• Holding on. Consolidation in markets with US equities & bond yields little changed. Lower vol. helped AUD & NZD edge higher.

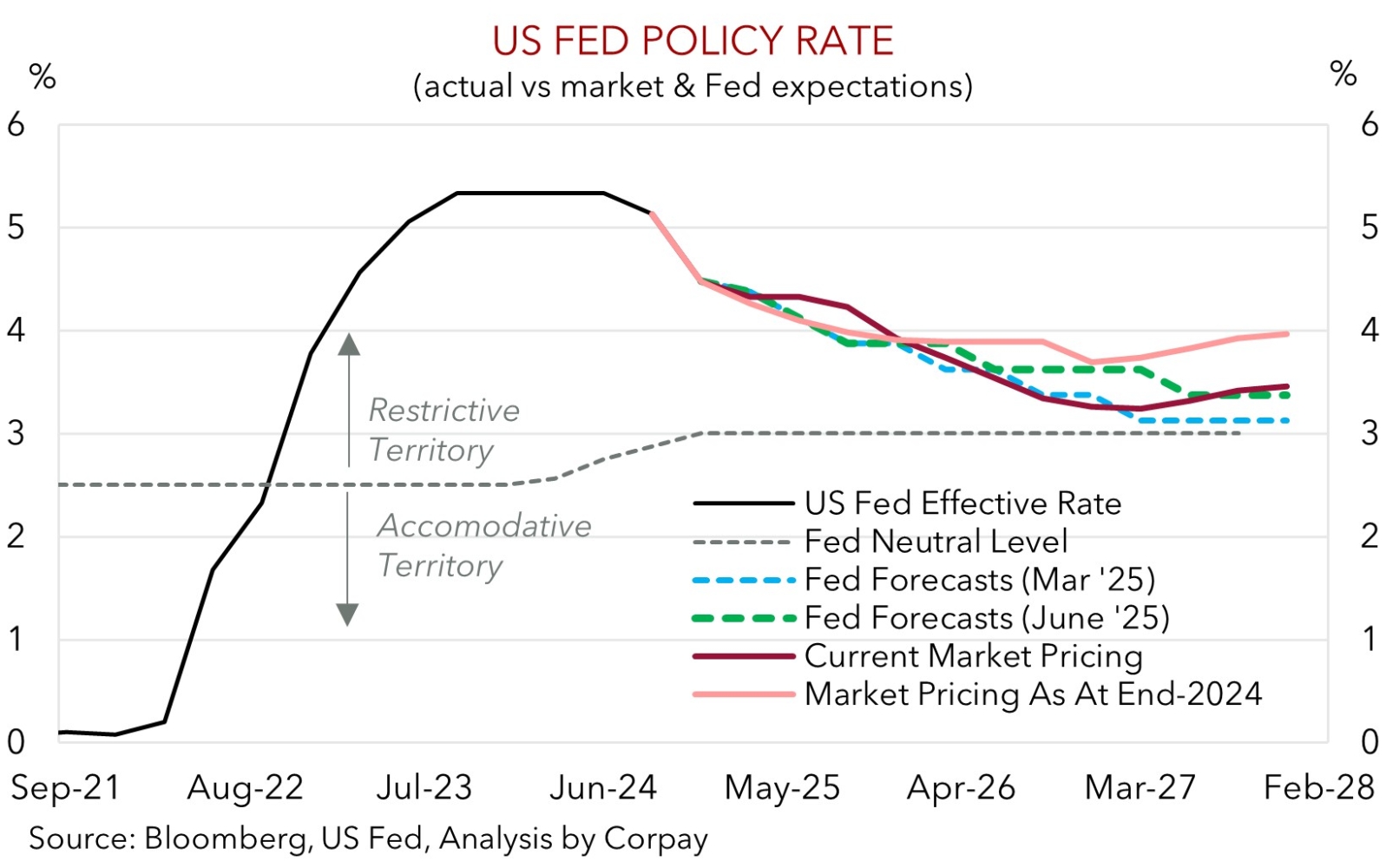

• US Fed. Policymakers still projecting two cuts in late-2025. But fewer reductions are anticipated in 2026 because of tariff-related inflation risks.

• AU jobs. Monthly Australian employment figures out today. After a strong result in April will the volatile series show some payback in May?

Global Trends

Following the zigzag moves over the past few days on the back of evolving Middle East news markets consolidated overnight ahead of the US public holiday. The S&P500 was range-bound as were US bond yields. In FX, the USD index tread water with EUR holding steady (now ~$1.1482), and USD/JPY (now ~145.14) little changed. Closer to home, the NZD ticked up a fraction (now ~$0.6029), while the drop off in volatility helped the AUD (now ~$0.6508) outperform over the past 24hrs.

There were no major new developments in the Israel/Iran conflict, although there is scope for more bursts of geopolitical driven volatility over the period ahead with President Trump indicating the US “may” or “may not” strike Iranian nuclear facilities and that next week would be “very big” for the course of the conflict. Macro wise, the US Fed meeting was in focus this morning. As expected, the US Fed kept interest rates on hold with policymakers in “wait and see mode”. According to Chair Powell the Fed will watch labor market and inflation data “over the summer” before making a call on rates. This suggests that without a large shock, the next quarterly update meeting in September could be the earliest time the Fed might look to tinker its policy settings. Notably, the Fed’s median 2025 “dot” within its interest rate projections still implies two rate cuts by year-end. However, tariff related inflation risks are starting to move things under the hood. Seven Fed members now see no interest rate cuts in 2025, up from four in March. And further out, the ‘dot plot’ shows fewer rate reductions over 2026/27. As our chart illustrates, the Fed’s updated thinking generated by stickier inflation projections is back broadly in line with the path markets were pricing in at the end of last year. A decent step up from the interest rate outlook currently baked in.

The Juneteenth holiday tonight will see US cash equity and bond markets closed. Trade on Friday may also be lighter than usual if people take a long weekend. Thinner liquidity conditions could generate bursts of volatility if geopolitical tensions flare up over the rest of the week. We think developments in the Middle East risk giving the beleaguered USD some support over the near-term, as could the ‘hawkish’ tilt in the US Fed’s longer-term outlook.

Trans-Tasman Zone

The relatively calmer night from a geopolitical perspective, and muted reaction to the US Fed’s latest update has helped the AUD and NZD tick a bit higher over the past 24hrs (see above). At ~$0.6508 the AUD is hovering above its 1-month average, as is the NZD (now ~$0.6030) with a pickup in NZ GDP growth momentum in Q1 also providing a helping hand at the margin. The drop in volatility also saw the AUD edge up on the crosses with gains of ~0.3-0.6% recorded against the EUR, JPY, GBP, NZD, CAD, and CNH overnight.

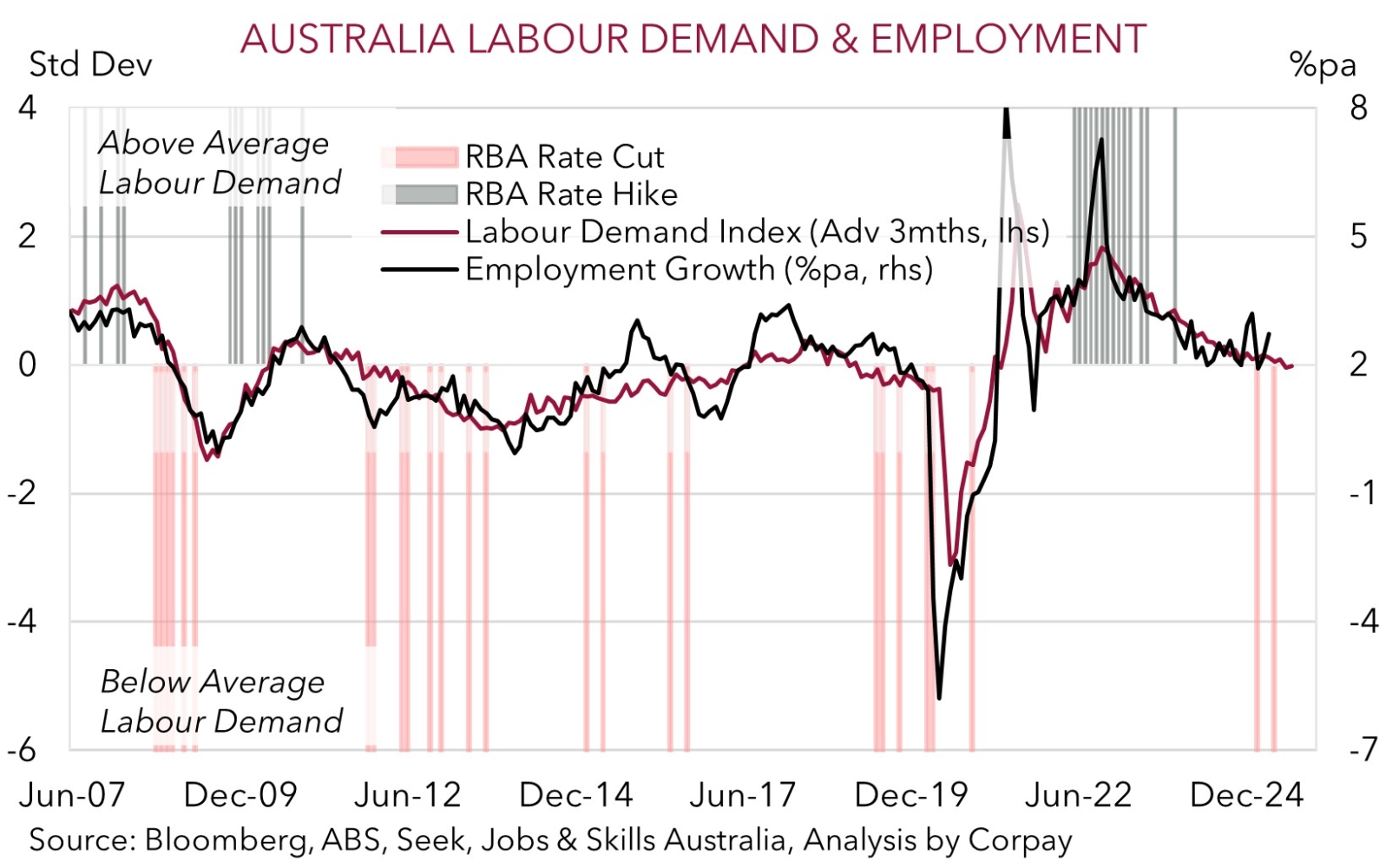

Today, attention in Asian trade will be on the monthly Australian jobs report (11:30am AEST). The Australian labour market has been resilient in the face of softer growth across the private sector and higher interest rates over the past year. However, forward indicators such as job ads, hiring intentions, and vacancies are suggesting the ground might finally be starting to shift and that a step down in employment/higher unemployment over the period ahead could be in the pipeline (see chart below).

The Australian labour force figures are volatile. After the outsized employment gains in April we think there is a risk of some payback and a softer report in May. If realised, we believe signs labour market conditions are loosening may reinforce bets the RBA will deliver another interest rate cut on 8 July (this is currently ~80% priced in) and exert a little renewed downward pressure on the AUD in the near-term. As could a pickup in the USD, which is where we feel the risks reside given the ‘hawkish’ tweaks in the US Fed’s medium-term guidance (see above) and ongoing tensions in the Middle East. As observed over the past week the situation in the Middle East remains fluid and further bouts of headline driven volatility are possible as things continue to play out.