Investors are making up for a lack of actual intelligence on the state of the economy by betting on artificial intelligence instead. The dollar is attracting inflows, mid-curve Treasury yields are pushing higher, and equity futures are pointing to further gains at the open after OpenAI and Advanced Micro Devices yesterday announced they would collaborate to build AI data centres, with the ChatGPT maker agreeing to buy tens of billions of dollars’ worth of chips from AMD while taking a 10-percent stake in the chipmaker over time.

The euro is consolidating around lower levels as the dust settles after French Prime Minister Sebastien Lecornu’s surprise resignation triggered a spike in Franco-German bond spreads, the British pound is extending its slide, and the Canadian dollar is trading sideways as traders await news out of Prime Minister Mark Carney’s meeting with President Trump later today. A positive outcome is seen triggering a reversal in the loonie’s slump, or a breakdown in relations could push the spot exchange rate through the 200-day moving average at 1.3980 and into the low 1.40’s.

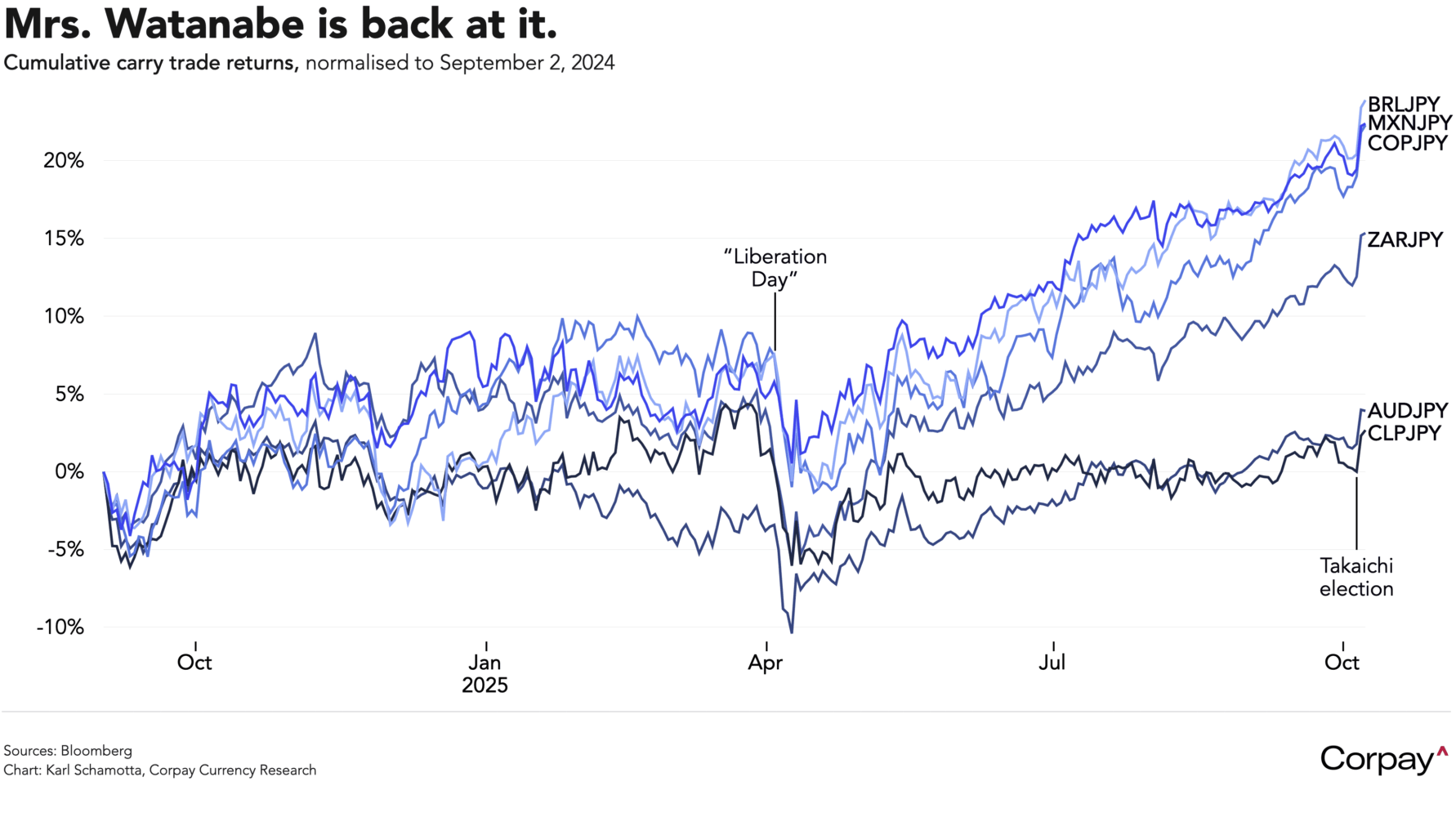

The implications of Sanae Takaichi’s unexpected victory in Japan’s leadership election are still rippling across financial markets. With the incoming prime minister expected to double down on Shinzo Abe’s “Abenomics” monetary and fiscal easing policies, investors are bidding up Japanese equities, selling long-term bonds, and bailing out of the yen, driving it to a -2.2-percent loss over the last two trading sessions. We think Takaichi’s room for manoeuvre will prove far more limited than markets expect, but swap-implied odds on a rate hike at the Bank of Japan’s October meeting have fallen to 23 percent from 57 percent on Friday, and rate differentials are widening against the currency once again, putting renewed impetus behind the carry trade.

Speculators who borrow in the low-yielding yen and invest in higher-yielding currencies have earned substantial profits since last year’s August shock, and might add to their positions in the coming weeks if government officials and central bankers begin rowing in a more dovish rhetorical direction, and background volatility remains low. Currencies like the Mexican peso, Brazilian real, and Colombian peso could push even higher as long as nasty surprises are avoided.

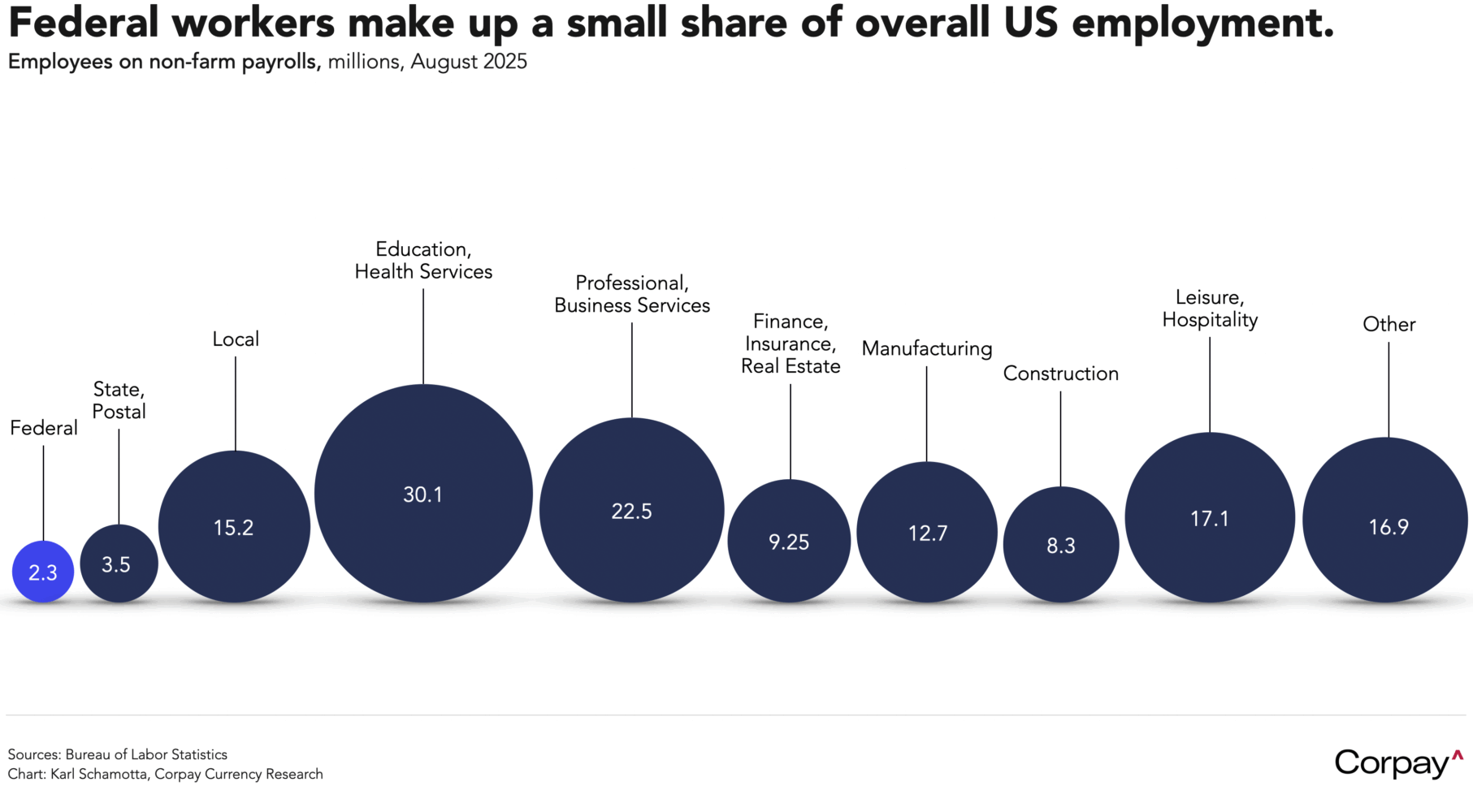

We don’t think Donald Trump’s threats to fire federal workers during the current government shutdown will provide sufficient motivation for a carry unwind. With the postal service removed, the federal government employs just 1.5 percent of the total US labour force*, meaning that further incremental workforce reductions are unlikely to make a serious dent in overall employment levels.

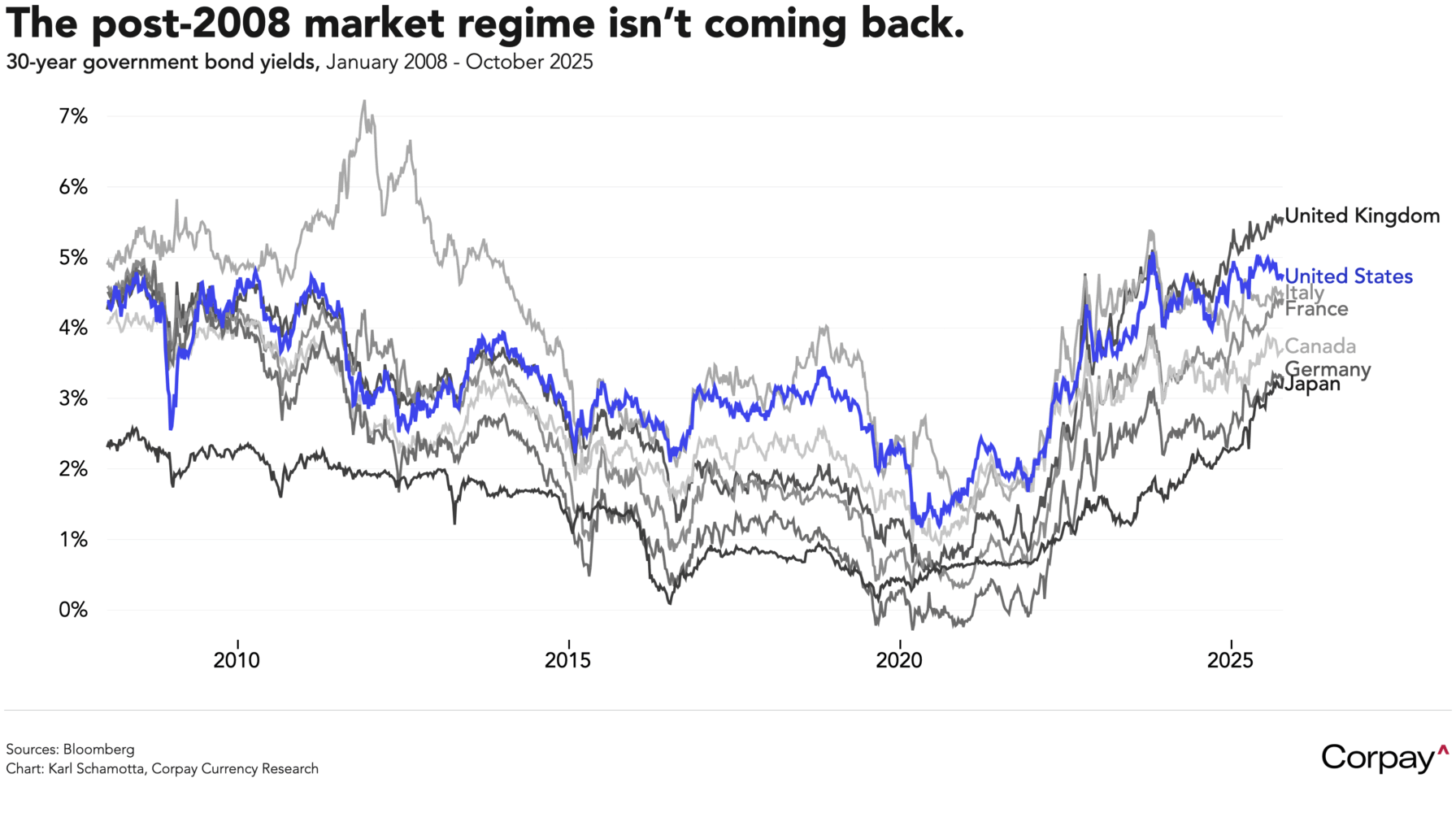

But worrisome things are happening in the broader financial system. This year’s astonishing rise in gold and silver prices, cryptocurrencies, and long-term bond yields is indicative—to us, at least—of deeper concern about the extent to which a “fiscal dominance” regime is emerging, in which central banks come under pressure to stabilise government finances by keeping interest rates artificially low and allowing inflation to run hotter. We’re not quite back to the early nineties—when semi-mythical bands of “bond vigilantes” roamed global markets punishing countries for fiscal incontinence—but investors, traders, and hedgers should be wary of non-linear risks that could unfold if the current state of calm is broken.

*Contrary to popular perception, excepting temporary spikes during the global financial crisis and the pandemic, the federal government’s share of overall employment has held steady for decades.