• Hanging on. A quieter end to last week. US equities consolidated. USD a bit softer. AUD & NZD ticked up but still lost ground over the week.

• US trends. US data has generally been a bit better than anticipated recently. Will this trend continue & will the USD’s rebound extend?

• Event Radar. RBA Gov. Bullock speaks (Thurs) & the ECB meets (Thurs night). The global business PMIs are also due later this week.

Global Trends

After a few bursts of volatility earlier in the week it was an uneventful trading session on Friday. US equities consolidated around record highs, US bond yields slipped back ~4bps across the curve, and in FX the USD softened a little. EUR (now ~$1.1630) ticked up, yet it still recorded a second straight weekly fall. USD/JPY (now ~148.38) tread water near the upper end of its ~3-month range, while NZD (now ~$0.5945) and AUD (now ~$0.6511) recovered a bit of lost ground.

Data wise US housing starts and building permits for June were better than predicted, although they remain at levels consistent with sluggish construction activity. Elsewhere, US consumer sentiment recorded a back-to-back improvement in July. The US data releases added to the run of positive surprises over the week. That said, the broader economic pulse and medium-term trajectory is keeping the door open to US Fed interest rate cuts down the track. And according to ‘dovish’ Fed voting member Waller the central bank should lower interest rates by 25bps at the meeting later this month given current settings are still ‘restrictive’ and downside risks in the US labour market. Markets don’t totally agree with a cut in late-July only assigned a ~6% chance and a full reduction only factored in by October.

Tariffs are also still hanging over the market’s head. Reportedly President Trump has escalated demands in negotiations with the EU, and is pushing for a minimum tariff of 15-20% in any deal. The EU is the biggest source of US imports with ~20% of goods shipped into the US coming from the bloc. Higher US tariffs would raise the chance of EU retaliation, and may be a catalyst for renewed bouts of market turbulence over the period ahead.

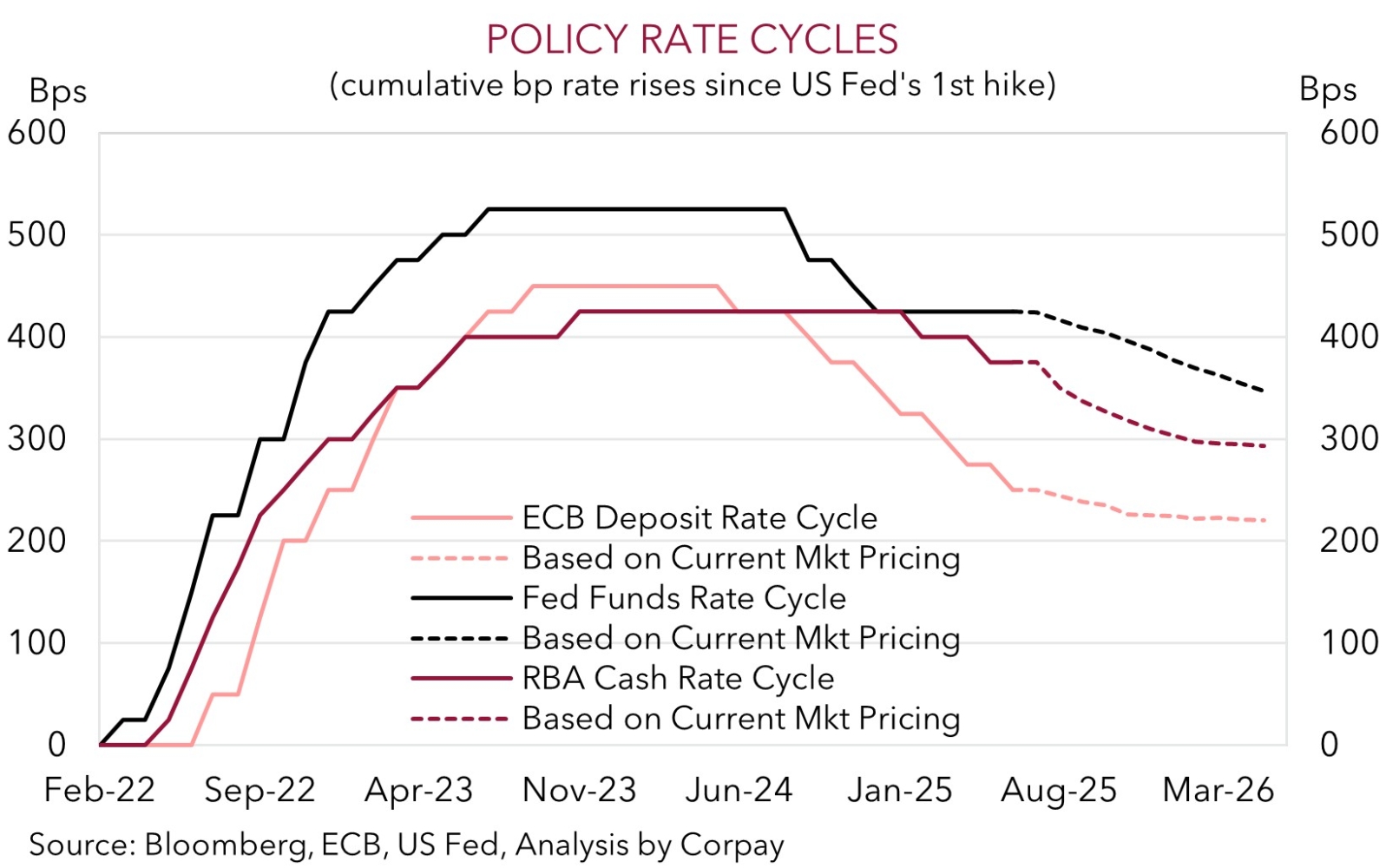

The global business PMIs are due this week (Thurs), US Fed Chair Powell speaks (Tues night AEST), and the European Central Bank meets (Thurs night AEST). The ECB is expected to hold steady after delivering 200bps worth of cuts so far this cycle. Overall, we remain of the view that the USD, which is still tracking below our ‘fair value’ estimate, is biased to extend its recent upswing in the near-term given resilience in the US data and/or prospect for intermittent tariff related volatility.

Trans-Tasman Zone

The relatively quieter time in markets helped the AUD (now ~$0.6511) and NZD (now ~$0.5945) bounce back a bit on Friday (see above). However, it wasn’t enough to recover earlier losses with the AUD shedding ~1.1% last week, its first weekly fall in a month, while the NZD posted a back-to-back weekly decline of ~0.8%. Some strength on most of the major crosses also gave the AUD a helping hand on Friday. The AUD recorded gains of ~0.2-0.4% versus the JPY, GBP, CAD, and CNH.

Data wise, Q2 NZ CPI inflation was released this morning. Although the topline result was slightly below market expectations at 2.7%pa headline NZ inflation still came in a touch above the RBNZ’s projections. Within the detail external price pressures (i.e. tradeable inflation) look to be behind the miss compared to consensus forecasts with non-tradeable inflation (i.e. domestic prices) stickier. On net, we remain of the view that lingering NZ growth challenges and underlying inflation trends could see the RBNZ deliver a little more interest rate relief this cycle, though with that already discounted by markets we don’t expect it to exert much lasting downward pressure on the NZD over the medium-term.

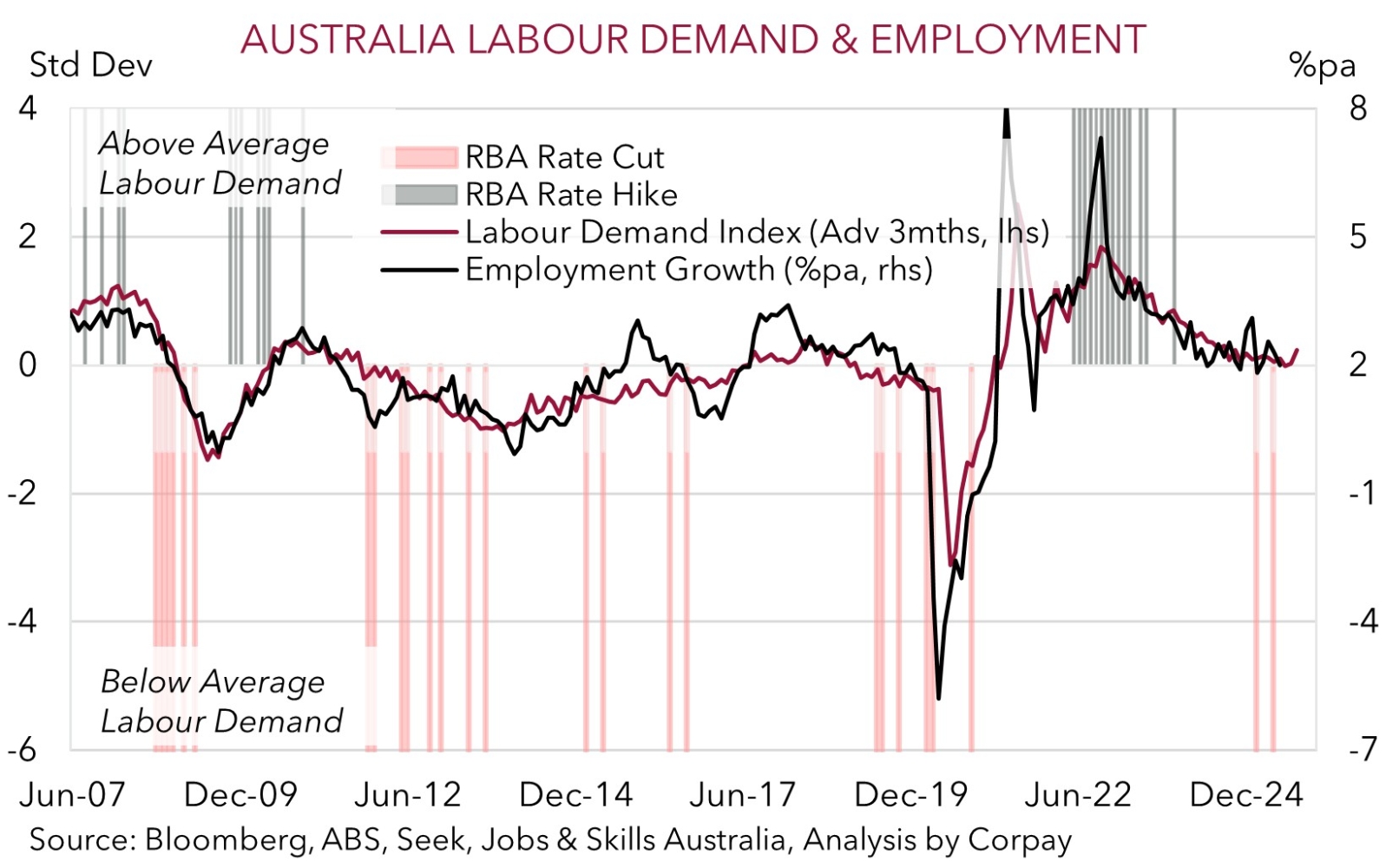

In terms of the AUD, a speech by RBA Governor Bullock is the local focal point this week (Thursday). Last weeks Australian jobs report underwhelmed predictions and showed that slack in the labour market is increasing. Based on our forward looking labour demand tracker softer employment growth/higher unemployment is likely over coming months. In our opinion this should support the case for the RBA to deliver a couple of interest rate cuts over H2 2025. A move by the RBA on 12 August is now more than fully discounted with 3 cuts by February baked in. Nevertheless, we believe ‘dovish’ comments by Governor Bullock this week could exert knee-jerk downward pressure on the AUD. Moreover, as outlined last week, we would also note that the AUD has usually had negative seasonal tendencies in late-July/August. AUD/USD has declined in August in 21 of the past 28 years. The implementation of the US’ new tariffs (1 August), rebound in US GDP growth (30 July), an on hold US Fed (30 July), subdued Q2 AU inflation (30 July), US jobs report (1 August), a RBA rate cut combined with ‘dovish’ guidance (12 August), signs of tariff induced US inflation (12 August), and/or no deals struck at the end of the US-China tariff truce (12 August) could be catalysts for this pattern to repeat in 2025.