Financial markets are back in recovery mode and Nasdaq is coming off its best day in six months as growing evidence of a “Fed put” boosts risk appetite. Index futures are pointing to further gains, Treasury yields are down across the curve, and the dollar is losing altitude after Federal Reserve officials expressed deepening concern about labour market softness, prompting a recovery in technology stocks and encouraging investors to set aside—at least for now—worries about stretched valuations.

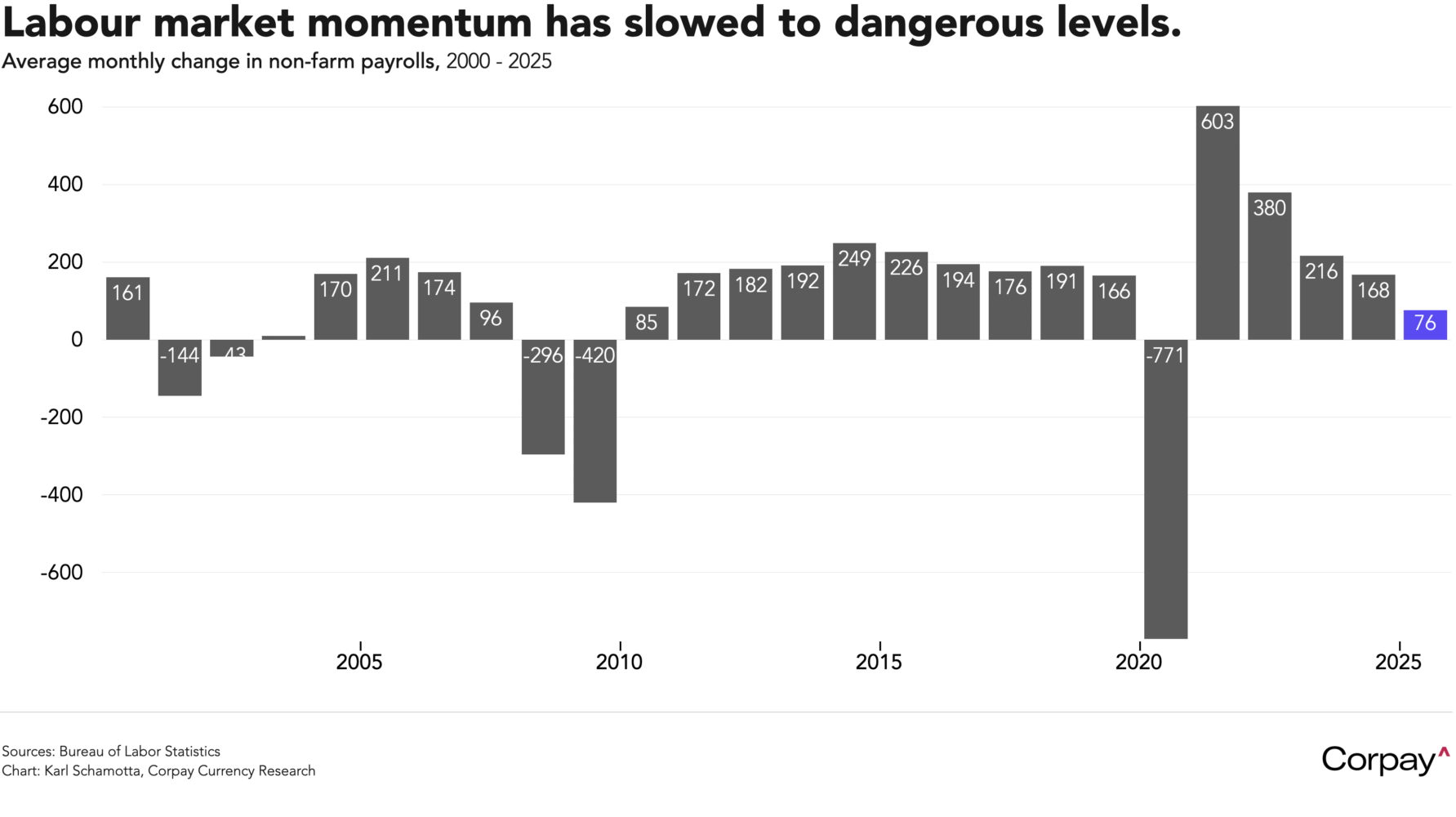

Markets are pricing in a nearly 80-percent chance of a December rate cut—up from less than 30 percent only a week ago—after New York Fed President John Williams rode to the rescue with a dovish message on Friday, followed by Governor Christopher Waller and San Francisco President Mary Daly yesterday. In an interview on Fox, Waller—who is a voting member this year—said “most of the private sector and anecdotal data that we’ve gotten is that nothing has really changed,” since the central bank’s October meeting, but “The labour market is soft. It’s continuing to weaken”. Daly, who does not have a vote, but often aligns with Chair Powell’s thinking, told the Wall Street Journal “On the labour market, I don’t feel as confident we can get ahead of it. It’s vulnerable enough now that the risk is it’ll have a nonlinear change”.

Perceptions could shift during today’s session. Should the long-delayed September retail sales and producer price reports, together with the November Conference Board consumer-confidence reading, show households continuing to spend even as second-round tariff effects push prices higher, traders may adopt a less sanguine view of the prospects for an extended easing cycle—and could begin paring back risk.

But we think the consensus on the Fed’s rate-setting committee has shifted in a dovish direction in recent days, perhaps driven by last week’s employment data showing a sharp rise in the September jobless rate. A hawkish faction remains, but more centrist officials appear to be mounting a coordinated effort—complete with an interview granted to the Wall Street Journal’s “Fed-whisperer,” Nick Timiraos—to steer market expectations ahead of the pre-meeting blackout period beginning this weekend. In our view, a ‘hawkish cut’—a rate reduction accompanied by a more restrained message on the pace of future easing—now represents the most plausible base case for hedgers going into the December 9–10 meeting.

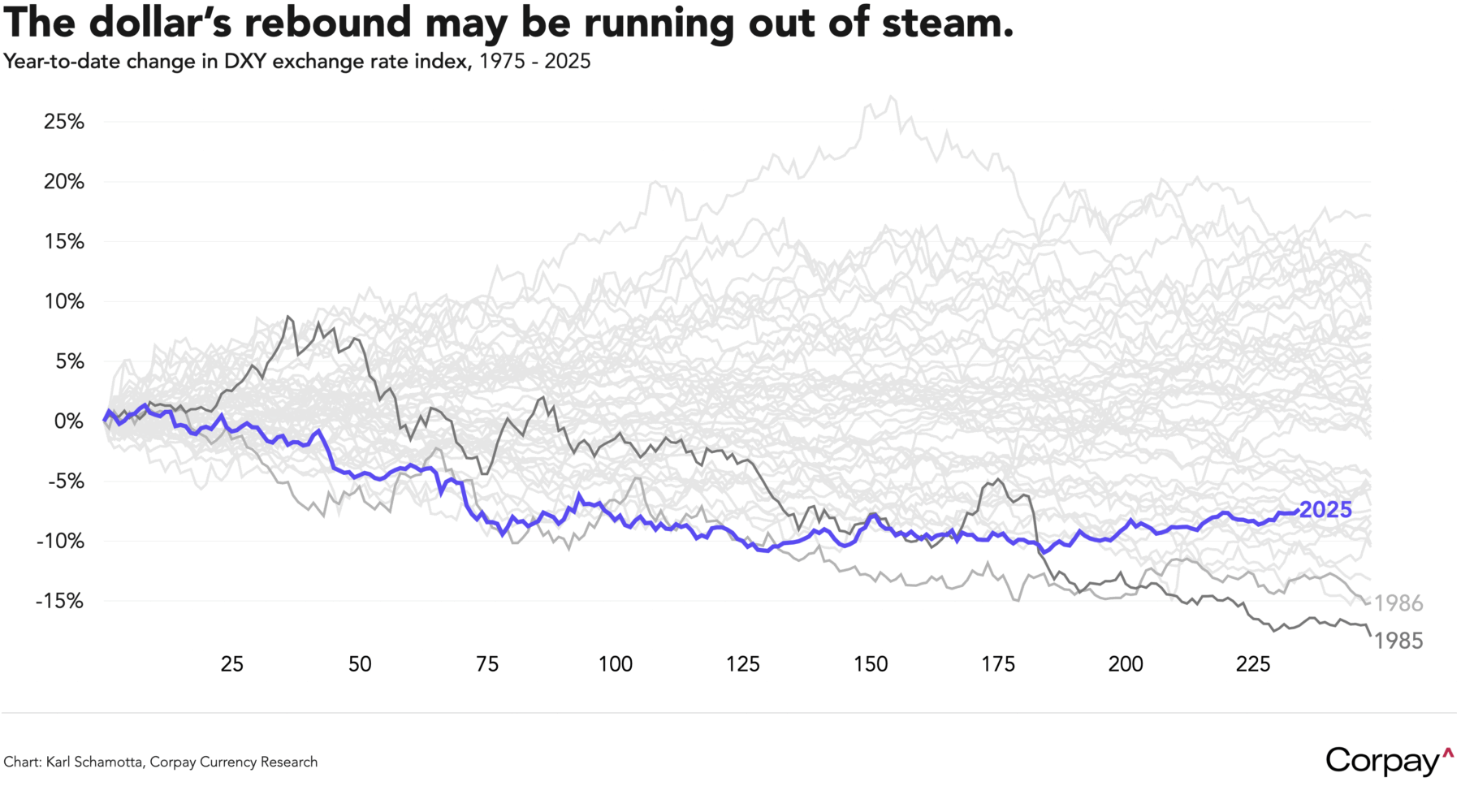

A re-widening in rate differentials is curbing the dollar’s advance, tempering a rally that has seen the currency advance 3.6 percent against a basket of its peers since the Fed’s September meeting. The closely-watched DXY index is now down -7.3 percent for the year—not disastrous, but a performance that places it near the bottom of the post-Bretton Woods range. Barring a major risk-off turn in global markets, we see limited scope for a meaningful year-end surge, and think a further downward shift in interest-rate expectations could leave the greenback vulnerable to renewed depreciation.

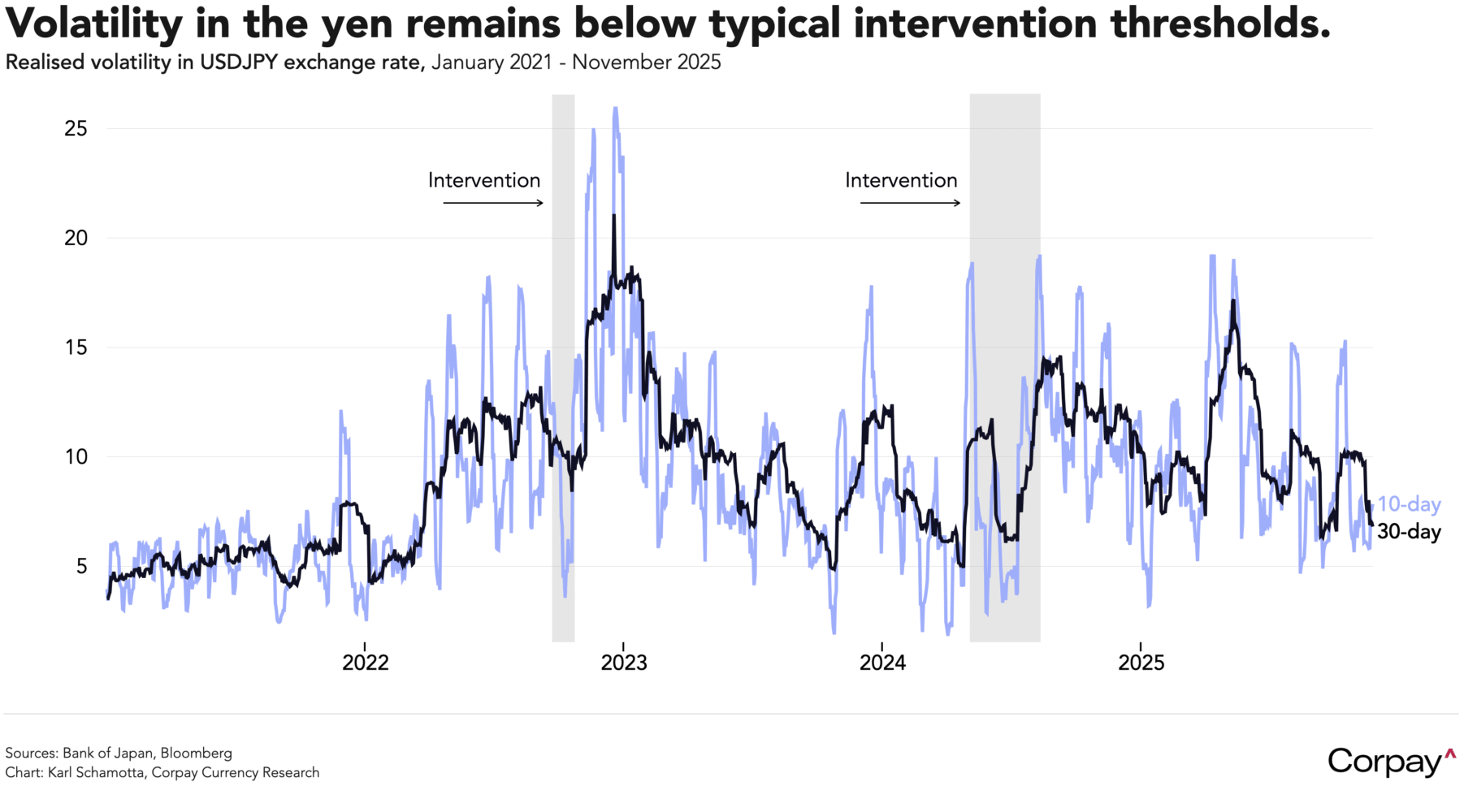

Across the Pacific, the Japanese yen is trading with a slightly firmer bias as market participants hedge themselves against a possible intervention effort during the Thanksgiving holiday. The Ministry of Finance and Bank of Japan have learned to use thin liquidity conditions—the “witching hours” between the North American close and the Asia open, or market holidays—to maximise the impact of their yen-buying efforts in recent years, and investors are wary of something similar playing out in the days ahead. We can’t discount the possibility—from a technical standpoint, the yen looks vulnerable here—but realised volatility remains well below the levels that have preceded intervention efforts historically, and would also note that the central bank’s tightening trajectory represents an upside possibility in the months ahead. To an unusual extent, there are significant two-way risks embedded in the yen here.

And in the UK, where tomorrow’s Autumn Budget is sucking all the air out of trading floors, one-week implied volatility is sitting well above normal. We think market fears of a fiscal accident are overwrought—and heavily influenced by post-traumatic stress syndrome brought on by the Truss administration’s experimentation—but would nonetheless encourage hedgers with sterling exposures to consider putting protection in place against unfavourable moves to either side.