Foreign exchange markets are trading on a mixed footing this morning as the US government data backlog begins to clear and investors brace for a series of critical corporate earnings releases. Equity futures are pointing to a firmer open (although this may be a Pavlovian response to a ten-week winning streak on Mondays), and benchmark Treasury yields are creeping up ahead of appearances from Fed officials including Governors Jefferson and Waller later today. The dollar is outperforming pro-cyclical currencies like the Australian and Canadian dollars, holding its own against the British pound and euro—which are clinging to technical resistance levels in thin trading—and edging higher against the safe-haven Swiss franc and Japanese yen.

Expectations for a rate cut at next month’s Federal Reserve meeting have collapsed under a drumbeat of hawkish remarks from policymakers. After Jerome Powell cautioned in late October that a move was hardly a “foregone conclusion—in fact, far from it,” at least four officials have since struck an overtly-hawkish tone (by our subjective tally), six have positioned themselves in neutral territory, and four have remained dovish. Minutes from the October meeting, due Wednesday, are likely to underscore the extent of these “strongly differing views,” leaving investors with a heightened sense of uncertainty over the eventual outcome.

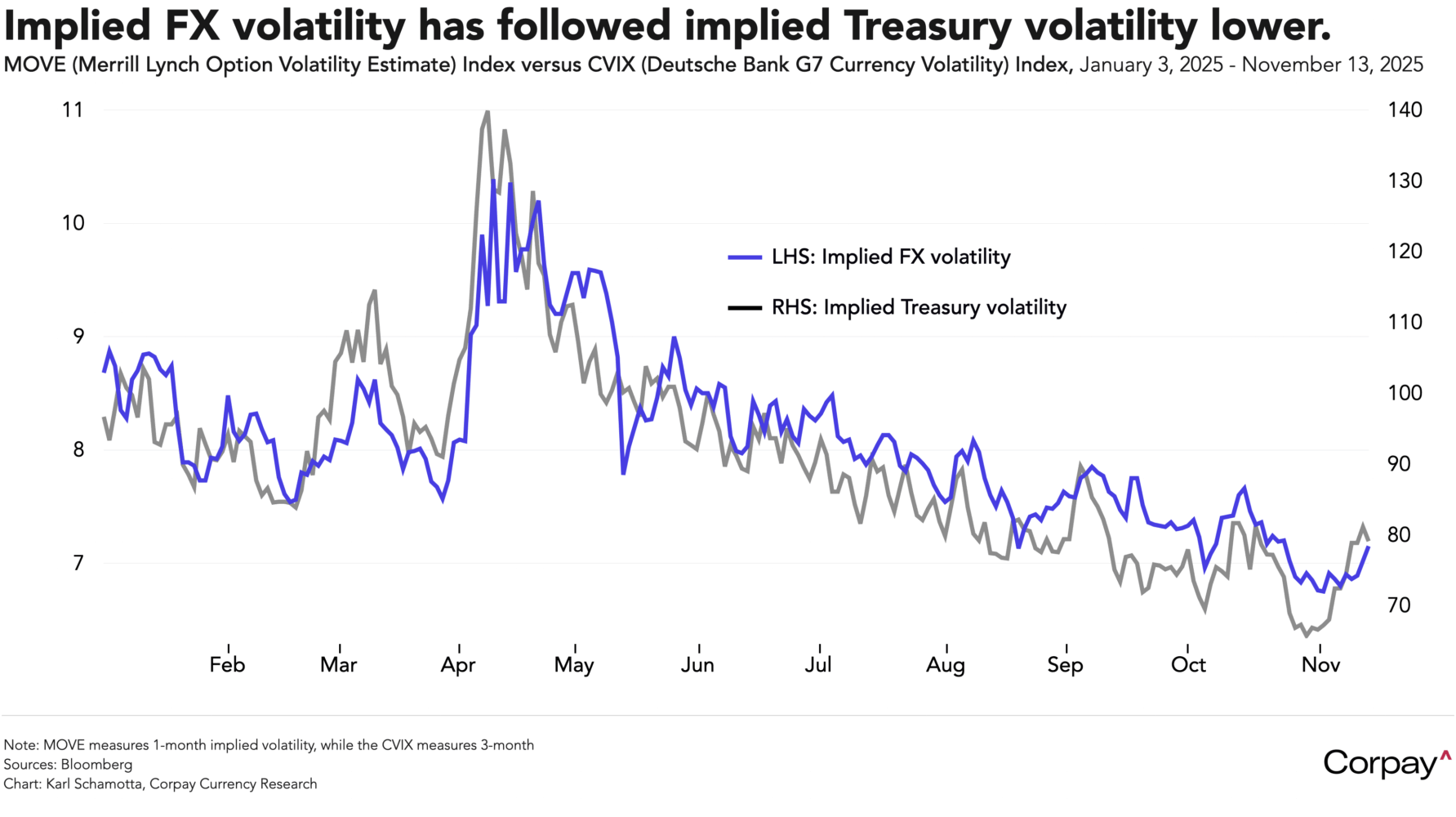

We think this week’s official data releases will have little bearing on foreign-exchange markets. The second-tier indicators due in the days ahead are badly out of date, and Thursday’s non-farm payrolls report is broadly expected to confirm what investors already believe—that job creation was slowing in September—without shedding light on how labour-market conditions have shifted since. With such an incomplete read on the underlying economy, traders are likely to remain wary of taking heavy directional risk, and implied volatility in currency markets—which has mirrored developments in Treasury markets through most of this year—should remain restrained. Data published in early December should prove far more pivotal.

Instead, corporate earnings could provide the spark for a widening in trading ranges. With consumer-spending bellwethers such as Home Depot, Target, and Walmart releasing results, and Nvidia—the emblem of the artificial-intelligence boom—reporting on Wednesday, investors may gain a clearer—and more actionable—read on the economy’s underlying growth dynamics. Continued earnings strength would add to the argument for a pause in the Fed’s easing cycle—and support dollar strength—while a slowdown might have the opposite effect.

Canadian economists expect this morning’s update to show inflation remaining too hot for comfort in October, with core prices seen rising 3.0 percent year-over-year compared with a 2.1 percent gain in the headline index. A surprise could stir speculation around the Bank of Canada’s next step, but we suspect any reaction will prove fleeting. Governor Tiff Macklem and his colleagues have clearly raised the threshold for further policy action, and markets have taken note—suggesting that fixed-income instruments and the exchange rate should grow increasingly indifferent to incremental shifts in the inflation data.