• Middle East. Weekend developments with the US entering the fray have dampened sentiment. USD a bit firmer this morning. AUD on backfoot.

• Fluid situation. How Iran responds will be in focus. Will it look to disrupt global oil flows? More market volatility anticipated over the period ahead.

• Event Radar. Data wise AU CPI indicator due this week. Global PMIs are out today. Fed Chair Powell speaks & US PCE deflator is released.

Global Trends

Market wise there isn’t a lot to say about what happened on Friday night with US equities drifting back (S&P500 -0.2%), bond yields a touch lower, and the firmer USD exerting some downward pressure on cyclical currencies like the AUD and NZD. That said, the further escalation in the Middle East conflict over the weekend should supersede Friday’s action, and the relative calm could seem like a distant memory. News the US stepped into the fray and launched strikes on Iran’s nuclear facilities may rattle nerves, though the extent will depend on Iran’s response. US President Trump has warned there might be more attacks if Iran does not make peace, while Iran has stated it reserves all options to defend its sovereignty and people.

In typical knee-jerk ‘risk off’ fashion US equity futures have opened a bit lower in early-Asian trade (S&P500 -0.5%), bond yields remain on the backfoot, oil prices have risen (Brent crude has increased ~3.5% to ~US$80/brl, a high since January), and the USD extended its upswing. AUD (now ~$0.6430) is tracking just above its 200-day moving average, with the NZD (now ~$0.5945) near the bottom of its 1-month range.

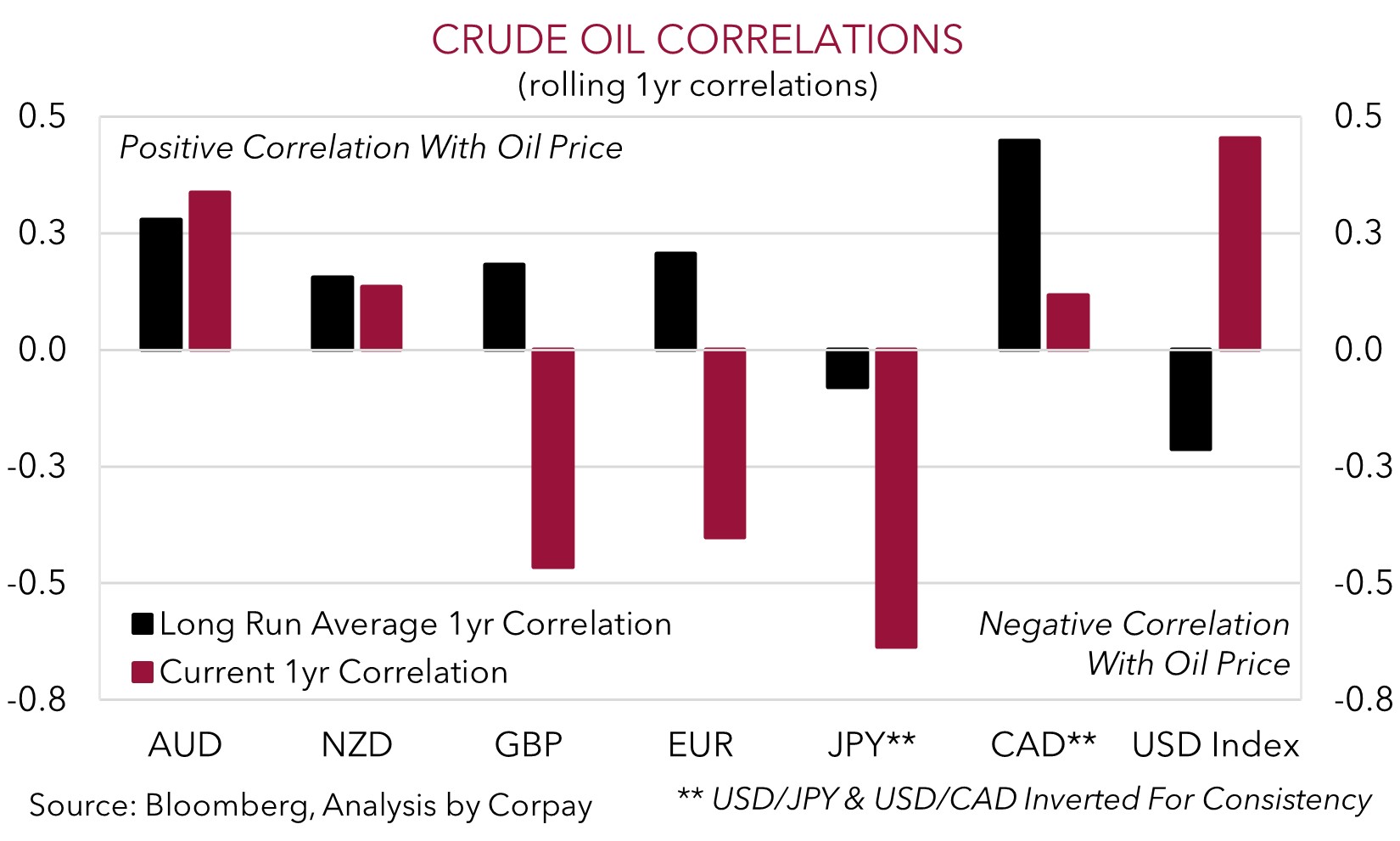

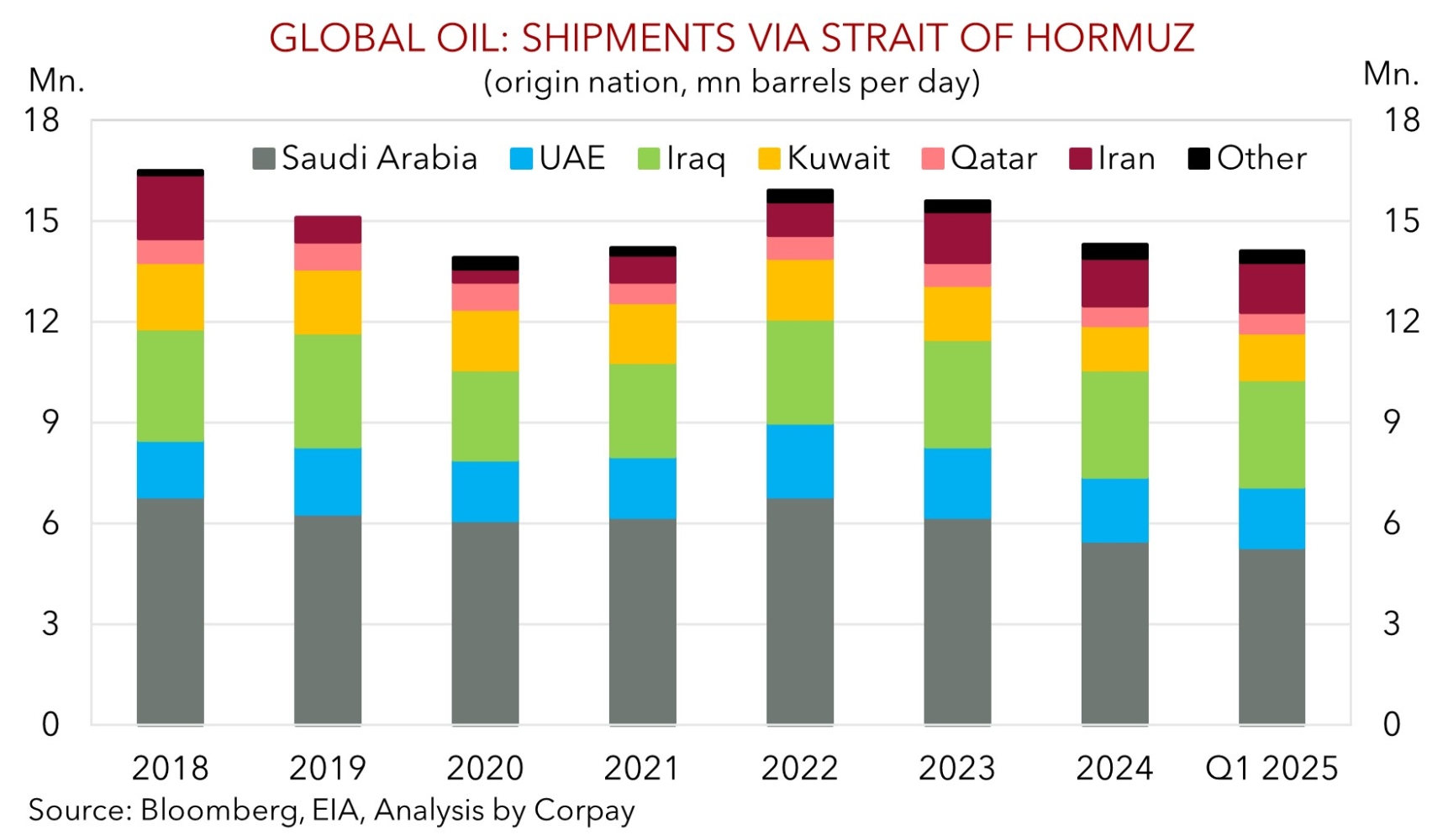

The situation remains fluid, and as outlined over the past week or so, more headline driven bursts of volatility should be anticipated over the period ahead. Key focus over the near-term will be how or if Iran fights back. One option being floated is the possibility Iran looks to block the Strait of Hormuz which would disrupt global oil flows given ~20% of the world’s supply is shipped through the narrow passage. As our chart shows, the major Middle East producers use this route with ~80% of Iran’s output sent to China. Hence, there have reportedly been calls for China to wade in via diplomatic channels. Any moves that crimp global oil supply are likely to see prices jump higher. And given the US’ swing to a ‘net energy exporter’ over the past few years this should be USD supportive, in our opinion.

On top of the Middle East ructions the latest global business PMIs are due (today), Fed Chair Powell delivers his semi-annual Congressional testimony (Tues night AEST), and the US PCE deflator (the Fed’s preferred inflation gauge) is released (Fri night AEST). On balance, we believe signs the US economy is holding up and/or comments from Chair Powell about the prospect of fewer interest rate cuts over the next year given tariff related inflation risks could be another positive USD impulse over the short-run.

Trans-Tasman Zone

The developments in the Middle East have dampened risk sentiment with the firmer USD and nervousness about global growth exerting downward pressure on cyclical currencies like the AUD and NZD (see above). At ~$0.5945 the NZD is around the lower end of its multi-week range, with the AUD (now ~$0.6430) also near a ~1-month low just above its 200-day moving average. The backdrop has also seen the AUD weaken on the crosses with falls of ~0.8-0.9% recorded versus the EUR and CNH, and more modest declines of ~0.4-0.5% posted against JPY, GBP, and CAD.

In Australia this week the monthly CPI indicator for May is released (Wednesday). Given it is the mid-quarter month the CPI indicator will have more info on services prices. Headline inflation is predicted to moderate a little (mkt 2.3%pa), however we think core inflation may continue to linger towards the top of the RBA’s 2-3% target band. While it isn’t perfect the monthly CPI indicator is one of the few remaining data releases ahead of the 8 July RBA meeting where markets are factoring in a ~80% chance another rate cut is delivered. Hence, any upside surprises in the CPI may generate some AUD volatility as RBA expectations adjust.

That said, barring a large miss from consensus forecasts, we doubt local macro developments will be in the AUD driver’s seat over the near-term. We expect geopolitics to be the main point of focus. And as outlined above, the risks of reprisals by Iran which disrupt global oil supply and push up prices might give the USD a leg up. As our chart illustrates, and as discussed last week, the US is now a ‘net energy exporter’ and as a result the USD is positively correlated with moves in oil prices. This is a change from the historical norm. This, and likely negative spillover into broader risk sentiment could see AUD/USD shed more ground over the short-run, in our view. However, based on Australia’s supportive surplus basic balance of payments position and standing as a ‘net energy exporter’, we believe the AUD could rebound against EUR and GBP given higher energy prices tend to act more like a tax on households/businesses in the Eurozone and UK.