The dollar is cruising toward a third consecutive day of declines and short-term Treasury yields are coming under mild downward pressure as investors firm bets on a fairly-forceful easing path from the Federal Reserve. Most major foreign exchange pairs are caught in narrow trading ranges amid a lack of political and economic catalysts, leaving currencies like the Canadian dollar and Mexican peso almost unchanged on the week.

The Fed’s latest Beige Book survey pointed to a slowing in momentum in the world’s largest economy. On balance, “economic activity changed little” between September and October, with three of twelve districts reporting slight to modest growth, five reporting no change and four reporting a slight softening. In August, four reported “modest growth” while the other eight indicated “little or no change in economic activity”. The labour market weakened as “more employers reported lowering headcounts through layoffs and attrition, with contacts citing weaker demand, elevated economic uncertainty, and, in some cases, increased investment in artificial intelligence technologies”. All twelve districts saw “moderate or modest” price growth, with several districts highlighting a tightening in margins as tariffs, insurance, health care, and technology costs rise.

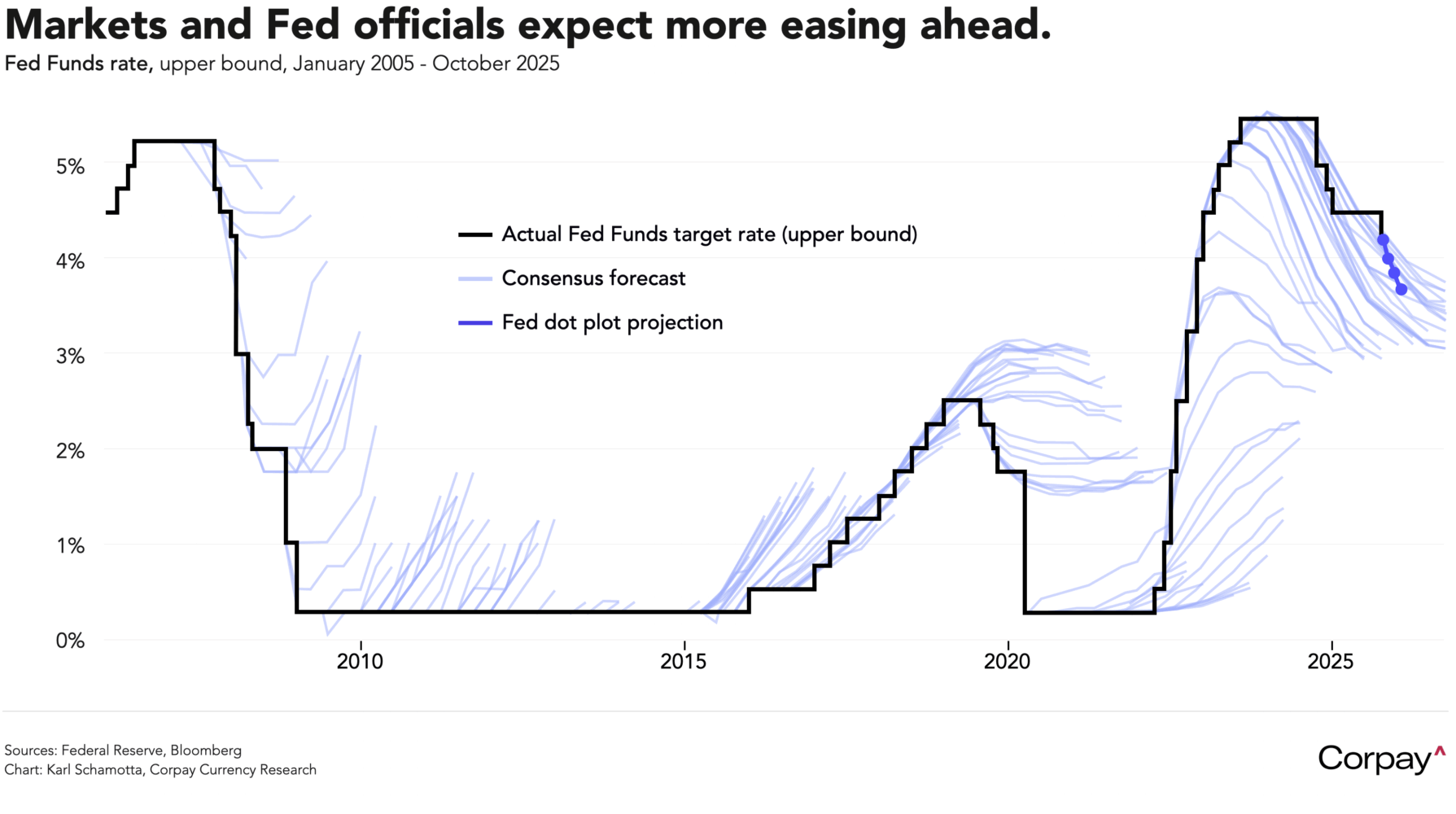

Forecasters expect policymakers to deliver two back-to-back rate cuts in October and December, followed by another three in 2026. This is slightly more aggressive than the path Fed officials pencilled into the last “dot plot” summary of economic projections, but the difference of opinion is not particularly extreme relative to history*.

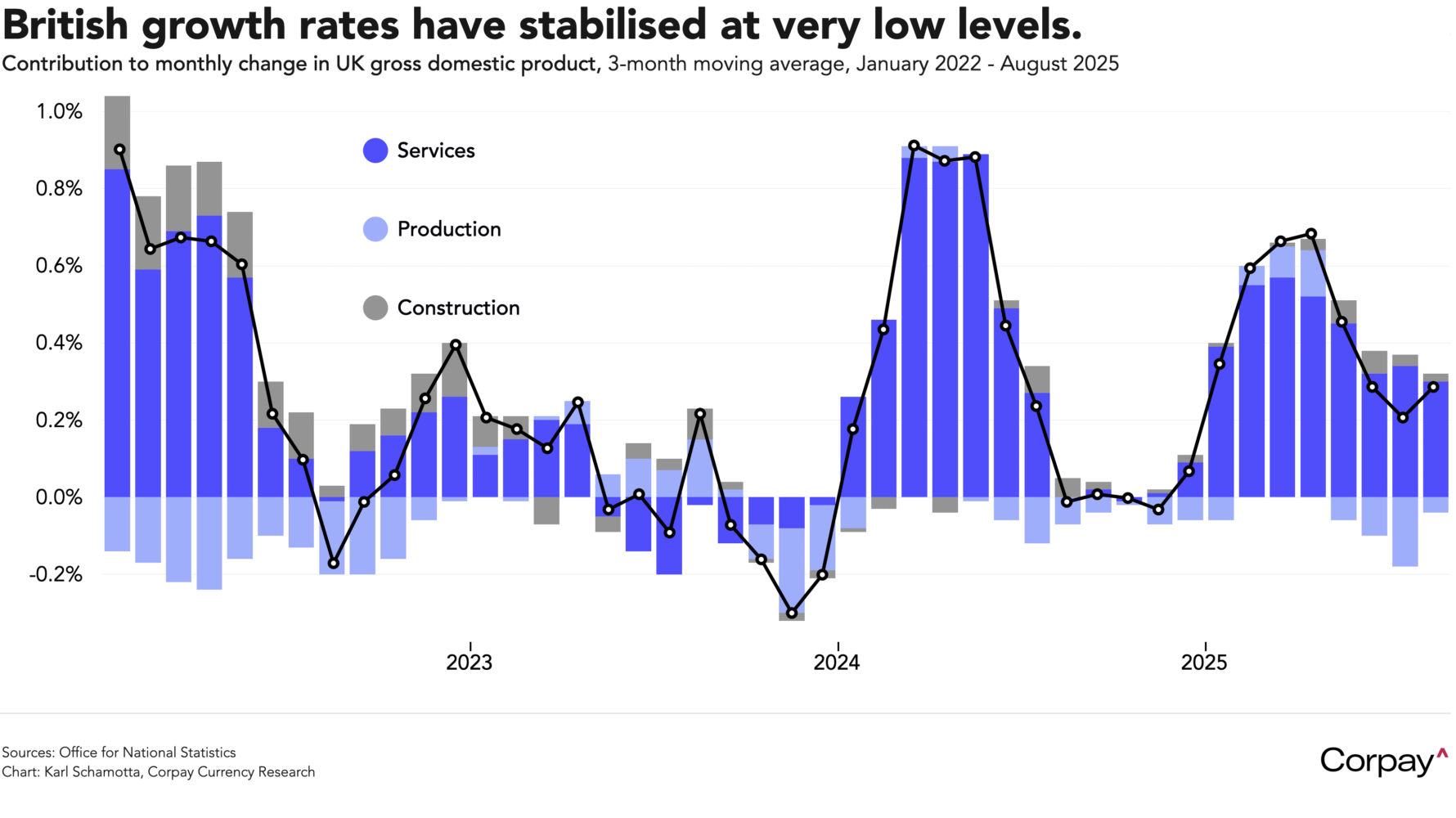

The British pound is continuing its advance after the Office for National Statistics said the economy eked out a small gain in August, reversing July’s contraction. According to the updated numbers, output expanded 0.1 percent in the month after declining -0.1 percent in the prior month, with a faster-than-anticipated 0.7-percent jump in manufacturing activity helping offset continued weakness in the services and construction sectors. The Bank of England is still seen cutting rates by its March meeting.

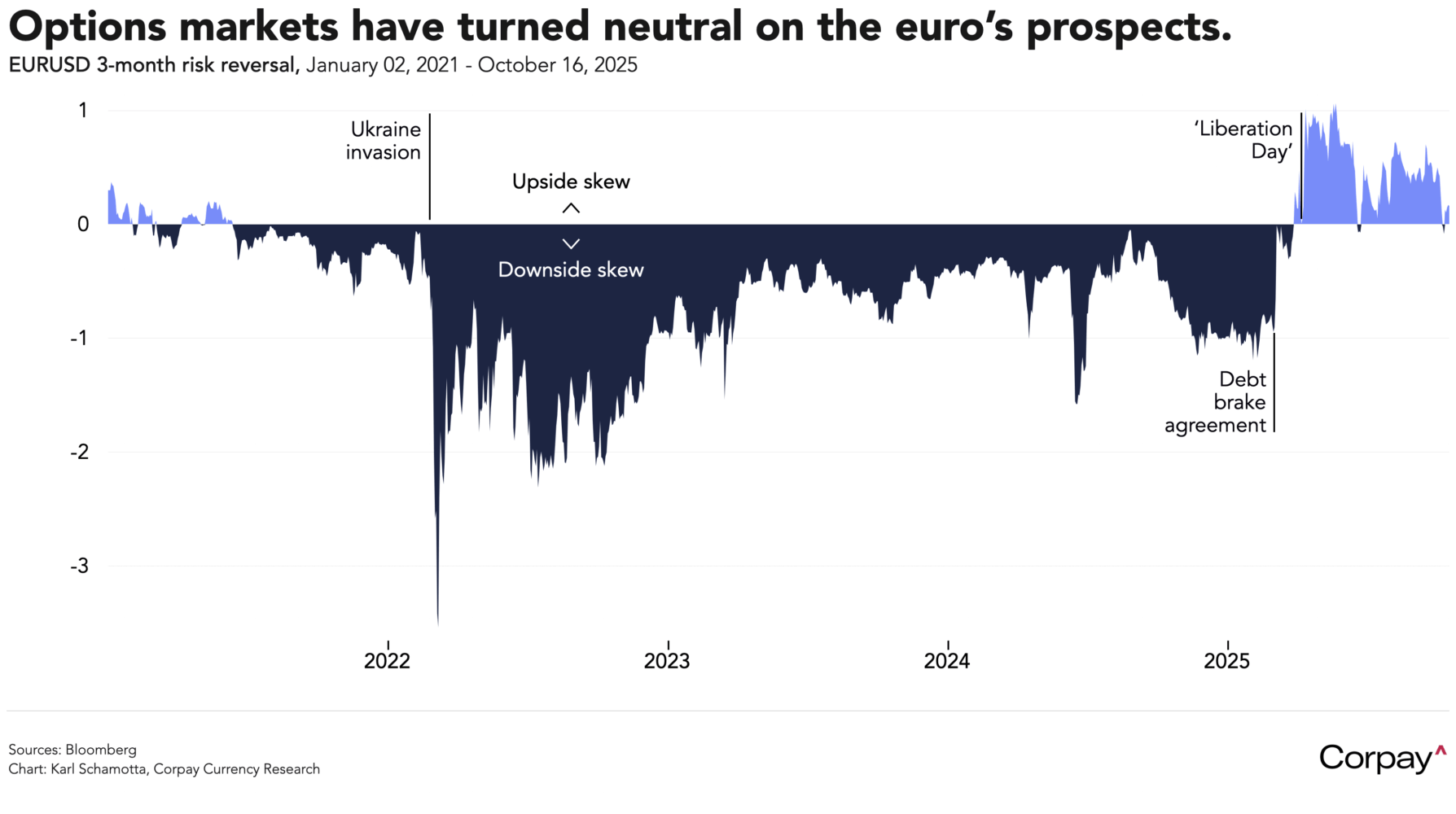

Across the Channel, the euro is pushing toward a third day of gains after French prime minister Sébastien Lecornu survived two successive no-confidence votes, reviving hope that the government could succeed in passing a watered-down budget before year end. The country remains on an unsustainable fiscal trajectory, but the likelihood of legislative elections ushering the far right into power has diminished, and some traders are beginning to see the 1.15 threshold as a floor level for the common currency against the dollar.

Sentiment on the euro has turned far less positive in the last month or so, and positioning has moved closer to neutral. Three-month risk reversals—which measure the difference in demand for bullish and bearish options—are now only modestly skewed toward euro upside, suggesting that the surge in optimism surrounding Germany’s early-year fiscal reforms has faded away, leaving investors focused on an incremental convergence in expected policy rates between the European Central Bank and the Fed.

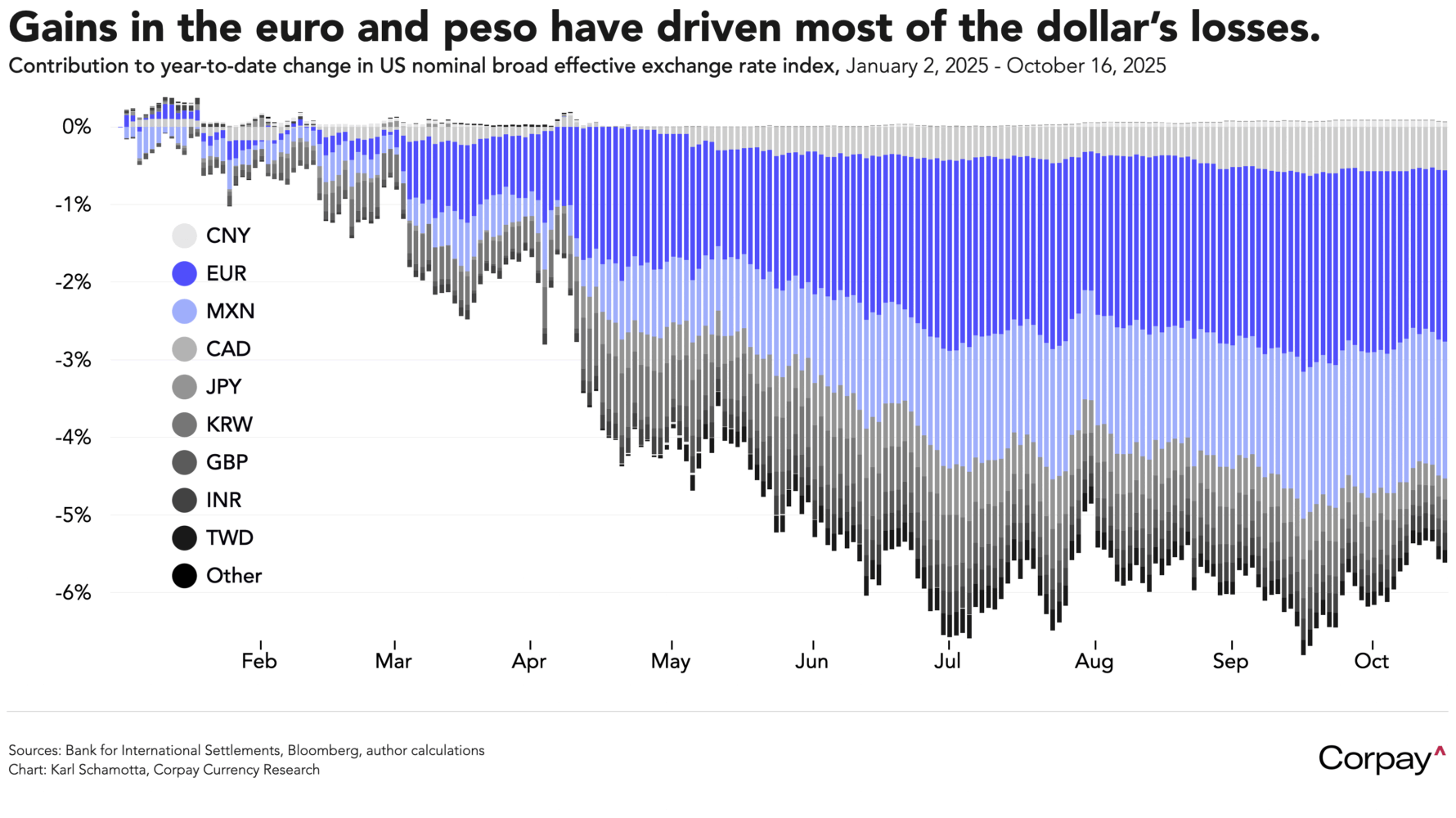

We think the next move in the dollar will be driven by changes in US economic conditions and financial markets, as opposed to another momentous shift in narratives on the European economy. Given that the euro’s appreciation did most of the heavy lifting in driving the trade-weighted dollar lower this year, it is reasonable to think that further downside will require a meaningful softening in US data or a broader tightening in financial conditions—both of which remain elusive for now.

*It should be clear, however, that both groups will be wrong. As the chart illustrates, no one has a particularly good record of forecasting the Fed’s moves.