• Market jolt. Reports & denials about whether Chair Powell may be removed generated a burst of volatility. On net, US equities rose & USD weakened.

• Fed changes. Fed Chair can’t be fired ‘without cause’. Disagreement over rates not enough. Potential change another example of US policy uncertainty.

• AU jobs. Volatile Australian jobs report released today. Will it show cracks are widening? US retail sales & import prices out tonight.

Global Trends

A burst of headline driven volatility washed through markets overnight. Rather than being tariff related it stemmed from possible changes at the top of the US Federal Reserve. Various media reports indicated President Trump was considering firing current Fed Chair Powell. In response, in moves usually seen in emerging market economies when chaotic policy steps are taken and the independence of the central bank is questioned, the S&P500 and USD lost ground, while bond yields rose. However, theses moves subsequently reversed course after President Trump stated that although he doesn’t rule anything out he thinks “it’s highly unlikely” Chair Powell will be removed before his term ends next year.

On net, US equities ended the whippy session higher (S&P500 +0.3%), bond yields declined (the 10yr rate fell ~3bps), and the USD recovered some of its intra-day falls though it is still lower than where it was 24hrs ago. The EUR (the major USD alternative) has edged up (now ~$1.1640) and USD/JPY (the second most traded currency) declined (now ~147.80). Elsewhere, the AUD (now ~$0.6529) and NZD (now ~$0.5947), which swung around in a ~1% range overnight, are a fraction above where they were this time yesterday.

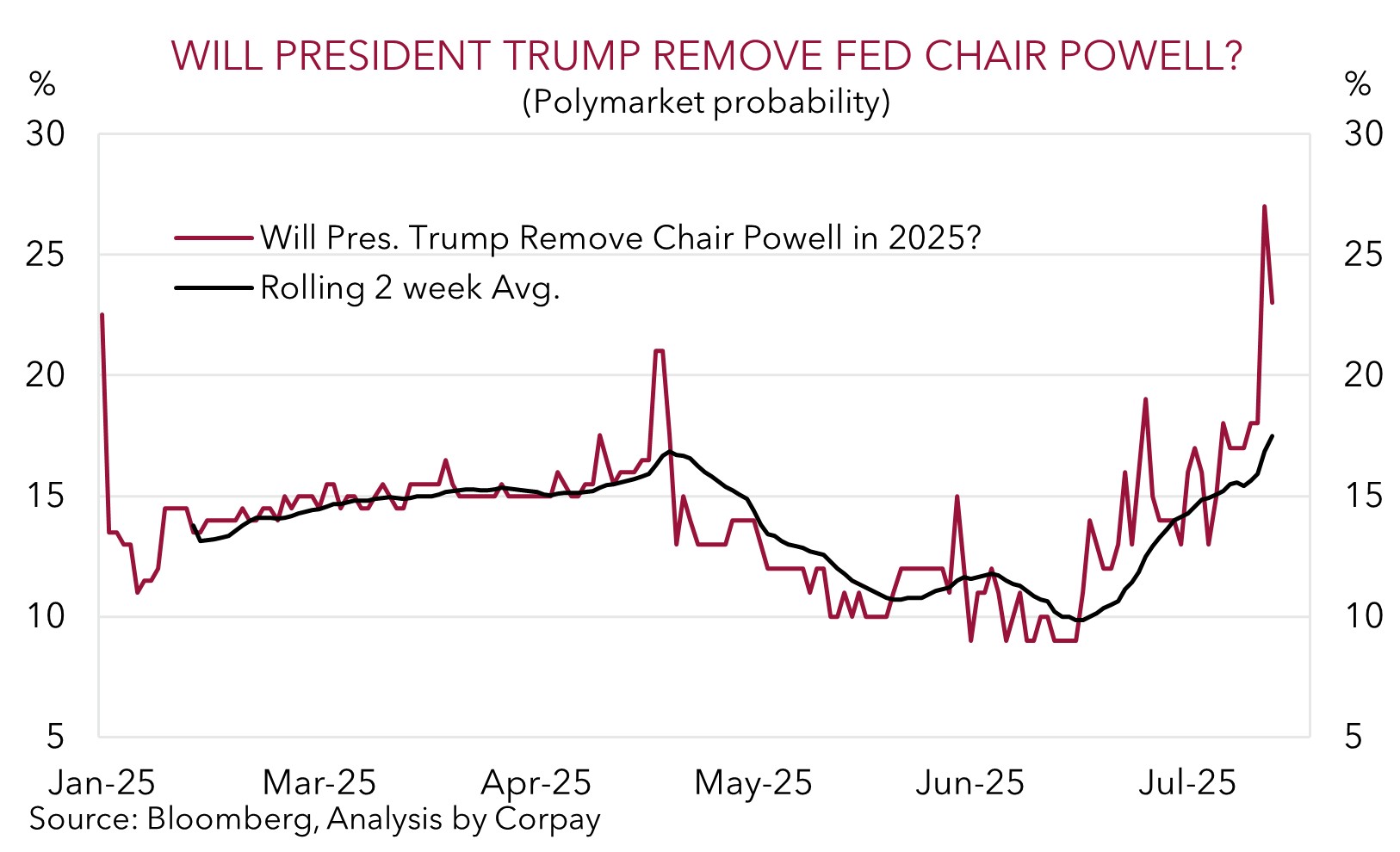

Where there’s smoke there’s often fire. As our chart shows, odds Chair Powell is removed have increased, and the latest batch of reports suggest things shouldn’t be viewed as a low probability ‘tail risk’. President Trump has been vocal about his displeasure the Fed, under Chair Powell’s leadership, hasn’t lowered interest rates more aggressively. As a reminder President Trump appointed Chair Powell during his first term but that seems to matter for little. No Fed Chair has been fired, dismissed, or removed by a President before the end of their term. The Federal Reserve Act allows for the removal of Board members (including the Chair) only “for cause” as it looks to preserve the Fed’s independence, a critical pillar to help achieve price/inflation stability. A disagreement over interest rates doesn’t qualify, but the apparent “excessive” US$2.5bn renovation costs of the Fed’s building have crept up as a potential avenue for the White House to investigate and possibly use.

The prospect of the Trump Administration looking at making changes at the US Fed is a factor, along with the push to implement and maintain hefty import tariffs, that may generate more market turbulence over the period ahead. The policy uncertainty and economic challenges the US is facing over the next year are reasons why we expect the USD to weaken over the medium-term. However, in the short-run, we believe the USD may garner support from a rebound in US retail sales and/or lift in import prices (both 10:30pm AEST). If realised, this could dampen expectations looking for the US Fed to cut rates over Q3.

Trans-Tasman Zone

The intra-day volatility in financial markets generated by reports and denials about whether US Fed Chair Powell may be removed whipped around the AUD and NZD over the past 24hrs with both trading in a ~1% range (see above). On net, the AUD (now ~$0.6529) and NZD (now ~$0.5947) are a fraction higher compared to where they were this time yesterday, although both are lower relative to where they closed last week. On the crosses the AUD has been mixed. The AUD lost a bit of ground against the EUR (-0.1%), JPY (-0.5%), and CAD (-0.1%), while it strengthened versus the NZD (+0.2%) and CNH (+0.2%).

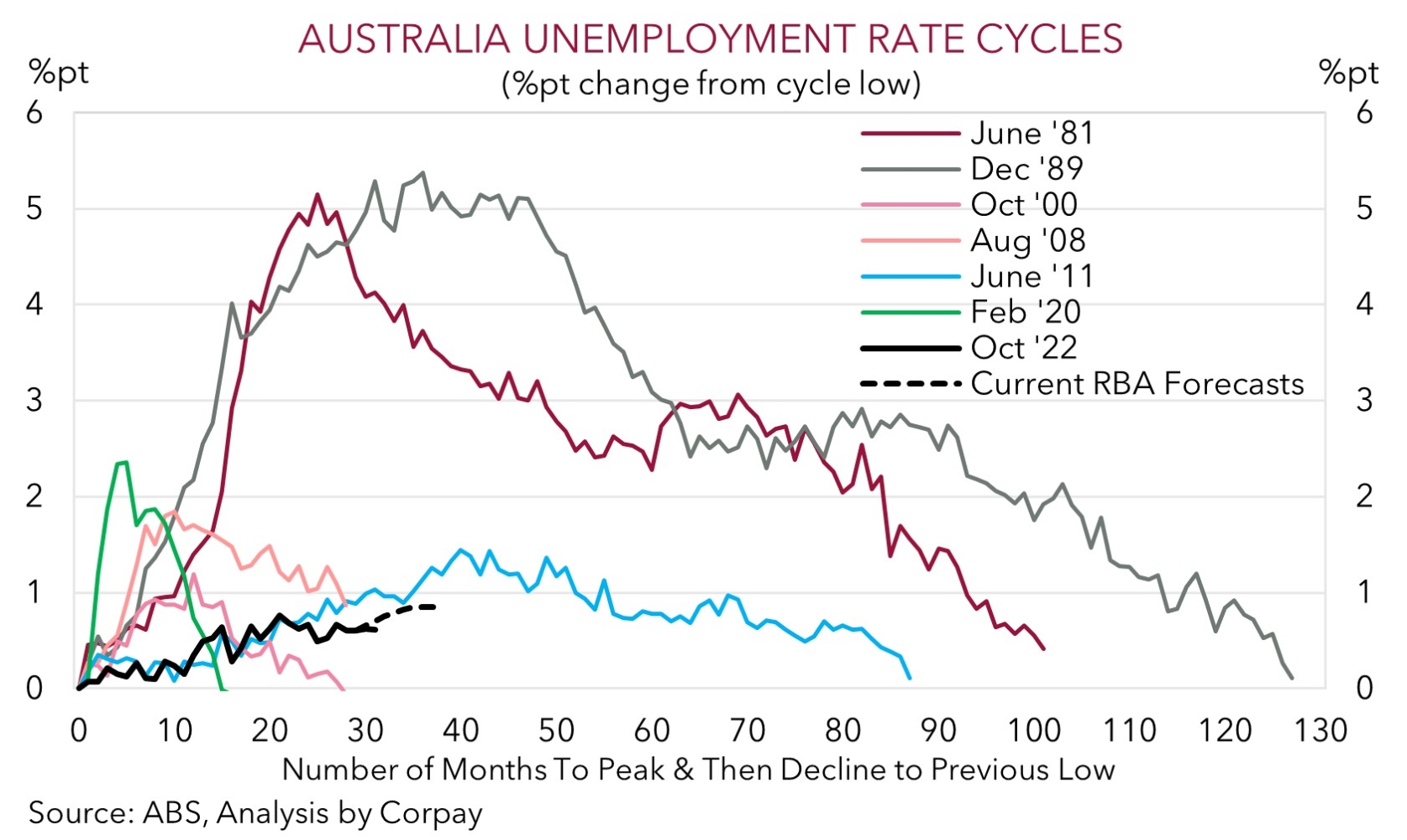

Today in Australia the volatile monthly employment data is released (11:30am AEST). The Australian jobs market has been remarkably resilient in the face of slower private sector growth and higher interest rates. As our chart shows, the upswing in unemployment so far this cycle has been fairly modest compared what happened before. That said, forward looking demand indicators like job ads and hiring intentions have turned down, suggesting weaker jobs growth down the track. In our view, there are risks the June labour market report shows overall conditions are softening with the subsamples within last month’s survey hinting at a possible rise in the unemployment rate. Cracks in the Australian jobs market might reinforce thinking the RBA will lower interest rates a few more times over H2 2025, which in turn may exert some downward pressure on the AUD in the short-term, in our opinion. As could a rebound in US retail sales (10:30pm AEST).

Beyond that, we would also reiterate that the AUD has usually had negative seasonal tendencies in late-July/August. AUD/USD has declined in August in 21 of the past 28 years. The implementation of the US’ new tariffs (1 August), rebound in US GDP growth (30 July), an on hold US Fed (30 July), US jobs report (1 August), a RBA rate cut combined with more ‘dovish’ guidance (12 August), signs of tariff induced US inflation (12 August), and/or no more deals struck at the end of the US-China tariff truce (12 August) could be drivers for this pattern to repeat in 2025.