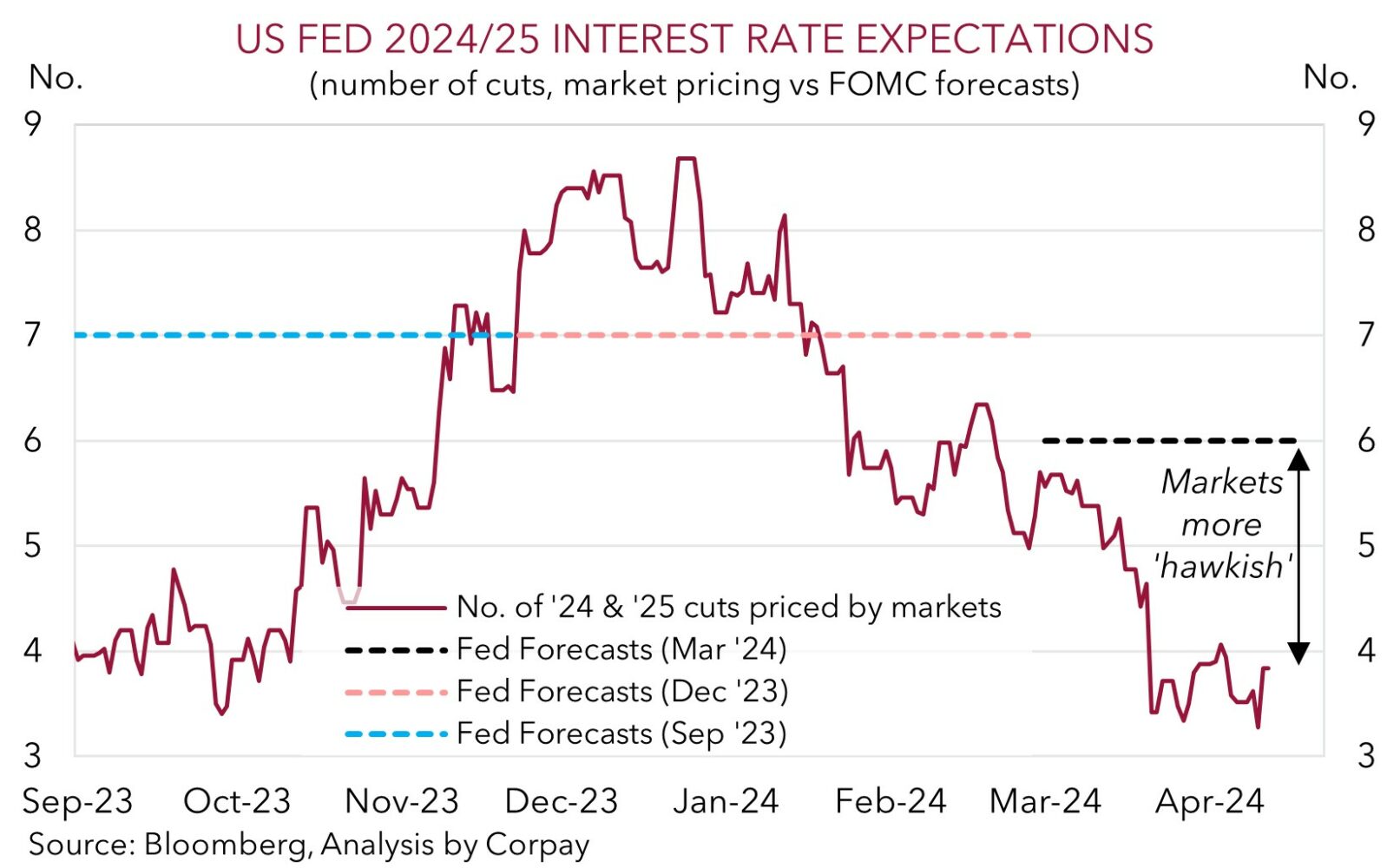

• Expectations matter. US Fed failed to live up to the markets “hawkish” thinking. Rates set to stay higher for longer, but this was already priced.

• Yields adjust. Fed Chair Powell doesn’t see more hikes. US yields slipped back & the USD softened. AUD recovered ~1/2 of yesterday’s fall.

• JPY swings. Another sharp jump in the JPY caught the markets eye after the Fed. US jobs report (Friday night) the next major market event.

The US Fed meeting was in focus this morning. As per our thoughts outlined over the past week the Fed failed to live up to very ‘hawkish’ expectations. The Fed kept policy steady and introduced new language that “in recent months, there has been a lack of further progress toward the Committee’s 2% inflation objective”. This is a known known and inline with comments made by Fed officials the past month. Elsewhere, the Fed announced it would taper how fast it is shrinking its balance sheet, and importantly there was no adjustment to its forward guidance, with the committee repeating it needs “greater confidence” inflation is heading towards target before cutting rates. In his press conference although Chair Powell stressed future decisions will be data dependent and that rates will probably stay higher for longer than previously anticipated, he seemed adamant rates are sufficiently ‘restrictive’ (and just need more time to work). Hence, there was little reason to envisage more hikes (Powell sees “paths to cutting and paths to not cutting”).

US equities whipped around and ended a bit lower (S&P500 -0.3%), and bond yields slipped back as aggressive pre-Fed ‘hawkishness’ was trimmed. US yields declined 5-8bps across the curve with traders adding back some rate cut bets. A run of softer US data also had an impact. The manufacturing ISM dipped into ‘contraction’, and JOLTS job openings (a gauge of labour demand) showed conditions are cooling with the vacancies and the hiring rate falling. As did the quit rate, with lower labour market churn pointing to slower wages and services inflation down the track. In our opinion, the unfolding labour market dynamics mean a Fed rate cutting cycle kicking off later this year remains on the table.

In FX, the USD tracked US yields and lost altitude. EUR is back above ~$1.07, GBP is at ~$1.2525, while USD/JPY tumbled late in the US session (now ~155) with the sharp intra-day move eerily like what happened a few days ago which we believe was a bout of intervention to prop up the weak JPY. We think more intermittent steps are probable and this may help USD/JPY and AUD/JPY converge down to where fundamental drivers indicate the various crosses should be (see Market Musings: USD/JPY & AUD/JPY: A line in the sand?). The weaker USD helped the AUD recover about ½ of yesterday’s slide with it back near its 200-day moving average (~$0.6522).

The April US jobs report (released Friday 10:30pm AEST) is the next major event. Jobs growth is forecast to remain positive, however various leading indicators suggest momentum might have softened after a stellar Q1. We see downside risks to consensus. In our view, signs of weakness in the US labour market could revive longer-dated US rate cut pricing and exert more downward pressure on the lofty USD.

AUD Corner

The AUD has clawed back ~1/2 of yesterday’s fall to be back around its 200-day moving average (~$0.6522) with the USD softening after the US Fed failed to exceed the markets ‘hawkish’ expectations (see above). The AUD also edged higher on most crosses with gains of 0.2-0.3% recorded over the past 24hrs against the EUR, GBP, CAD, and CNH. AUD/NZD continues to hover near ~1.10 with yesterday’s weak Q1 NZ labour market report reinforcing views the RBNZ could start lowering interest rates sooner and more aggressively than the RBA.

By contrast, AUD/JPY shed ~1% (now ~101) with the JPY strengthening late in the US session following another possible bout of intervention by Japanese authorities. As outlined, we believe there is more downside than upside potential in AUD/JPY from here. We are forecasting the pair to fall down towards ~97 over the next few months (see Market Musings: USD/JPY & AUD/JPY: A line in the sand?).

The fall out from the overnight US Fed meeting, and sharp swings in the JPY are likely to dominate during today’s Asian session. Data wise, Australian building approvals and trade data are due (11:30am AEST), but they aren’t usually market moving. Looking ahead, the next major event will be the April US jobs report (Friday 10:30pm AEST). In our judgement, after a strong Q1 the risks are tilted to US jobs growth cooling and the unemployment rate lifting more than projected. If realised, we think this may see markets price in more chance of US Fed rate cuts later this year and over 2025, which in turn could weigh on the USD and support the AUD.

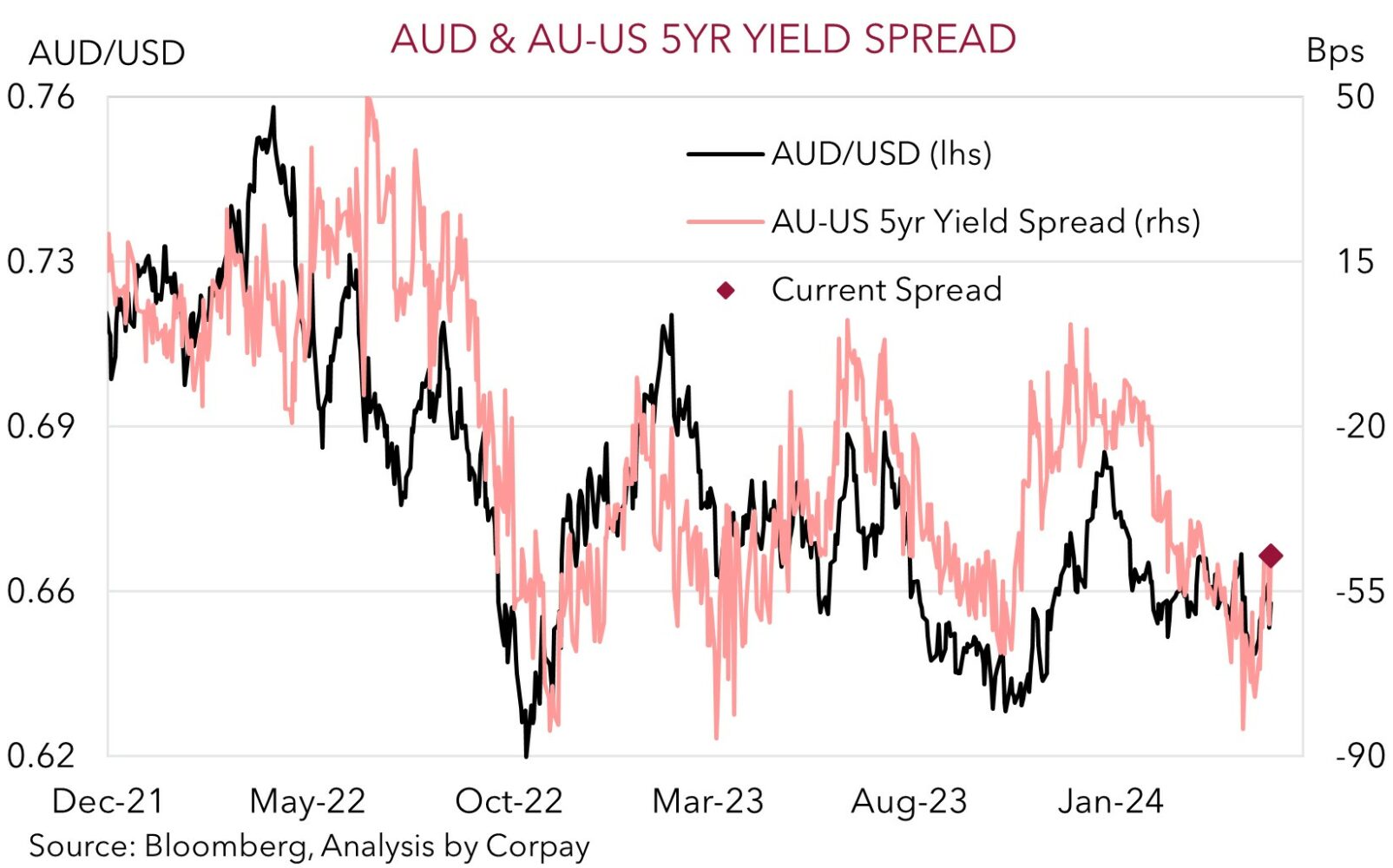

As outlined previously, we feel there is too much negativity factored into the AUD down near current low levels. Bearish ‘net short’ positioning (as measured by CFTC futures) is large, and capital flow/valuation support remains in place. Moreover, we continue to think that the stickiness in domestic inflation, resilient labour market, incoming stage 3 tax cuts, and more cost-of-living relief at the May Federal Budget could see the RBA lag its peers in terms of when it starts and how far it goes in the next global easing phase. Indeed, we see a chance that the RBA hikes rates again over coming months. Diverging monetary policy expectations and Australia’s sturdier economic fundamentals should be AUD supportive (outside of AUD/JPY). As our chart shows, bond yield differentials are already pointing to a higher AUD. The average across our suite of models is indicating AUD ‘fair-value’ is now ~$0.67.