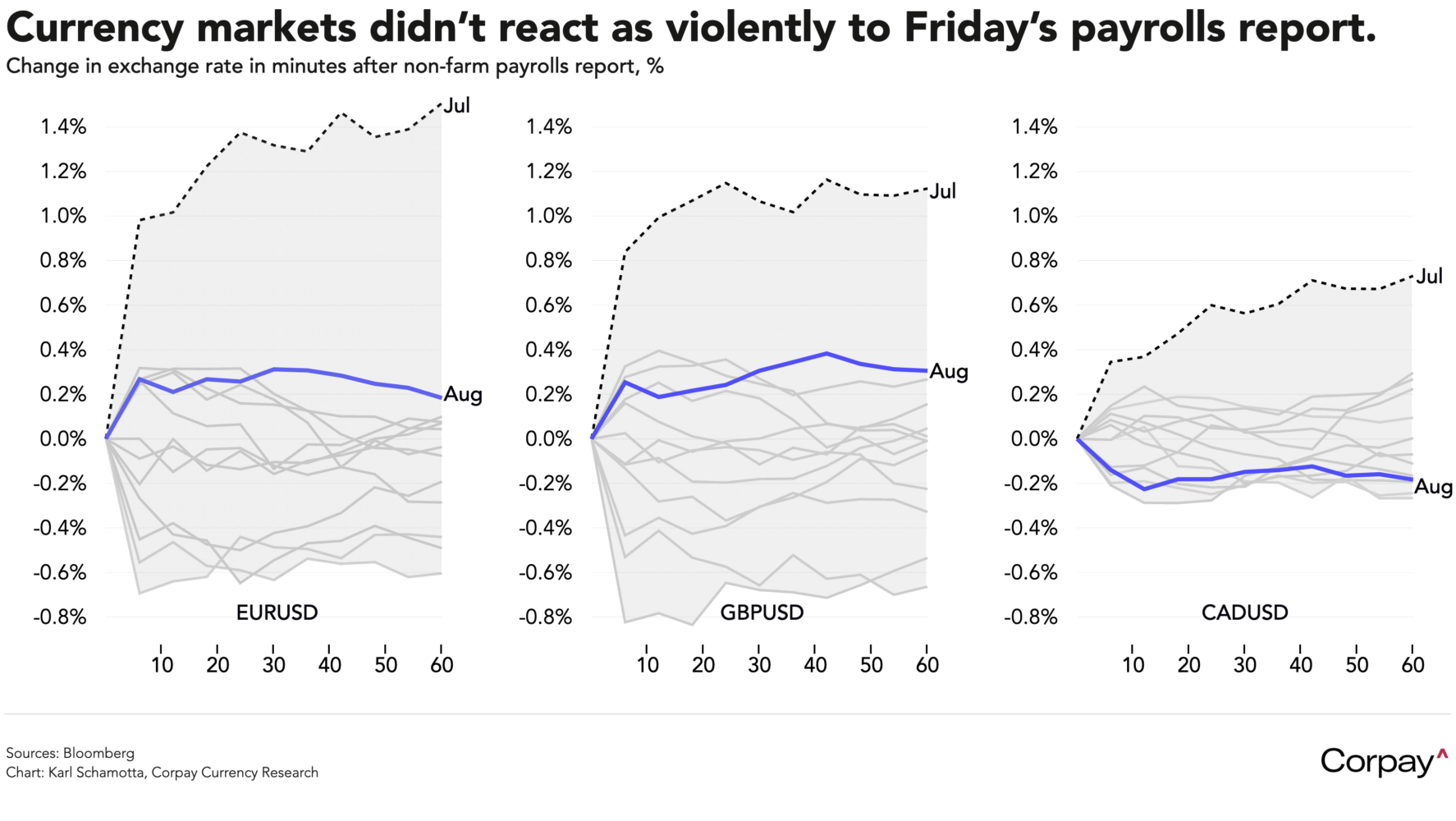

Currency markets are back in consolidation mode as investors keep an eye on international developments and await inflation data that could alter US monetary policy expectations across the front end of the curve. Ten-year Treasury yields are holding firm, equity futures are setting up for gains at the North American open, and the dollar is trading slightly lower against its major peers after a relatively-subdued reaction to Friday’s data.

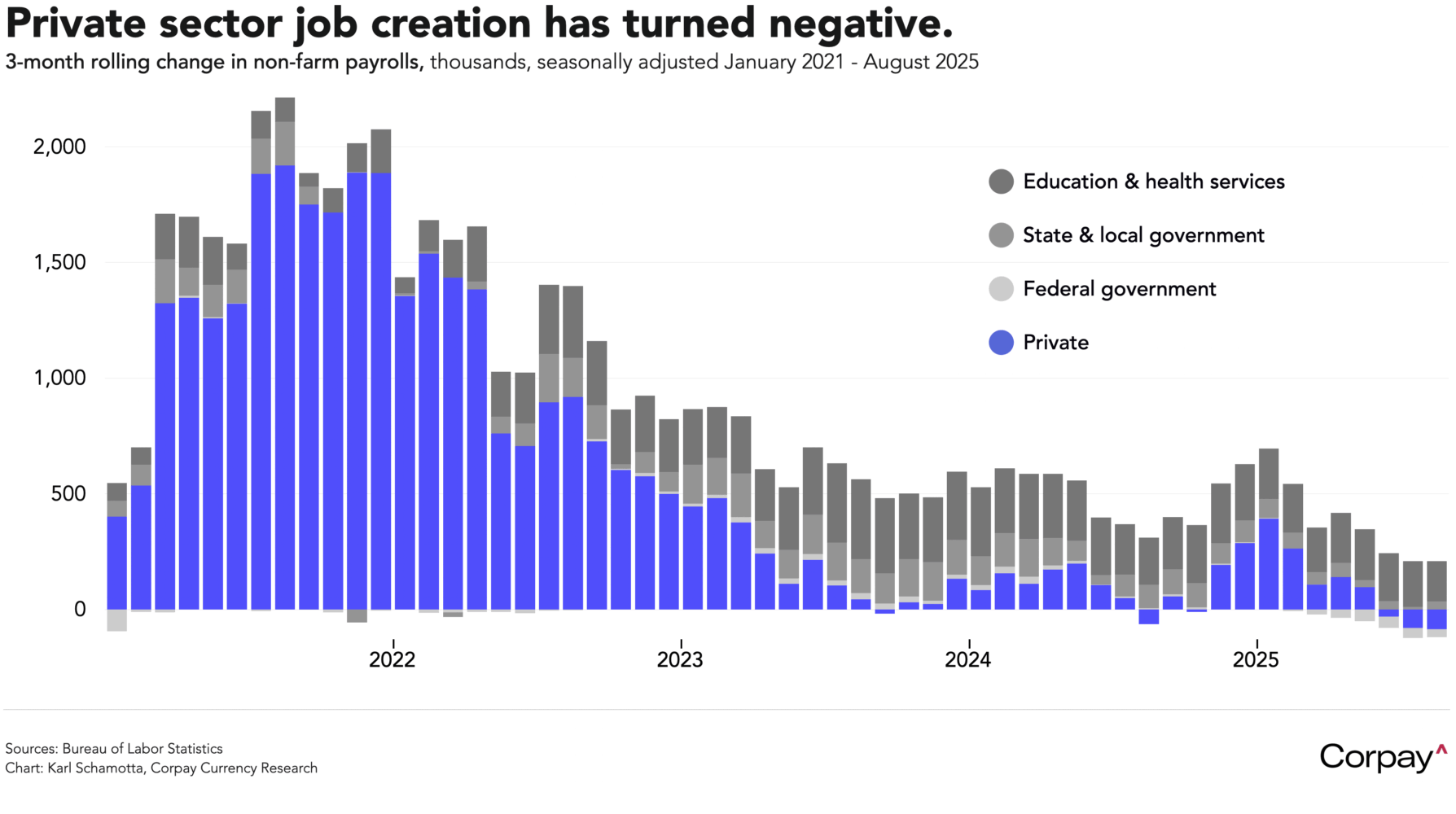

Markets are assigning better than 100-percent odds to a rate cut at next week’s Federal Reserve’s meeting after Friday’s non-farm payrolls report delivered incontrovertible evidence of a slowdown in US labour markets. Overall jobs growth stalled in August, and the unemployment rate crept up to 4.32 percent, marking its highest level since October 2021. With government and government-adjacent healthcare and education sectors removed, the economy shed 86,000 roles in the last three months.

Some are now betting on more aggressive policy easing, with a number of financial media personalities* calling for a 50 basis-point move in appearances over the weekend.

But this week’s inflation data should show price pressures remaining elevated. Wednesday’s producer price index—which measures changes in wholesale goods and services costs—is seen putting upward pressure on the Fed’s preferred gauge of underlying inflation later this month. We’ll be watching the services less trade, transportation, and warehousing measure most closely after it hit 3.1 percent on a year-over-year basis in July, rising from 2.8 percent in the prior month. Thursday’s broader consumer price index is seen climbing to 2.9 percent in the year to August, up from 2.7 percent in the prior month.

We think a 25 basis-point move remains the most plausible base case, and would warn market participants against expecting a dovish sea change in the central bank’s messaging. The drumbeat of negative news surrounding the US economy is getting louder—and a downturn has become more probable than not—but there are reasonable reasons to think that a re-acceleration in growth could take place instead. Officials at the Fed—who, despite the criticisms levelled at them, have broadly called the economy’s path correctly in the last year—are unlikely to abandon all caution in a headlong rush toward easier monetary policy.

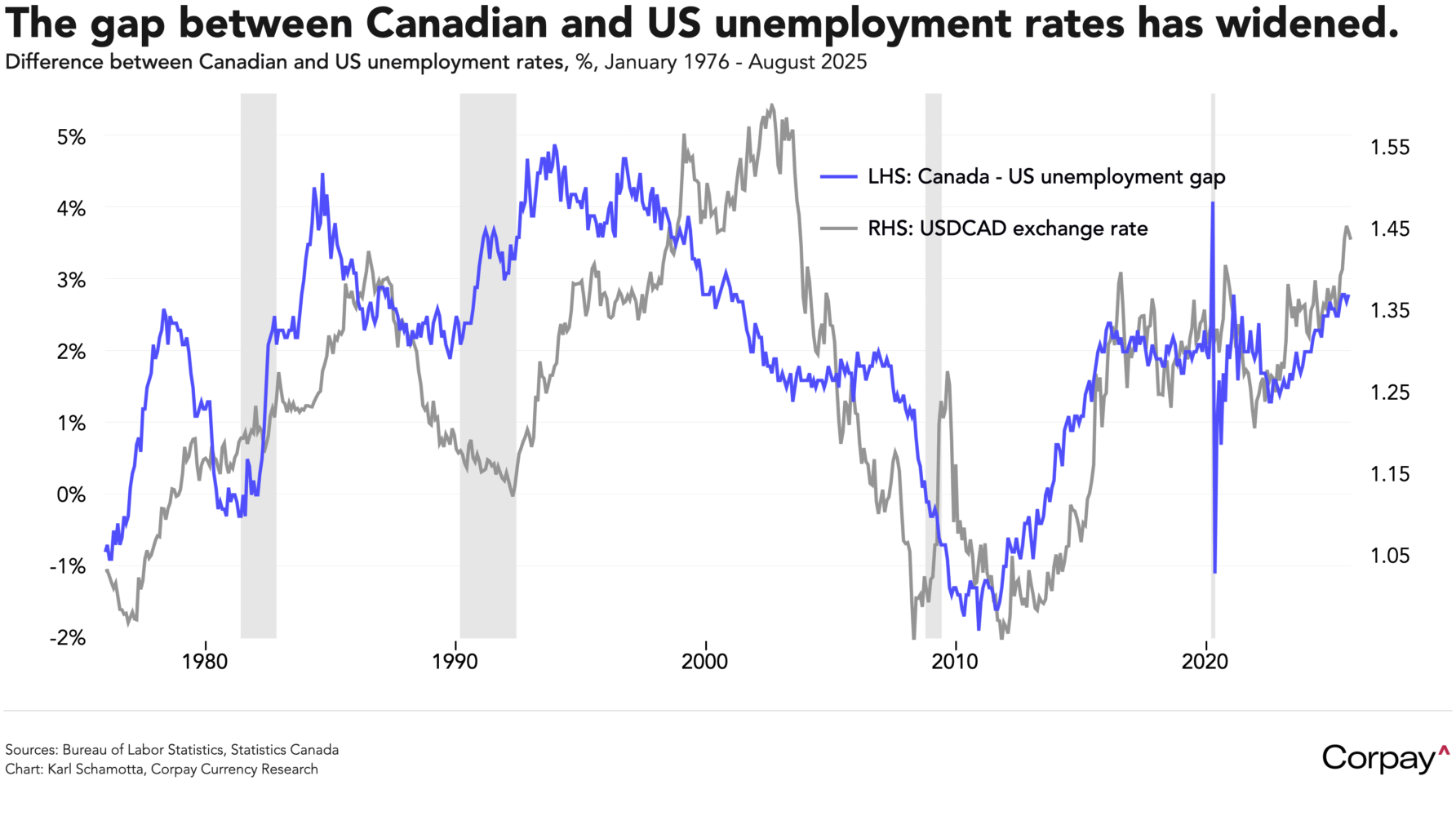

In Canada, the likelihood of a September rate cut jumped to 73 percent in line with Friday’s disappointing jobs report, and the loonie has slipped back into last place among its major-currency peers against the dollar on a year-to-date basis. The gap between Canadian and US unemployment rates, which has proven a relatively strong predictor of long-term moves in currency markets**, has widened in recent months, adding to the bear case against the loonie even as problems south of the border have contributed to the greenback’s broader decline.

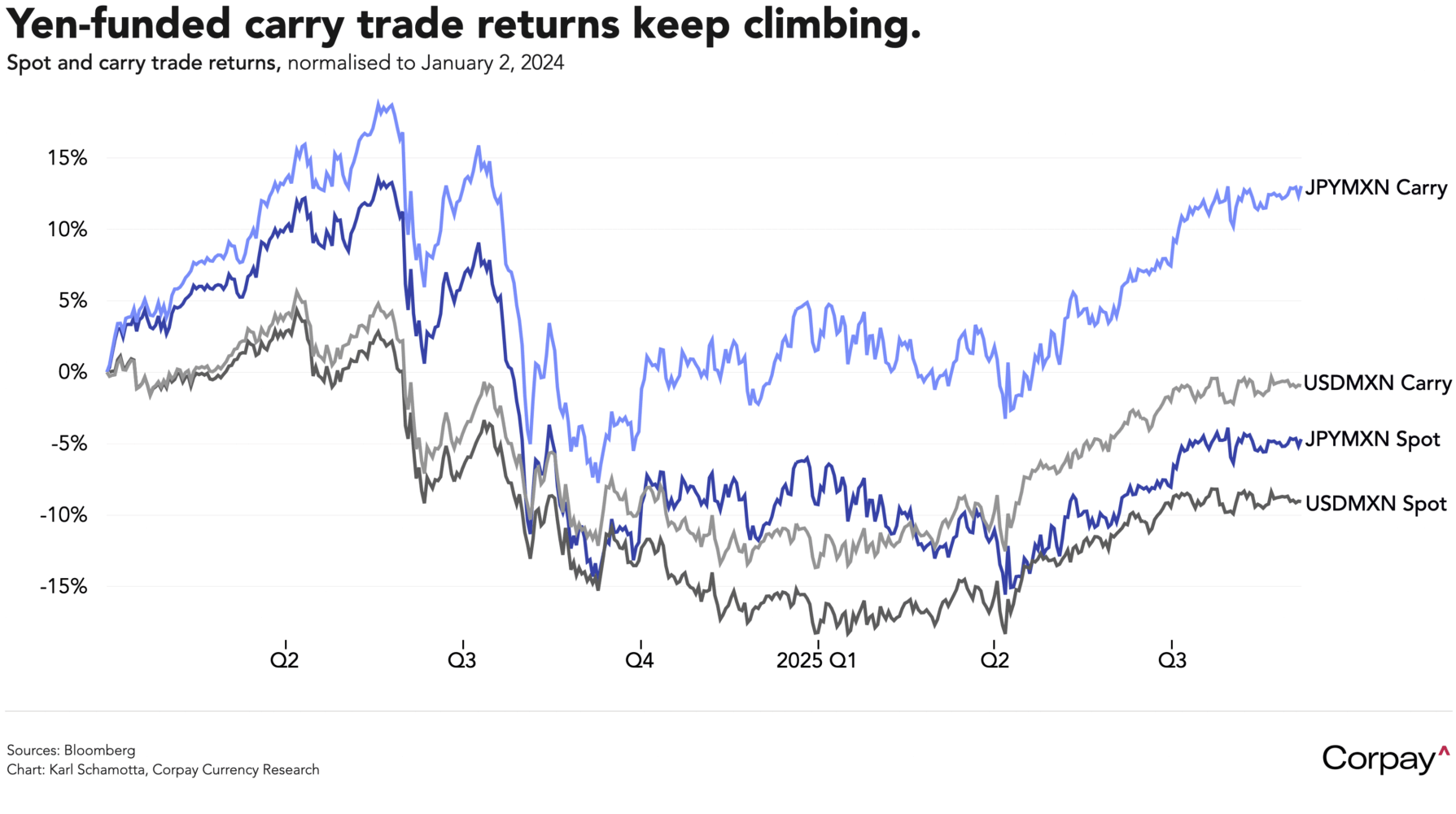

The Japanese yen is down slightly after Prime Minister Shigeru Ishiba delivered a long-awaited resignation announcement, potentially opening the field to successors who could favour a more moderate normalisation in monetary policy. During his brief time in office, Ishiba negotiated a relatively-favourable trade deal with Washington which reduced tariffs 15 percent in exchange for Japan pledging to invest more in the United States and buy more American goods, but saw his internal support fracture and led his Liberal Democratic Party to losses of control in both houses of the Diet.

Voters are increasingly frustrated with high inflation and economic stagnation, and support for more unorthodox policy platforms is gaining momentum. Within the party, the leading contenders to replace Ishiba are moderate Shinjiro Koizumi and conservative Sanae Takaichi—who has expressed dissatisfaction with the Bank of Japan’s hiking plans—but a new national election can’t be ruled out. We think this backdrop could add short-term support to the “carry trade”—in which speculators borrow in low-yielding yen and invest in higher-yielding currencies like the Mexican peso—despite the growing risk of a spike in global market volatility.

French Prime Minister François Bayrou is likely to lose today’s confidence vote over his controversial deficit-cutting measures, intensifying pressure on President Emmanuel Macron to resolve a parliamentary deadlock. Despite leading a fragile minority government, Bayrou called the vote before presenting his €44-billion 2026 budget, arguing that consensus on tackling France’s soaring debt was essential, but opposition parties—angered by his proposals to scrap two public holidays, raise taxes on pensioners, and freeze government spending—have said they are poised to remove him. A defeat could force Macron to appoint his fifth prime minister in two years or to call risky snap elections, but deep ideological rifts between parties make forming a stable government and improving the country’s fiscal position increasingly difficult.

Markets don’t see Gallic political instability as a systemic challenge to the euro project itself however, and the common currency has remained strong even as yields on French debt have pushed toward their highest levels since the euro crisis. We believe cross-Atlantic interest differentials will remain more important drivers for the exchange rate for now.

*It should be noted that many market pundits (especially newsletter writers) are incentivised to deliver hyperbolic calls. Investors with actual skin in the game are placing 10-percent odds on a jumbo-sized move.

**This is a relationship originally identified by Doug Porter at BMO.