Currency markets are turning in a mixed performance this morning amid an utter lack of new volatility catalysts. The dollar is holding steady in line with placid Treasury yields, most major currencies are trading within 20 basis points of yesterday’s close, and the yen is giving back some of yesterday’s gains after Prime Minister Ishiba’s governing coalition suffered losses in the weekend’s election.

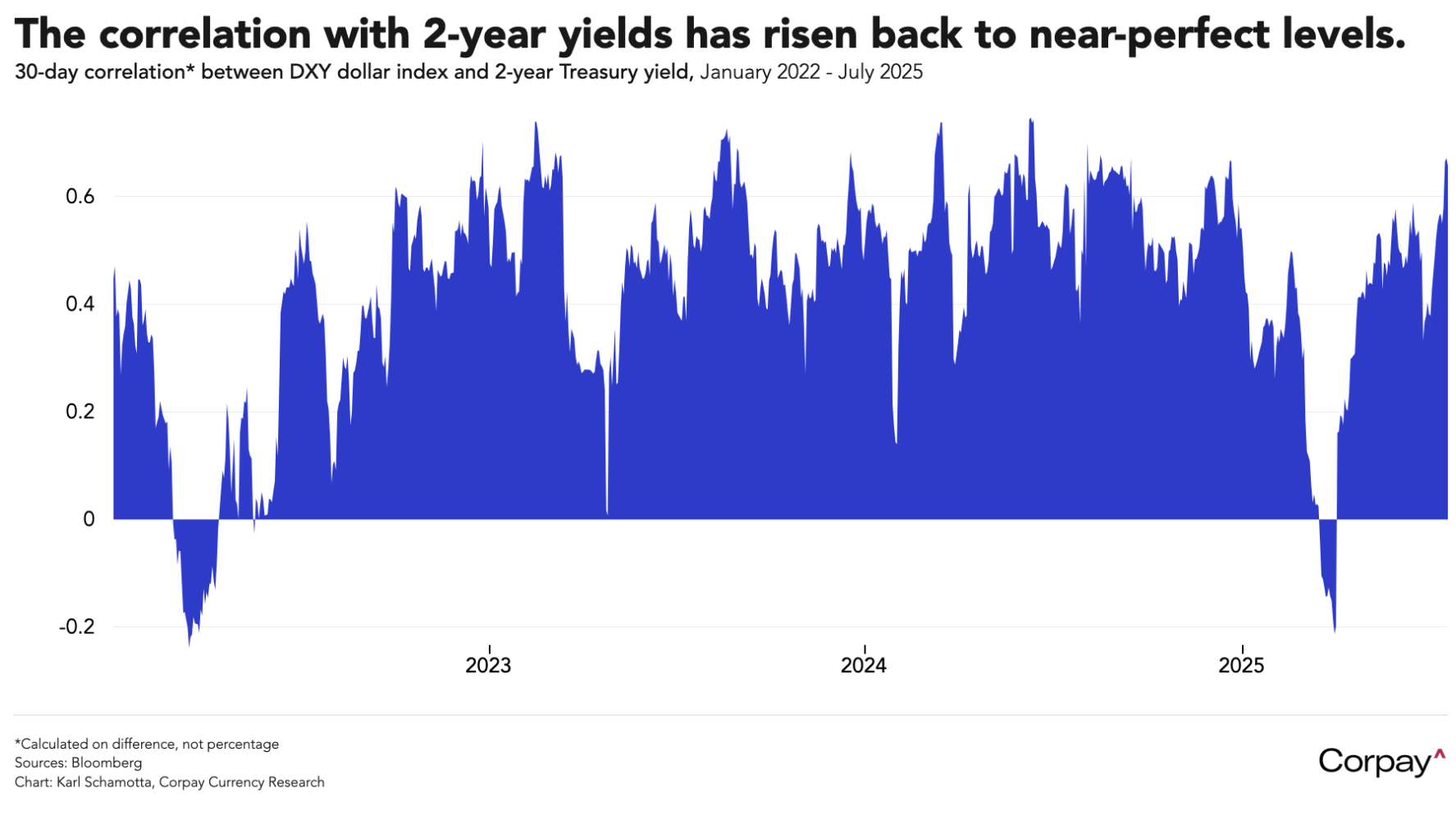

In the background, the dollar’s rebound appears to be fading. After investors spent much of early July correcting overly-bearish views on the American economy’s prospects by pushing monetary easing expectations back, short-term interest rates are reaching levels consistent with at least four rate cuts by early 2027, and the greenback’s extremely-high correlation with two-year yields has returned, underlining a shift in underlying market psychology relative to early April’s panic-driven selloff.

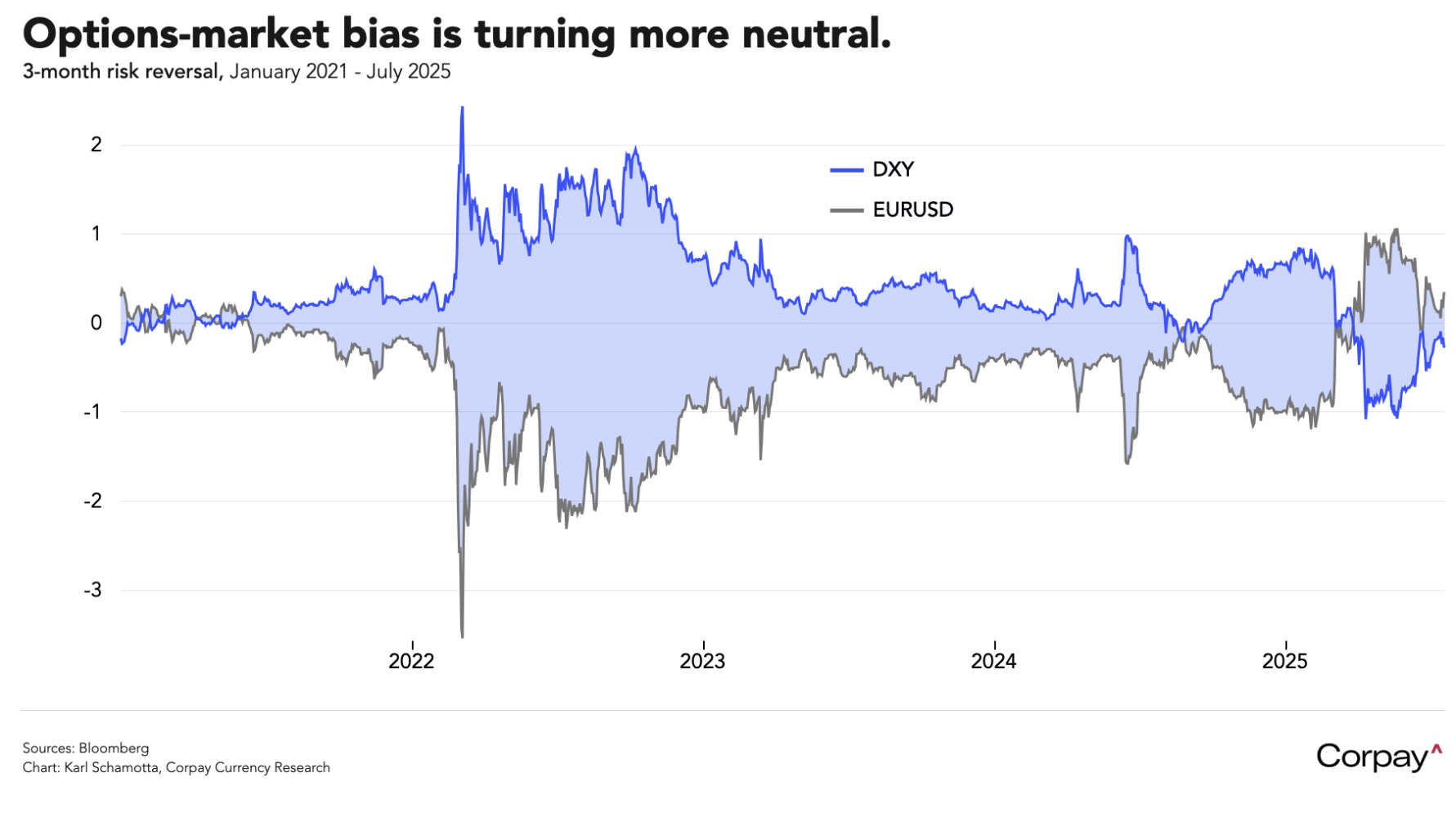

Market positioning is moving closer to neutral. Three-month risk reversals—which measure bias in currency options markets—have narrowed substantially in both the dollar and the euro over the last three weeks. We think this reflects an almost-inevitable slowing in spot market momentum, a reappraisal of the euro’s upside potential, and a return to “normal” market correlations amid a dialling-down in the Trump administration’s tariff rhetoric.

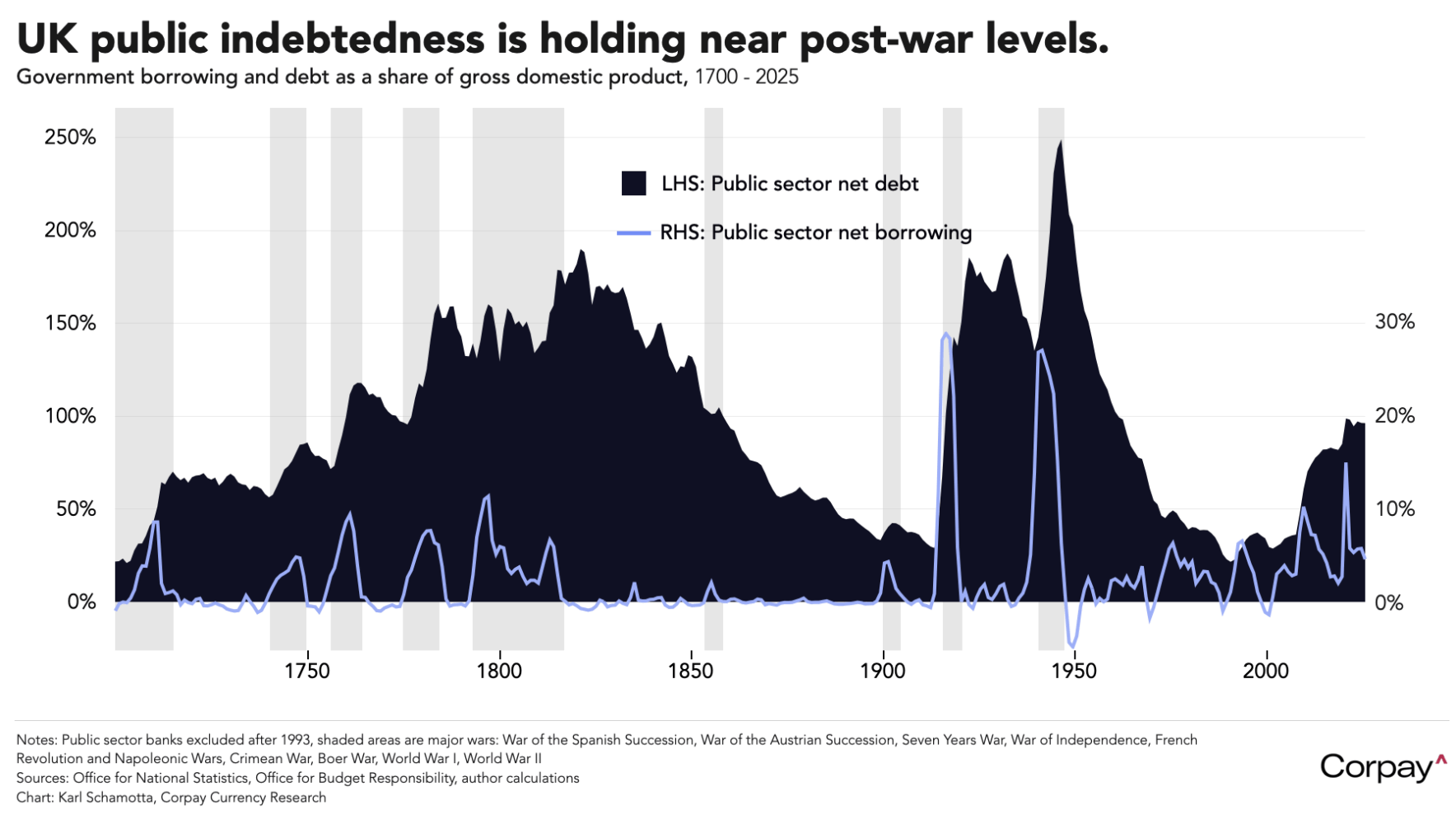

The pound is back on the defensive after the UK budget deficit widened more than expected in June, adding to market expectations for a new round of tax increases in this autumn’s budget. According to the Office for National Statistics, the government spent £20.7 billion more than it collected last month, with the increase mostly driven by a £16.4 billion payment partially tied to inflation-adjusted securities, which follow the retail price index. The public sector net debt-to-gross domestic product ratio excluding public sector banks climbed to an estimated 96.3 percent, up 0.5 percent from a year prior, and still at levels last seen in the early 1960s*. On the current trajectory, economists think Chancellor of the Exchequer Rachel Reeves will need to raise roughly £20 billion in her next budget, and recent attempts to cut spending have been met with an overwhelmingly-hostile reception, meaning that new wealth taxes—which could trigger capital outflows—are likely.

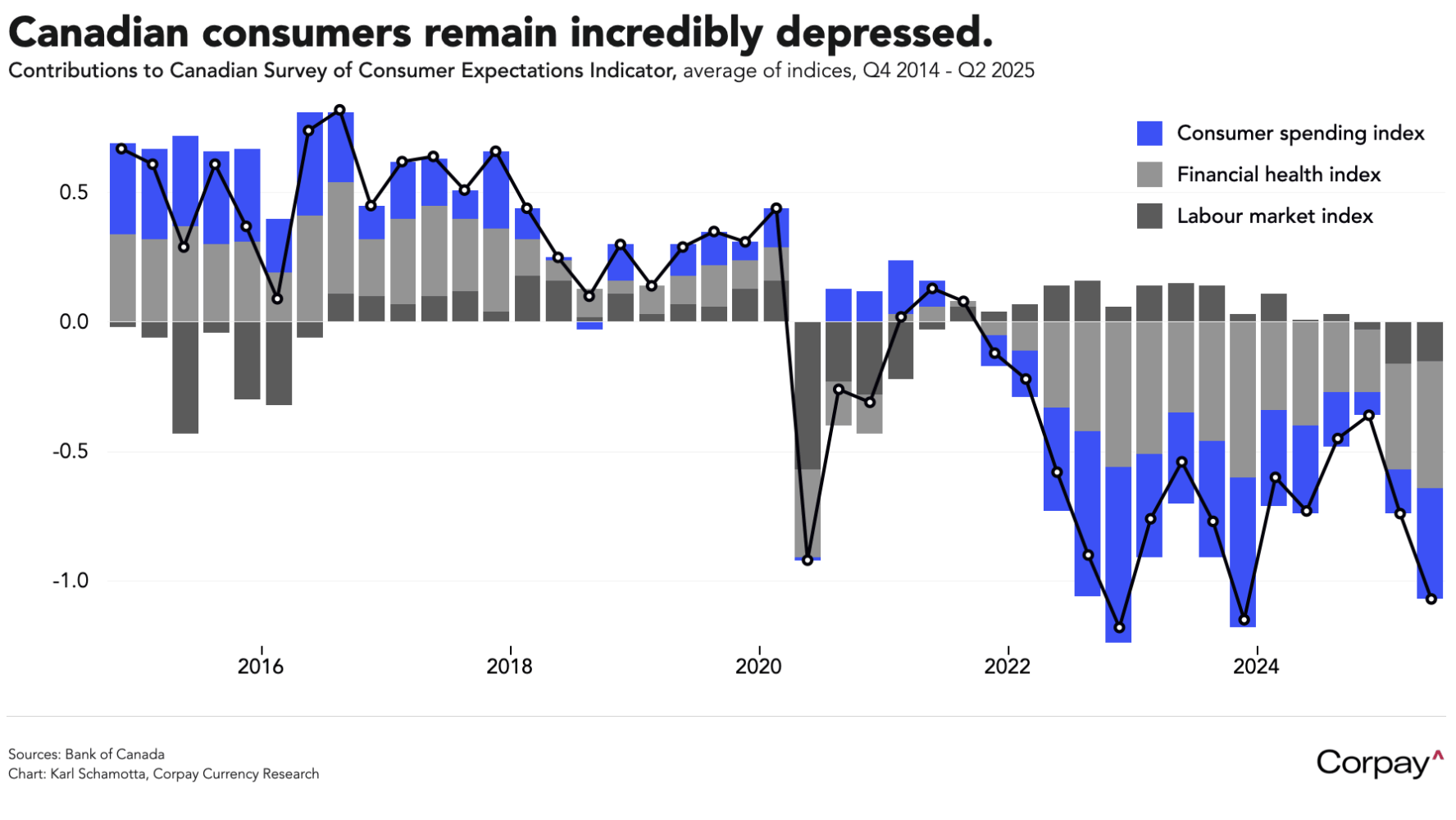

Trading in the Canadian dollar remains cautious, with market participants unwilling to enter significant long positions against a still-depressed economic backdrop. Although yesterday’s Bank of Canada Business Outlook survey showed fewer firms expecting a near-term recession, most also said they were slowing hiring and curbing investment plans in anticipation of further sales weakness, perhaps exacerbated by another round of US-driven trade turmoil. The Bank’s new Canadian Survey of Consumer Expectations indicator, which seeks to measure household sentiment across three dimensions—financial health, labour market conditions, and spending intentions—tumbled for a second consecutive quarter, primarily driven by a decline in spending plans. Inflation expectations remained well above pre-pandemic averages however, suggesting that a July rate cut from the Bank could prove foolhardy, and pointing to a cautious return to easing later in the year.