• Push-pull forces. US shutdown still in place. Geopolitics outside US generates some vol. EUR & JPY lose ground. AUD & NZD edge up a little.

• Japan politics. Shock leadership selection jolted Japanese markets. Nikkei surged & JPY weakened on prospect of fewer rate hikes & fiscal stimulus.

• RBNZ meeting. RBNZ expected to cut rates tomorrow. Debate is on the size with markets split between a 25bp & 50bp move. NZD volatility anticipated.

Global Trends

The US Government Shutdown, which kicked off at the start of October, remains firmly in place and there appears to be little movement from either side to get a deal done. The last few US shutdowns ranged from 16 to 35 days and this iteration could be at the lengthier end of the spectrum. The large pool of US Federal employees that have been ‘furloughed’ should mechanically depress economic activity over the near-term and the situation will also play havoc with the US economic data flow as the closure of government agencies means the collection and publication of official statistics is put on ice until things reopen.

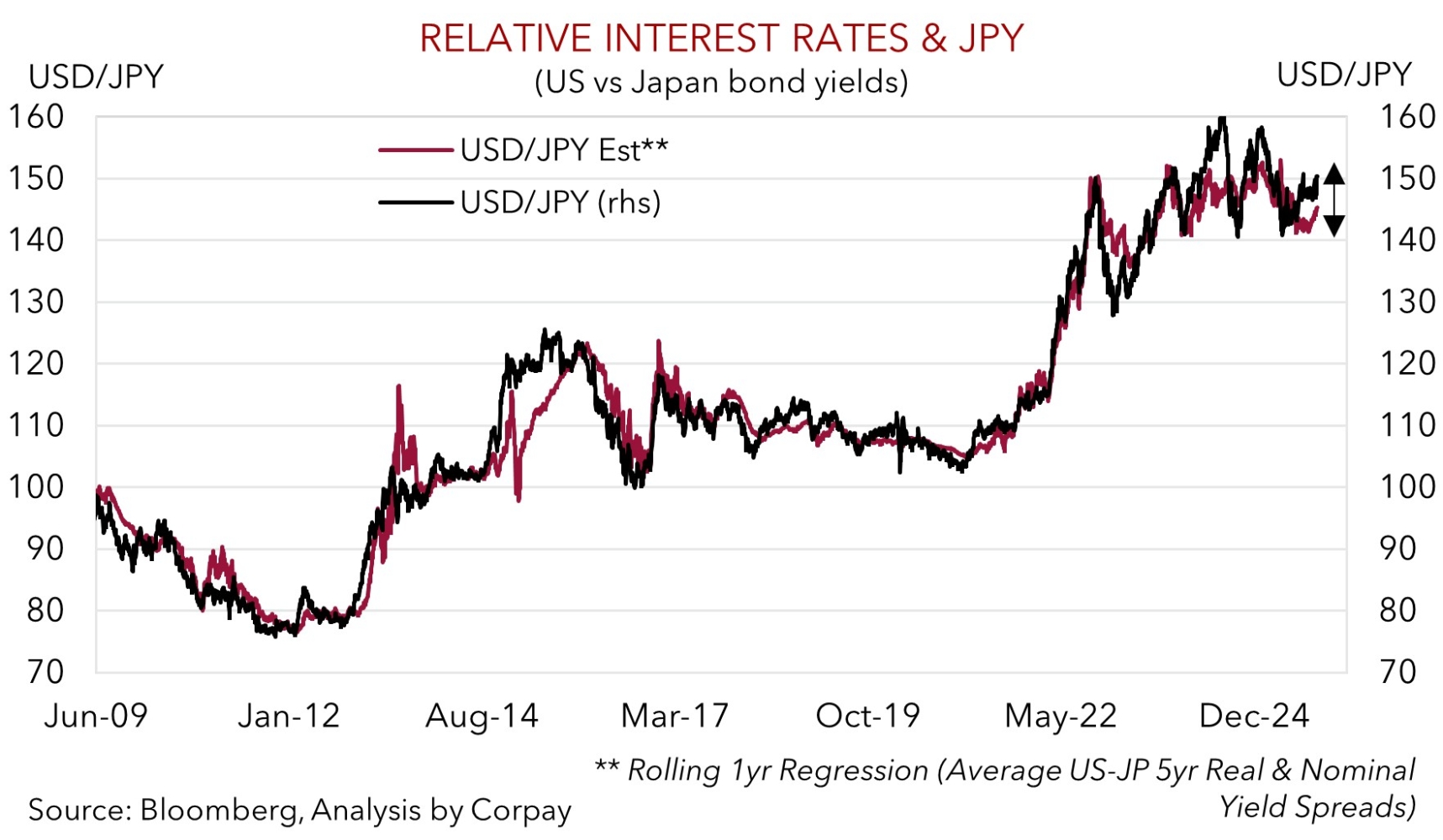

Nevertheless, US markets continue to take things in stride with the S&P500 (+0.4%) ticking up towards record highs overnight. US bond yields also nudged up ~1-3bps across the curve and the USD index has risen at the start of the new week. Although the firmer USD largely reflects developments outside of the US such as the unexpected resignation of fairly new French PM Lecornu which exerted a bit of downward pressure on the EUR (now ~$1.1710) and slump in the JPY after the shock weekend selection of Sanae Takaichi as new LDP leader (and in turn the first female Prime Minister). The move jolted Japanese financial assets yesterday with the Nikkei surging almost 5% to a record high, at the same time as the yield curve steepened due to Takaishi’s support of monetary and fiscal stimulus. Markets are now only factoring in a ~25% chance of a late-October BoJ rate hike with another move only fully discounted by next March. USD/JPY (and crosses like AUD/JPY) jumped up sharply with the former (now ~150.32) near the top of its multi-month range.

We judge the JPY may have moved too far too quickly with the knee-jerk reaction during yesterday’s early Asian trade (which typically has lower liquidity) amplifying the FX swings. Underlying inflation trends in Japan are quite different to what they were in the past and this may mean the BoJ’s hands are tied and/or the prospect of more aggressive fiscal measures being deployed aren’t as elevated as some participants think. Indeed, as shown in the chart below, our interest rate based model suggests USD/JPY should be tracking closer to ~145 not ~150 even after accounting for the adjustment in relative bond yields. A drift lower in USD/JPY towards levels implied by fundamentals could flow through to the USD given it is the second most traded currency pair. This would align with our broader view that the challenging growth backdrop in the US and outlook for more US Fed interest rate cuts over coming months should exert downward pressure on the USD over the period ahead.

Trans-Tasman Zone

The bursts of geopolitical inspired volatility in Europe and particularly Japan at the start of the week has pushed and pulled on the AUD and NZD over the past 24hrs (see above). That said, on net, both have ticked up a little with the AUD near ~$0.6620 and the NZD approaching ~$0.5840. Relative strength on the crosses has provided a helping hand with the AUD appreciating by ~0.6% versus the EUR and CNH, and rising ~0.2-0.4% against GBP, NZD, and CAD. There was a larger jump in AUD/JPY with the pair (now ~99.47) ~2.3% above where it closed last week to be at levels last traded in November 2024.

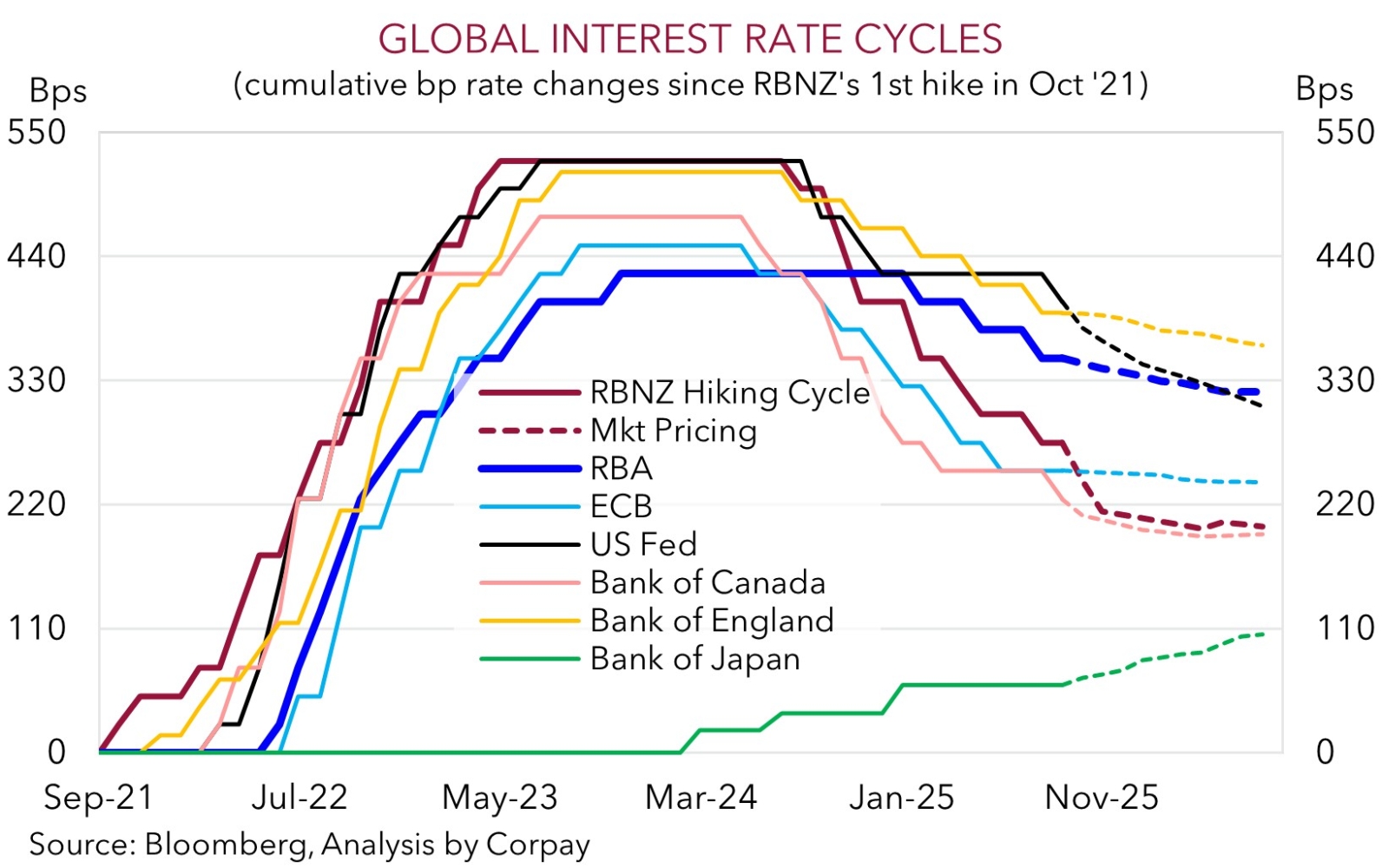

In Australia this week RBA Governor Bullock testifies to the parliamentary committee (Friday). We would expect the Governor to hold the recent line that policy decisions will be taken meeting by meeting. Further RBA rate cuts are far from guaranteed. From our perspective the stickiness in Australian inflation, resilient jobs market, and pick up in economic momentum suggests the odds of another RBA rate cut this year are low. The diverging policy trends between the RBA and other central banks such as the US Fed, coupled with an improvement in China’s growth pulse, should, in our opinion, support the AUD into year-end.

Across the Tasman the RBNZ meets tomorrow. Following the run of weak NZ data, especially the subpar Q2 GDP, another rate cut is anticipated. The debate is centered on whether the RBNZ delivers a 25bp reduction or a larger 50bp move. Interest rate markets and surveyed economists are evenly split. Markets are pricing in ~35bps of easing for tomorrow’s meeting. This means a bout of NZD (and AUD/NZD) volatility is probable around the event one way or another. For example if a 25bp cut is announced the NZD could rise initially (and AUD/NZD might fall back after its strong run), while a 50bp move should see the NZD weaken (and AUD/NZD lift even higher). We believe a 50bp rate cut is the more likely outcome. The NZ economy is in a rough spot and the level of interest rates is still too ‘restrictive’. Moreover, a couple of RBNZ committee members already voted for a larger reduction in August, indicating the seed has already been planted amongst policymakers.