The dollar is tumbling against most of its major rivals after a private-sector report showed employers slashing payrolls by far more than anticipated, raising market-implied odds on a third consecutive rate cut at the Federal Reserve’s December meeting. According to the Challenger, Gray, and Christmas job cut report—not typically a market-moving release—businesses laid off 153,074 people in October, up 175 percent from the 55,597 announced in the same month last year, and up sharply from the 54,064 announced in September. Policy-sensitive two-year Treasury yields are back below the 3.6-percent mark, equity futures are setting up for incremental gains at the open, the greenback is down roughly a third of a percent, and currencies like the Canadian dollar, euro, and pound are all trading back above key technical levels.

The data stands in sharp contradiction to yesterday’s Institute of Supply Management report, which showed activity in the US services sector expanding more quickly than expected last month. The headline services index climbed to 52.4 in October, up sharply from the prior month, and well above the 50 threshold that separates expansion from contraction. The employment sub-index contracted at a slower pace than in the month prior, the current conditions measure rose to 54.3, and new orders leapt to 56.2, while the prices-paid component hit 70—marking its highest level since 2022, and pointing to an intensification in inflation pressures.

We would therefore caution against expecting this morning’s reaction to hold. With official data releases suspended, traders are operating without reliable government figures and are likely to prove reluctant to chase momentum or take large directional positions on numbers that could later be revised away. For hedgers, episodes of volatility like the one underway should be seen as a source of tactical opportunity rather than evidence of a durable shift in trend.

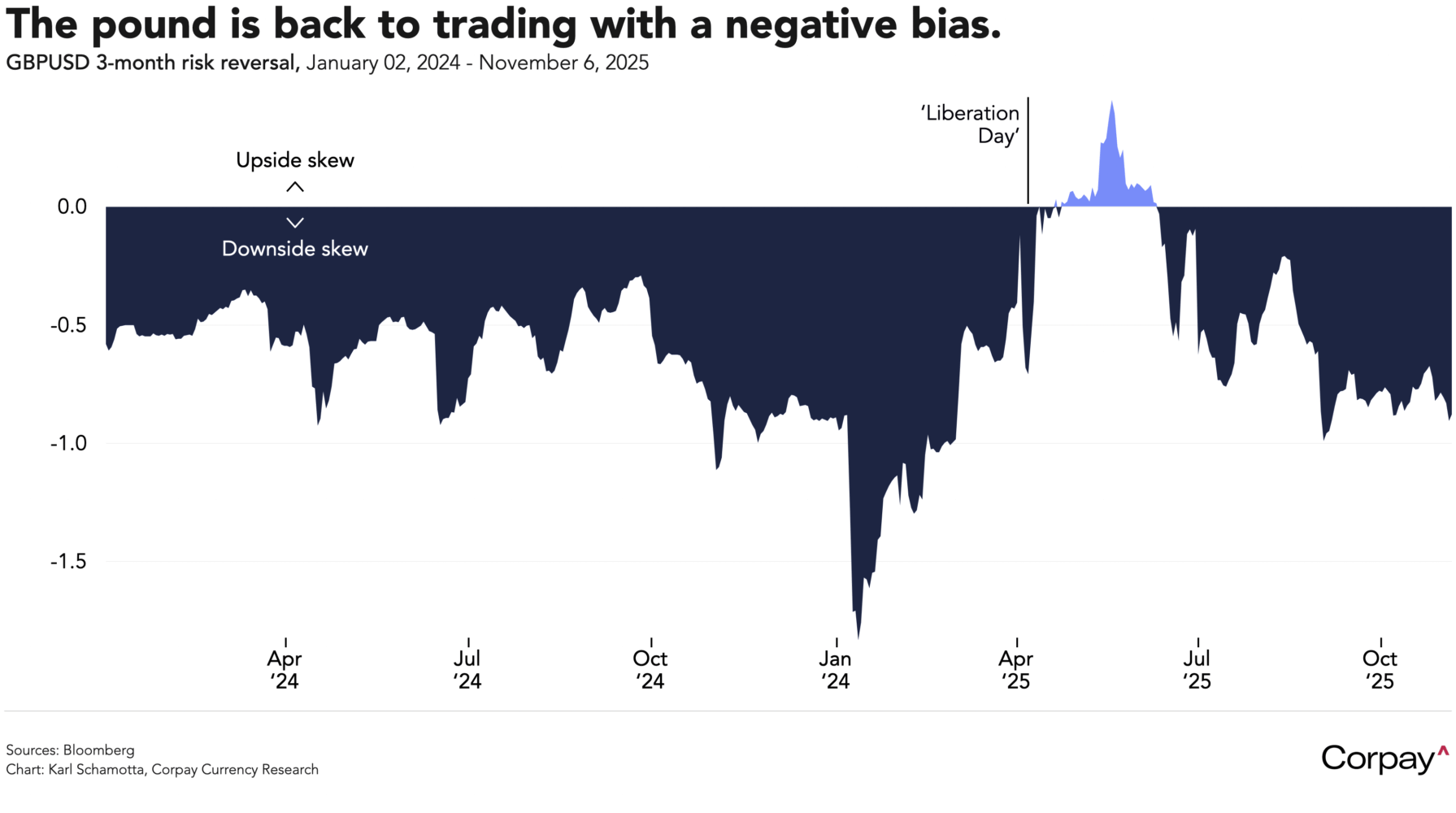

The British pound is paring its gains after the Bank of England left rates unchanged in a decision that opened the door to a move in the coming months. Officials on the central bank’s rate-setting committee voted by a 5-to-4 margin to keep the Bank Rate at 4 percent, but altered the statement language to acknowledge that policy was “likely to continue on a gradual downward path”. Governor Bailey noted that inflation risks had become “less pressing” since August, and Sarah Breeden warned that downside risks to demand “have become more prominent”. Traders are now assigning two-in-three odds to a cut in December, and are maintaining a bearish bias on the pound ahead of the government’s upcoming budget, in which Chancellor Rachel Reeves is expected to unveil a somewhat-deflationary mix of tax increases and spending cuts.

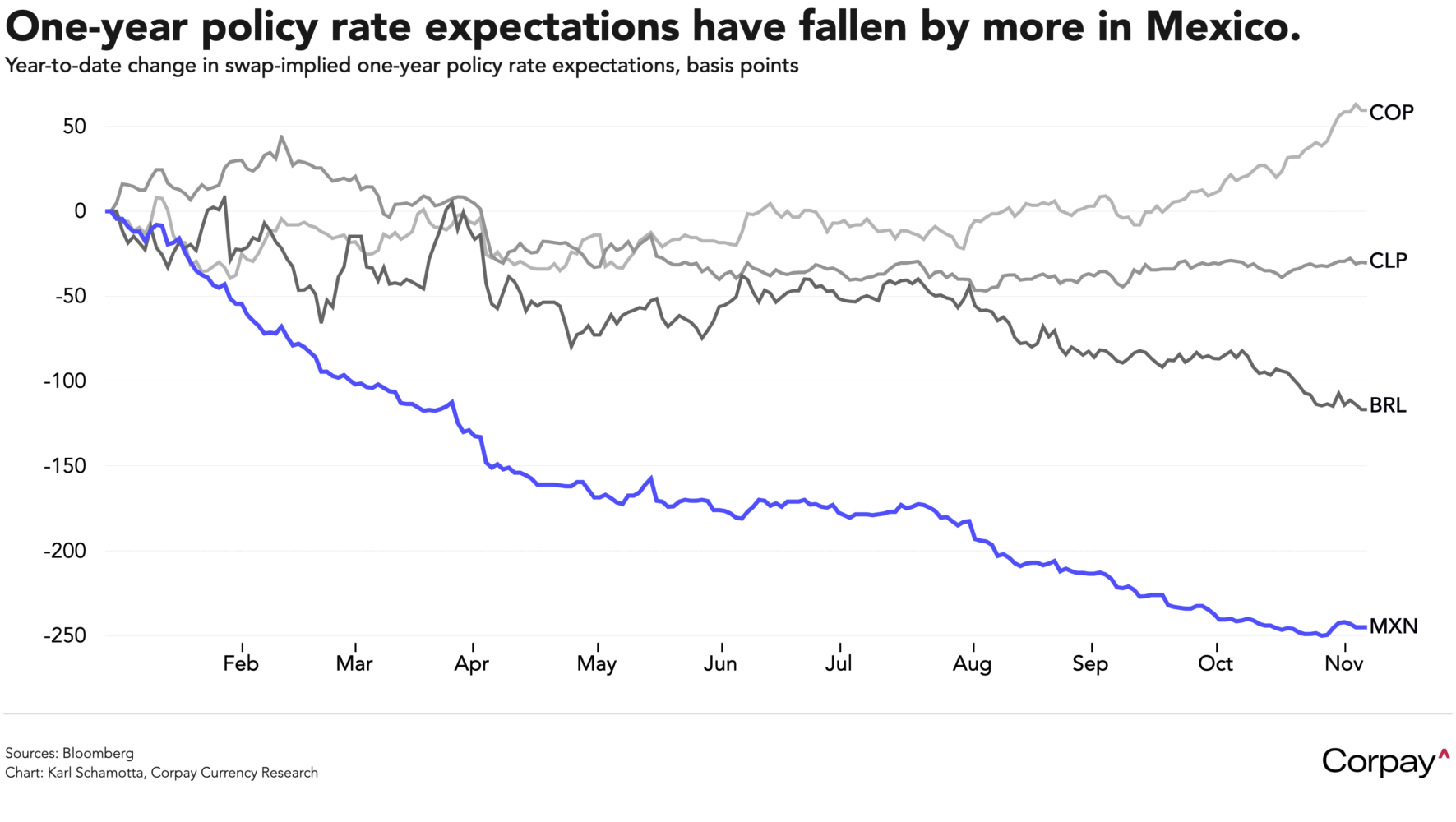

Markets expect Mexico’s central bank to deliver another rate cut this afternoon as inflation pressures ease and the economic outlook dims. Deputy Governor Heath, an inflation hawk, might dissent once again in favour of staying on hold, but the bulk of the committee should remain focused on downside risks to remittances, trade, domestic demand, and inflation, and are likely to vote for continued gradual easing. Year-ahead policy expectations have come down by more in Mexico than in other major Latin American economies this year, and we think prospective carry returns could erode by more in the months ahead as changes in US policy add to the structural headwinds facing the economy. The peso’s long run of outperformance seems doomed to fade, even if outright declines don’t materialise.

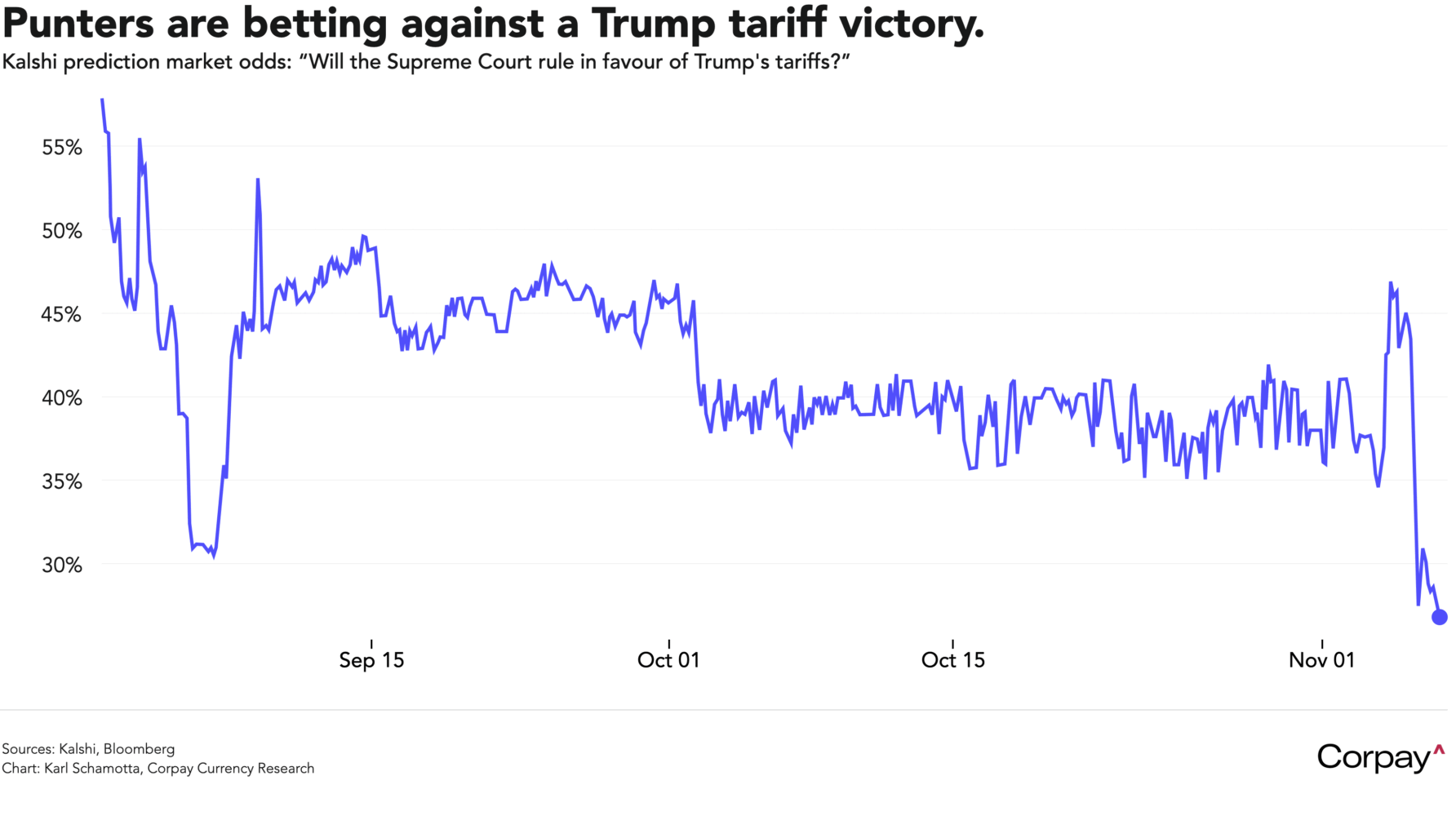

Yields and equity markets climbed during yesterday’s Supreme Court hearing on Donald Trump’s tariffs, suggesting that investors see a tax cut on the horizon. In the high-profile hearing, a number of justices—including those on the Republican end of the political spectrum—expressed deep reservations about the president’s expansive use of the International Emergency Economic Powers Act (IEEPA) and questioned whether a law intended for foreign policy crises could legitimately be stretched to usurp Congress’s constitutional control over taxation. A few seemed open to the administration’s national-security rationale, while others—including Chief Justice John Roberts and Justice Neil Gorsuch—warned against allowing emergency powers to serve as a backdoor expansion of executive power. No one knows what the verdict will be—and the discussion during introductory arguments can be deceptive—but prediction market odds on an administration victory plunged during the hearing, and haven’t recovered since.

Should the administration lose, most observers expect to see a narrower, more restrained set of levies implemented. At first glance, this may appear to be a distinction without a difference. However, replacing broad “reciprocal” tariffs with measures targeted at specific products and sectors would make them harder to implement and subject to greater Congressional oversight. For countries like Canada, the practical impact may be minimal—most US taxes on Canadian imports are already imposed under Section 232—but policy uncertainty could ease as the president’s negotiating latitude narrows.

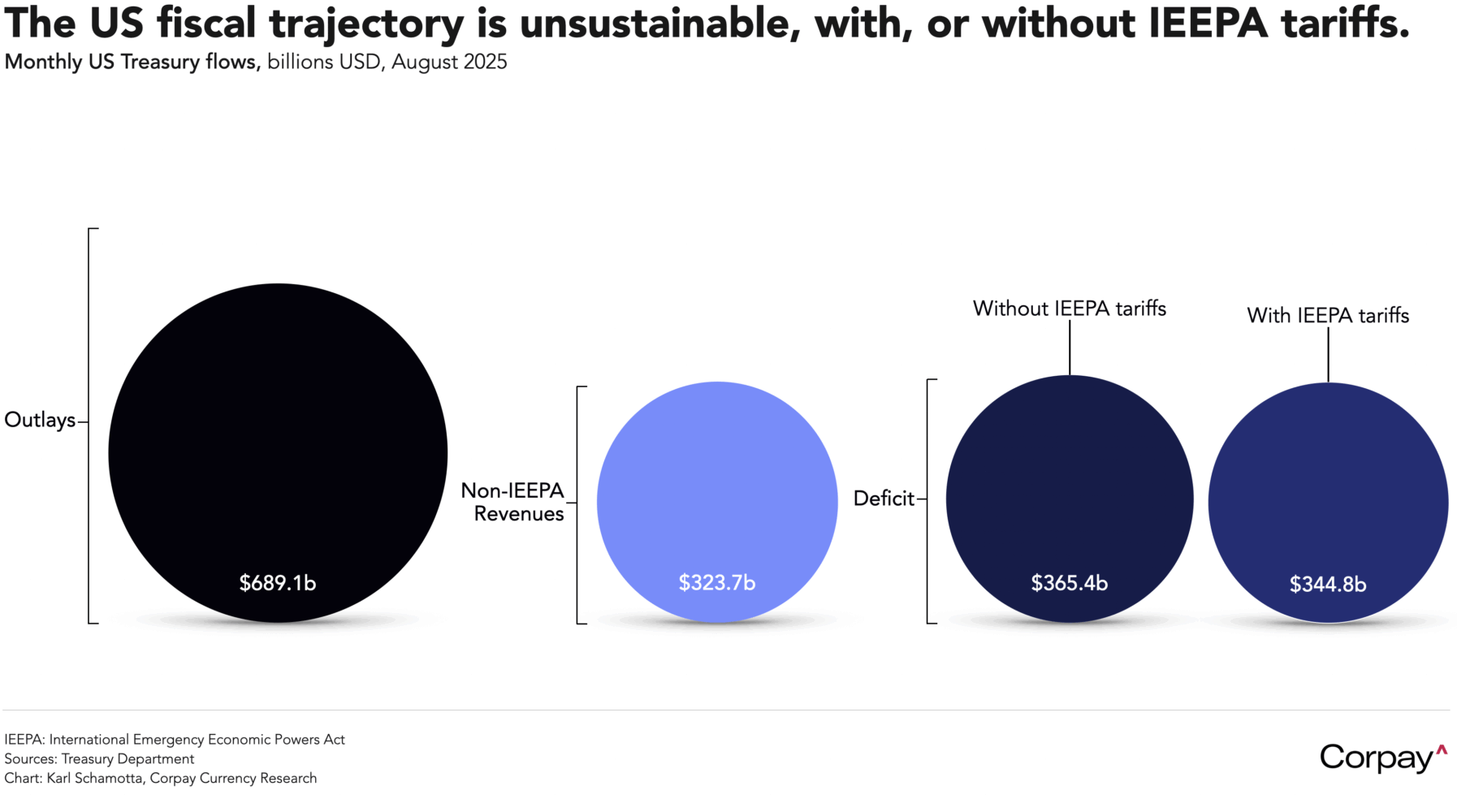

Some have argued that a rollback in the IEEPA tariffs could lead to a substantial rise in interest rates and a decline in the dollar as the US fiscal position worsens. I find this unconvincing. The gap between federal spending and revenues dwarfs tariff proceeds, and will continue to do so under any credible forecast—particularly given the fiscal provisions enacted in the Big Beautiful Bill Act. Investors are not going to abandon US assets in reaction to a reduction in the tariff offset. If anything, the prospect of a more efficient, less distortionary economy could prove supportive for the dollar.