• Positive vibes. Risk markets supported by signals last nights ECB rate hike could be the last, more policy easing in China, & positive US retail sales.

• EUR & GBP softer. The shift in relative yield spreads has weighed on EUR & GBP. AUD has held its ground, with AUD/EUR & AUD/GBP rising.

• Data pulse. Also helping the AUD was a positive local employment report. Today, the market focus will be on the August China activity data.

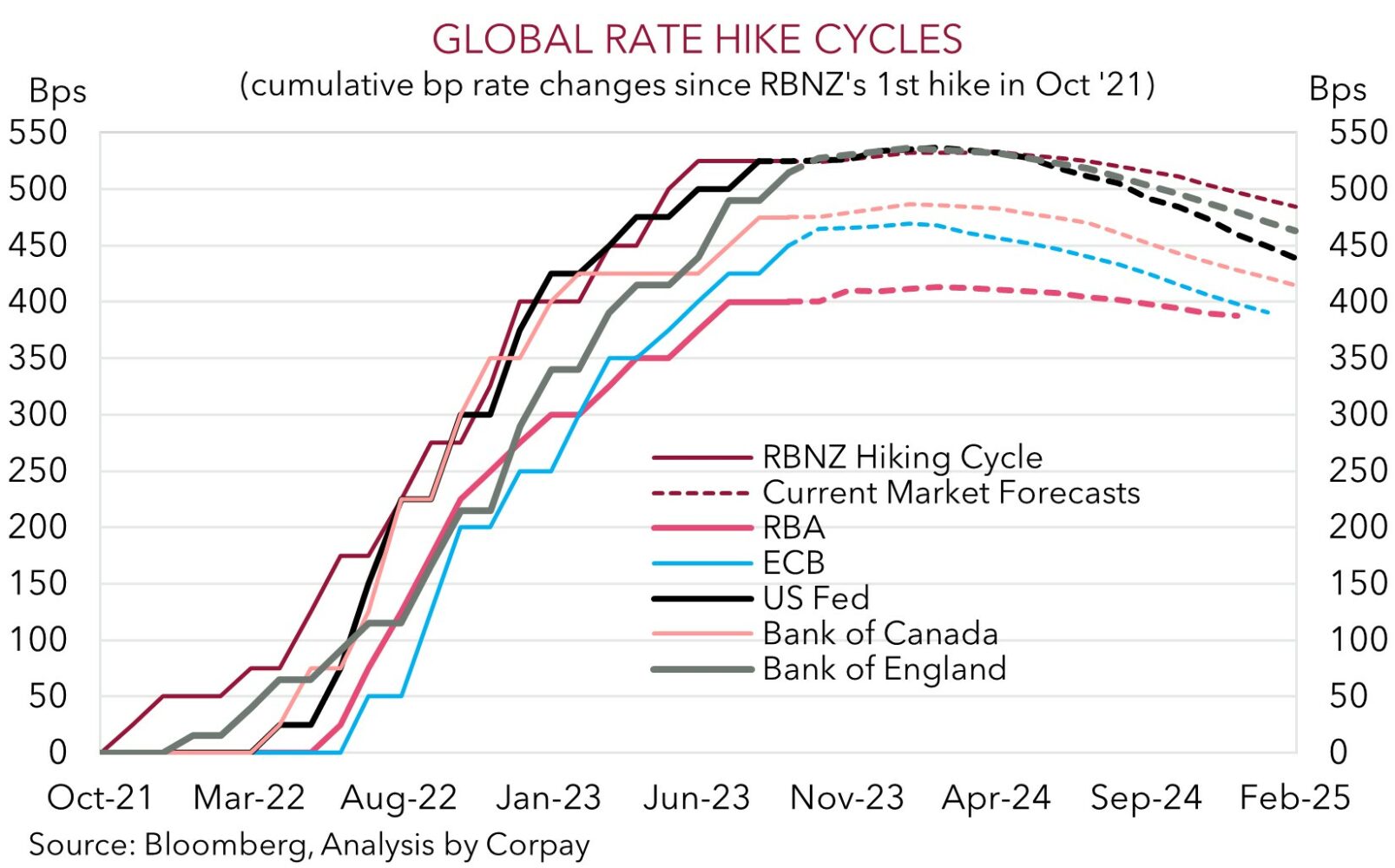

It has been a busy 24hrs with several data releases and policy decisions coming through. On net, the events have supported risk sentiment with signals from the ECB the tightening phase is nearing its end, more policy easing in China, and US data brightening growth expectations. In terms of the specifics, the ECB raised rates by another 25bps, lifting the main policy rate to 4.5%. Markets and analysts were evenly split as to whether a hike would occur. But downward revisions to its Eurozone growth outlook, coupled with forecasts showing inflation back near target in 2025, and updated guidance stating that the ECB thinks “rates have reached levels” that should be sufficiently restrictive has solidified thinking the interest rate peak is in.

Elsewhere, US retail sales beat expectations, rising by 0.6% in August. That said, higher gasoline prices boosted the topline numbers. The retail sales control group, which feeds into US GDP and excludes various volatile items, ticked up by a far more modest 0.1%, and prior months were revised lower. US jobless claims remained at a low levels, indicative of still solid conditions, and producer price inflation picked up with the upswing in oil prices flowing through to the headline annual growth rate. In China, ahead of today’s activity data batch for August (released 12pm AEST), the PBoC cut the reserve requirement ratio for most banks by another 25bps. This is the 6th reduction this cycle and the first move since March. The RRR cut will add further liquidity to the banking system. The easing adds to the other incremental steps announced over recent weeks aimed at reinvigorating China’s stumbling economic recovery. Expectations for the China data appear quite downbeat. We think upside surprises could reinforce the markets positive mood.

Equities rose (EuroStoxx50 +1.3%, S&P50 +0.8%), as did energy and base metal prices. WTI crude oil is up another +1.8% to be over ~US$90/brl for the first time since mid-November, copper increased (+0.8%), while iron ore (now ~US$120/tonne) is up around its highest level in ~6-months. Bonds were mixed. European yields fell as markets trimmed back their interest rate expectations (German and UK 2yr and 10yr yields declined by ~3bps and ~6bps respectively). By contrast, US 2yr yields ticked up ~4bps (now 5.01%), although we would note that the implied probability of another Fed rate hike this cycle is little changed. Markets are still assigning just under a 50% chance of another increase by year-end. In FX, the shift in relative yield spreads has given the USD Index a lift, though this was due to a weaker EUR (now ~$1.0643, the bottom of its ~6-month range) and GBP which has slipped under its 200-day moving average (~$1.2433). USD/JPY has consolidated near ~147.45, and the AUD has nudged a bit higher compared to this time yesterday (now ~$0.6439).

Global event radar: China Activity Data (Today), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

Despite the firmer USD Index, the AUD has ticked up over the past 24hrs (+0.3% to ~$0.6439). The lift in equities and commodity prices on the back of further policy easing in China, strong signs from the ECB that its rate hiking cycle has ended, and solid US retail spending compounded yesterday’s positive Australian labour force report. This combination helped the AUD outperform on the crosses. AUD/EUR (+1.1% to 0.6050) and AUD/GBP (+0.9% to 0.5189) have popped up to levels last traded in early-August. AUD/JPY (+0.3%) is hovering just under ~95, while AUD/NZD (+0.4%) is up near ~1.09.

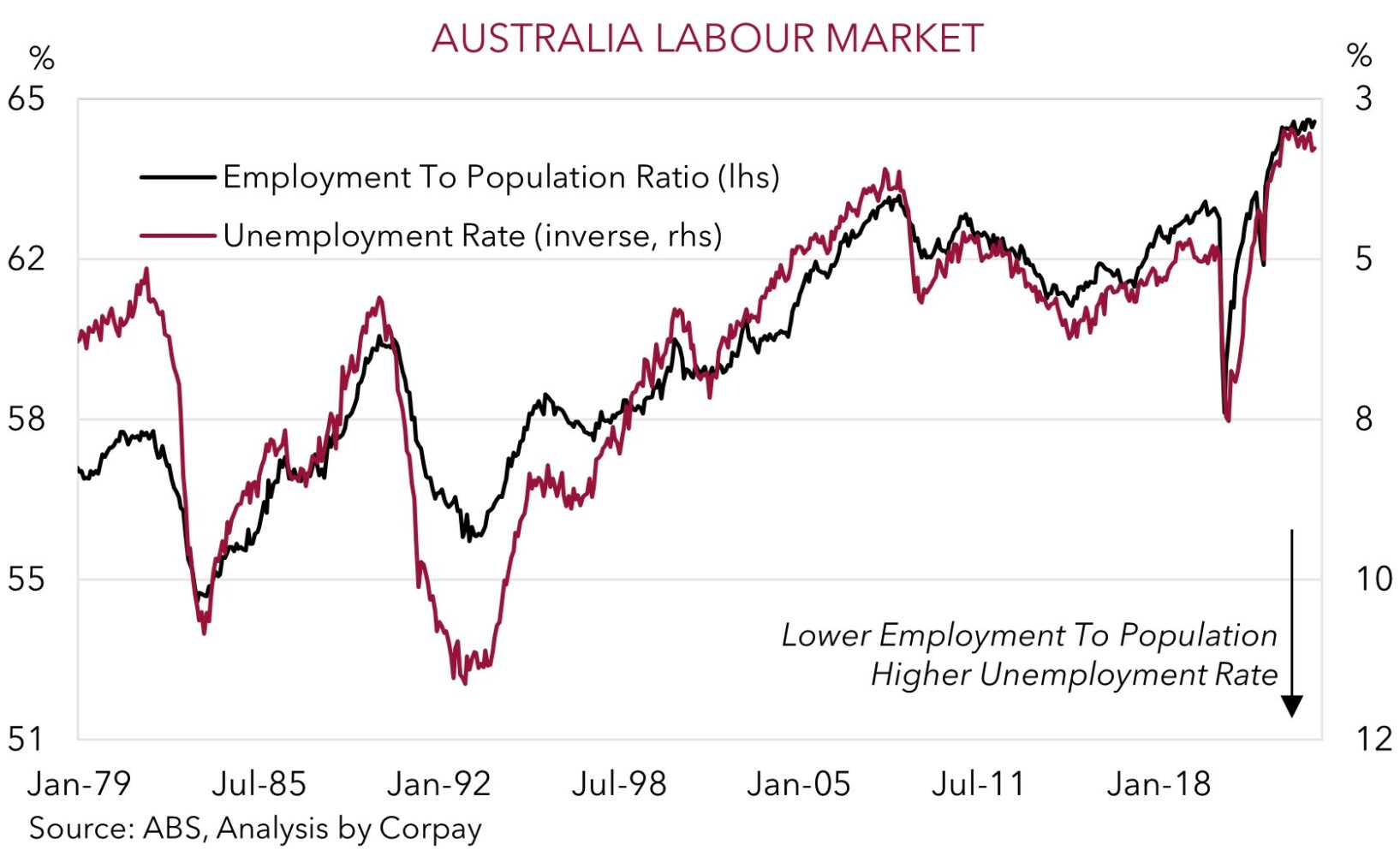

Locally, as mentioned, the August labour force report was better than anticipated. Employment bounce back after a soft July, with 64,900 jobs added. Most were part-time (+62,100), with full-time up only slightly (+2,800). Nevertheless, the jobs growth means the employment-to-population ratio remains very high, and despite increasing labour supply (the participation rate hit a record high), the unemployment rate held steady at 3.7%. Given the policy lags the labour market is often the last shoe to drop, and we expect the unemployment rate to gradually lift over time, but as of right now conditions still look quite tight.

Based on: (a) the stickiness in areas of services inflation like rents; (b) Australia’s poor productivity growth; (c) tightness in the labour market and slow-moving wage dynamics due to multi-year enterprise bargaining agreements; (d) upturn in house prices; and (e) income supportive tax cuts coming in mid-2024, another RBA rate rise can’t be completely ruled out. Markets are factoring in a ~55% chance of another RBA hike by March 2024. If anything, this list of factors points to the RBA lagging its peers when the easing/rate cutting cycles come through at some point down the track. The narrowing in relative yield differentials which has weighed on the AUD may be peaking, and we think over time there could be a swing in favour of a higher AUD, particularly with the population boom supporting aggregate demand and with China’s economic outlook looking like it is turning the corner as policymakers step up their efforts to re-energise activity. For more see Market Musings: AUD: Always darkest before the dawn.

Today, attention will be on China’s August activity data batch (12pm AEST). Analysts are assuming a bit of a mixed bag, with annual growth in retail sales (from 2.5%pa to 3%pa) and industrial production (from 3.75pa to 3.9%pa) projected to lift, while fixed asset investment is forecast to slow (from 3.4%pa to 3.3%pa). In our view, expectations about China’s growth outlook have become quite downbeat recently. With this in mind we think there could be a greater and more positive AUD reaction (particularly on the crosses) should the data positively surprise.

AUD event radar: China Activity Data (Today), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6562

SGD corner

USD/SGD has, on net, edged up modestly compared to this time yesterday (+0.2% to ~1.3635). The firmer USD Index as EUR and GBP came under pressure on the back of shifting relative yield spreads has been a key driver (see above). On the crosses, with the EUR underperforming, EUR/SGD (now ~1.4512) has lost ground. EUR/SGD is down near a ~3-month low. By contrast, SGD/JPY (now ~108.14) has held steady near the top of its historic range.

As discussed, ahead of today’s August data batch policymakers in China eased policy further by lowering the reserve requirement ratio for most banks. This adds to other steps taken recently aimed at stabilising, and in time, boosting growth momentum. Expectations for today’s China data appear low, in our view. We think positive surprises could keep risk sentiment buoyant, this in turn could be a positive for cyclical Asian currencies like the SGD over the near-term.

SGD event radar: China Activity Data (Today), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3401, 1.3459 / 1.3690, 1.3711