• Positive vibes. Increased odds of a December US Fed rate cut boosted sentiment. US equities rose. AUD & NZD ticked higher on Friday.

• AU/NZ events. RBNZ expected to cut rates again (Weds). Most are predicting a 25bp move. First full monthly CPI inflation report out in Australia (Weds).

• Event Radar. In the US shutdown delayed retail sales & PPI data due (Tues night AEDT). Thanksgiving holidays may impact liquidity later in the week.

Global Trends

Intra-session market swings continued Friday, in line with the erratic daily gyrations that have been coming through recently. The zig-zag pattern in US equities extended with the S&P500 closing ~1% higher, though the rebound wasn’t enough to stop the index recording its second weekly fall in the past three weeks. US bond yields lost ground with rates falling ~3-4bps across the curve. In FX the USD generally drifted a bit lower. EUR consolidated near the bottom of its 4-month range (now ~$1.1516), GBP ticked up (now ~$1.3104), while USD/JPY slipped back after its strong showing (now ~156.69). Ahead of this Wednesday’s RBNZ meeting where another rate cut is expected the NZD nudged up from multi-month lows (now ~$0.5613) and the AUD rose a little (now ~$0.6458).

A catalyst for the moves and improved risk sentiment were comments by influential US Fed member Williams. In his view, given upside risks to inflation have eased, increased labour market risks, and with policy settings mildly restrictive, there is room to lower interest rates “in the near-term”. As NY Fed President Williams is typically closely aligned to the Fed leadership odds of another rate cut at the mid-December meeting have risen with markets now assigning it a ~63% chance, up from less than 30% on Thursday. The retracement in the JPY was also a factor exerting pressure on the USD. USD/JPY is the second most traded currency pair. Japanese officials have started to ramp up rhetoric about the JPY’s sizeable and rapid one-sided moves raising the prospect of FX intervention. Added to that core Japanese CPI inflation quickened to 3.1%pa. Sticky inflation coupled with higher import prices stemming from a weaker JPY suggest the door to more BoJ rate hikes remains open, in our opinion. As our chart shows, USD/JPY looks to be tracking too high compared to relative yield spreads, indicating markets may have moved too aggressively, and we believe there are more downside than upside risks around current levels.

This week government shutdown delayed US data will continue to be released with September Retail Sales and PPI inflation on the schedule (Tues night AEDT). Later on trading conditions and liquidity could be impacted by the US Thanksgiving holiday (Thurs), with US bond/equity markets also only open for a few hours on Friday. In the UK the government budget is set to be unveiled (Weds night AEDT). We think more bursts of headline/data driven volatility are likely, but on balance, we feel the USD, which has enjoyed a positive run, might moderate if the incoming US data shows slower growth momentum, lower producer price inflation, and/or widening labour market cracks.

Trans-Tasman Zone

The upbeat tone across markets generated by increased pricing for a December US Fed rate cut helped AUD and NZD tick a bit higher on Friday (see above). However at ~$0.5613 the NZD remains near the bottom of the range it has occupied since mid-April. The AUD (now ~$0.6458) is hovering just above its 1-year average with a modest uptick against the EUR (+0.3%), CAD (+0.2%) and CNH (+0.1%) more than offsetting weakness versus the JPY (-0.4%) and NZD (-0.2%). As outlined last week, we think the bout of rapid-fire JPY underperformance may have run ahead of fundamentals and there is a risk of an abrupt reversal in the JPY over the period ahead. Crosses like AUD/JPY and NZD/JPY look stretched compared to underlying drivers such as relative yield spreads, in our view.

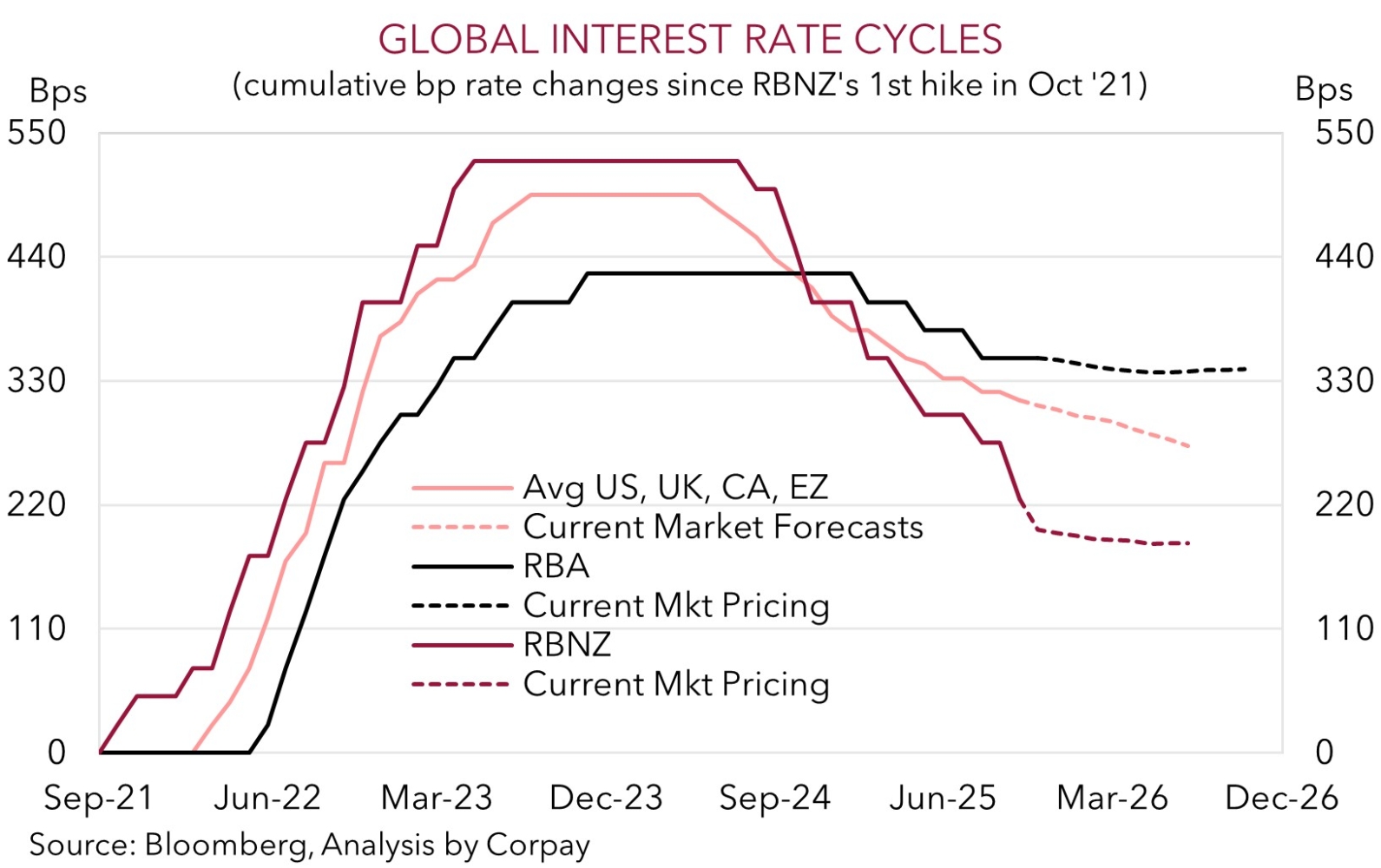

This week, in addition to the US government shutdown delayed retail sales and producer price inflation data (Tues night AEDT), the AUD and NZD will also have domestic events to navigate. Across the Tasman the RBNZ is meeting (Weds) and because of NZ’s economic struggles another rate cut is widely predicted. The question is how big will it be? The bulk of economists and interest rate markets are factoring in a 25bp reduction, though there is always a chance the cavalier RBNZ delivers another larger 50bp cut. On the assumption the RBNZ lowers the cash rate by 25bps to 2.25% we think the beleaguered NZD may edge higher over the short-term in a “sell the rumor, buy the fact” type scenario as markets start to factor in the possible end of the easing cycle.

In Australia, the first release of the full monthly CPI inflation figures is in focus (Weds). Up until now the monthly CPI series has been a partial indicator. The new full monthly series will still have teething problems and might be volatile for a while given seasonal-adjustment issues. That being said we believe the data could again show the underlying inflation pulse remains sticky with annual CPI running around the upper end of the RBA’s 2-3% target band. This type of result could, in our opinion, reinforce the view that the RBA may not cut interest rates again this cycle. Markets are only discounting ~1/2 a RBA rate reduction by mid-2026. In the near-term, we believe more bursts of data driven AUD volatility are possible. But barring a sharp sustained deterioration in risk sentiment we feel the underlying improvement in US/China trade relations, more favourable yield spreads between Australia and other nations, and/or a pickup in growth momentum in China as stimulus measures gain traction should help the AUD claw back lost ground over coming months.