD support.

AUD Corner

The AUD has come under some renewed downward pressure with yesterday’s partial reversal higher fading. The firmer USD and shaky risk sentiment has pushed the AUD down towards ~$0.6635, the bottom of its ~2-month range and only slightly above its 1-year average. The AUD has also lost altitude on most of the major crosses. The AUD has weakened by ~0.5-0.7% against the EUR, CAD, and CNH over the past 24hrs, with more modest falls recorded versus GBP (-0.2%) and NZD (-0.1%). By contrast, a softer JPY has boosted AUD/JPY. At ~101.30 AUD/JPY is near levels traded in July.

The next major piece of major local economic news is Q3 CPI. But this isn’t released until next Wednesday. Because of the drags from government subsidies/electricity rebates headline inflation should mechanically step down below 3%pa. However, the progress on core CPI (which provides a better guide to the true inflation pulse) should be more constrained. This is what the RBA is focusing in on, as headline inflation will snap back once government policies end. In our opinion, underlying inflation trends coupled with a resilient labour market means RBA rate cuts may be some time away. We believe the start of a modest RBA rate cutting cycle is a story for H1 2025.

Over the medium-term, we think the divergence between the RBA and others should be AUD supportive against currencies like EUR, CAD, GBP, and NZD where their central banks are lowering rates due to weaker growth and receding inflation. This was on show again overnight with the Bank of Canada delivering a 50bp cut which lowered its policy rate to 3.75%. Today, Eurozone (7pm AEDT) and UK (7:30pm AEDT) PMIs are due. Signs Eurozone growth remains sluggish might weigh on EUR, and generate a bit of AUD/EUR support.

That said, versus the USD, there are bigger forces at play which could keep the AUD on the backfoot. The US Election is less than 2 weeks away, and as we have discussed odds former President Trump retakes the White House are on the rise with a Republican sweep of Congress also possible. Trump’s combative trade policies, more fiscal spending, and push to curb US immigration are generally viewed as being USD positive given the spillover impacts on US inflation and in turn interest rates.