Don’t fight the US Federal Reserve. The old market saying is back with a vengeance following Chair Powell’s explicit ‘dovish’ pivot in his latest speech at 2024 Jackson Hole Symposium. After being laser focused on upside inflation worries over the past few years the pendulum has clearly swung to the other part of the Fed’s ‘dual mandate’ with downside risks to employment now front of mind.

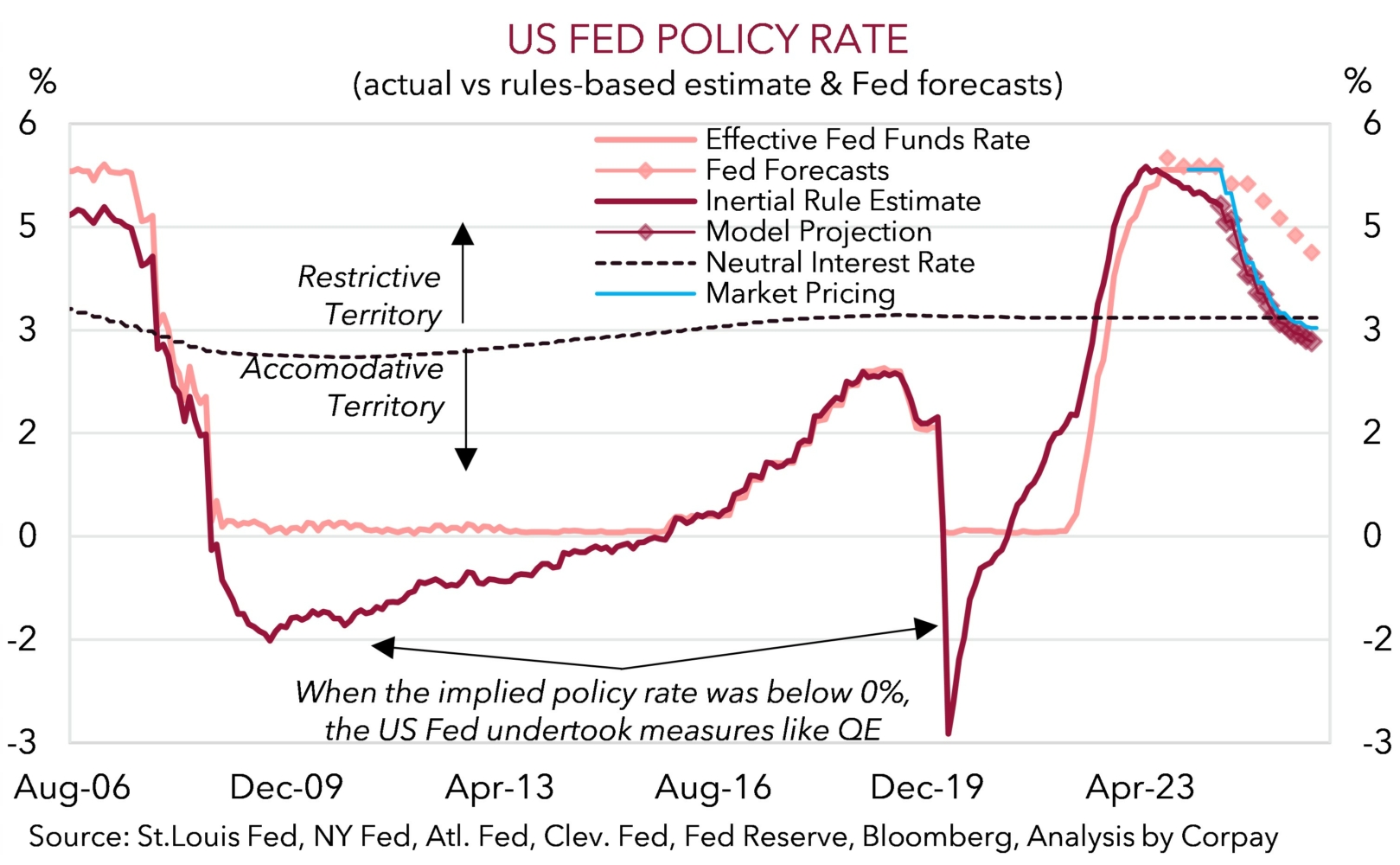

Importantly, in the words of Chair Powell “the time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks”. This is significant. With Chair Powell also stressing that the Fed “do not seek or welcome” a further cooling in the labour conditions, that the jobs market shouldn’t be a “source of elevated inflation pressures anytime soon”, and that the “current level” of the policy rate (i.e. 5.25-5.50%) gives them “ample room to respond” to the unfolding situation, a rather substantial recalibration lower in US interest rates is looming. This isn’t a surprise to us. Based on our replication of the Fed’s ‘policy rules’ and thoughts that a forward-looking risk management tilt to its decisions would gain prominence as policymakers try to navigate a ‘soft landing’ we had long assumed a shift was probable in late-Q2/Q3 2024 (see Market Musings: US Fed pivot has further to run) (chart 1).

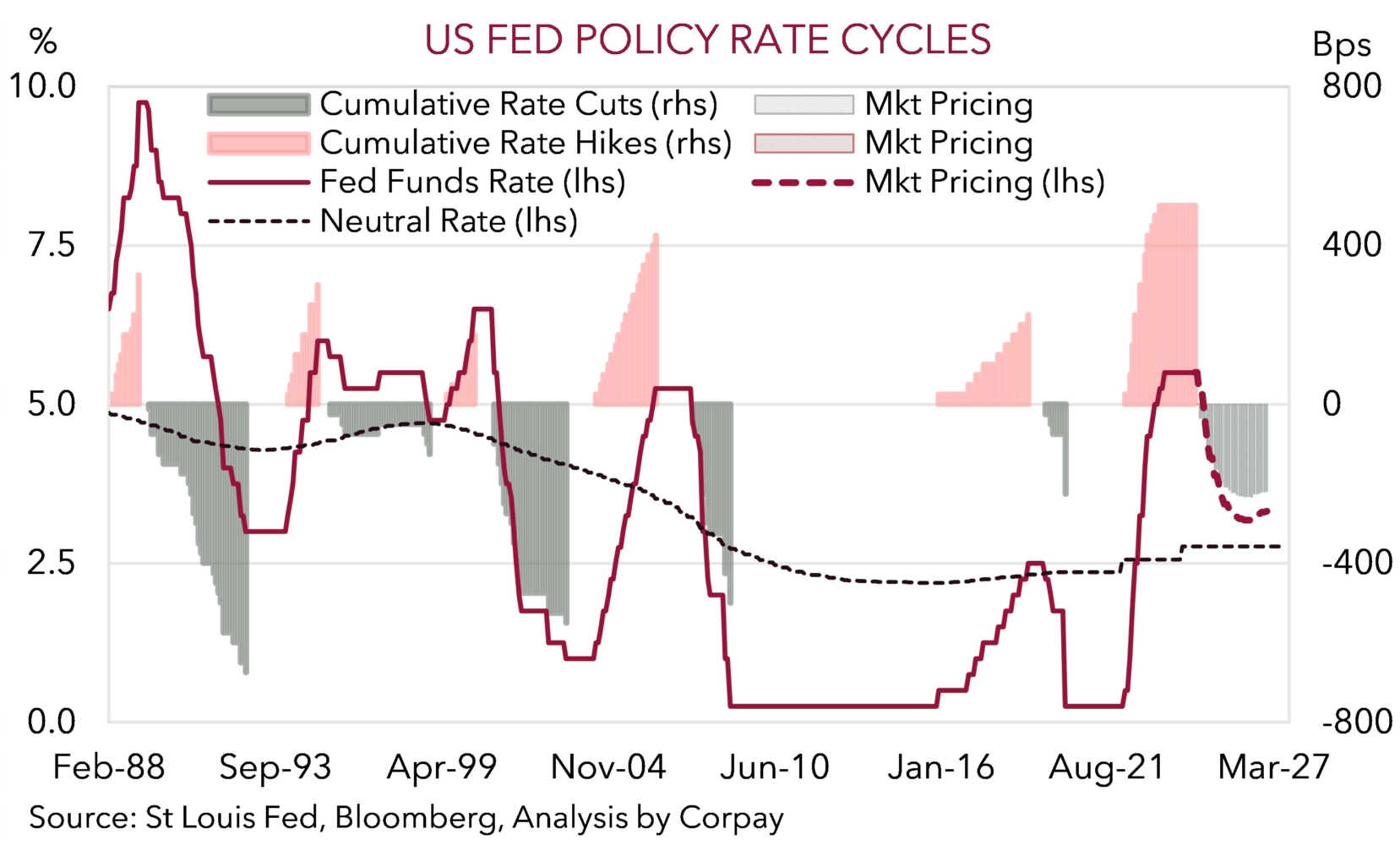

US interest rate cuts are coming, but the size and number of moves are up for debate. Markets are grappling with whether the US Fed will kick things off in 25bp or 50bp steps. Traders are assigning a ~60-70% chance of 50bp reductions by the US Fed at its next 5 meetings. The incoming data will be key and the August US jobs report (released 6 September) will be a major input in what the Fed does at its 18 September meeting. As things stand, we think calls for outsized near-term interest rate cuts are a bit aggressive, and we continue to believe a steady stream of orderly 25bp moves is more appropriate.

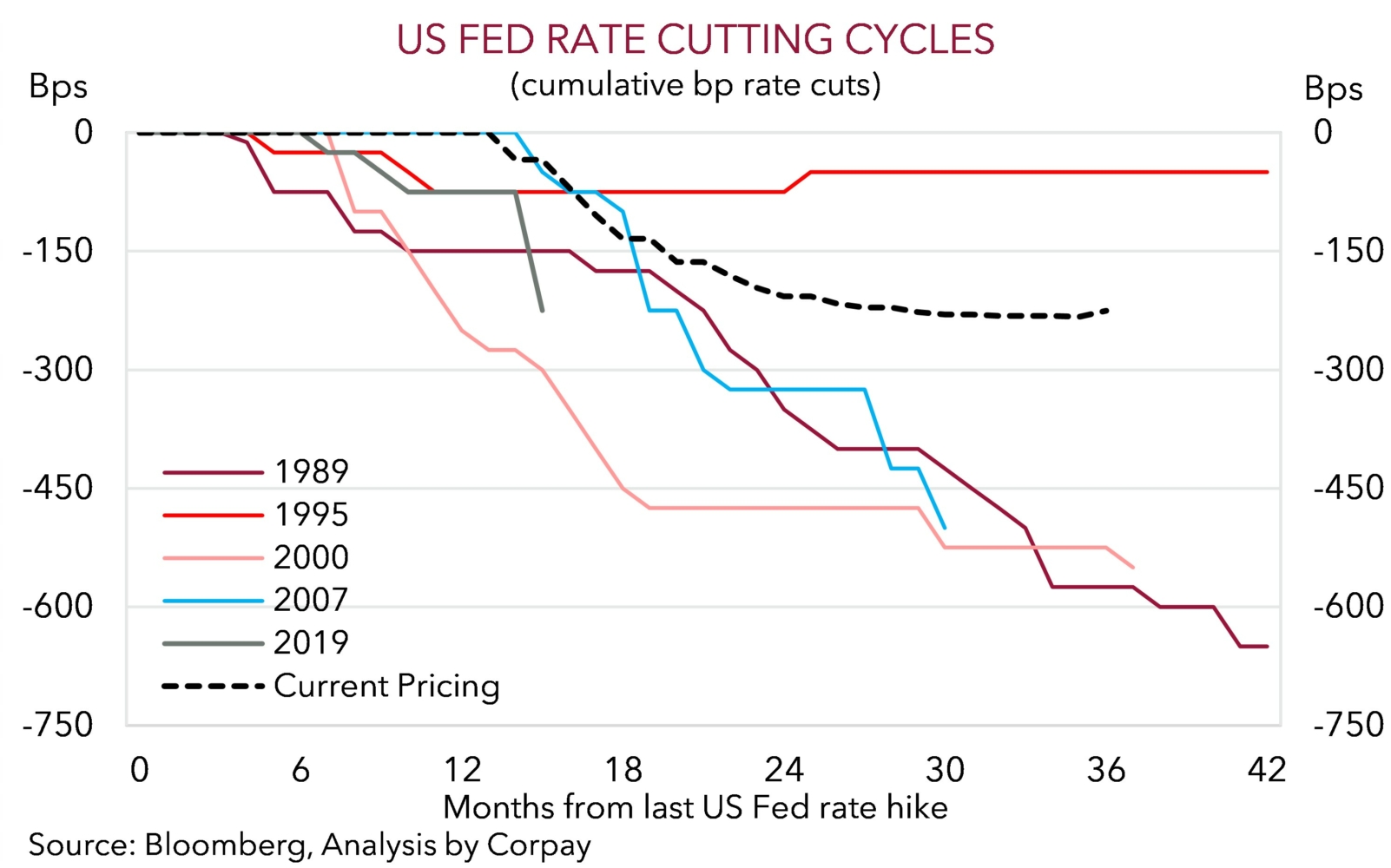

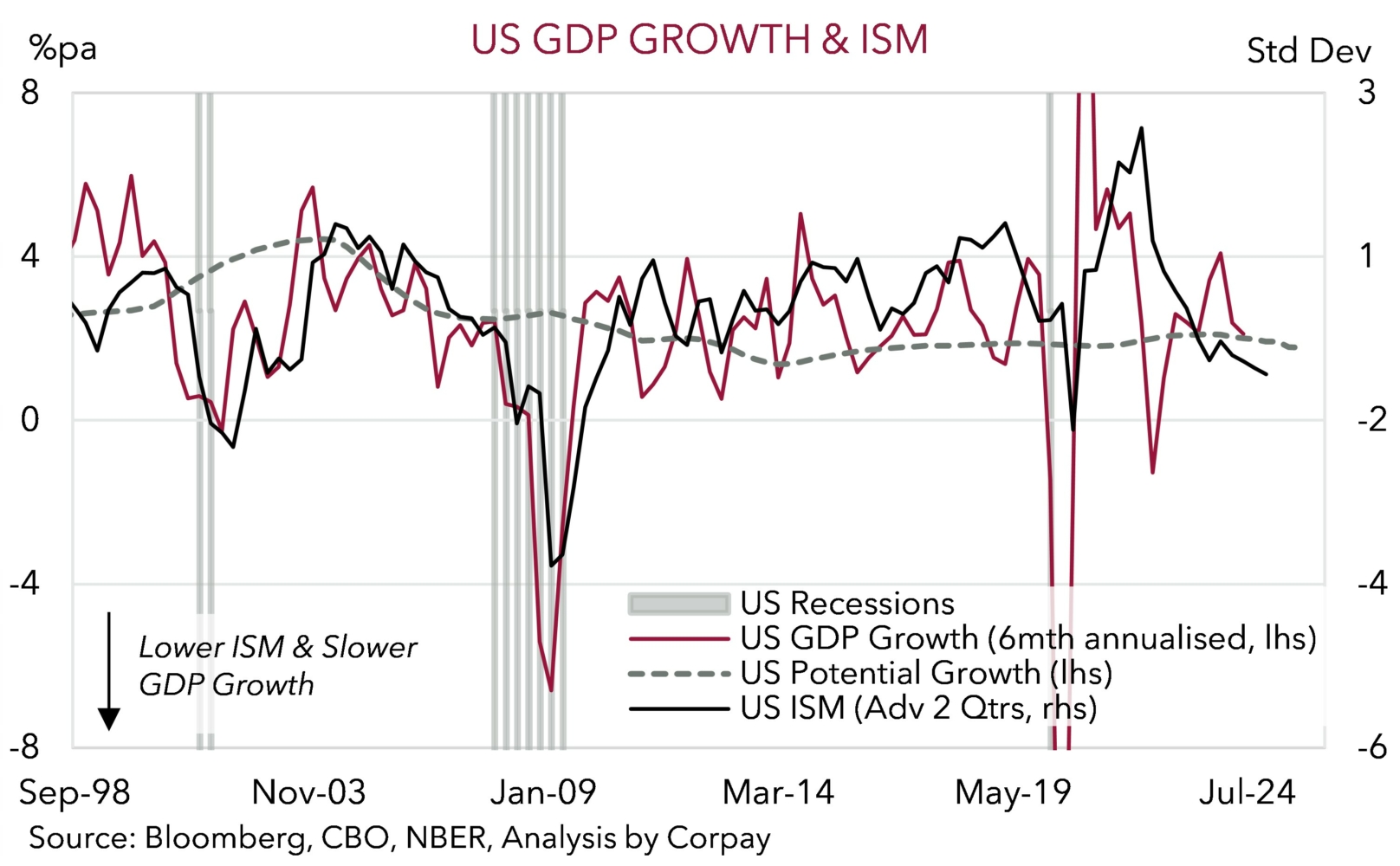

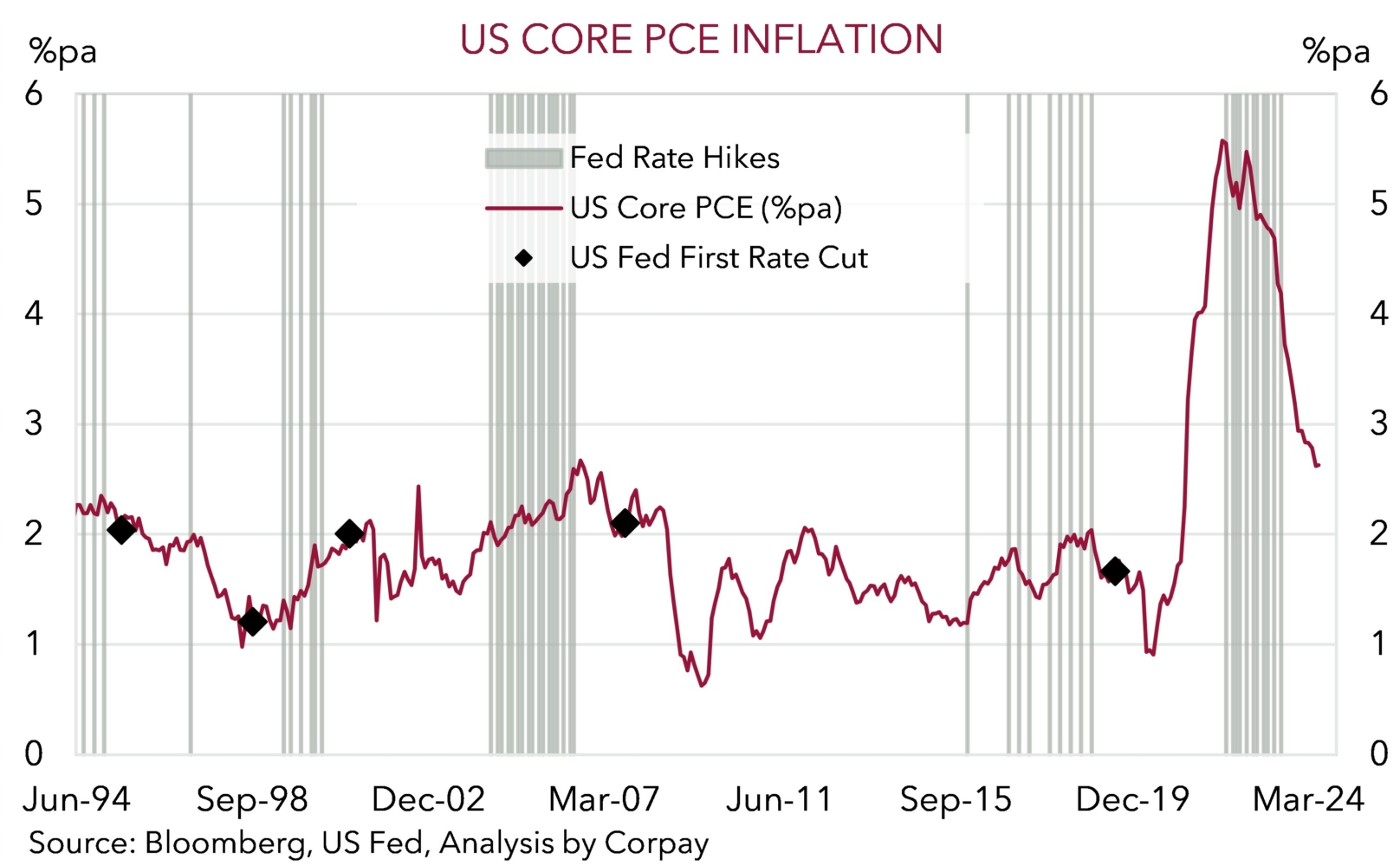

Notably, in 3 of the past 5 easing cycles the US Fed’s first step was to move by 25bps (chart 2). Moreover, a look across the US economic landscape doesn’t find any major macro or market disruptions brewing. US household debt levels are well down from pre-GFC levels, US growth has slowed but it remains positive and a decent way from recession (chart 3), and fiscal policy is loose. Additionally, while core inflation has unwound a lot of its COVID surge, it is north of where it was when previous US Fed easing cycles got underway (chart 4).

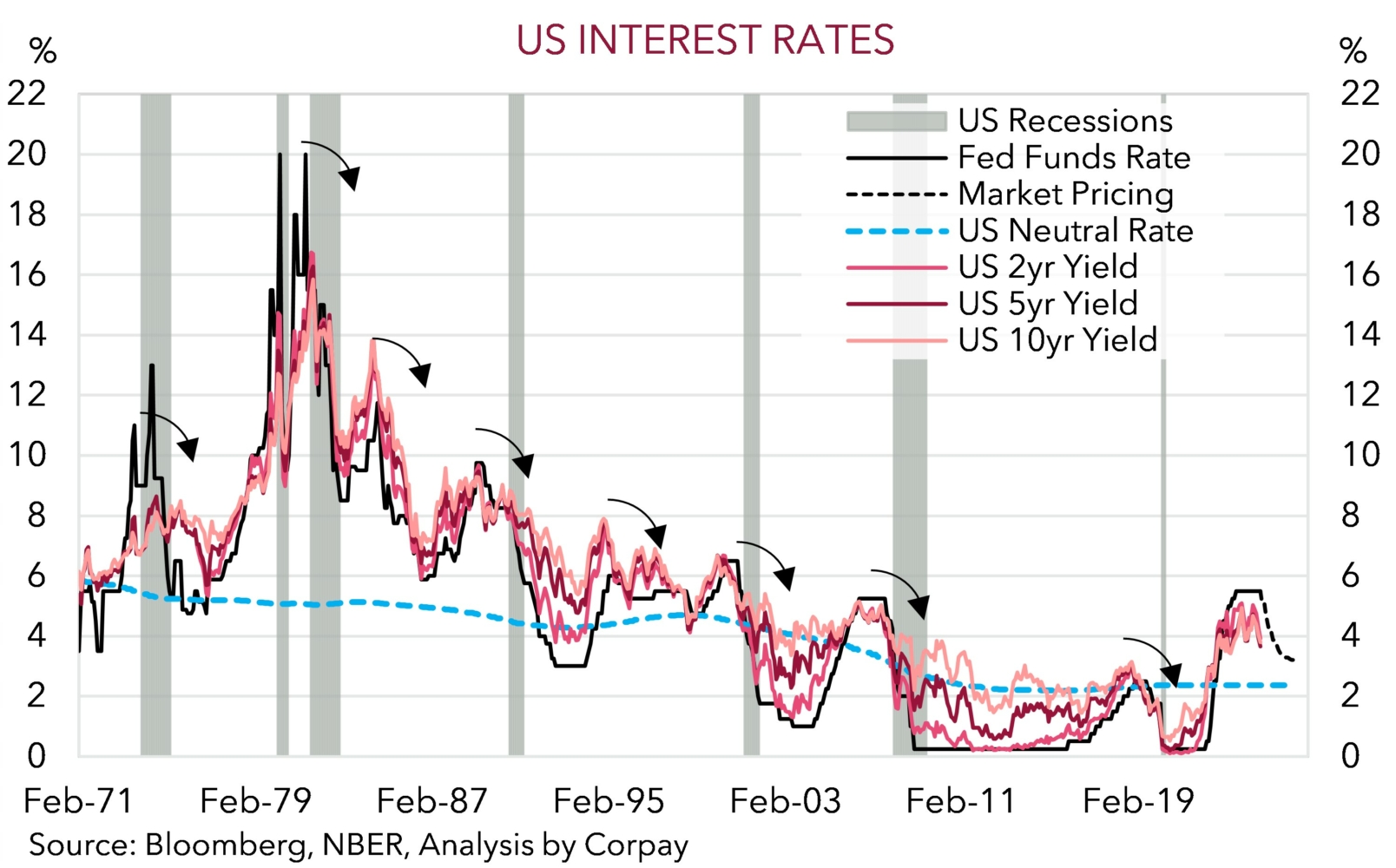

All up this suggests there is some chance the beleaguered USD recoups a little ground over the period ahead if the US economic data positively surprises consensus predictions and expectations for larger than normal Fed rate reductions are trimmed. However, we feel this would be a short-term influence on the USD. Fundamentally, the medium-term trajectory looks to be for the USD to weaken as Fed policy easing drags down US bond yields (this has been the usual pattern of play over the past ~50yrs) (chart 5). And importantly as the Fed’s actions are also aimed at underpinning activity and warding off a potential sharp deterioration in growth and jobs risk sentiment should also be propped up, constraining USD demand normally generated by downturns.

In our mind, the Fed’s preoccupation with avoiding a ‘hard landing’ may also mean longer-dated US interest rate expectations have scope to adjust even lower. Reducing interest rates back down to the equilibrium ‘neutral’ zone (which is pegged at ~2.75%) should be the US Fed’s initial signpost. Yet markets still aren’t there (markets are penciling in a trough of ~3%). Indeed, we would also point out that in the bulk of previous cycles interest rates generally moved below neutral into ‘expansionary’ territory (chart 6).

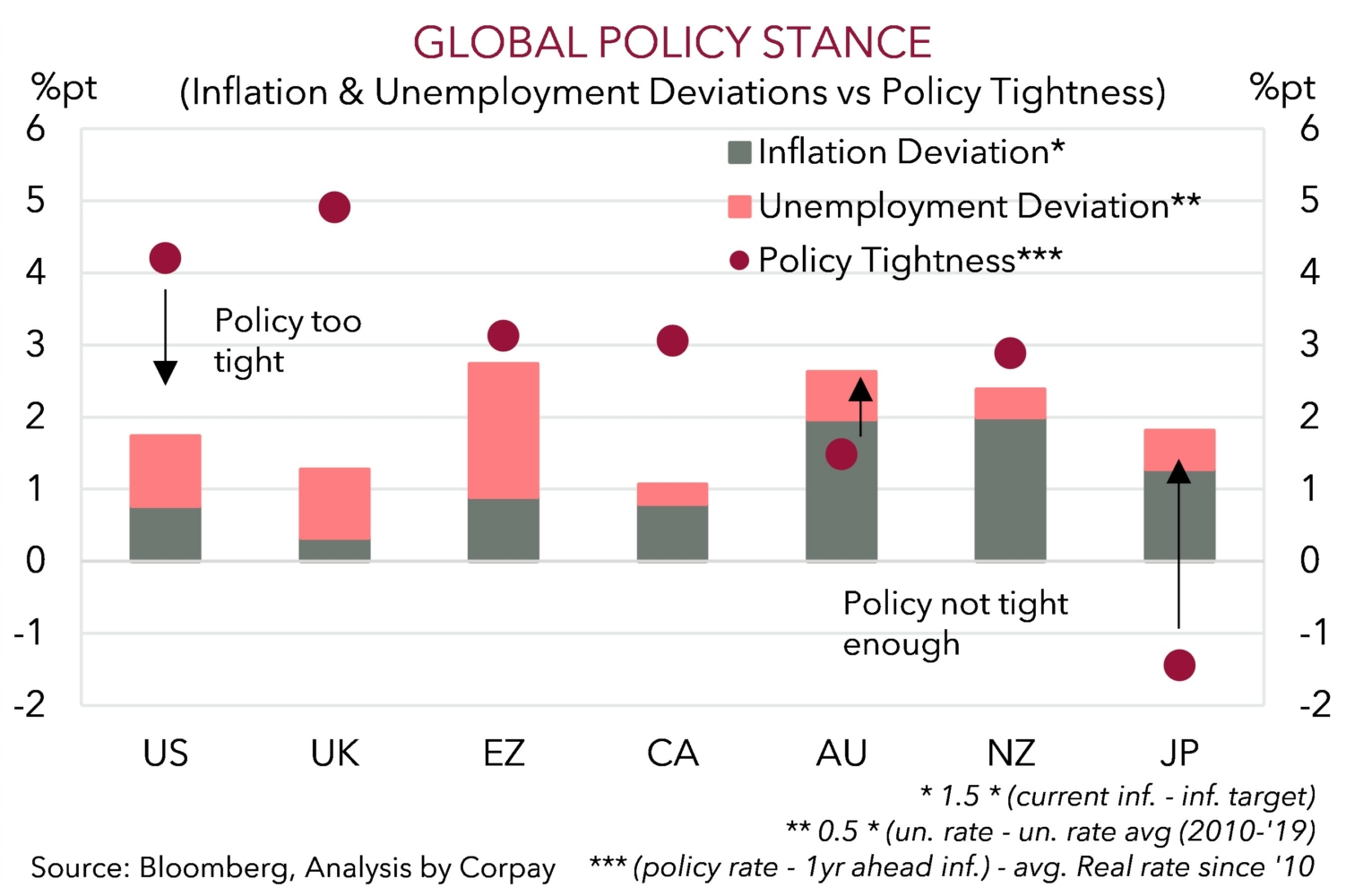

Markets don’t move in straight lines, and there will be bumps along the journey as risk sentiment waxes and wanes. However, as mentioned we expect the general underlying trend of a gradual deflating of the ‘overvalued’ USD to remain intact over coming quarters as growth and interest rate differentials progressively move against the US. FX is a relative price, and as our estimates of the current and appropriate ‘policy stance’ of the major central banks indicates the US Fed is a long way from where it should be (chart 7).

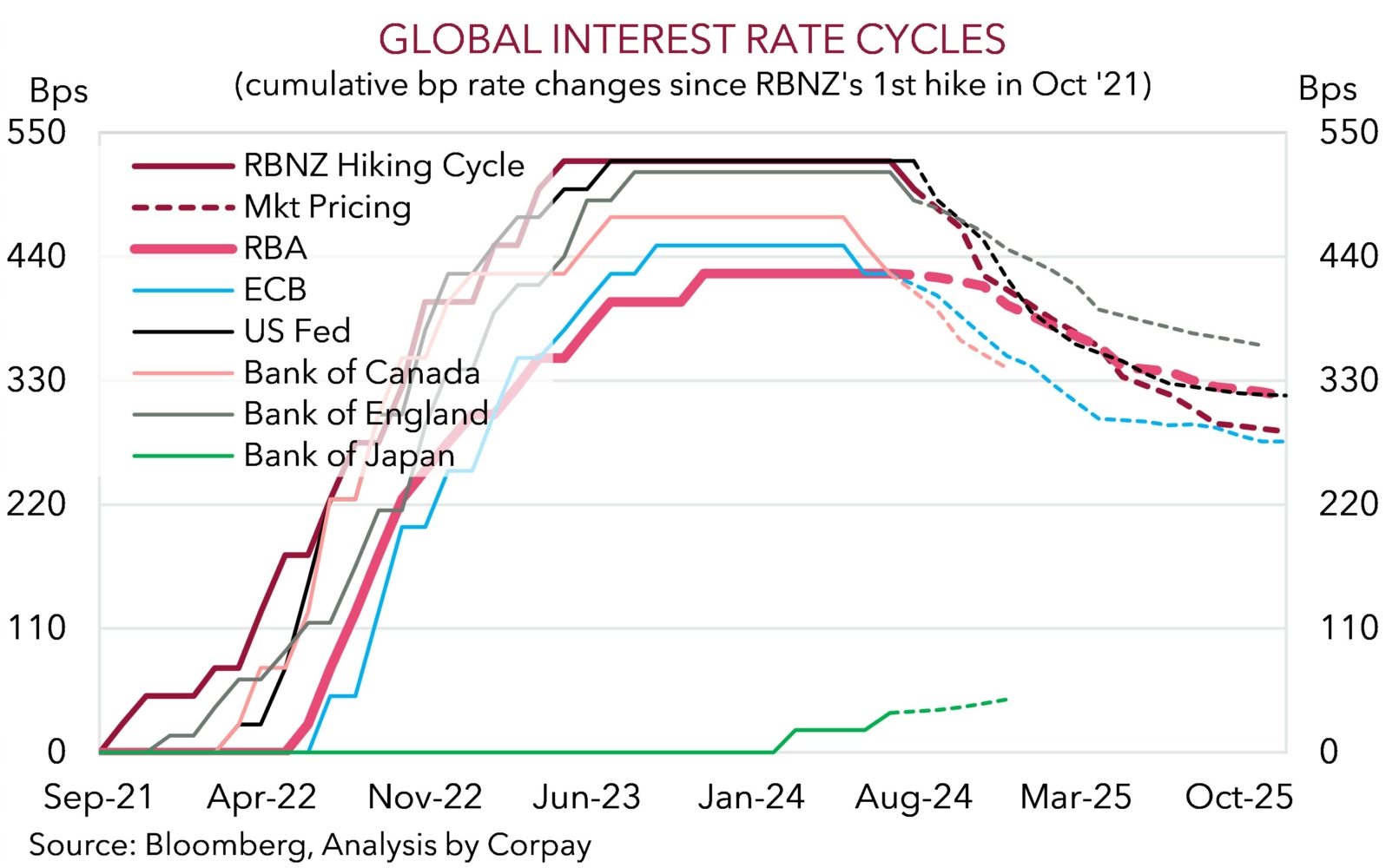

By contrast, the Bank of Japan still appears behind the curve, while the RBA’s ‘not as high for longer’ strategy is also on show (see Market Wire: RBA: Hold your horses). The burgeoning policy divergence between the US Fed and central banks such as the BoJ and RBA underpins our bullish longer-term bias towards the JPY and AUD (chart 8). As outlined previously, we think the next move by the RBA should be to lower rates. But this looks to be a story for H1 2025 with the still resilient Australian labour market, elevated level of activity across the private sector, sticky services prices, lower interest rate starting point, and flowing fiscal/income support also likely to limit how far it might go.