• Market swings. US equities dipped again, while US yields & USD rose. NZD remains on backfoot. AUD unwound yesterday’s CPI induced gains.

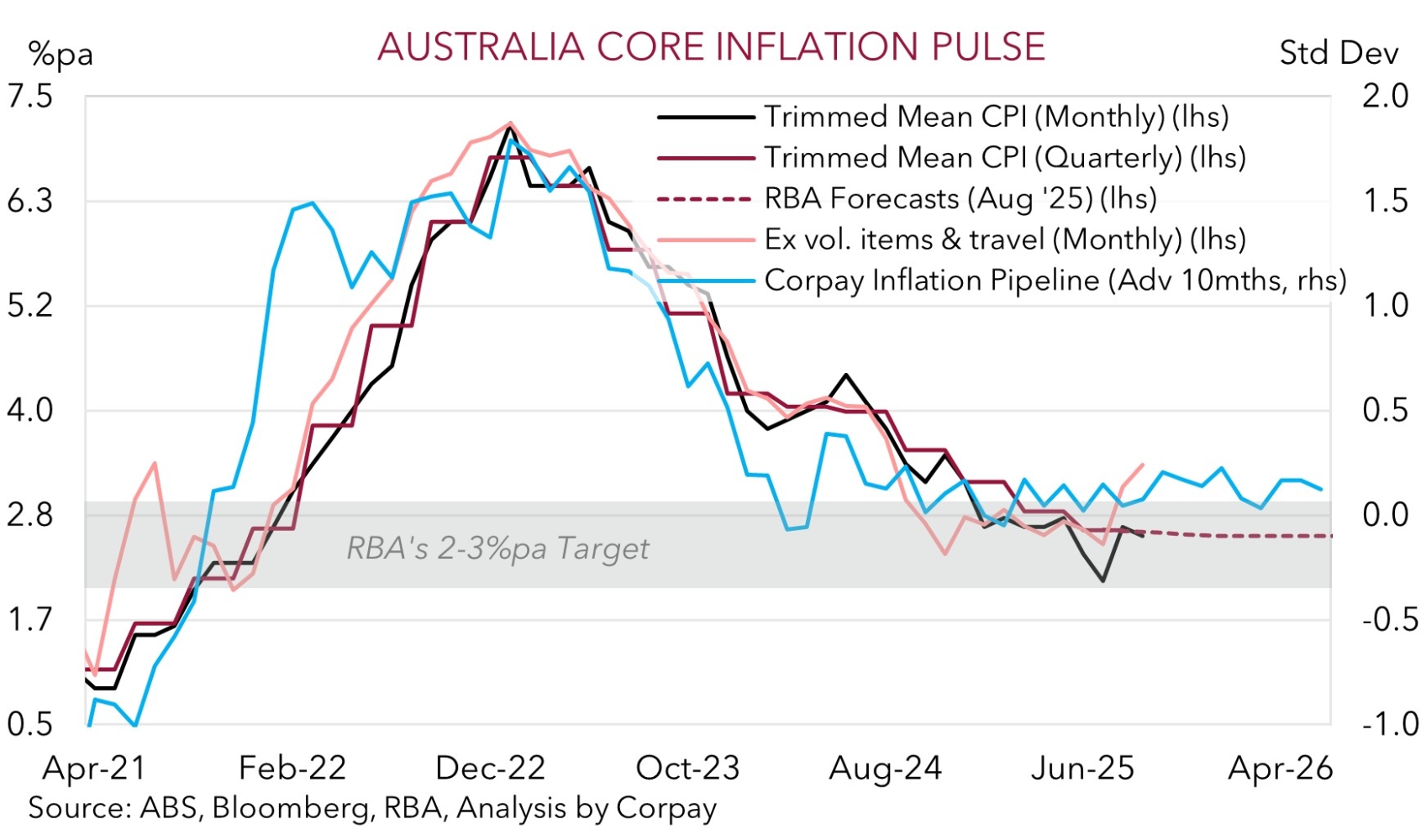

• AU CPI. Inflation hotter than expected in August. Data raises doubts about further RBA rate cuts. Relative policy trends can be AUD supportive.

Global Trends

There were a few more market wobbles overnight with US equities declining modestly for the second straight session (S&P500 -0.3%), US bond yields ticking up ~2-4bps across the curve, and the USD clawing back ground. The EUR (the major USD alternative) slipped down towards ~$1.1740 (the lower end of its ~2-week range), while the interest rate sensitive USD/JPY tracked the uptick in bond yields (now ~148.80, the upper bound of the range occupied since early-August). GBP also declined (now ~$1.3447), as did the NZD (now ~$0.5815, the bottom of its 5-month range). The AUD also more than unwound yesterday’s hotter than expected Australian CPI induced strength (now ~$0.6584).

News wise, the Germany IFO survey underwhelmed. The IFO business climate index fell to a 4-month low with US tariff related headwinds have a negative impact on European trade and production. This, coupled with ‘hawkish’ comments by President Trump about Ukraine potentially reclaiming territory from Russia, looks to have taken some of the sting out of the EUR. At the same time, US new home sales surged ~20% in August, though this looks in part driven by builders offering greater incentives to offload inventory. On the policy front 2025 Fed voting member Goolsbee noted the data only shows a “mild cooling” in the jobs market and that he is “uncomfortable with overly frontloading a lot of rate cuts”. Markets don’t seem to agree with another Fed rate cut in late October assigned a ~94% chance and 4 reductions factored in over the next year.

Looking ahead, Fed member Goolsbee speaks again tonight (10:20pm AEST), as does President Trump’s uber ‘dovish’ appointee Miran (10:15pm AEST). US trade data, durable goods orders (a proxy for business investment), and weekly initial jobless claims are also due (10:30pm AEST). On balance, we think softer US data could see the USD back peddle a bit in the near-term. Over the medium term (i.e. next few months) we remain of the view that the mix of slower US growth, lower US interest rates, and/or reduced inflows into US assets should see the USD’s downtrend re-assert itself.

Trans-Tasman Zone

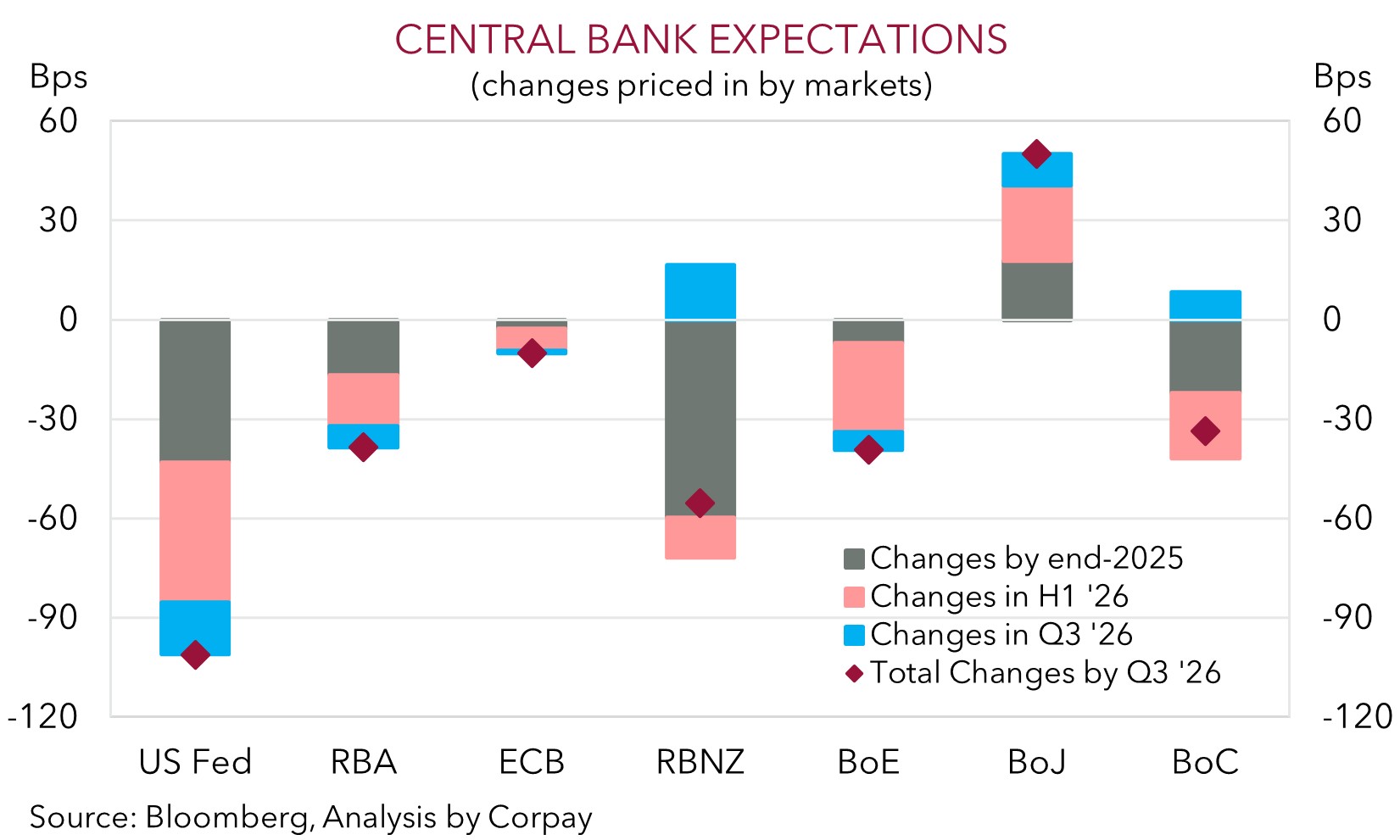

The USD rebound and volatility in a few asset markets exerted downward pressure on NZD and AUD overnight (see above). The NZD extended its slide (now ~$0.5815) to be back trading near the lower end of its 5-month range. Expectations of more aggressive RBNZ rate cuts over the next few meetings remains a NZD headwind, in our view. Markets are pricing in a small chance the RBNZ delivers an outsized 50bp cut on 8 October with ~70bps worth of easing factored in by February. We think there is a risk the RBNZ looks to re-set rates lower to more appropriate levels over the October/November meetings to give new Governor Breman a fresh start when she takes the reins in December.

AUD has been whipped around by domestic economic factors and USD rebound over the past 24hrs. The latter won out with the AUD (now ~$0.6584) near a 2-week low. That said, the AUD outperformed on the cross-rates with gains of ~0.2-0.6% recorded against EUR, JPY, GBP, NZD, and CAD. More specifically AUD/NZD (now ~1.1322) is up at levels last traded in Q4 2022 with economic and interest rate trends still firmly in Australia’s favour. Data wise the monthly Australian CPI indicator for August came in hotter than anticipated. Headline inflation accelerated to 3%pa (fastest pace since mid-2024) while the preferred monthly core measure (i.e. ex volatile items and holiday travel) quickened to 3.4%pa (fastest pace in a year).

The stickiness in parts of the CPI basket, particularly around ‘services’ prices has raised doubts about further RBA rate cuts. Indeed, Q3 inflation is tracking above the RBA’s projections. At the same time activity data has been “slightly stronger” according to Governor Bullock. We wouldn’t be a surprise to see the RBA hold steady for the rest of the year as it monitors the landscape and waits for a couple of quarterly CPI prints to come through. There is a possibility no more rate cuts are delivered by the RBA, in our opinion. Markets expectations have shifted with another RBA rate cut now only fully factored in by next March. Over the medium term (i.e. next ~3-12 months) we continue to see the AUD grinding higher. We believe the AUD can be supported by a mix of a weaker USD as the US Fed lowers interest rates, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds, firmer momentum in Australia’s economy, and ongoing cautious approach from the RBA.