• Calmer markets. European equities rose, while US markets gave back initial gains. EUR lost a bit of ground. AUD & NZD edged higher.

• Tariff news. Tariff-related developments somewhat negative. EU/US talks haven’t found common ground. China still pushing back. US data soft.

• Macro events. China GDP out today. In the US retail sales & speech by Fed Chair Powell in focus tonight. AU jobs report due tomorrow, as is NZ CPI.

Global Trends

Compared to the past few weeks markets were relatively calm overnight. While European equities rose (EuroStoxx600 +1.6%), the US indices gave back initial gains to end the session slightly in the red (S&P500 -0.2%). Bond yields were similarly mixed with Eurozone rates ticking up ~1-4bps and US rates losing a bit of ground for the second straight day. The US yield curve flattened with the benchmark 10yr yield shedding ~4bps (now ~4.33%) and the 2yr yield consolidating (now ~3.84%). In FX, the USD index drifted modestly higher with EUR (the major USD alternative) easing a little further from its cyclical highs (now ~$1.1285) and USD/JPY treading water around the bottom of its multi-month range (now ~143.10). GBP nudged up (now ~$1.3230, a 6-month high) on the back of another solid UK labour market report with the unemployment holding steady and employment stronger than predicted. Cyclical currencies also extended their recovery with the NZD (now ~$0.5890) at levels last traded in early-December and the AUD (now ~$0.6335) broadly inline with its 6-month average.

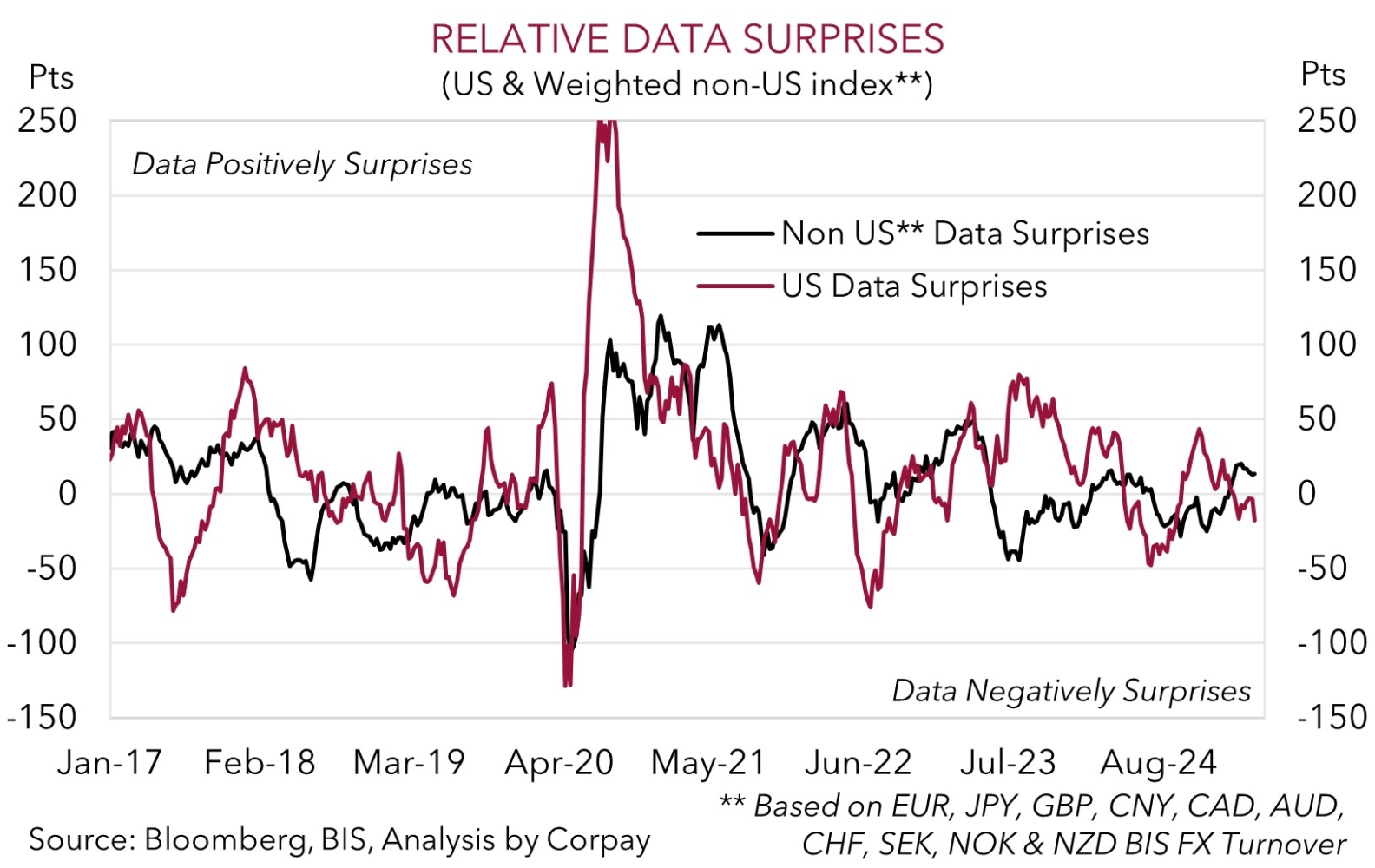

Despite the sense of calm across markets the tariff-related newsflow remained somewhat negative. After initial discussions EU and US trade negotiators are said to have made little progress in finding common ground with the US reiterating the new baseline tariffs and levies on autos and metals would not be removed outright. China also continues to push back with authorities reportedly ordering airlines not to take further deliveries of Boeing aircraft and to halt the purchase of aircraft equipment and parts from US firms. On our figuring, aircraft and parts account for ~8% of the US’ exports to China. Not to be outdone, tech megacap Nvidia announced that the US requires it to now have a license to export certain products to China. The US survey data was also underwhelming. The Empire manufacturing index, the first regional survey to capture ‘Liberation Day’ impacts, showed “stagflation” vibes. Prices paid rose to their highest since H2 2022, while a future business conditions measure plunged to its lowest reading since 2001.

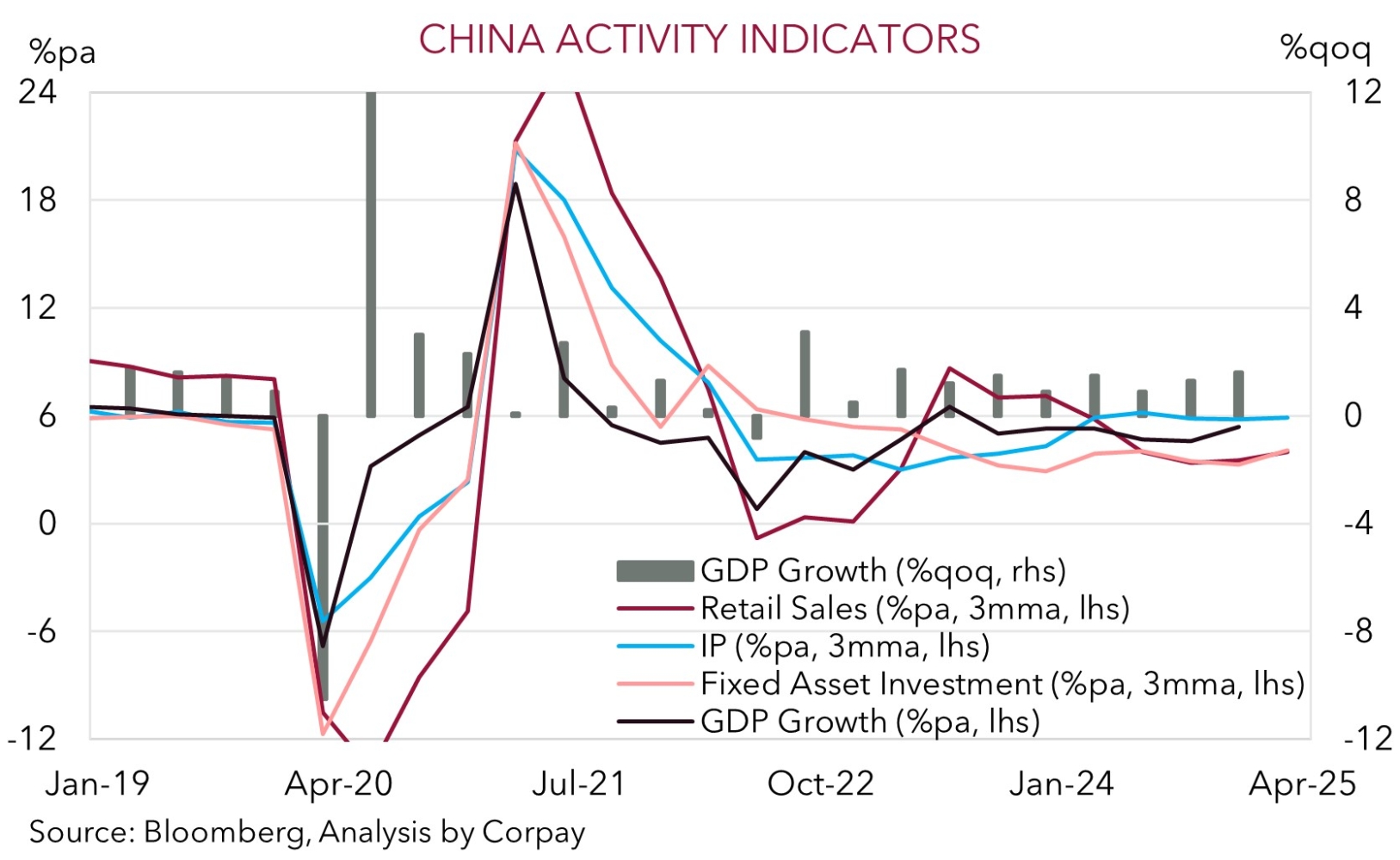

Macro wise, the China data batch which includes Q1 GDP is due today (12pm AEST), US retail sales are out tonight (10:30pm AEST), the Bank of Canada is expected to lower interest rates again (11:45pm AEST), and US Fed Chair Powell speaks (3:30am AEST). Some front-loading of activity ahead of US tariffs is expected to have supported US retail sales, as well as growth in China which should also be helped along by stimulus measures. This mix may generate a bit of renewed support for the USD, particularly if Fed Chair Powell keeps the door to near-term interest rate cuts closed. That said, we remain of the view that downside US growth risks and shaken investor confidence can see the USD trend lower over the medium-term.

Trans-Tasman Zone

The calmer state of markets and lower levels of volatility compared to the acute bout of turbulence experienced earlier in the month has helped cyclical currencies like the NZD and AUD extend their respective rebounds (see above). The NZD (now ~$0.5890) is near the top of its ~5-month range ahead of tomorrow mornings Q1 NZ CPI report which is expected to show inflation pressures remain contained. The AUD (now ~$0.6335) is more than 7% from its recent low and broadly inline with its 6-month average. The AUD has also perked up on some of the major crosses over the past 24hrs. AUD/EUR has risen ~0.8% to ~0.5610 and there were also gains in AUD/JPY (now ~90.62), AUD/CAD (now ~0.8844) and AUD/CNH (now ~4.6415, just below its 1-year average).

As mentioned above, in addition to any further tariff developments, over the near-term the AUD will be influenced by Q1 China GDP (12pm AEST), US retail sales (10:30pm AEST), a speech by Fed Chair Powell (3:30am AEST), and tomorrow’s Australian jobs report. Given the AUD’s sharp rebound over the past week, we wouldn’t be surprised if it drifts back a little over the very short-term, particularly if US retail sales shows a solid lift in spending ahead of the implementation of trade tariffs, and/or Fed Chair Powell indicates rate cuts probably aren’t likely until the dust settles due to lingering inflation concerns. Markets are assigning a ~20% chance the US Fed delivers a 25bp rate cut in early-May.

However, beyond more bursts of data/headline driven volatility, we think that over the medium-term, there is still more upside potential for the AUD. In addition to our outlook for a weaker USD because of the downside growth risks in the US economy, the domestic economic fundamentals in Australia remain on solid ground. This could be on show again in tomorrow’s March jobs report where monthly employment is forecast to snap back. Furthermore, as mentioned before, Australia’s direct trade with the US is limited (only ~4% of exports are sent to the US) and any pressure in China’s export sector looks set to be counteracted by moves to stimulate domestic activity. This is where Australia’s key exports are plugged into. The AUD also has valuation support with it tracking a couple of cents under our suite of ‘fair value’ models, even after accounting for recent moves, and with current levels still rather low (since 2015 the AUD has traded sub-$0.6350 less than 5% of the time).