The dollar is losing momentum amid month-end cross-currents, but looks set to end October with its biggest gain in two years as growth data continues to surprise to the upside and anticipation rises ahead of next week’s election.

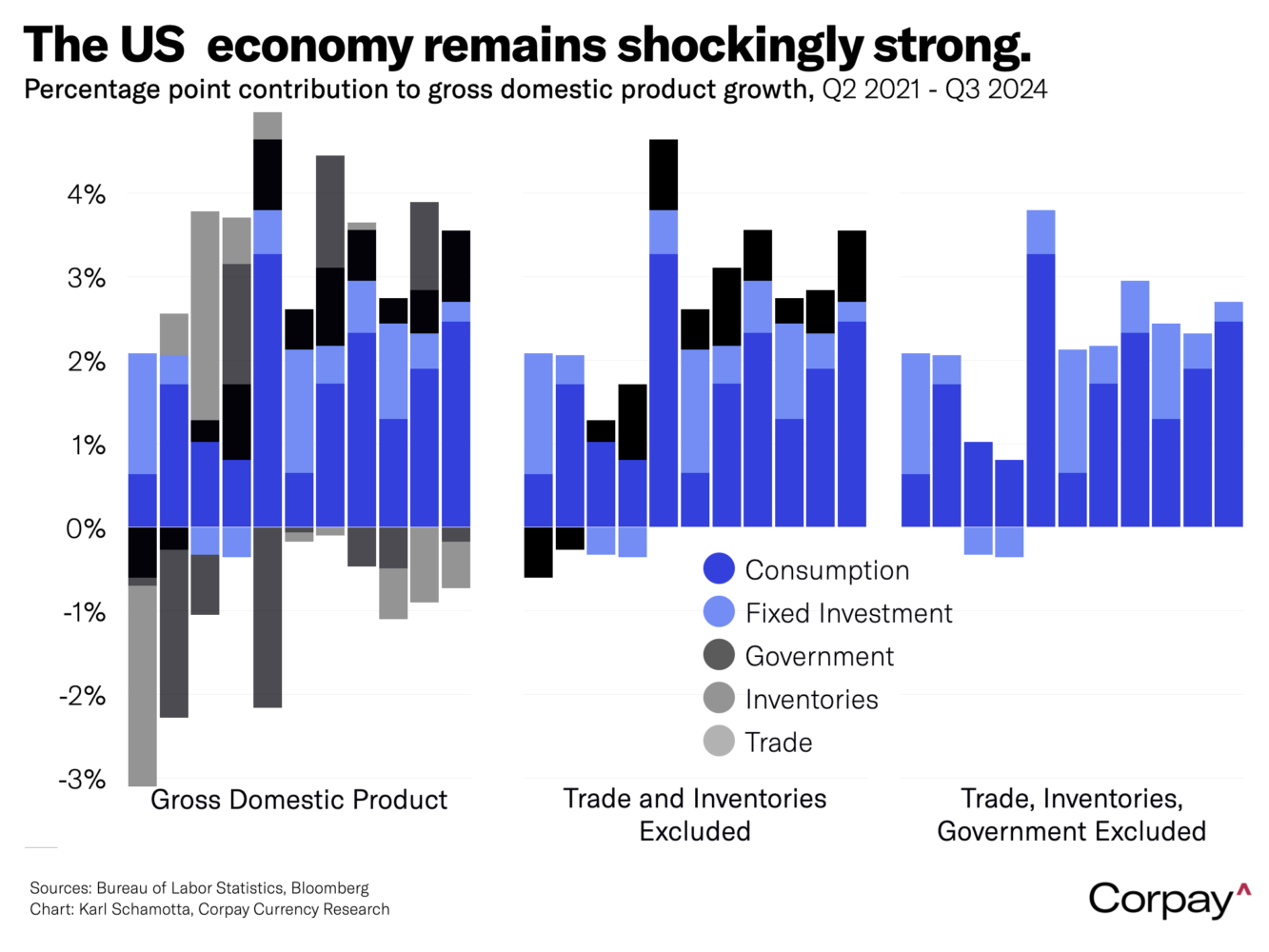

Numbers released yesterday showed the economy gaining steam. According to ADP’s measure, private sector employment jumped by 233,000 jobs in October, accelerating from 143,000 in September, and nearly doubling consensus forecasts. Gross domestic product climbed at a 2.8-percent annualised rate in the third quarter, slightly slowing from the second quarter’s 3-percent pace, but final private sales to domestic purchasers – an arguably-cleaner measure of underlying growth – rose 3.2 percent, up from 2.7 percent previously, and personal consumption climbed at the fastest pace since early 2023.

This morning’s data should leave monetary policy expectations unchanged. The core personal consumption expenditures deflator – the central bank’s preferred measure of inflation – climbed 0.3 percent month-over-month in September, up from 0.1 percent in August, up 2.7 percent on a year-over-year basis. Spending levels jumped by 0.5 percent in the month, but with personal income growing at a more sedate 0.3-percent pace, a decline in the savings rate did a lot of the heavy lifting. The Employment Cost Index showed wage pressures easing further to a year-over-year 3.9-percent rate in the third quarter, and weekly jobless claims remained elevated as hurricane-related effects intersected with the ongoing strike at Boeing factories in Washington.

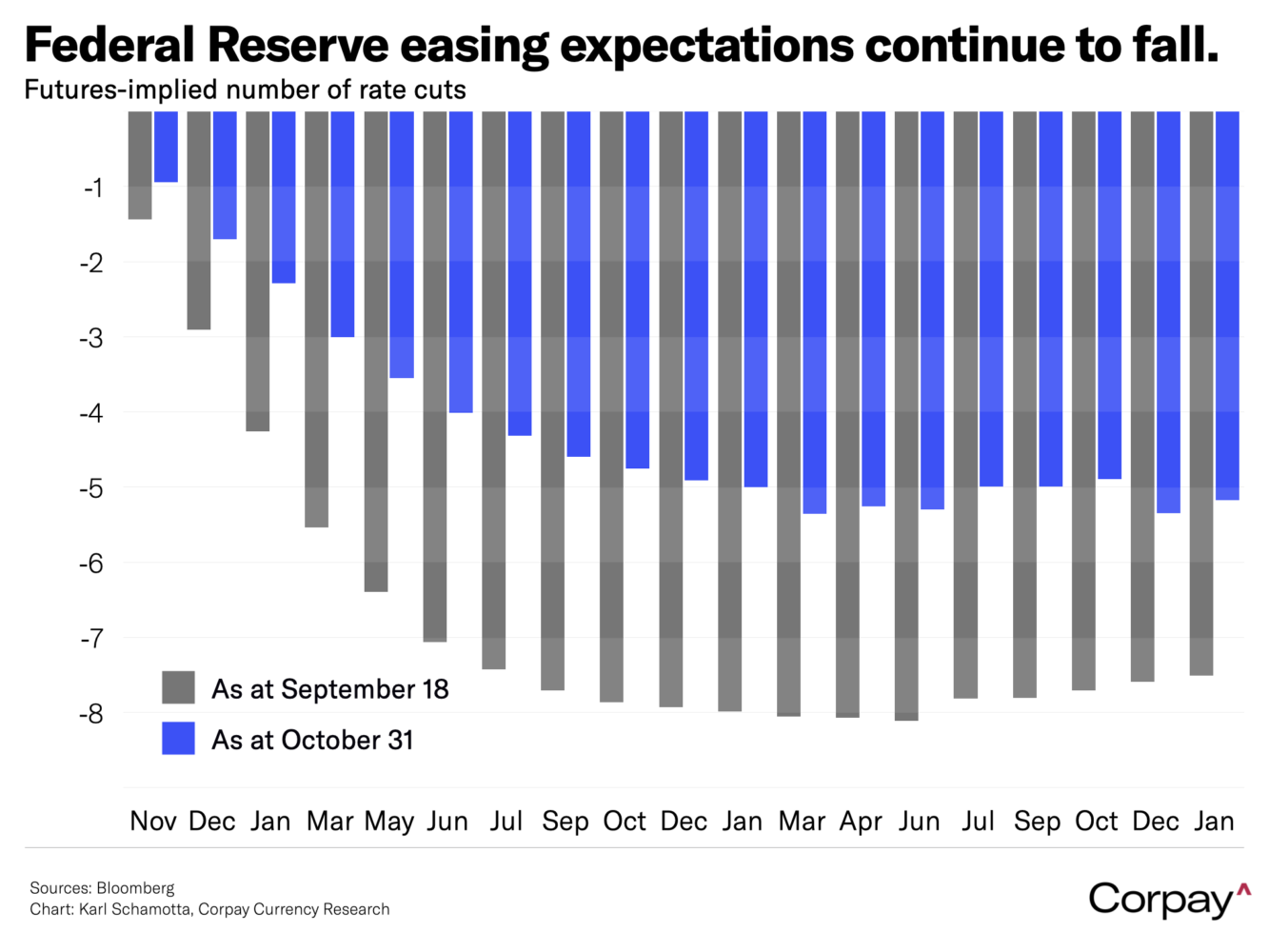

The Federal Open Market Committee is widely expected to deliver a quarter-point rate cut at next week’s meeting, followed by another four over the next year. This is down from the eight – almost nine – moves that were expected in the aftermath of the central bank’s September meeting, reflecting overwhelming evidence of economic resilience – and concern that inflation could remain stubbornly elevated in the new year, particularly under a Trump 2.0 regime.

Statistics Canada confirmed a lacklustre pace of growth in the Canadian economy through the end of the third quarter, keeping the loonie on the defensive. According to a preliminary estimate published a short time ago, the economy posted a 0.3-percent expansion in September – signalling a slightly stronger handoff to the fourth quarter – but growth was negative in July and flatlined in August, putting the rate for the quarter well below the Bank of Canada’s previous forecasts, and keeping hopes for a half-point rate cut in December alive. The Canadian dollar is pushing lower, but is again running into strong support below the 1.40 threshold. We think risks are tilted to the downside heading into Tuesday’s US election, and suspect that the exchange rate could weaken sharply if Donald Trump emerges victorious.

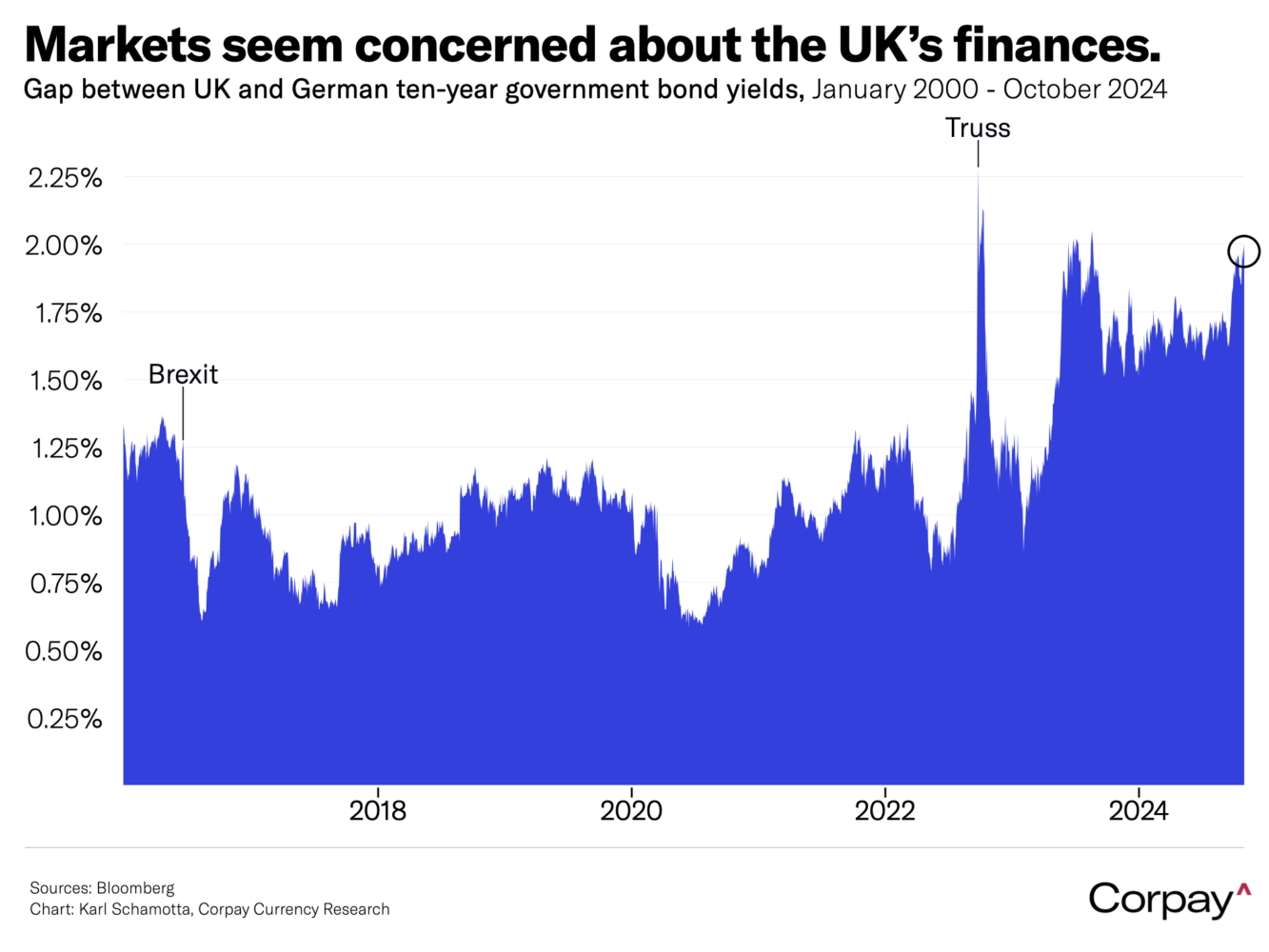

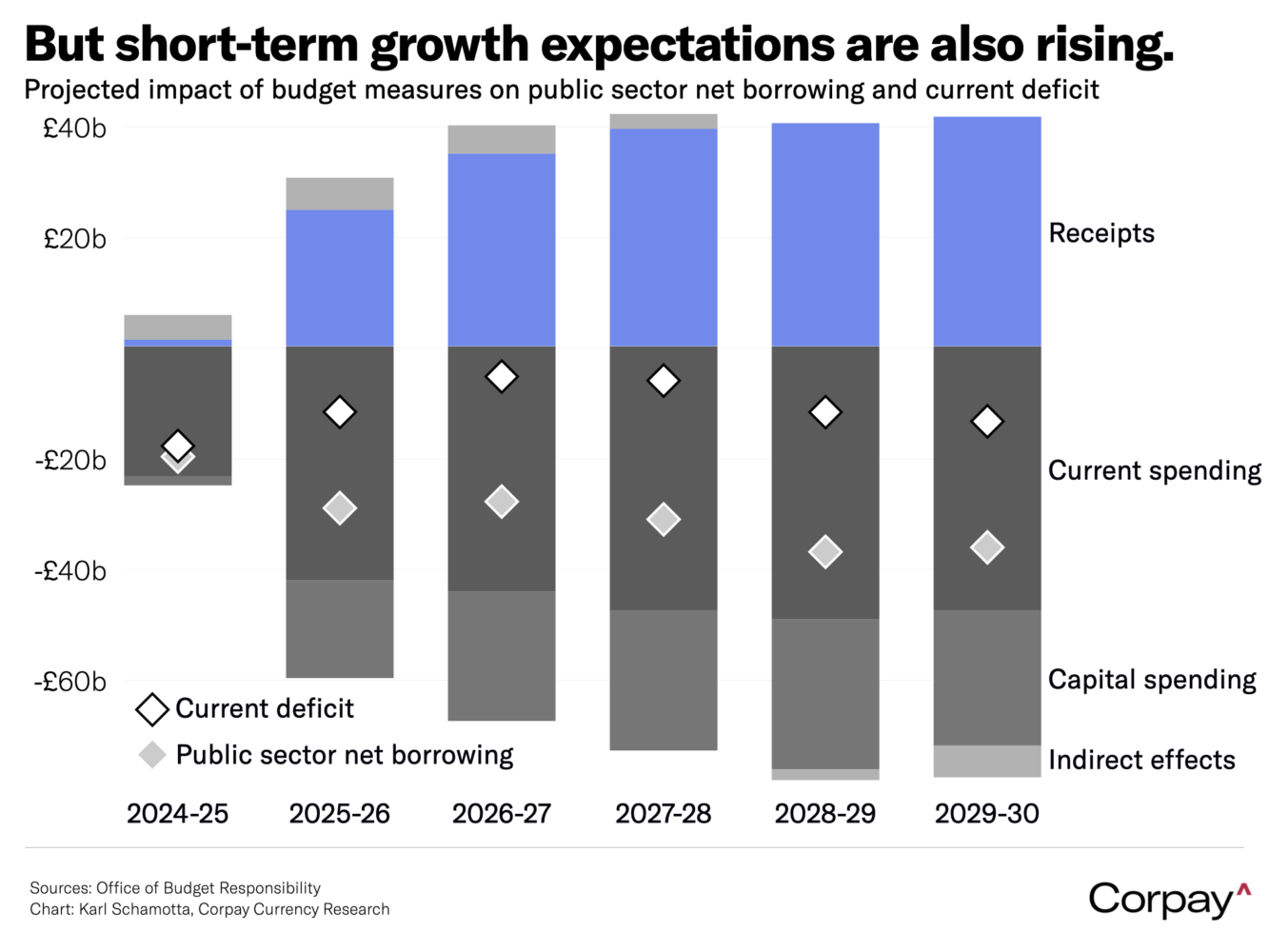

Across the pond, gilt yields are trading near their highest levels since November last year as investors process the implications of yesterday’s Autumn Budget. On the face of it, it would seem that markets are nervous about the implications for the country’s sovereign finances: under the proposed measures, the Office for Budget Responsibility expects current deficits to widen, with the government’s borrowing increasing by £36 billion pounds – approximately 1.3 percent of gross domestic product each year – over the next five fiscal years. The spread between British ten-year yields and their German equivalents is holding above 2 percent.

But expectations for the Bank of England’s easing trajectory have also been pulled back, and the pound has held steady. This suggests that the temporal difference between spending increases – heavily front-loaded – and a higher tax burden – set to arrive at a delay – is helping bolster growth expectations in the short term. Investors think the central bank will cut rates more carefully than previously anticipated, with four moves now priced into overnight index swaps before the end of 2025, down from the six that had been projected earlier in the month.

The euro is trading on a modestly-stronger footing after headline inflation came in slightly above expectations, further trimming the odds on a half-percentage-point rate cut at the European Central Bank’s December meeting. Eurostat’s all-items price basket climbed 2 percent in the year to October, above the 1.9 percent consensus expectation, and core inflation held at 2.7 percent year-over-year. Overnight index swap markets are now putting sub-20-percent probabilities on an outsized move in December, down from above 40 percent last week.

The Bank of Japan left benchmark rates unchanged in last night’s decision, but signalled its intent to continue tightening policy in the coming months, helping kick the yen almost a full percentage point higher. In the post-decision press conference, Governor Ueda said “developments in wages and prices have been in line with our projections”. “Regarding overseas factors, including the US, we’ve been looking at the downside risks, but that fog is starting to clear,” and “Needless to say, new risks could emerge depending on the policies coming from the new US president,” but “If the outlook for the economy and prices is realised, then I believe we will need to continue raising interest rates and adjust the level of monetary easing accordingly”.