De-risking activities are dominating trading activity in financial markets this morning as participants brace for what could be the most momentous fortnight of the year. Treasury yields are climbing once again, with the ten-year now yielding 4.25 percent, the dollar is advancing against its major peers, and trade-sensitive currencies – like the Canadian dollar and Mexican peso – are flirting with year-to-date lows.

Crude prices are down sharply after Israeli aircraft struck military targets in Iran over the weekend, avoiding any obvious harm to the country’s energy infrastructure and giving Tehran room to avoid another round of escalation. Implied volatility is falling as oil traders – who had been bracing for a potentially-disruptive retaliatory attack – move back to focusing on steadily-worsening demand and supply imbalances in physical markets, with global output seen outpacing consumption through the early part of 2025.

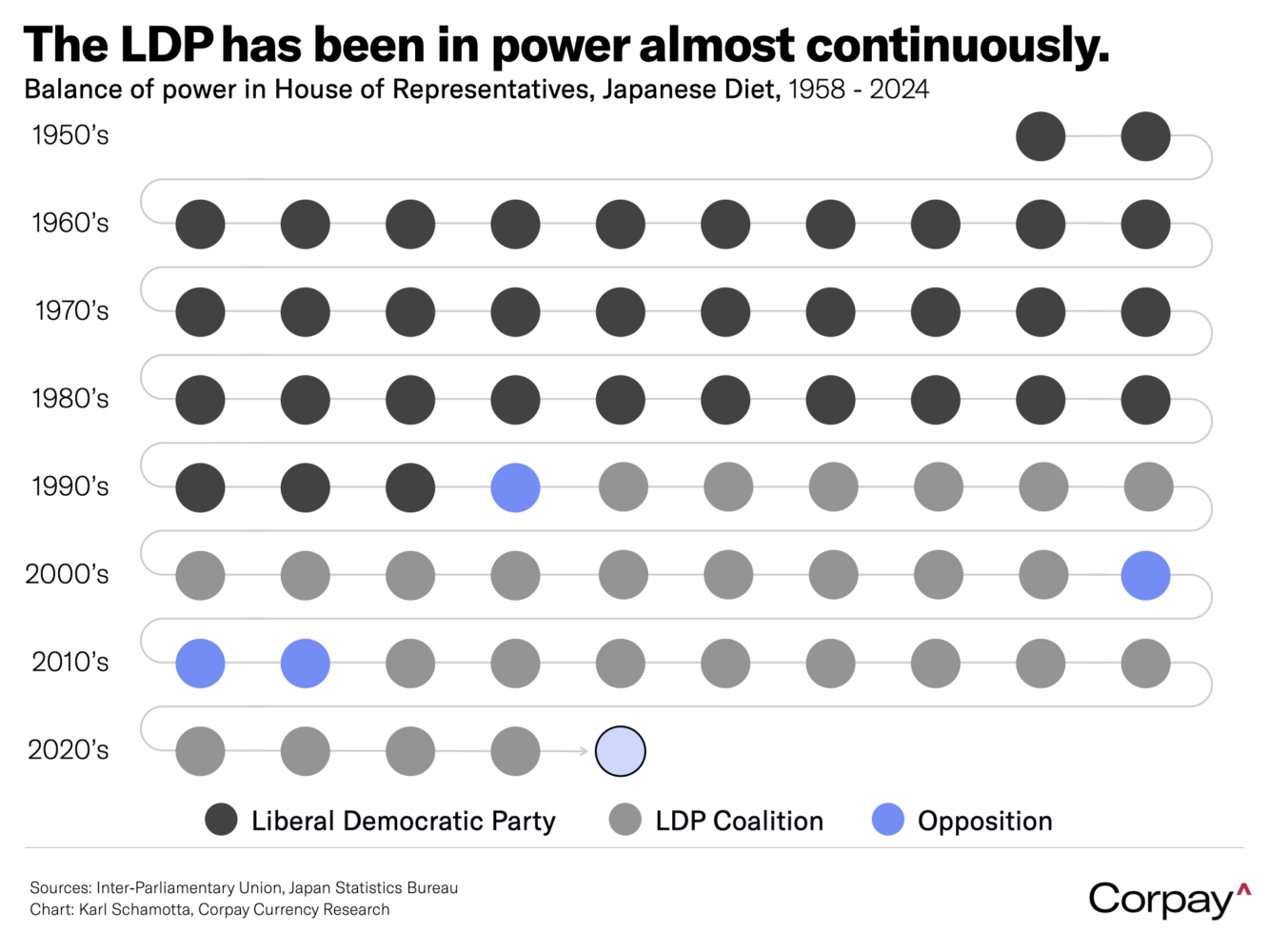

The Japanese yen is trading near its weakest levels since July after the ruling coalition failed to capture a majority in the weekend’s election, potentially complicating the central bank’s monetary tightening plans. The Liberal Democratic Party – which has ruled the country for most of its post-war history – and its coalition partner, the Komeito, received a solid rebuke from voters, taking just 215 out of a total 465 seats in the lower house of the Diet, down from 279 previously. This is well below the number needed to pass legislation without entering into power-sharing deals with other parties – many of which have starkly-different views on economic policy and are openly opposed to the Bank of Japan’s rate hikes. An environment in which the central bank is under pressure to move more cautiously could be one in which the temporarily-dormant “carry trade” in which investors borrow in low-yielding yen and invest in higher-yielding currencies – roars back to life.

The two-week calendar ahead is littered with potential volatility catalysts: US statistics agencies will publish a series of important updates on consumer confidence, economic growth, inflation, labour costs, and job creation. Five of the ‘Magnificent Seven’ tech companies will release third-quarter earnings, and the US Treasury will publish its latest refunding projections on Wednesday. UK finance minister Rachel Reeves will announce her first budget, clarifying the government’s spending and borrowing intentions. The euro area will print third quarter gross domestic product numbers and September inflation. Canada will distribute new growth and employment estimates. The Bank of Japan, Reserve Bank of Australia, Bank of England, Federal Reserve, and Banco de Mexico will all deliver rate decisions.

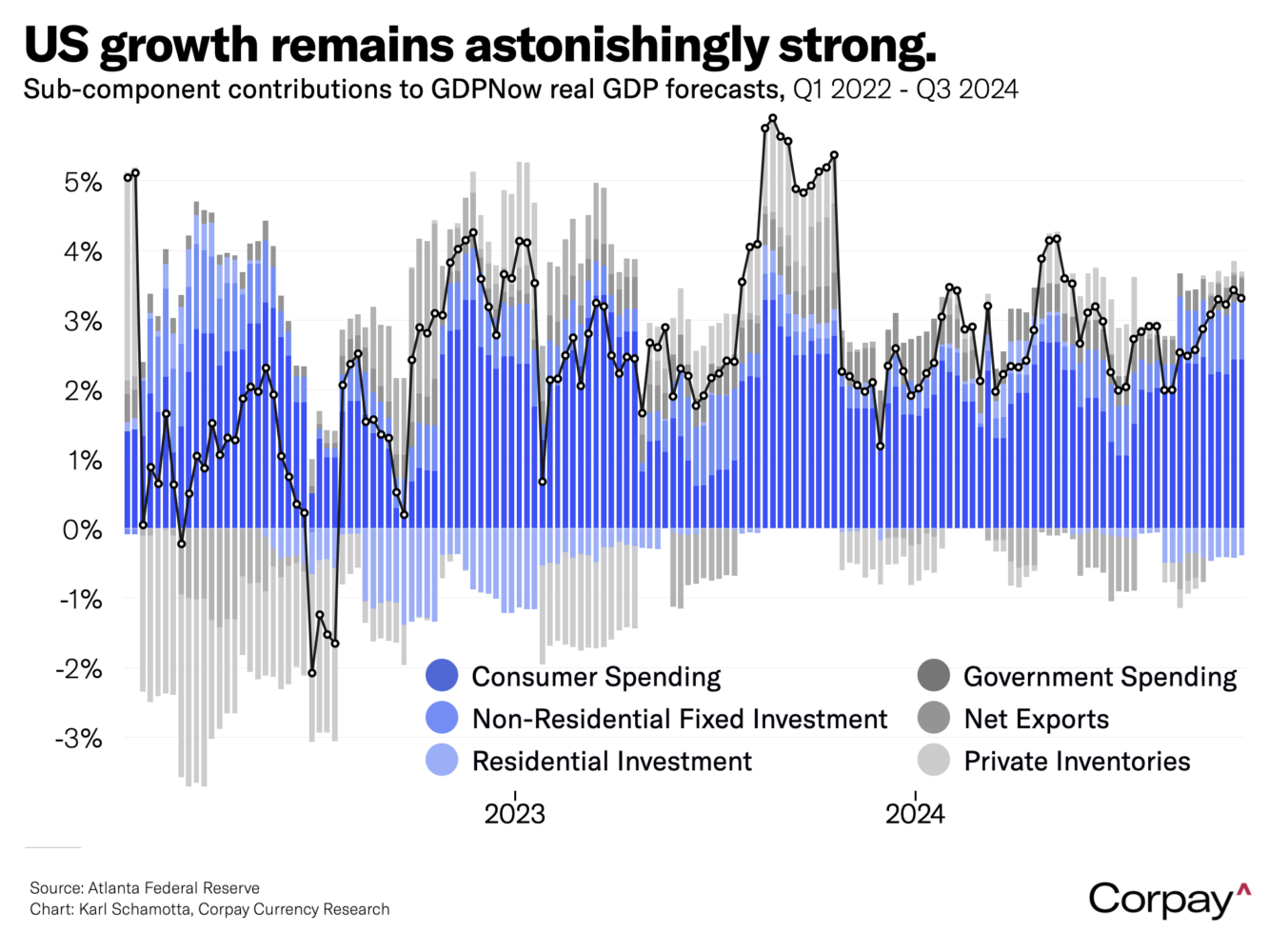

Broadly speaking, data releases are likely to confirm what markets have long suspected: that the US economy continues to outperform its global counterparts by a wide margin. This week’s US numbers will be distorted by hurricane-related effects – along with extraordinarily-high levels of uncertainty and political polarisation – but should nonetheless show underlying momentum remaining intact, with strong consumer spending translating into a virtuous circle in other areas of the economy. The Atlanta Fed’s GDPNow model is pointing to a 3.3-percent annual growth rate in the third quarter – far above comparable rates in the euro area, United Kingdom, Canada, or Japan.

Central banks will reflect this divergence, with global policymakers making increasingly-dovish noises even as the Federal Reserve starts to slow-walk its easing campaign. We think the Federal Reserve is biased toward delivering a quarter-point cut at next week’s meeting – with a larger move only coming if Friday’s non-farm payrolls report delivers a truly shocking negative surprise – and markets seem to agree, with just 24 basis points in easing now priced in for next week.

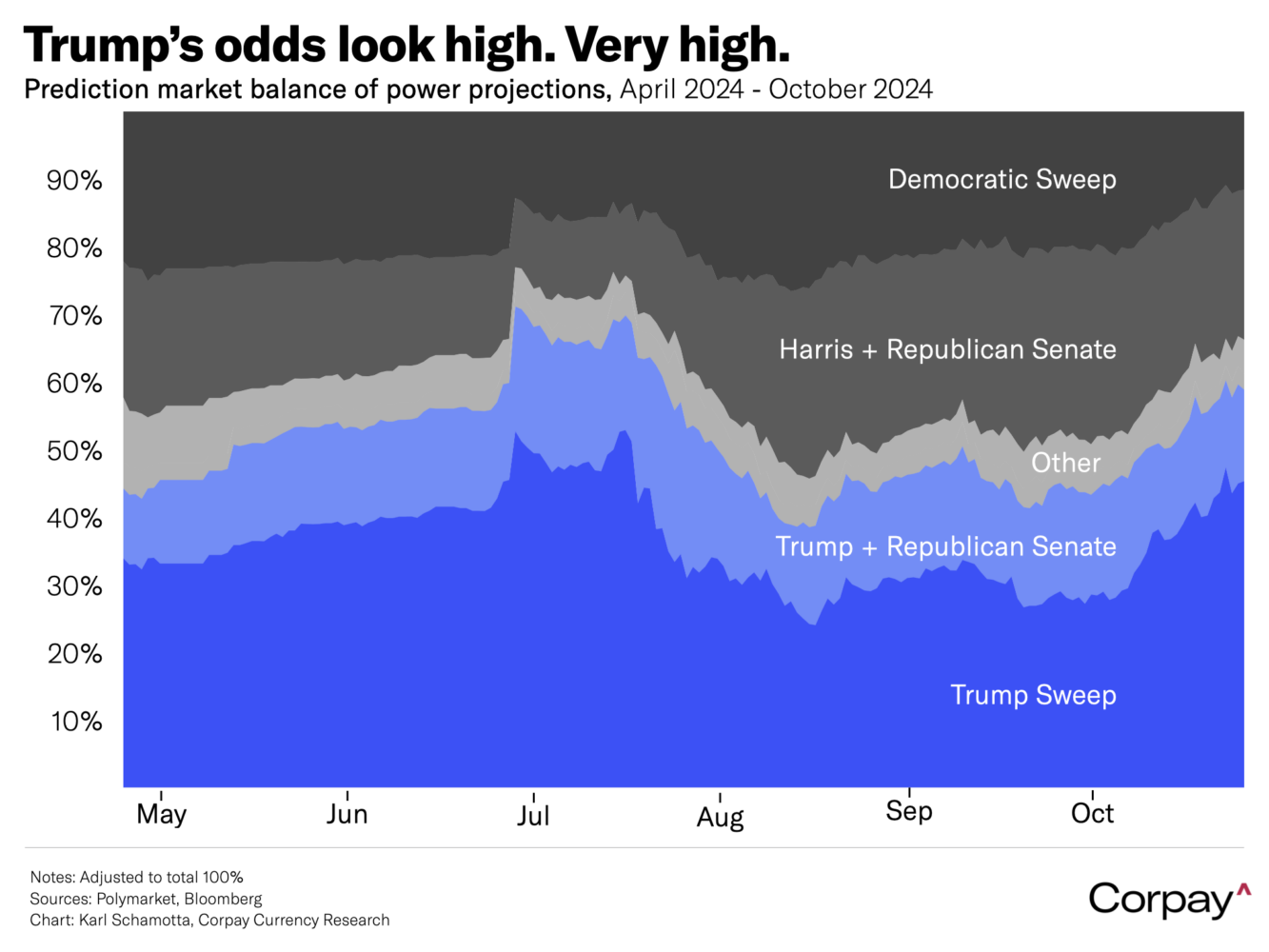

Against this backdrop, an absolutely-bonkers bit of reality television – otherwise known as the US presidential election – will keep playing, keeping traders on their toes. In the days ahead, we think markets will continue to respond to a steady rise in Donald Trump’s electoral odds, and will accordingly try to front-run a repeat of 2016’s selloff by shorting the Mexican peso and Canadian dollar. It remains impossible to disentangle the degree to which recent dollar gains have been sponsored by US economic outperformance as opposed to changes in prediction markets – and we claim no particular edge in assessing election probabilities themselves – but if investors ultimately overestimate the chances of a Trump victory or Republican sweep, a swift unwind could take place as the election results roll in.