• Consolidation. US equities drifted back a bit on Friday, but still rose over the week. USD a little softer. AUD & NZD ticked up modestly.

• Event Radar. RBNZ expected to cut rates again (Weds). Global PMIs are due (Thurs). US Fed Chair Powell speaks at Jackson Hole (Fri night AEST).

Global Trends

A subdued end to last week across markets as macro and geopolitical forces pushed and pulled on various asset classes. On net, US equities drifted back a bit from record highs on Friday (S&P500 -0.3%), though it wasn’t enough to stop the S&P500 from posting its 6th increase in the past 8 weeks. Bond yields also ticked up modestly with the benchmark US 10yr rate edging above its 1-year average. And in FX the USD index dipped a little with EUR nudging higher (now ~$1.1713) and USD/JPY losing altitude (now ~147.17), while the NZD (now ~$0.5926) and AUD (now ~$0.6512) rose slightly.

Data wise, US retail sales were better than forecast thanks in part to positive revisions to prior months which means consumption growth (the engine room of the US economy) is stronger than first thought. That said, consumers are still feeling the pinch with jump up in tariffs and labour market wobbles dampening confidence. The University of Michigan consumer sentiment gauge dropped further below average while inflation expectations increased. In China, the monthly activity data batch underwhelmed with retail sales, industrial production, and fixed asset investment growth all slowing in the year to July as hot weather and heavy rain across the country compounded tariff-related external headwinds. With respect to geopolitics the anticipated Trump-Putin summit in Alaska ended without a significant breakthrough on Ukraine.

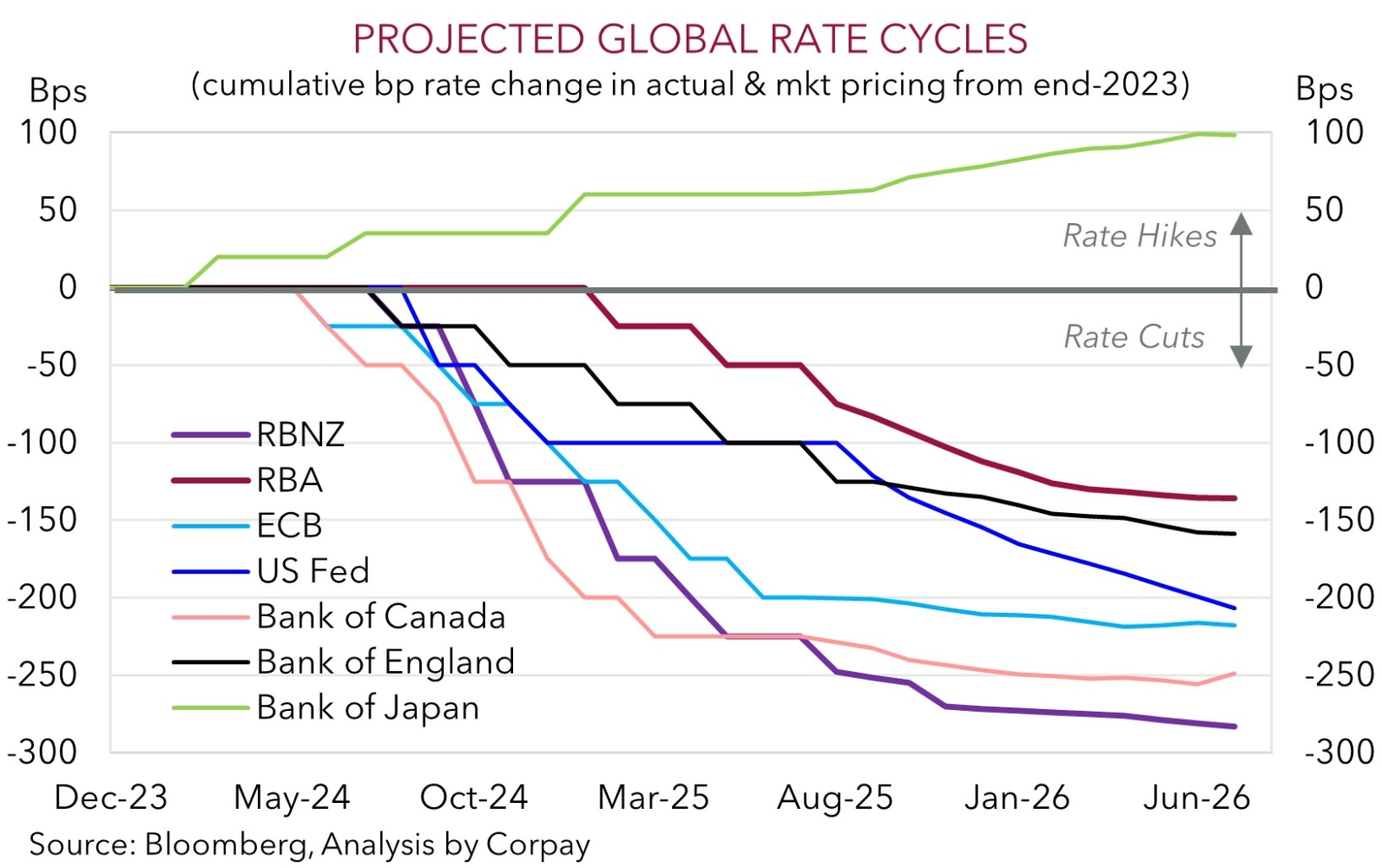

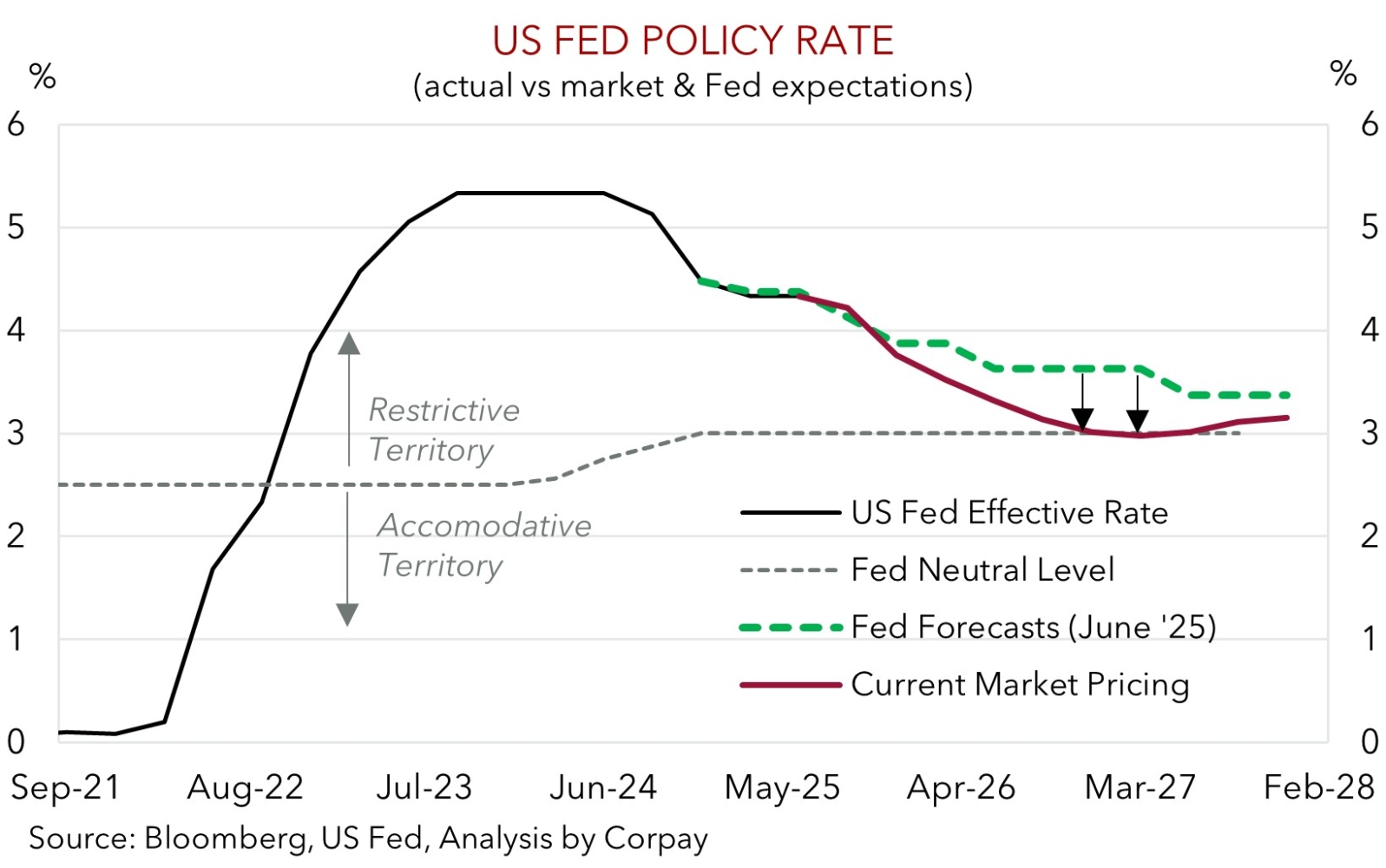

It could be a quiet start to the week with no major events/data scheduled today. Further ahead the focal points for markets will be the RBNZ meeting where another cut is anticipated (Weds), the latest batch of global business PMIs (Thursday), and Fed Chair Powell’s speech at the annual Jackson Hole Symposium (Fri night AEST). We think Chair Powell could signal some policy easing is likely over the back end of this year, as per the baseline forecasts of the committee, however we doubt he will explicitly call out a rate cut in September particularly as there is another round of monthly economic data (including CPI and a jobs report) due ahead of the next Fed meeting. What’s priced in matters and given the ‘dovish’ skew in market pricing (see our chart below) we believe a more ‘cautious’ tone/approach from Chair Powell, coupled with relative resilience in the US PMIs, may see markets pare back their aggressive looking near-term Fed rate cut expectations. If realised, we feel this might give the USD some support.

Trans-Tasman Zone

The AUD (now ~$0.6512) and NZD (now ~$0.5926) ticked up a bit at the end of last week with the slightly softer USD more than offsetting the slowdown in growth momentum in China (see above). That said, it wasn’t all one way with the macro and geopolitical cross-currents resulting in a mixed performance for the AUD on the crosses. On the one hand the AUD slipped back by ~0.2-0.3% versus the EUR and JPY, while on the other hand the AUD edged up ~0.1-0.3% against the NZD, CAD, and CNH.

This week it is quiet in Australia with no market moving data releases on the schedule. Across the Tasman, the RBNZ meeting is in focus (Weds). Another 25bp RBNZ cut is universally expected which would lower the policy rate to 3%. The key outstanding question is how much further might rates go in NZ after that? We think there is a risk the RBNZ’s updated assessment concludes that more easing is necessary, and that the new interest rate projections show a chance of at least one further rate cut coming through. In our opinion, this type of messaging could exert some downward pressure on the NZD and give AUD/NZD (which is at the upper end of its multi-month range) additional support.

In terms of AUD/USD, as mentioned above, the key focus for global markets this week will be US Fed Chair Powell’s Jackson Hole speech (Fri night AEST). We believe that based on where US Fed rate pricing now is Chair Powell might have a hard time being more ‘dovish’ than what is baked in. Outcomes compared to expectations drive financial markets. Hence, in our view, a paring back of US rate cut pricing may flow through to a firmer USD which if realised could drag a little on AUD/USD later this week.