The almighty greenback is holding near a three-month high this morning as investors scale back their exposure to technology stocks and grapple with uncertainty surrounding the Federal Reserve’s next policy move. US equity markets are set to open lower after Palantir Technologies issued a somewhat-disappointing revenue forecast, risking the near-150-percent jump in its share price this year, and intensifying concerns about stretched valuations across the tech sector. Policy-sensitive Treasury yields are easing even after several officials—including Governor Lisa Cook, San Francisco’s Mary Daly, and Chicago’s Austan Goolsbee—signaled a lack of conviction in a potential December rate cut, citing the evolving balance of risks between still-firm employment and elevated inflation.

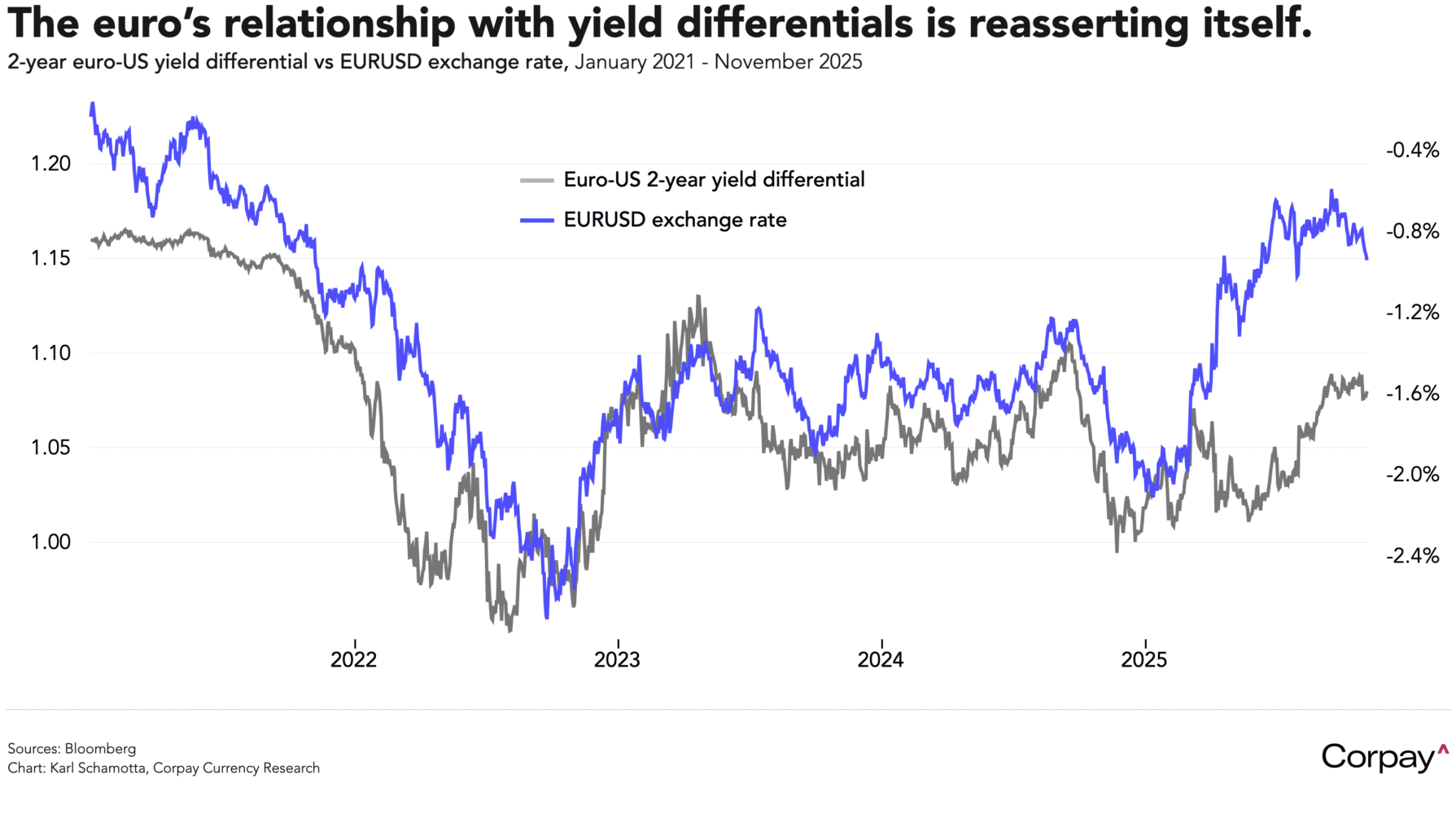

The euro is flirting with key psychological support at the 1.15 threshold as cross-Atlantic rate differentials tilt against the common currency. There have been no major domestic data releases to push market views in one direction or another, and statements from European Central Bank policymakers since last week’s meeting have been consistent with market expectations for a long period on hold, but a hawkish repricing in US yields and a reassertion of the decades-long relationship between yield differentials and the exchange rate is putting the common currency on the back foot.

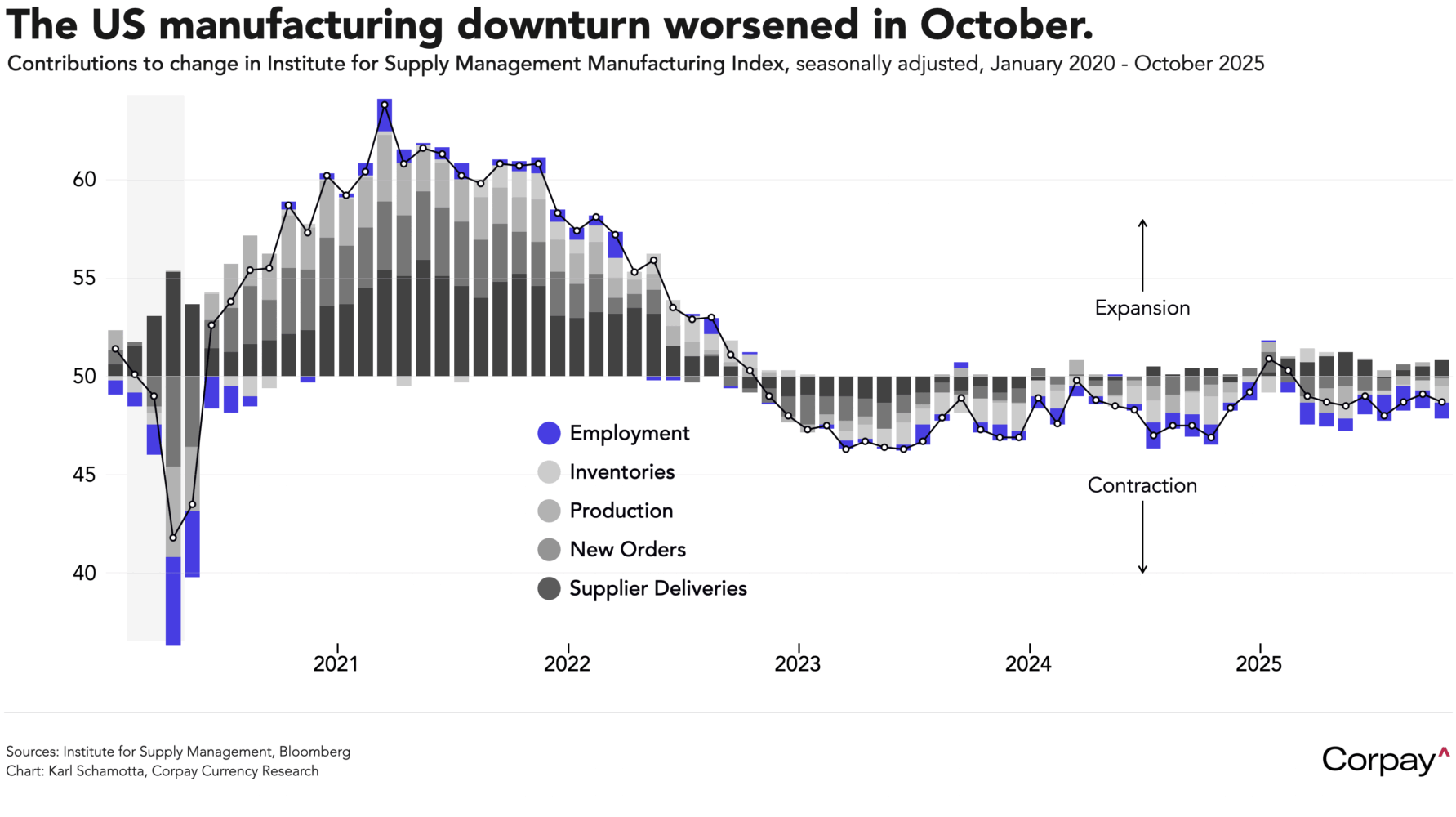

US factory activity contracted at a faster pace last month, defying expectations for a slight improvement. The Institute for Supply Management said yesterday that its purchasing managers’ index of manufacturing activity fell to 48.7 in October from 49.1 in September, remaining in contractionary territory for an eighth consecutive month. “Business continues to be severely depressed. Profits are down and extreme taxes (tariffs) are being shouldered by all companies in our space,” said one factory manager, “Steel tariffs are killing us,” another said, and “Tariffs are still causing issues with imported goods into the US,” said another.

Does this matter? For currency markets, not so much. The US manufacturing sector has been mired in a downturn for the better part of three years, and yet the broader economy has continued to outperform and financial markets have marched ever higher, attracting vast sums of international capital. The signalling value once attached to factory activity has diminished in recent decades, meaning that it doesn’t play a large role in the macroeconomic models used to generate trading signals.

Yet the ongoing weakness in the manufacturing cycle should prompt deeper scrutiny of the current rebound in US growth expectations. Upcoming private-sector data—including today’s Johnson Redbook retail sales and tomorrow’s ADP’s hiring figures—will be parsed carefully for signs of softening in other corners of the economy. We have long anticipated a stronger dollar into year-end as incoming data helped correct overwrought fears of a slowdown, but the rally could easily overshoot, creating scope for a subsequent pullback.

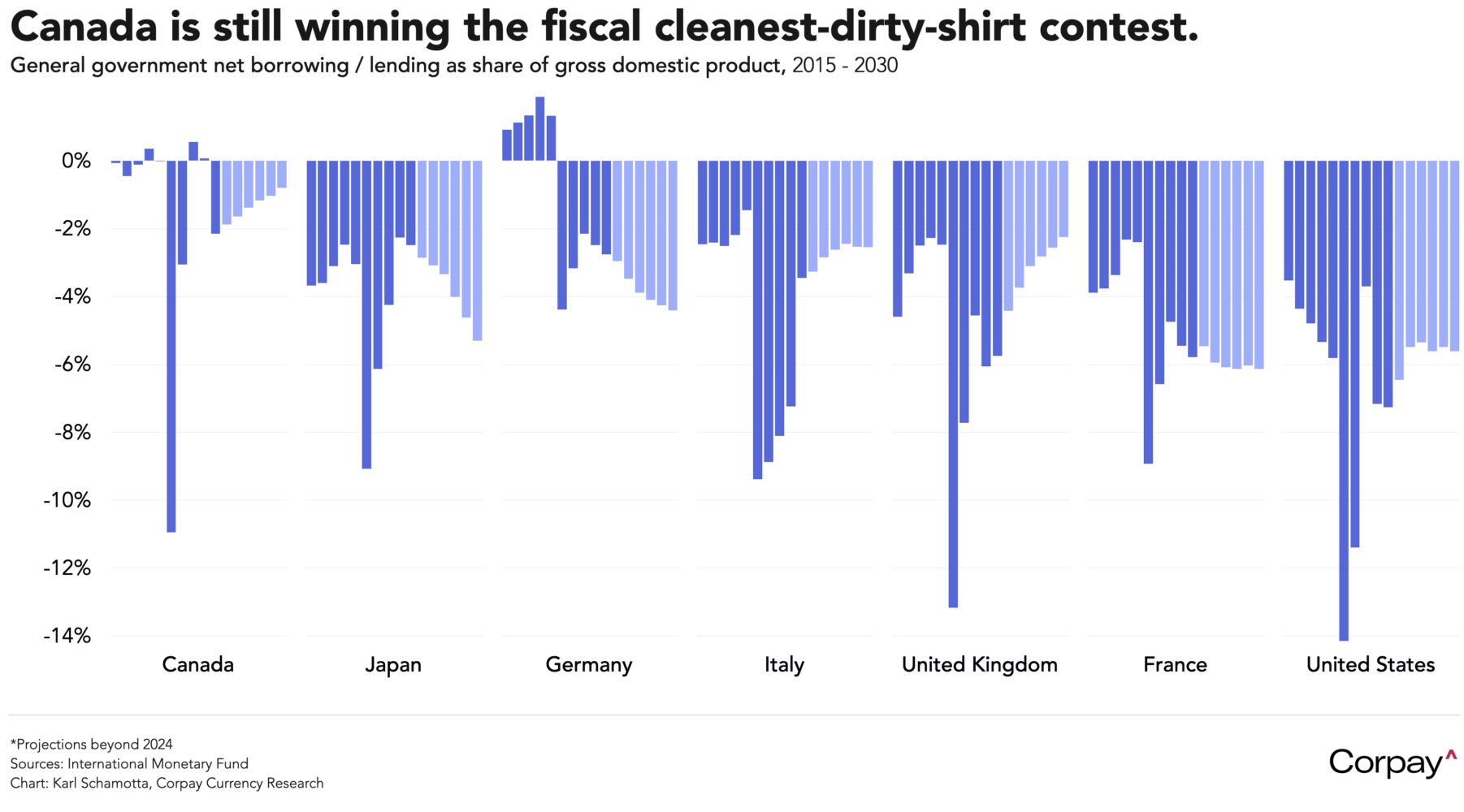

Canadian government budgets often amount to little more than attempts at economic virtue-signalling, but hedgers should keep an eye on this afternoon’s budget announcement. Finance Minister Francois-Philippe Champagne is expected to table a plan that prioritises billions of dollars in new spending on defence, infrastructure, housing, and tariff support measures even as tax and tariff revenues retreat. Military outlays are seen rising to NATO’s two percent-of-gross domestic product target by March next year, and to 5 percent by 2035, representing a near doubling from previous allocations. The number of major projects funded and fast-tracked by the government could rise, with more clarity delivered around expected timelines and performance metrics.

We don’t see this spooking debt markets. Under the government’s plans, deficits could climb to levels more consistent with national emergencies like wars, recessions, or pandemics, and the country’s general government debt-to-gross domestic product ratio is likely to worsen. Funding requirements will almost certainly expand even as global fixed income markets become less willing to absorb new sovereign issuance. But Canada remains highly-rated by debt agencies given that its current fiscal position compares favourably to its peers on a net basis, and there’s little evidence to suggest that investors are growing uncomfortable with the country’s debt trajectory.

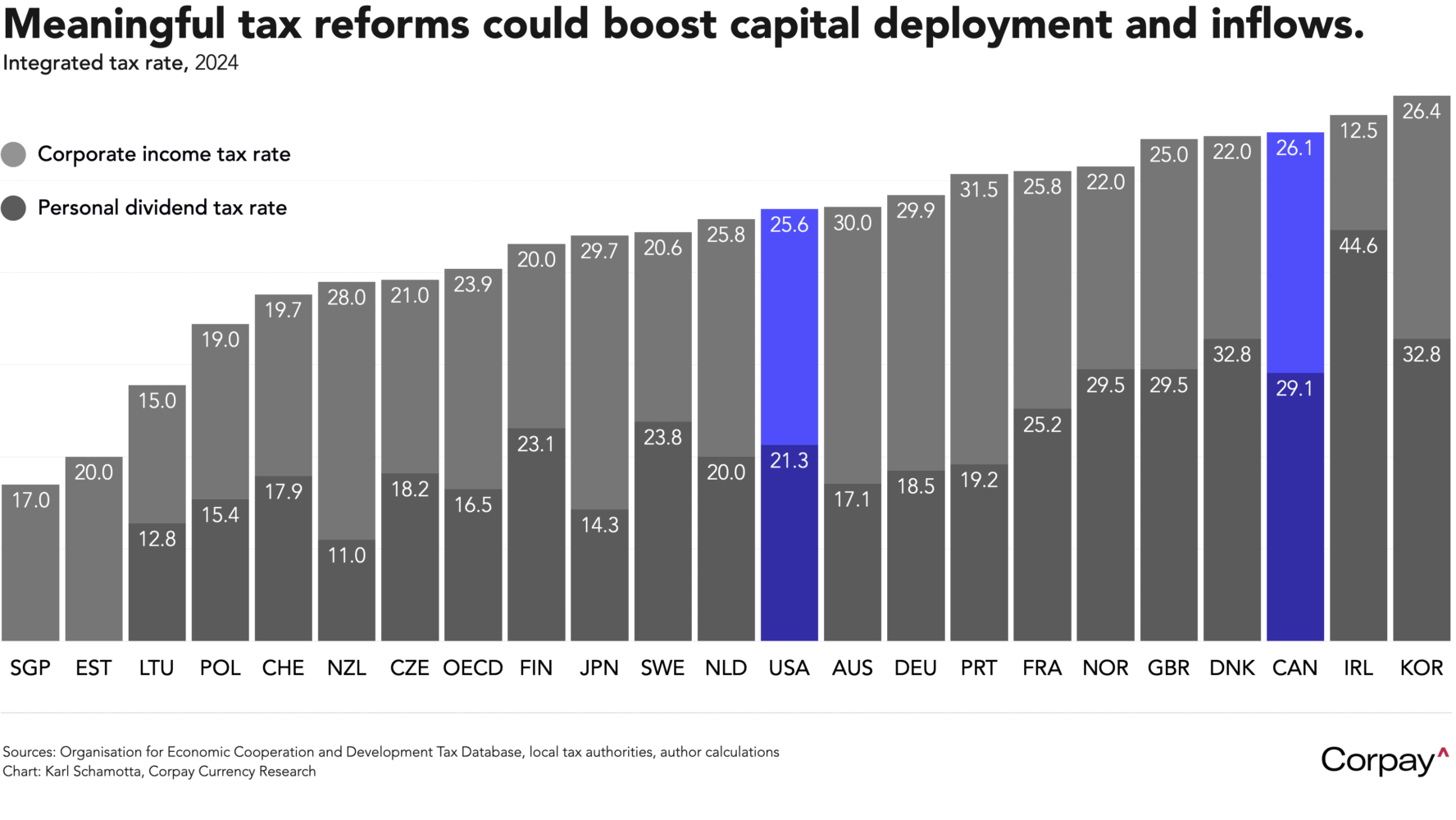

Investors could instead welcome efforts to boost Canadian competitiveness. A meaningful slowdown in public service sector hiring and measurable reductions in regulatory red tape might go a long way toward improving the country’s productivity profile. Tweaks to the immigration system and the foreign credential recognition process that increase the number of skilled workers added to the labour force would drive long-term gains. And a long-needed rationalisation in the tax code—especially the treatment of corporate investment—could make cross-border comparisons more favourable and spark renewed capital flows. If properly framed, today’s budget could help put a floor under the Canadian dollar.