• Upbeat tone. US equities, bond yields, & the USD edged up overnight. EUR eased back, as did NZD & AUD, though they remain at high levels.

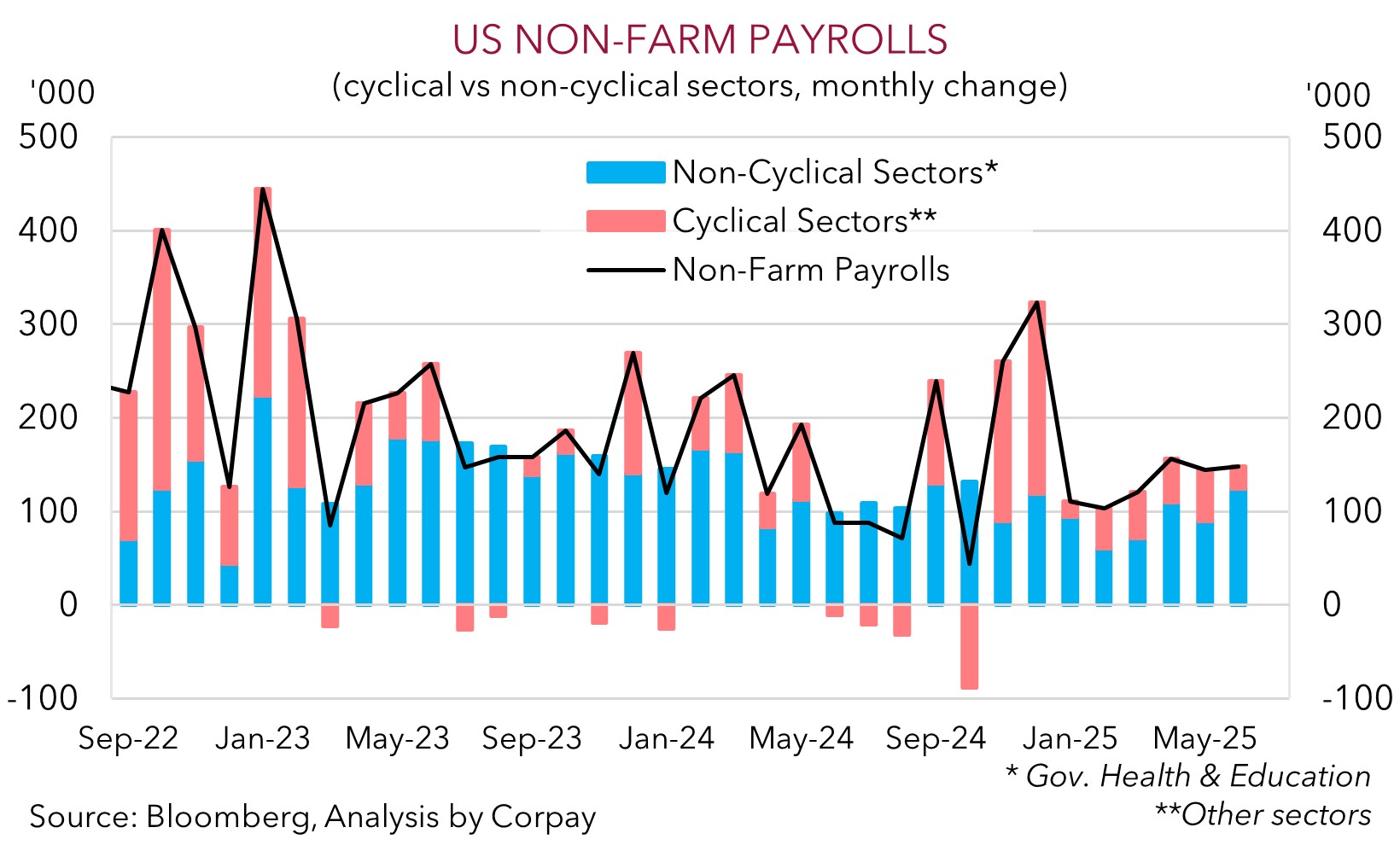

• US data. US jobs report a bit better than expected. But topline result masks some pockets of weakness under the hood. Private payrolls were soft.

• Event radar. US on holiday tonight. Next week RBA & RBNZ meet. RBA expected to cut rates. US’ ‘pause’ on higher tariffs also due to end.

Global Trends

Ahead of tonight’s US Independence Day holiday US equities extended their upswing, bond yields rose, and the USD recouped a bit of lost ground on the back of a better than predicted jobs report. The S&P500 (+0.8%) reached yet another record high with overnight moves driven by outperformance in IT and Financials. US yields increased with a ~10bp gain in the 2yr rate coming through as markets pared back some of their near-term US Fed rate cut expectations. Odds of a US Fed rate cut later this month have declined to ~5% after being up at ~25% earlier this week. This adjustment helped the USD with EUR easing from its cyclical peak (now ~$1.1787). The interest rate sensitive USD/JPY rose (now ~144.90), and a little heat has come out of the NZD (now ~$0.6069) and AUD (now ~$0.6570).

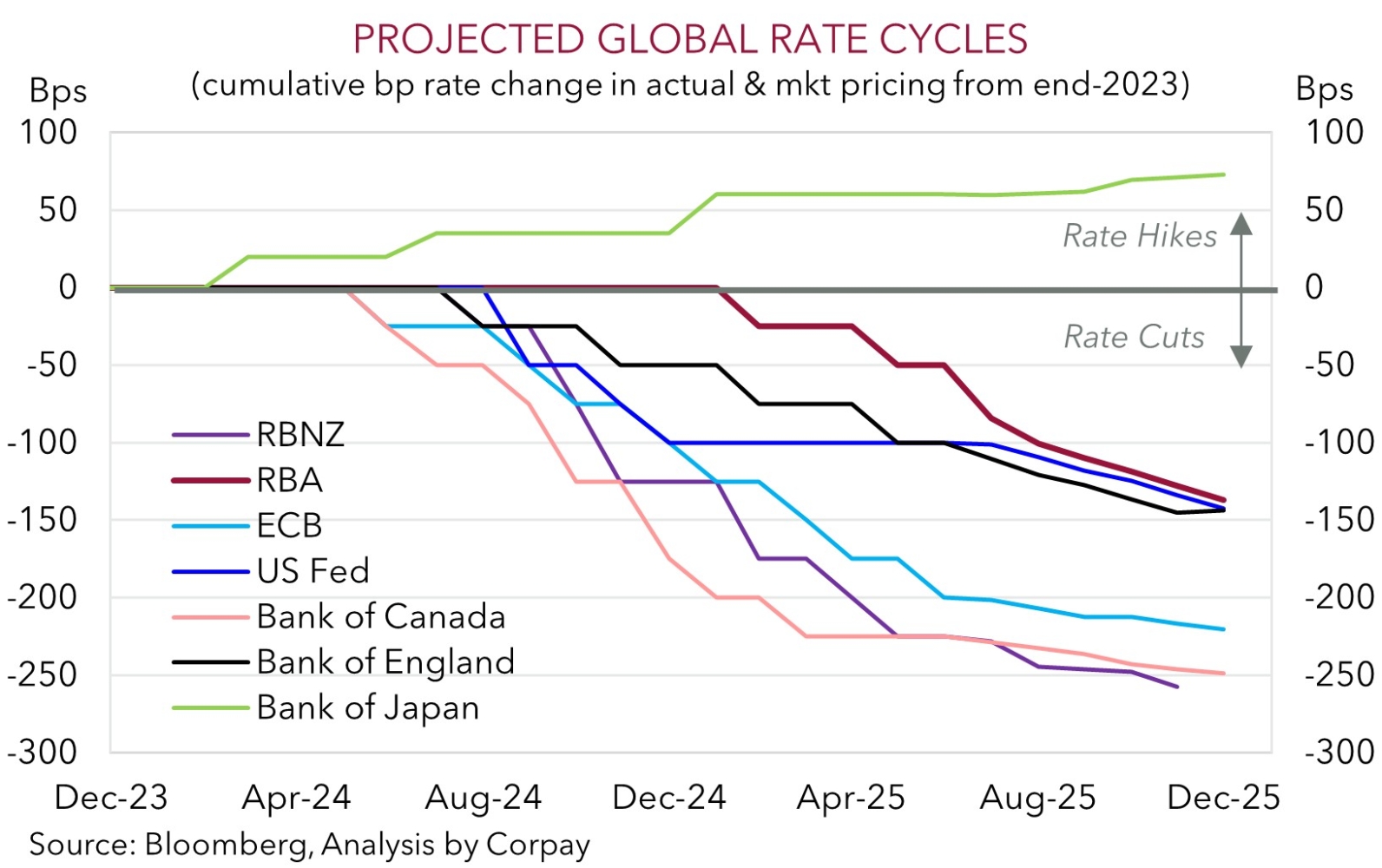

In terms of the US data non-farm payrolls increased by 147,000 in June, above consensus forecasts looking for a 106,000 gain, and the unemployment rate dipped to 4.1%. The topline figures look positive, however a closer look under the hood takes the gloss off the result. Another drop in labor force participation was a factor behind the lower unemployment rate, and as our chart shows, payrolls were propped up by non-cyclical sectors like education which is likely to unwind next month. Moreover, private sector payrolls were soft, a reflection of the uncertainty US businesses are facing and slower momentum across the economy. A step down in hiring intentions in the US ISM services survey further highlights the underlying risks to private jobs going forward, in our view. So while we think the US Fed should hold fire in late-July, the pressure to provide support to offset the underlying labour market headwinds may lift as H2 2025 rolls on. In other news, the US House passed the ‘big beautiful tax bill’. This happened after the US market closed, but as it was expected, the reaction should be muted.

With US equity and bond markets shut tonight we think that barring an exogenous shock markets may be quiet. The USD might grind a touch higher because of the upward adjustment in US rate expectations. However, we think moves should be limited, and we remain of the view that over the medium-term the prospect of weaker US growth, lower interest rates, and reduced capital inflows into the US could see the USD steadily weaken.

Trans-Tasman Zone

The uptick in the USD stemming from a slightly better than anticipated US jobs report and upward adjustment in US interest rate expectations exerted a bit of downward pressure on the AUD and NZD (see above). That said, at ~$0.6570 the AUD remains close to the top of its multi-month range with the NZD (now ~$0.6069) also still hovering near the upper end of the range it has occupied since mid-October. The upbeat tone in risk sentiment, as illustrated by the gains in US equities, helped the AUD strengthen a little on a few cross-rates with gains recorded against the EUR (+0.1%), NZD (+0.1%), and JPY (+0.7%). By contrast, the AUD eased by 0.1-0.2% versus GBP, CAD, and CNH.

Looking ahead, the RBA meets on Tuesday, the RBNZ hands down its decision on Wednesday, and the ‘pause’ on the US’ hefty ‘reciprocal’ tariffs is due to end next week. The upcoming events may generate a few bursts of volatility in the AUD and NZD, in our view. Based on the run of sluggish consumer spending data and slowing inflation we believe the RBA is likely to provide more interest rate relief and deliver another 25bp rate cut, while the RBNZ looks set to pause after easing policy aggressively the past year. However, we aren’t as sure as the market is with interest rate traders toying with the prospect of an outsized 50bp reduction by the RBA (a 25bp cut is ~110% discounted). Outcomes compared to expectations matter in markets. With this in mind we believe the impact on the AUD from the RBA announcing a 25bp interest rate cut and maintaining a data-driven approach should be limited. For the NZD, given a chance of another rate reduction is priced in (there is a ~15% probability of a 25bp move) an on hold decision could generate some support.

Moreover, as discussed before, when it comes to the AUD and NZD it should be remembered that local trends typically play second fiddle to what is happening with the USD. We believe the mix of fading US economic strength because of policy uncertainty and higher import costs, outlook for US Fed rate cuts over late-2025/2026, and reduced investor demand for US financial assets should see the USD weaken over the medium-term. This should, in our judgment, help the AUD grind higher the next few quarters.