• Holding on. Consolidation across markets on Friday. US yields slipped back. AUD & NZD tread water. AUD near 1-month average.

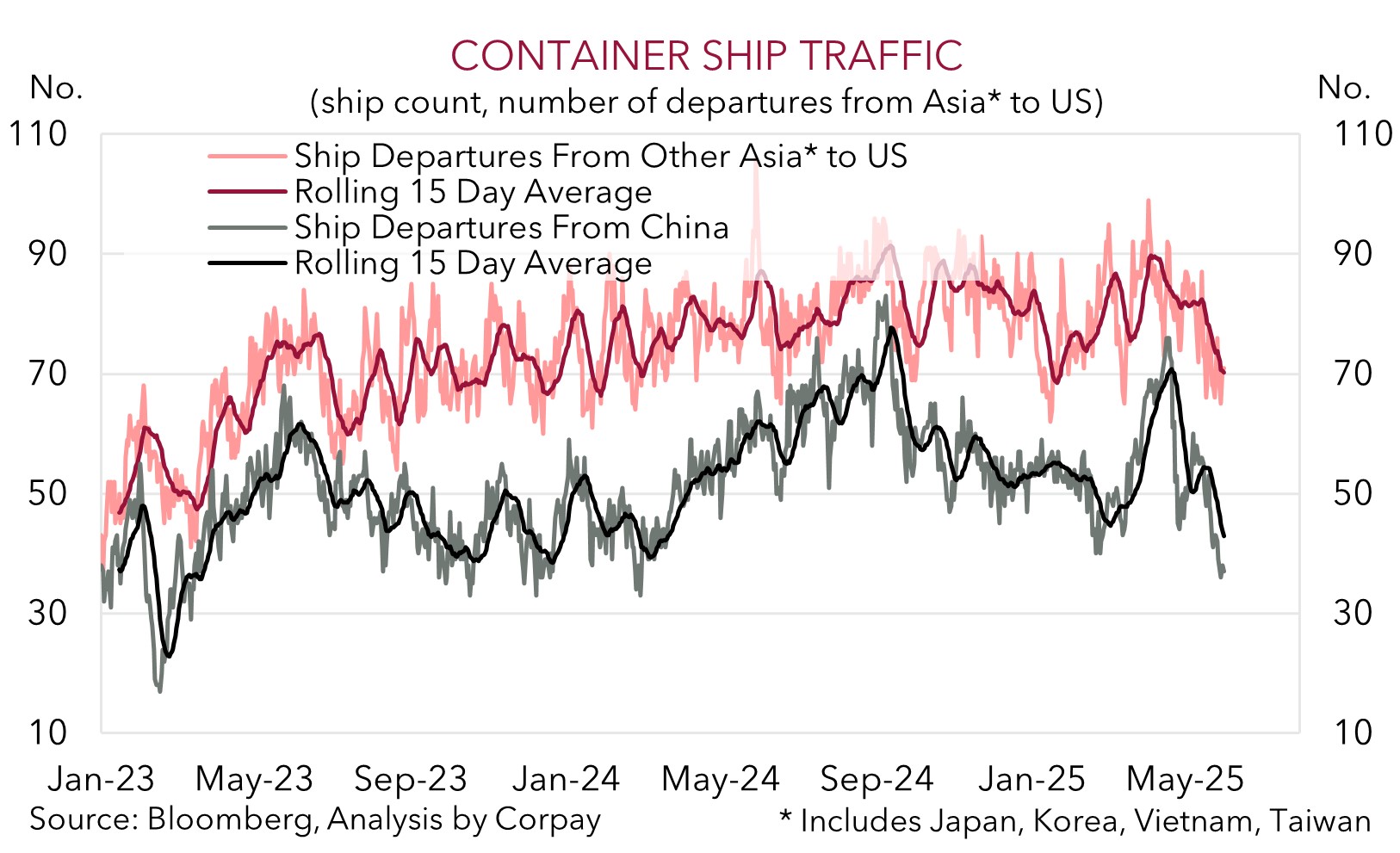

• Data flow. Tariff impacts starting to show. Container traffic to US slowing. Medium-term downside growth risks remain in place, in our view.

• Event Radar. Q1 AU GDP due this week. ECB & BoC are meeting. A few US Fed members speak. US ISM & monthly jobs report also scheduled.

Global Trends

Despite a flurry of US data releases on Friday it was a quiet end to the week in markets. On net the US S&P500 was little changed over the session, however this masked the recovery from the over 1% decline that came through early on. US bond yields drifted lower with a slightly larger fall in the policy expectations driven 2yr rate (now ~3.90%) causing the curve to steepen a touch. There were also only modest swings in FX with the USD index nudging higher as EUR (now ~$1.1350) and GBP (now ~$1.3454) slipped back and this overpowered a dip in USD/JPY (now ~143.84). AUD (now ~$0.6436) and NZD (now ~$0.5969) were range bound with the former hovering close to its 200-day moving average.

In terms of the data, the US personal income and spending figures showed an easing in consumption. At the same time, the PCE deflator (the US Fed’s preferred inflation gauge) moderated as services prices cooled, while the trade balance shrank in April as the pre-tariff front-running of imports unwound. This has mechanically lifted Q2 US growth estimates, though there is still a lot of water to go under the bridge and the underlying trend in various data series indicate negative tariff-related impacts are manifesting across the US economy. As our chart illustrates the number of container ships heading to the US from China and wider Asia has declined raising the prospect of weaker activity over the next few months. As stated previously, in our opinion, the higher import prices faced by households and businesses, coupled with policy/trade uncertainty, is likely to act as sand in the gears of the US economy over coming quarters.

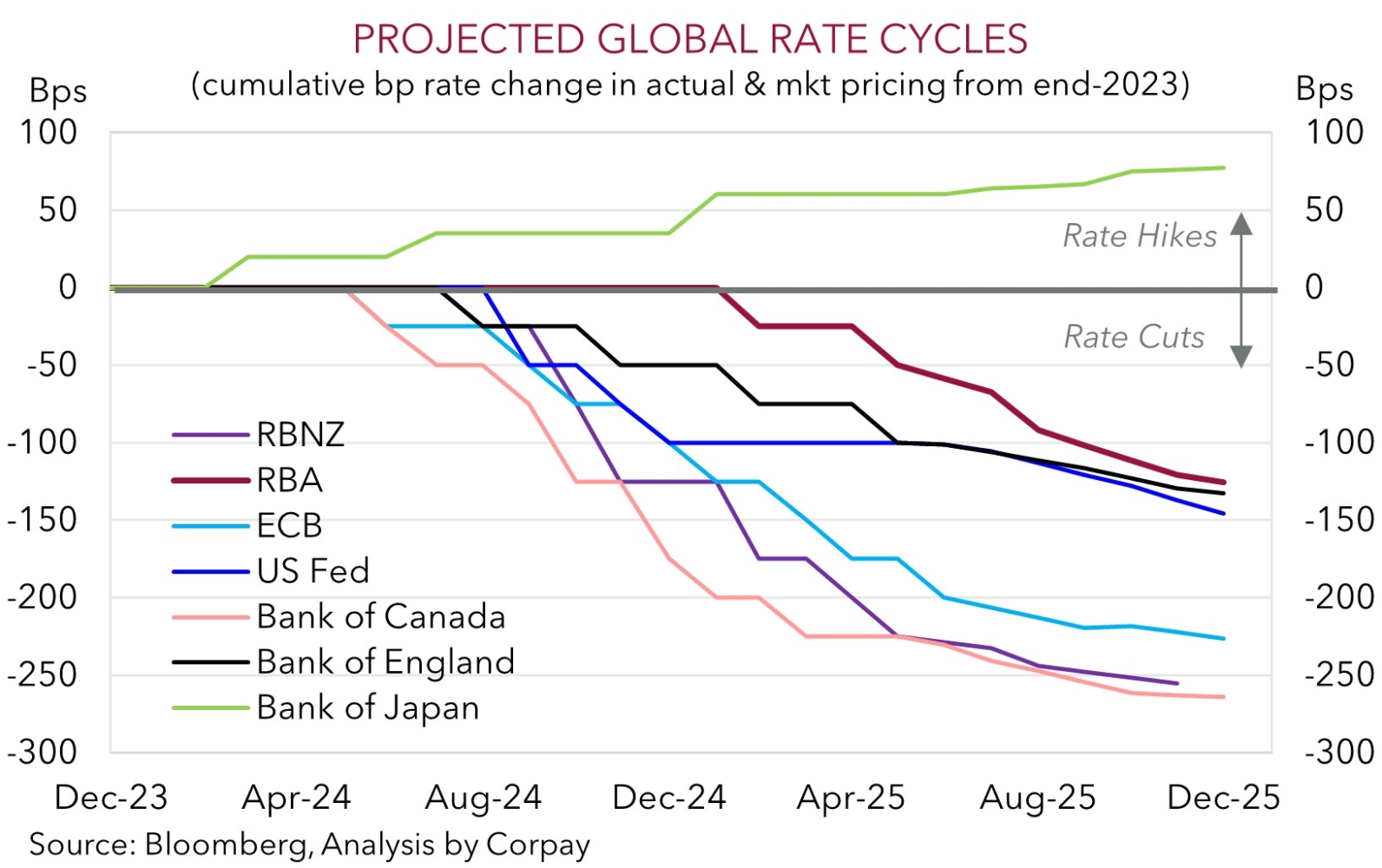

It is a macro heavy week. The European Central Bank (Thurs night AEST) is expected to cut interest rates by another 25bps, while economists and markets are split as to whether the Bank of Canada moves again (Weds night AEST). In the US several US Fed members are scheduled to speak and bellwether indicators such as the ISM survey (tonight AEST), JOLTS job openings (Tues night AEST), and the monthly jobs report (Fri night AEST) are due. Push-pull economic and geopolitical forces might generate a few intermittent bursts of volatility over the short-term, but on balance, we think the USD could lose a bit of ground if the incoming data underwhelms consensus predictions as tariff impacts and still restrictive monetary policy settings begin to bite. If realised, we believe this may bolster market pricing looking for the US Fed to re-start its interest rate cutting cycle later this year which in turn drags on the USD.

Trans-Tasman Zone

As outlined above it was a quiet end to the week and month in financial markets on Friday with AUD and NZD treading water. At ~$0.6436 the AUD is close to where it was tracking this time last week and is broadly in line with its respective 1-month and 1-year averages. The AUD was a little more mixed on the crosses with slight gains against GBP (+0.2%) and CNH (+0.1%) counterbalanced by weakness versus the JPY (-0.3%), NZD (-0.1%), and CAD (-0.6%).

Over the weekend US President Trump stated that he would double tariffs on steel and aluminium imports from 25% to 50% and indicated the new levies would come into force on 4 June. As stated before, despite the media hype, Australia’s exports of steel and aluminium to the US aren’t that large (on our figuring they account for ~4% of exports to the US), with broader trade with the US also relatively small (less than 4% of Australia’s total exports are sent to the US). Illustrating it another way, the value of Australia’s annual exports of aluminium and steel to the US is equivalent to ~1-2 days worth of Australia’s iron ore exports. As such, we don’t foresee any lasting impact on the AUD from the tariff-news.

More broadly, we think there may be a few more intermittent bouts of data-driven AUD/USD volatility over the near-term. There are several important US releases due this week including the monthly jobs report (Fri night AEST). Locally, Q1 GDP is out (Weds). Based on the high frequency data we believe the Australian economy expanded by ~0.4-0.5% in Q1, a decent result given the various headwinds. If realised, we feel signs the economy is still on solid ground could reinforce thinking that the RBA’s easing cycle will be gradual and limited. The next RBA interest rate cut isn’t fully discounted until August. This combined with the risk the US data underwhelms predictions might see AUD/USD edge a bit higher. The more favourable domestic economic and RBA policy trends should, in our view, also be AUD supportive against currencies such as the EUR, CAD, NZD, and CNH over time.