The dollar is again winning the cleanest-dirty-shirt contest this morning as mounting political turmoil in Japan and the euro area casts a pall over currency markets.

The yen is down almost 2 percent and Japanese equity markets are soaring after Sanae Takaichi unexpectedly triumphed in the Liberal Democratic Party’s leadership race, defying polls that had put her rival, Shinjiro Koizumi, ahead among party grandees. Investors believe Takaichi—an advocate of looser fiscal and monetary policy in the mould of Shinzo Abe’s “Abenomics”—could seek to unleash fresh government stimulus while pressing the Bank of Japan to pause its tightening.

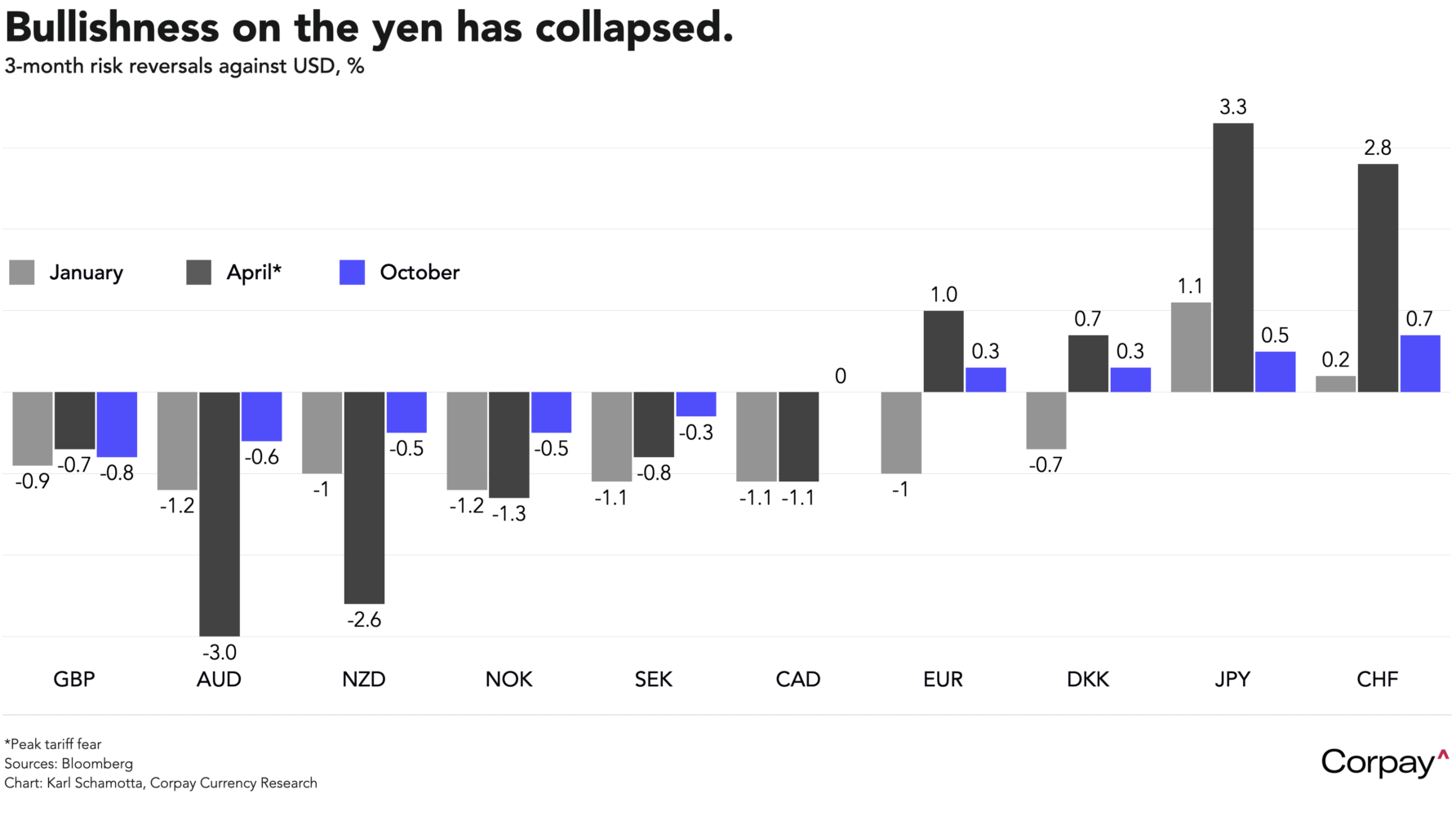

Options markets have turned far less optimistic on the yen’s prospects. So-called “risk reversals”—which measure the gap between prices for put options which give the holder the right to sell yen and buy dollars three months from now, and calls that confer the opposite privilege—have declined dramatically from levels reached in April as prospects for monetary tightening have faded. We think that this is reasonable: structural impediments mean the yen is likely to remain the world’s preferred carry funding currency for some time yet. However, we also suspect public hostility to rising prices is likely to constrain deficit-funded government largesse and limit Takaichi’s sway over the central bank in the near term, meaning that the currency could recover a little ground in the coming days.

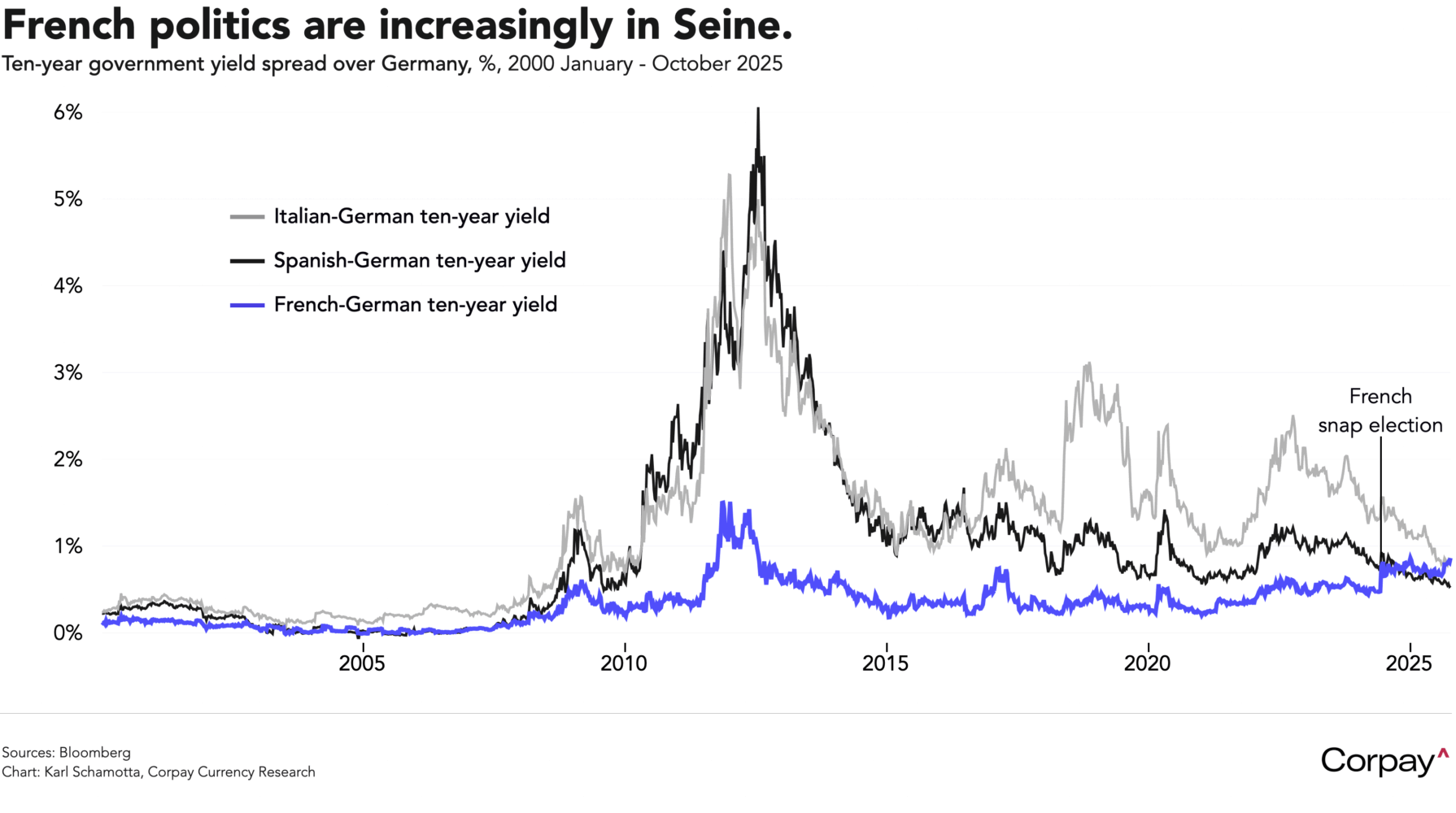

The euro is trading roughly 0.7 percent lower after French prime minister Sebastien Lecornu resigned less than a month* after his appointment. Lecornu—the third prime minister to leave office since President Emmanuel Macron called disastrous snap parliamentary elections last summer—chose to step down after foes and allies alike vowed to vote down his government, saying “One cannot be prime minister when the conditions are not met”. From here, Macron could appoint yet another caretaker prime minister, resign, or announce new legislative elections—opening up the possibility of a swing toward the far right, and enhancing the risk that the country’s fiscal issues continue to worsen. The interest rate gap between French government bonds and German bunds—a widely-watched measure of market stress—has widened to its highest levels since the eurozone debt crisis, and now exceeds spreads in Italy and Spain.

Here in North America, yields are following their global counterparts higher as investors brace for increasing strain in sovereign bond markets and hedge against risks associated with the US government shutdown, which threatens to stretch well beyond the middle of the month. No one can predict how long the impasse between Republicans and Democrats will last, but roughly 70 percent of the bettors on prediction markets think that it could drag on past the 15th.

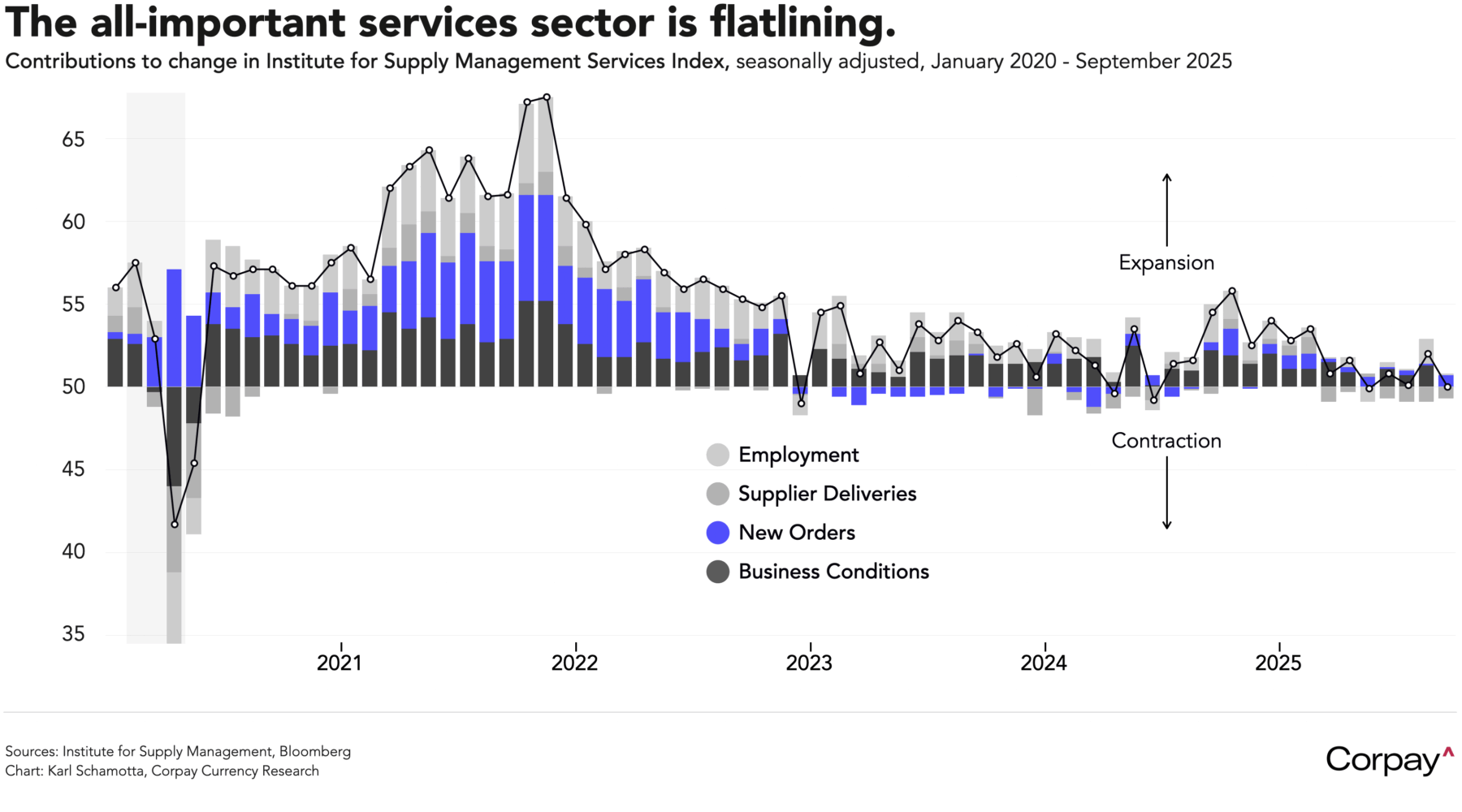

We doubt the shutdown itself will take a dramatic fundamental toll, but the psychological impact could prove quite damaging. According to an update published on Friday, the Institute for Supply Management services index—which measures activity in the biggest sector in the American economy—tumbled toward contractionary territory in September, with the business activity subindex falling well into negative territory for the first time since the pandemic in 2020. Respondents pointed to continued supply chain challenges, tariffs, and heightened policy unpredictability as contributing to the slowdown—factors that could worsen as dysfunction in Washington becomes more evident.

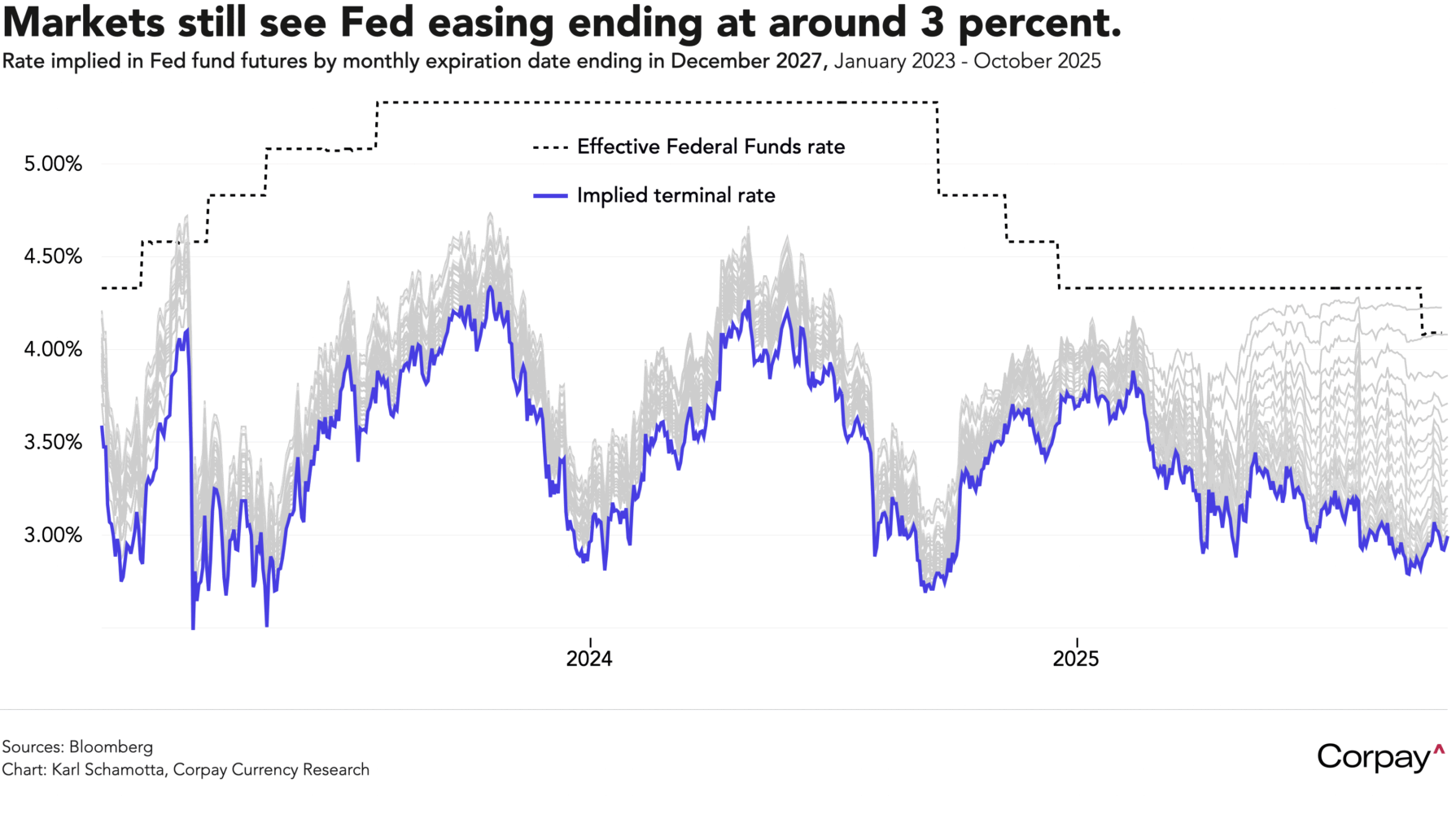

With official data on the US economy likely to remain unavailable this week, investors will turn their attention to what policymakers have to say on the monetary outlook. By our count, members of the Federal Reserve’s rate-setting committee are slated to make at least eighteen public appearances in the coming days, with their comments—along with Wednesday’s minutes from the September meeting—shedding light on just how isolated recently-appointed Governor Miran’s dovish stance really is. We think the balance of risks around the minutes is tilted in a hawkish direction: at the time of the meeting, hiring had undoubtedly slowed, but a number of economic indicators were showing signs of improvement, and the record will likely indicate that “most” participants remained sceptical of Miran’s contention that the “neutral rate” had fallen sharply under Trump. For now, markets are pricing in an eventual “terminal” Fed Funds rate close to 3 percent, up from levels expected ahead of the president’s latest round of attacks on the Fed’s independence.

*His 27 days in office amount to 0.61 Liz Trusses, or 2.45 Anthony Scaramuccis.