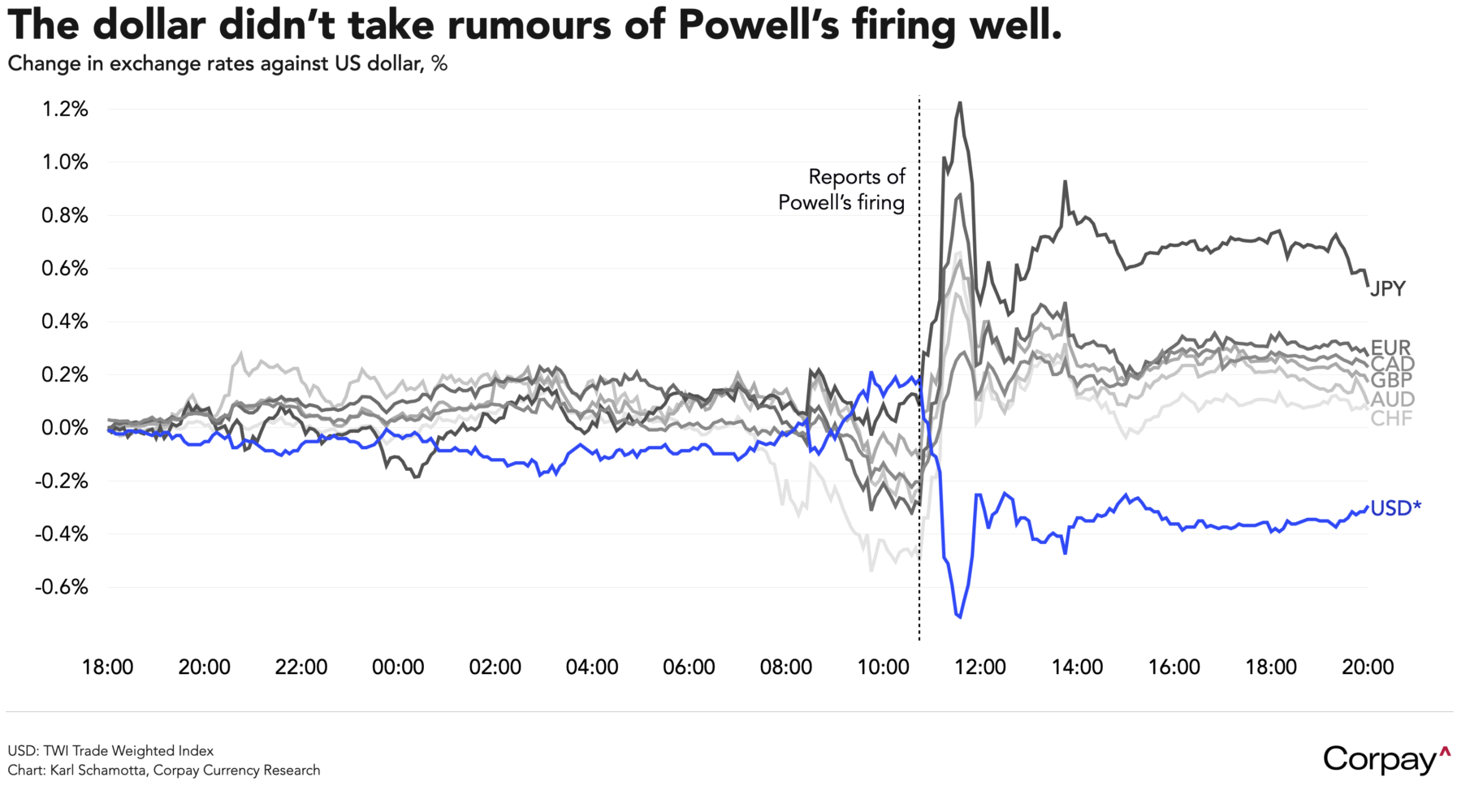

The dollar is resuming its upward climb and bond markets are stabilising after suffering a short-lived bout of extreme volatility early in yesterday’s session on speculation surrounding the potential firing of Federal Reserve chair Jerome Powell. Most major currencies are down between 1 and 1.5 percent against the greenback this week as the world’s most central currency enjoys a technical recovery against its peers.

If yesterday was a test run to see how investors would take the early dismissal of Jerome Powell, it didn’t go particularly well. The dollar slumped, short-term Treasury yields tumbled, long-term yields soared, and equity indices fell early in the session after several major news outlets reported that Donald Trump had met Congressional Republicans on Tuesday evening to discuss firing Powell, and that he had gone so far as to show them a draft termination letter. Less than an hour later, the president acknowledged the meeting, saying “I talked to them about the concept of firing him. I said, ‘What do you think?’ Almost all of them said I should” before denying that he would make an attempt to oust the Fed chair. Markets recovered—but the “risk premia” embedded in Treasury yields remained elevated—after he said “We’re not planning on doing anything… I don’t rule out anything, but I think it’s highly unlikely. Unless he has to leave for fraud.”

Trump later put pressure on emerging market currencies, saying that he would soon send letters to more than 150 countries informing them of “blanket” tariff rates between 10 and 15 percent.“We’ll have well over 150 countries that we’re just going to send a notice of payment out, and the notice of payment is going to say what the tariff” will be, he told reporters. “It’s all going to be the same for everyone,” but they are “not big countries, and they don’t do that much business.”

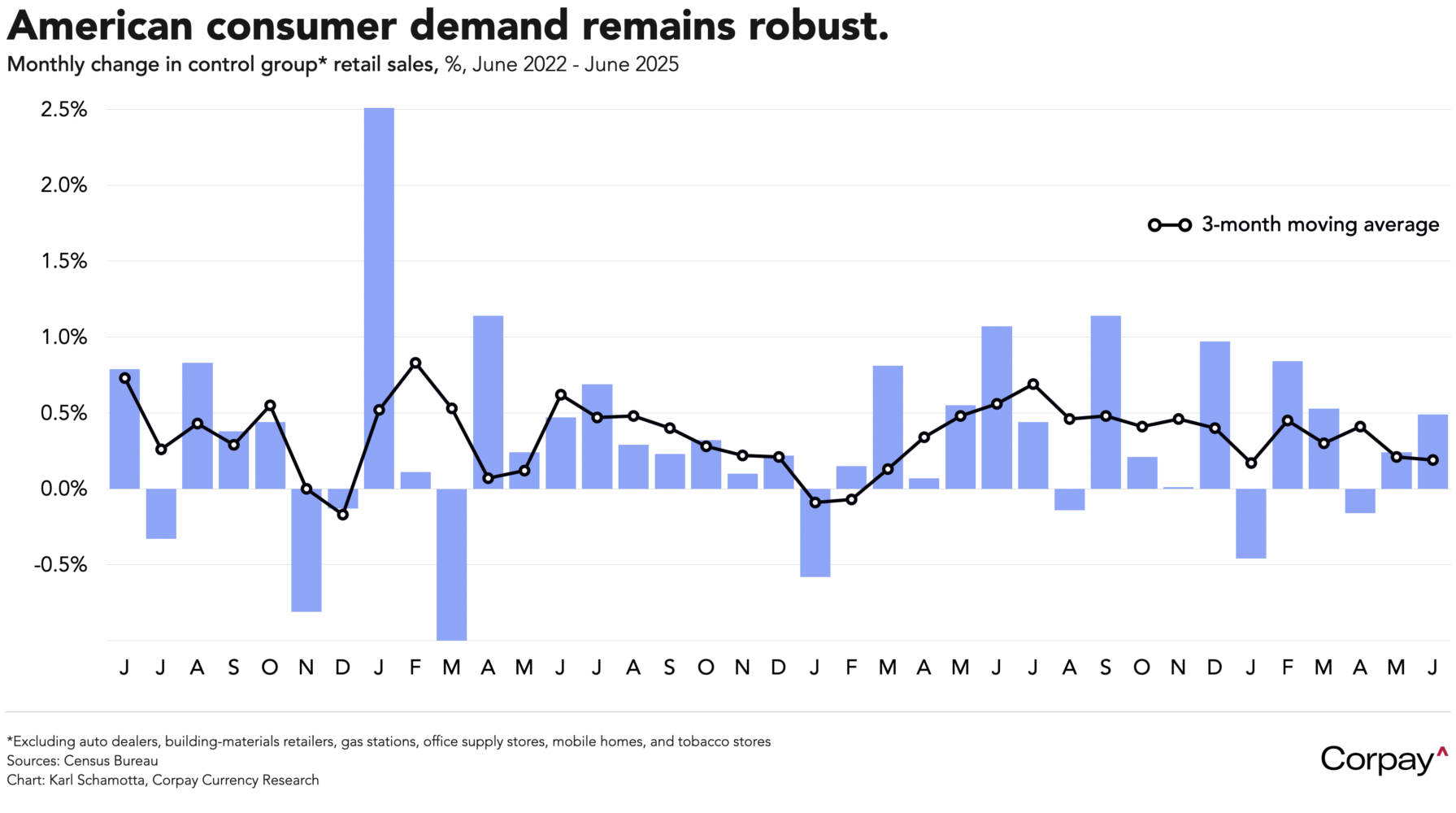

US retail spending climbed more than expected last month, again topping market estimates in a sign that an early-year plunge in consumer sentiment levels has—yet again—not translated into overall behaviour patterns. According to figures published by the Census Bureau this morning, so-called “control group” retail sales—with gasoline, cars, food services, and building materials excluded—rose 0.5 percent in June, beating forecasts set at 0.3 percent. Total receipts at retail stores, online sellers and restaurants rose 0.6 percent on a month-over-month basis, following a downwardly-revised -0.9-percent loss in the prior month as most products outside the tariff-impacted furniture and electronics categories posted growth. Markets were expecting a 0.1-percent monthly headline expansion, with auto sales exhibiting clear “bullwhip” effects related to newly-implemented levies on vehicles, as well as steel and aluminum.

Inflation concerns are still simmering in the background. According to yesterday’s Federal Reserve’s Beige Book survey—a compilation of anecdotes collected from across the central bank’s districts—businesses think prices will keep pushing higher. “Contacts in a wide range of industries expected cost pressures to remain elevated in the coming months,” it said, “increasing the likelihood that consumer prices will start to rise more rapidly by late summer”. In a closely-watched speech last night, New York Fed President Williams suggested that he expects inflation pressures to intensify in the coming months, keeping the central bank sidelined for now. “For items that are more exposed to higher tariffs … price increases so far this year have been well above what one would expect based on past trends,” he said, “Maintaining [the currently] modestly restrictive stance of monetary policy is entirely appropriate to achieve our maximum employment and price stability goals”. Futures markets are now priced for two rate cuts by year end, down from three at the start of the month.

Earlier in the session, labour market data from the United Kingdom showed conditions cooling at a gradual pace, helping clear the way for a rate cut at the Bank of England’s next meeting, while stopping short of providing support for back-to-back moves in the autumn. According to the Office for National Statistics, private sector pay packets climbed 4.9 percent in the three months ended in May, down from 5.2 percent previously, and the unemployment rate rose to 4.7 percent over the same period, up from 4.6 percent. 25,000 jobs were cut in May, and an early projection for June showed a further 41,000 positions lost. However, a series of positive revisions were made that brought the total number of jobs lost over the last year to just 178,000, or 0.6 percent of the total workforce: a pace indicative of slowing, but not collapsing, demand for workers. Traders are placing 90 percent odds on a rate cut in August, and have almost 50 basis points in easing priced in by year end, down from 55 on Tuesday.

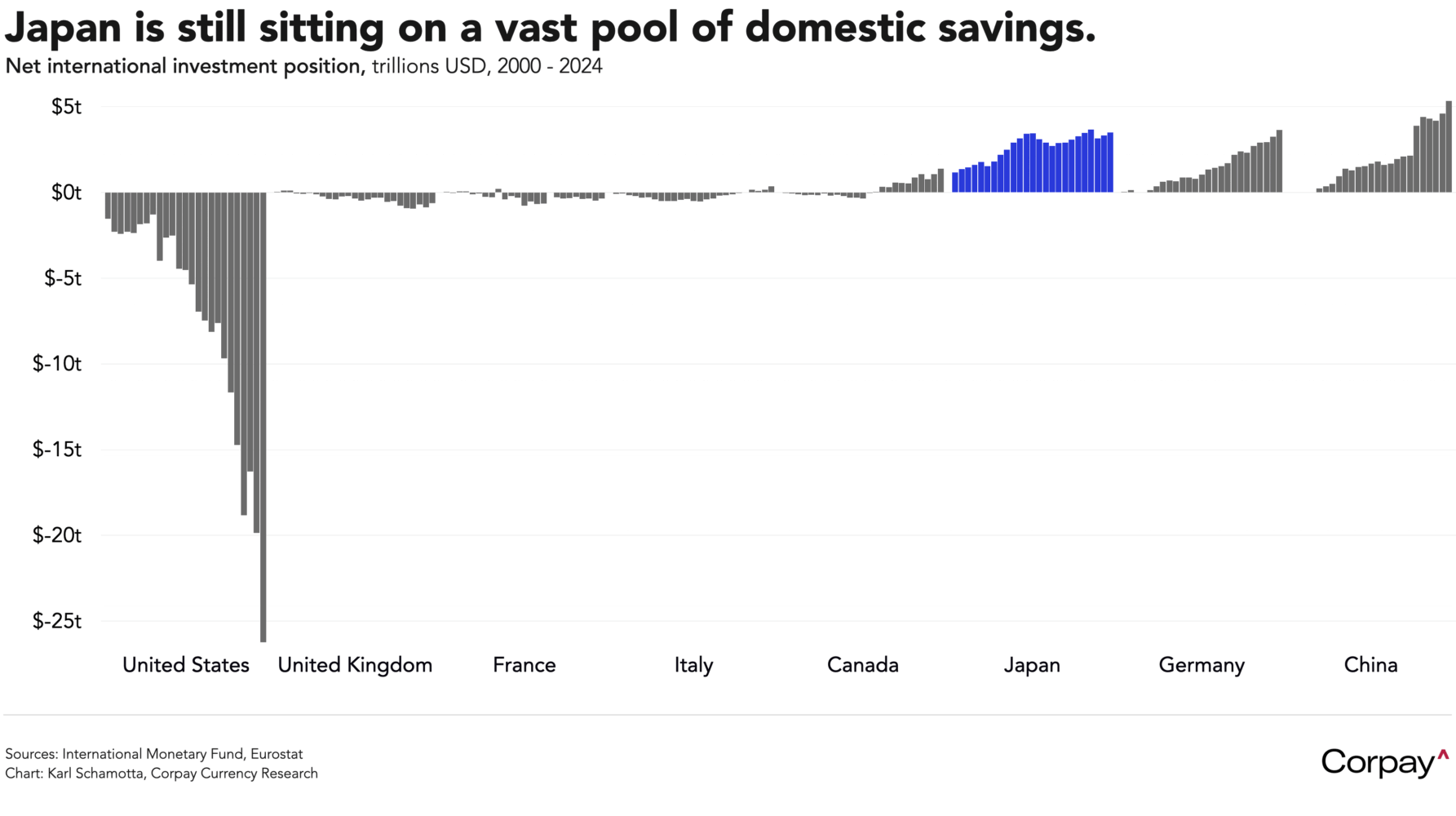

On the other side of the globe, the Japanese yen is flirting with the 150 threshold as traders brace for a more extensive fiscal expansion after this weekend’s upper house election. Polling suggests that Shigeru Ishiba’s Liberal Democratic Party-led ruling coalition could fail to secure a majority, forcing the government to launch new spending initiatives that could drive overall public debt levels—already, at 220 percent of gross domestic product, the highest among major developed economies—even higher. Long-term Japanese yields have surged in recent months, pointing to increased concern among global investors surrounding the country’s long-term growth path amid a weakening in export volumes, the government’s fiscal trajectory, and the yen’s role as a safe haven. We suspect this is somewhat overdone: pressure on the current account has thus far come mostly from Japanese automakers engaging in price wars amongst themselves and their Chinese competitors, and Japan’s net international investment position remains strongly positive, meaning that it is not reliant on the “kindness of strangers” to keep its finances afloat. But technical momentum is clearly bearish, and the currency could easily punch through into the mid-150’s if conditions continue to worsen.

Ahead today, Fed Governor Adriana Kugler is set to speak on the US economic outlook at 10 am, San Francisco President Mary Daly will join a moderated conversation at 12:45, and Governor Christopher Waller will present his views on the economic outlook at 6:30 pm. Next week will usher in a slightly slower cadence of data releases, with the Bank of Canada’s quarterly business and consumer sentiment surveys coming into focus on Monday, and a European Central Bank decision landing on Thursday. Expectations for a rate cut from Madame Lagarde & Cie are practically non-existent, but investors will be alert for guidance on the path ahead as the common currency bloc navigates increasingly-contradictory cross-currents.