• Upbeat tone. No news has been good news. US equities rose, while bond yields & USD slipped back. AUD a bit higher at start of new week.

• RBA guidance. RBA meeting minutes out today. Governor Bullock speaks later in the week. Will the RBA support expectations looking for multiple cuts?

• Data flow. Global PMIs due later this week. US corporate earnings also in focus with over 100 companies in S&P500 reporting over the next few days.

Global Trends

It has been a relatively positive start to the new week for risk assets. The US S&P500 (+0.1%) touched yet another record to now be over 7% higher year-to-date and more than 30% from its early-April ‘Liberation Day’ panic low. US and European bond yields slipped back with the benchmark US 10yr rate (now ~4.38%) dipping below its 2025 average, and base metal prices like copper and iron ore rose. In FX, the USD index faltered. EUR (now ~$1.1694) is back up around its 1-month average and USD/JPY (now ~147.34) declined a little. Yesterday’s JPY strength stemmed from the weekend Japanese election where the ruling coalition lost its majority in both houses of parliament for the first time. Japan PM Ishiba stated it will continue as leader, which in turn should mean there is some policy continuity, though for how long remains an open question given the historic election result. Elsewhere, the upbeat market sentiment supported the AUD (now ~$0.6523), while the NZD consolidated (now ~$0.5968) after the softer than forecast Q1 NZ inflation data kept the door open for another RBNZ interest rate cut in August.

The minutes of the last RBA meeting are due today (11:30am AEST), Bank of England Governor Bailey speaks (7:15pm AEST), and US Fed Chair Powell is scheduled to give opening remarks at a conference which aren’t likely to be monetary policy centric because of the FOMC black out period ahead of next week’s meeting. Also on the radar over the next few days given the strong run in the US stockmarket are the latest batch of corporate earnings. Over 100 companies in the S&P500 report this week including tech heavyweights Alphabet and Tesla after the close on Wednesday. Commentary about tariffs and what (if any) impact they are having on profit margins will likely be a focus for markets.

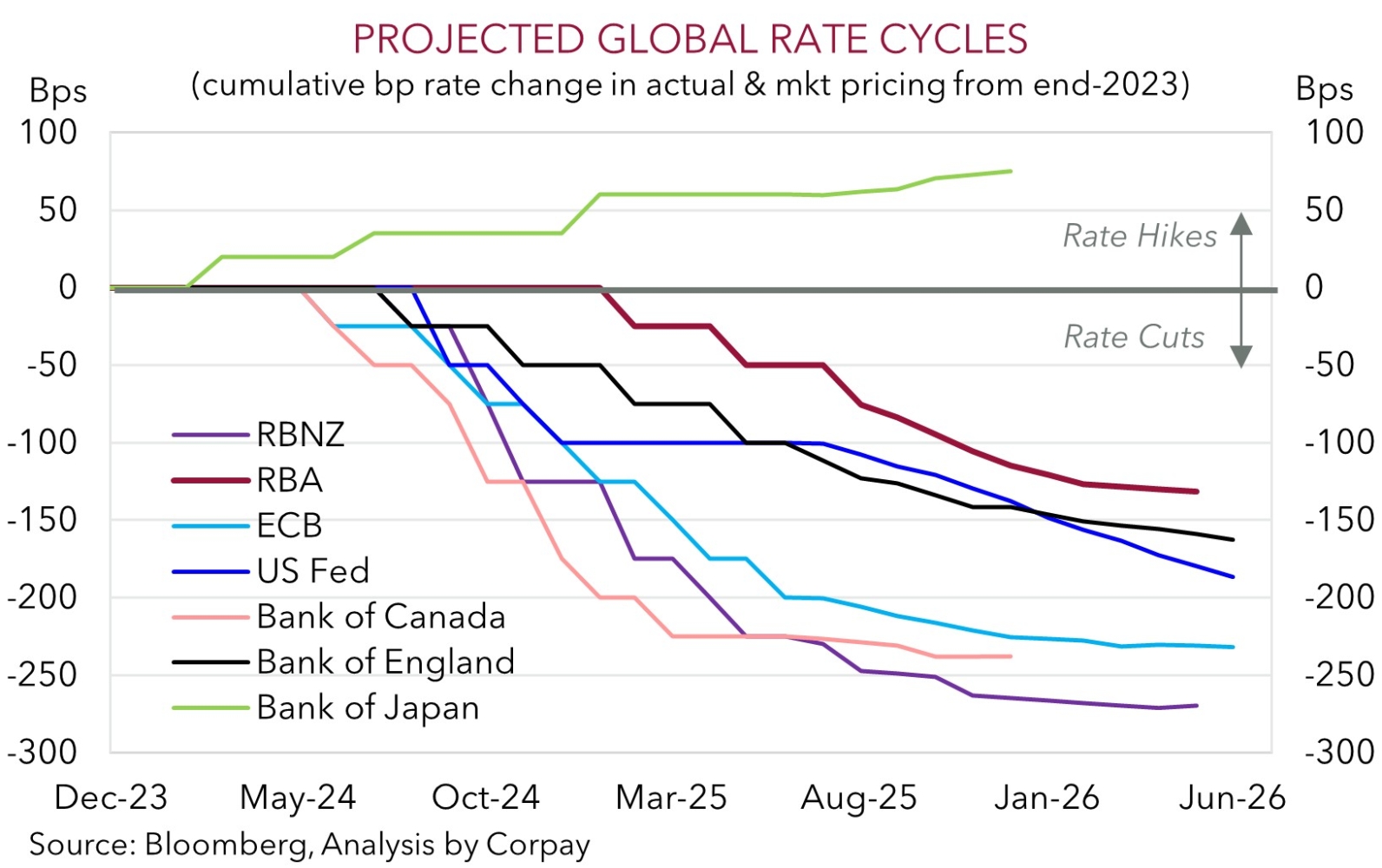

Later in the week the global business PMIs are released (Thurs) and the European Central Bank meets (Thurs night AEST). The ECB looks set to hold after delivering 200bps worth of cuts so far this cycle. We continue to think that, on balance, the USD (which is trading under our ‘fair value’ estimate) could recapture lost ground over coming weeks on the prospect of renewed bouts of tariff related volatility and/or resilience in the top tier US economic data.

Trans-Tasman Zone

The more positive market vibes, as illustrated by the rise in US equities and base metal prices, and softer USD has supported the AUD at the start of the new week (see above). At ~$0.6523 the AUD is hovering close to its 6-week average. However it wasn’t all one-way traffic. The AUD weakened by ~0.4-0.5% versus the EUR, JPY, and GBP over the past 24hrs. Across the Tasman, the NZD (now ~$0.5968) has been range-bound with the positive external forces offset by the lower than predicted Q1 NZ CPI which bolstered expectations that the RBNZ may deliver another interest rate cut in August.

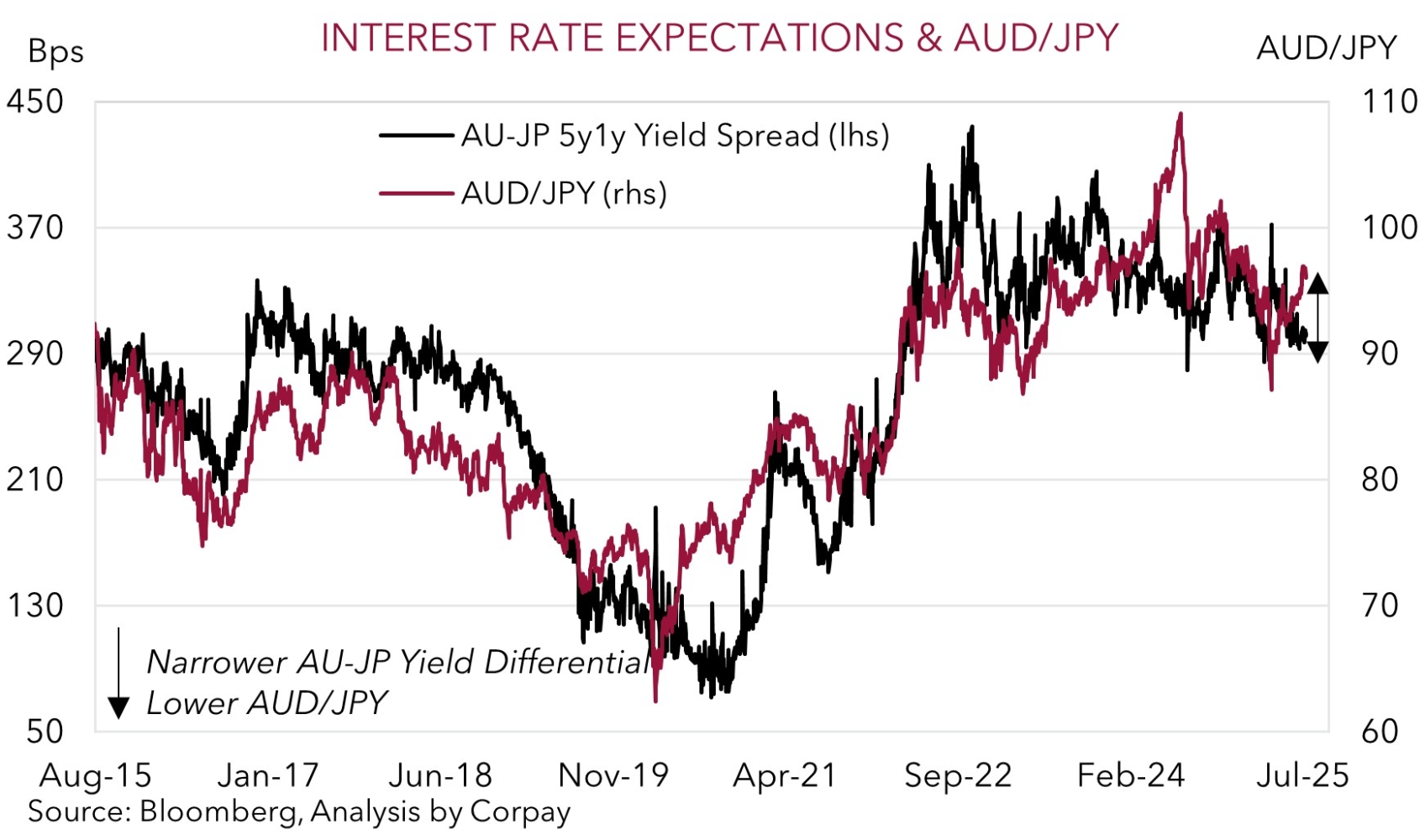

Today the minutes of the July RBA meeting are released (11:30am AEST). In July the RBA surprised the market by keeping interest rates on hold. That said, it was a close call given the 6-3 vote count and comments by Governor Bullock that there was mainly a “disagreement about timing rather than direction”. Based on the widening cracks in the Australian jobs market and reduced domestic inflation risks we think the RBA should provide more interest rate relief in August, and move settings closer to ‘neutral’ (i.e. a cash rate closer to ~3%) over the next few quarters. In our opinion, ‘dovish’ comments in today’s RBA meeting minutes and/or in Governor Bullock’s speech later this week (Thursday) reinforcing expectations for a few interest rate cuts to come through could exert a bit of downward pressure on the AUD. Indeed, as our chart shows, some cross-rates such as AUD/JPY already appear too high compared to where relative yield spreads are tracking.

Furthermore, as discussed over the past week, we would also highlight that the AUD has tended to have a negative seasonal bias in late-July/August. AUD/USD has weakened in August in 21 of the past 28 years. From our perspective the implementation of the US’ new tariffs (1 August), stronger US GDP growth (30 July), an on hold US Fed (30 July), sluggish Q2 AU inflation (30 July), a more positive US jobs report (1 August), a RBA rate cut (12 August), signs of tariff induced US inflation (12 August), and/or no deals struck at the end of the US-China tariff truce (12 August) might be triggers for this pattern to repeat in 2025.