• US Fed. Another rate cut was delivered but the US Fed signaled a shallower easing path ahead. US yields rose & the USD strengthened.

• AUD & NZD. The stronger USD has seen the AUD & NZD tumble to levels last traded in Q4 2022. AUD also lost ground on most major crosses.

• Overdone? A firmer USD is expected over H1 2025. But the extent of the post-US Fed reaction looks a little excessive, in our opinion.

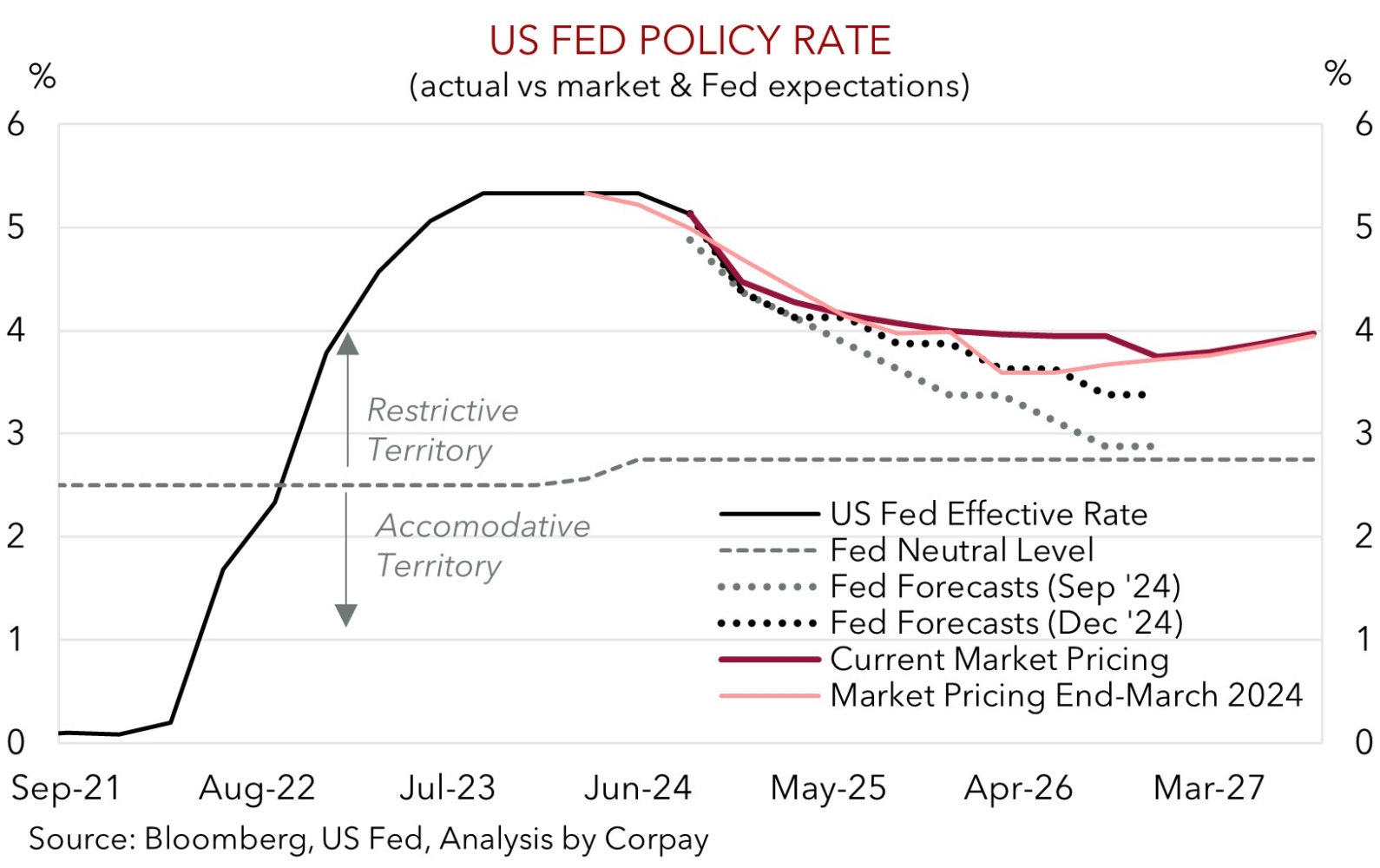

The US Fed was in the spotlight this morning, and adjustments made by policymakers have cascaded through markets. As expected, the US Fed reduced interest rates by another 25bps. This lowers the Fed funds target range to 4.25-4.50% and takes the cumulative recalibration (which only kicked off in September) to 100bps. That said, the resilience in the US economy and labour market, coupled with lingering inflation worries saw the US Fed signal a more measured and limited path forward in terms of further cuts. According to Chair Powell, the Fed can be “more cautious” as it considers future moves, with inflation trends crucial. While things still look “broadly on track”, the “higher rate projections” are consistent with “firmer inflation” with the Fed “not going to settle” for inflation holding above its 2% target. In terms of the numbers the US Fed now sees 2 rate cuts in 2025 (previously 4) and another 2 in 2026 (no change), with the equilibrium ‘neutral’ estimate also nudged up a bit further (now ~3%) in another signal a ‘shallower easing path’ is unfolding.

Interestingly, even though interest rate participants were already anticipating a ‘hawkish turn’ given the factored in interest rate path was sitting well above the US Fed’s prior ‘dot plot’, the reaction across various asset markets shows some were still caught by surprise. US bond yields extended their upswing with rates rising by ~10-13bps across the curve. At ~4.51% the US 10yr yield is tracking at the top of its ~6-month range. This has weighed on risk sentiment with US equities tumbling (S&P500 -2.9% (largest one-day drop since August), NASDAQ -3.6%) and base metal prices under pressure (copper -1.1%). In FX, the USD strengthened. EUR touched levels last traded in late-2022 (now ~$1.0356), ahead of tonight’s Bank of England meeting where no change is anticipated (11pm AEDT) GBP weakened (now ~$1.2571), and the interest rate sensitive USD/JPY tracked the rise in US yields (now ~154.62). The Bank of Japan also meets today (no set time) and although no change is the more likely outcome another rate hike can’t be ruled out. Elsewhere, USD/SGD (now ~1.3625) spiked to levels it hasn’t been at since May, NZD plunged to a fresh multi-year low (now ~$0.5659) with data this morning confirming the NZ economy re-entered a recession, while the backdrop also weighed on the AUD (now ~$0.6229, a region it last traded in in October 2022).

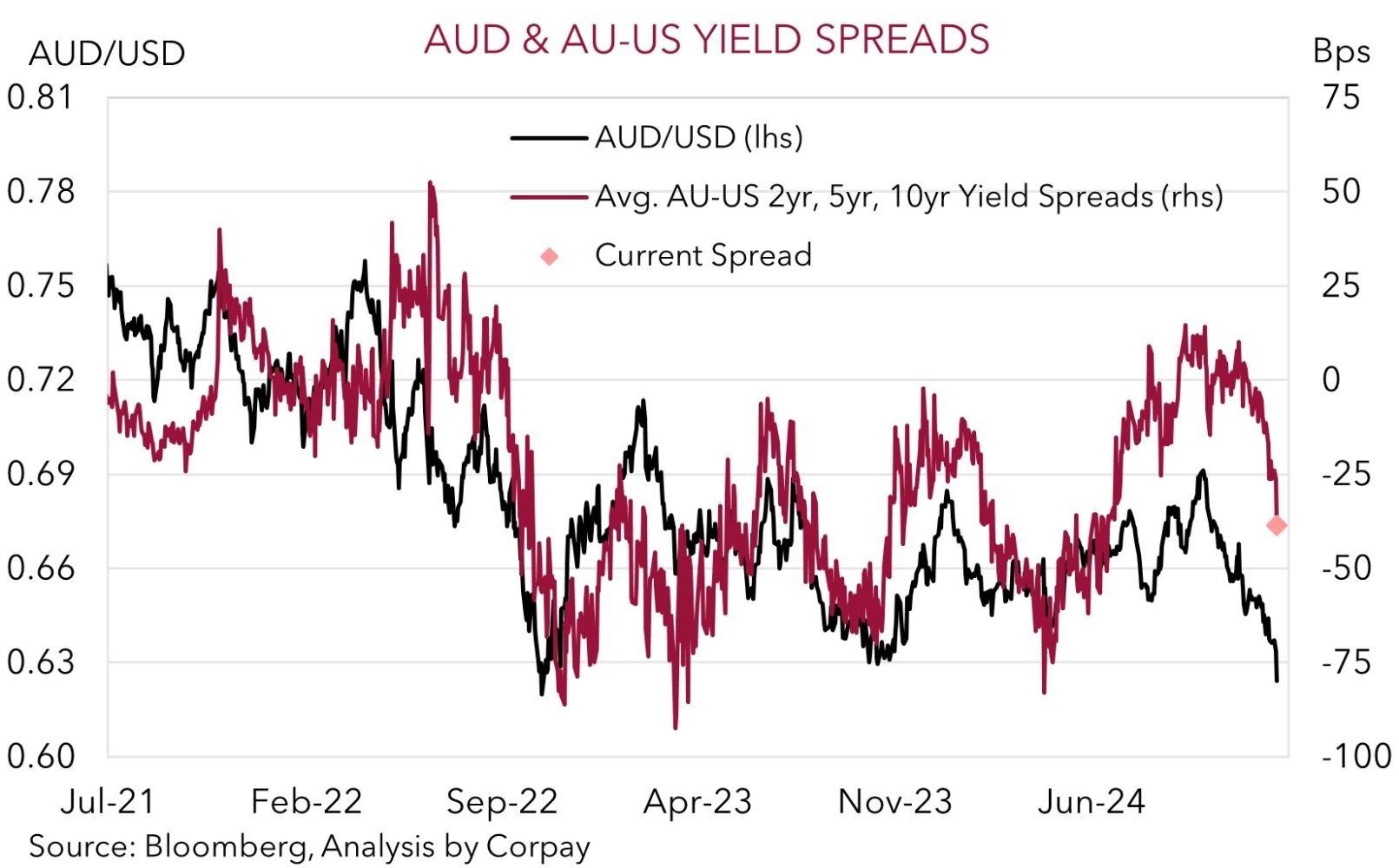

The US Fed’s updated thinking supports our broader outlook for the USD to remain firm over H1 2025, however we believe the extent of this morning’s knee-jerk response is looking a little overdone and some payback may be on the cards over the period ahead. The USD index (now at a ~2-year high) has hit ‘overbought’ levels on ‘relative strength indices’, the market was already assuming a more ‘hawkish’ US interest rate path, the US Fed’s projections are only back broadly inline with where they were in March, and yield spreads could struggle to move much more in the US’ favour.

AUD Corner

The bout of negative risk sentiment and a stronger USD stemming from the US Fed’s ‘hawkish’ rate cut and jump up in bond yields has exerted downward pressure on the AUD (see above). At ~$0.6229 the AUD is tracking down at levels it hasn’t traded at since October 2022. As a result it is over 10% from the pre-US election highs it reached in late-September. The backdrop has also seen the AUD fall back on the crosses, albeit to a lesser extent compared to the moves against the USD. AUD/EUR (now ~0.6015) is down near a 4-month low; AUD/GBP (now ~0.4955) is around levels traded in Q2 2020 with tonight’s BoE meeting (11pm AEDT) in its sights; AUD/JPY (now ~96.32) is under its ~2-year average ahead of today’s BoJ decision (no set time); and AUD/CNH (now ~4.56) tumbled to the lower end of its multi-quarter range. AUD/NZD has bucked the trend (now ~1.1057) with this mornings Q3 GDP data (which confirmed NZ re-entered recession) weighing a bit more on the NZD.

As outlined above, the US Fed’s updated more cautious guidance and shallower interest rate cutting path reinforces our firmer USD outlook for H1 2025. That said, as mentioned, we do believe the extent of the positive USD reaction, and AUD weakness, in response to the US Fed’s tinkering is looking somewhat ‘overdone’, particularly the AUD’s relative underperformance on a few of the crosses.

On balance, while we don’t expect the AUD to snap back aggressively over the period ahead (we are forecasting it to oscillate around ~$0.64-0.65 in Q1), we do believe there are asymmetric risks brewing given the low levels it is now hovering at (i.e. we see more chance of the AUD rising than falling much further). This is because: (a) the sharp drop in AUD/USD has seen it touch ‘oversold’ levels on technical momentum indicators such as relative strength indices (something which last happened in early-August); (b) a decent amount of ‘negativity’ is baked in with the AUD trading at a ~3-4 cent discount to our ‘fair value’ models; (c) as our chart below shows the AUD has overshot and diverged from various underlying drivers such as bond yield spreads; (d) statistically, the AUD is in ‘rarefied air’. Since 2015 the AUD has only been below where it is sitting less than 1% of the time, and the bulk of this very small pool of instances was during bouts of acute market stress such as the start of COVID. Australia’s elevated terms of trade and change in its capital flow trends, which generated the structural shift in the AUD’s distribution, are still in place; and (e) diverging policy trends between the measured RBA and other more aggressive central banks remain, and we expect this to be AUD supportive versus EUR, CAD, CNH, and NZD over time.