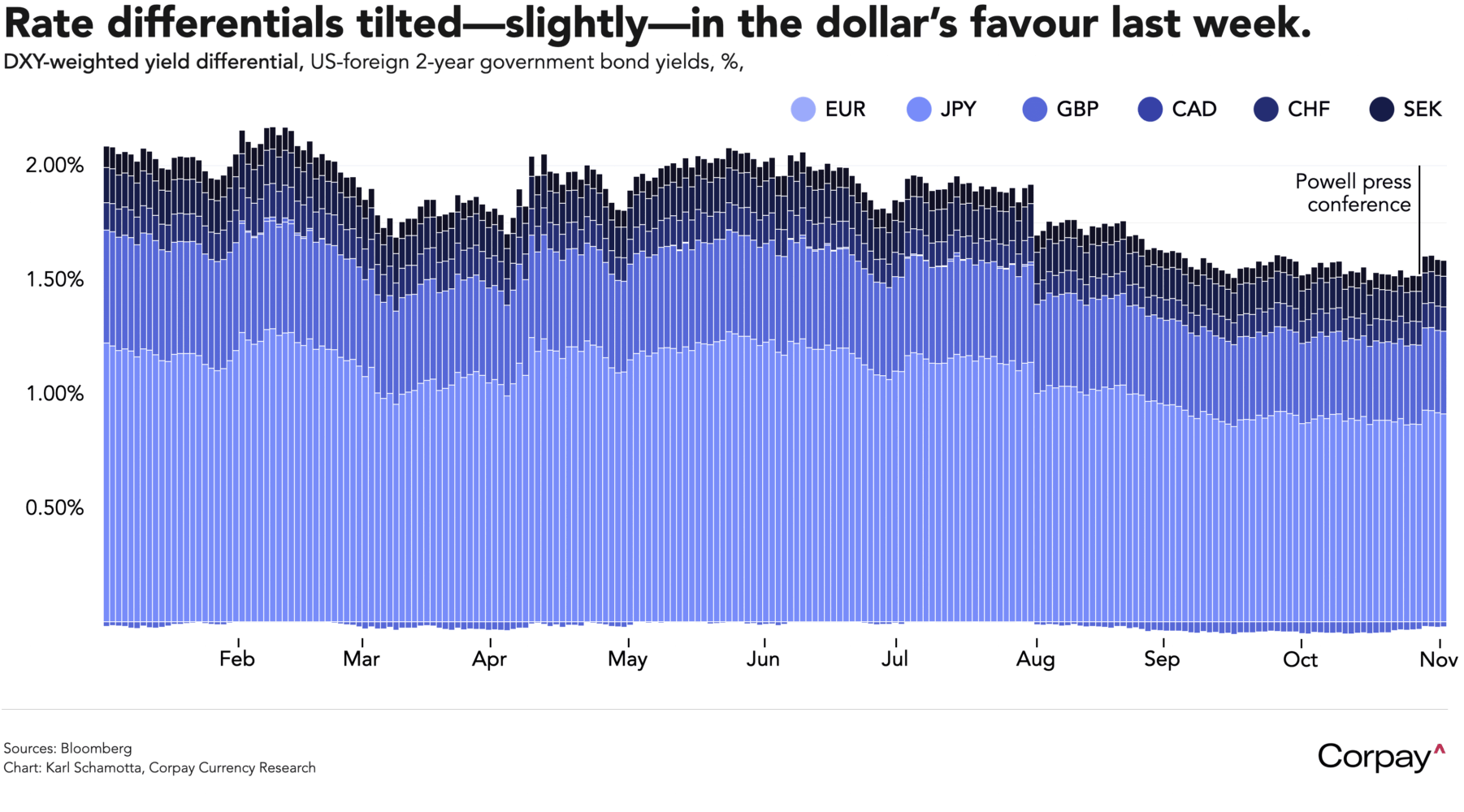

The dollar is starting November on a firm footing, edging higher against a basket of its major rivals after Federal Reserve Chair Jerome Powell last week repeatedly warned markets against expecting more monetary easing in December. Over the past four sessions, front-end rate differentials have shifted slightly in favour of the greenback—enhancing its relative appeal—and strong earnings from a number of the biggest technology names have enhanced foreign investor interest in American equities, adding further support to the currency.

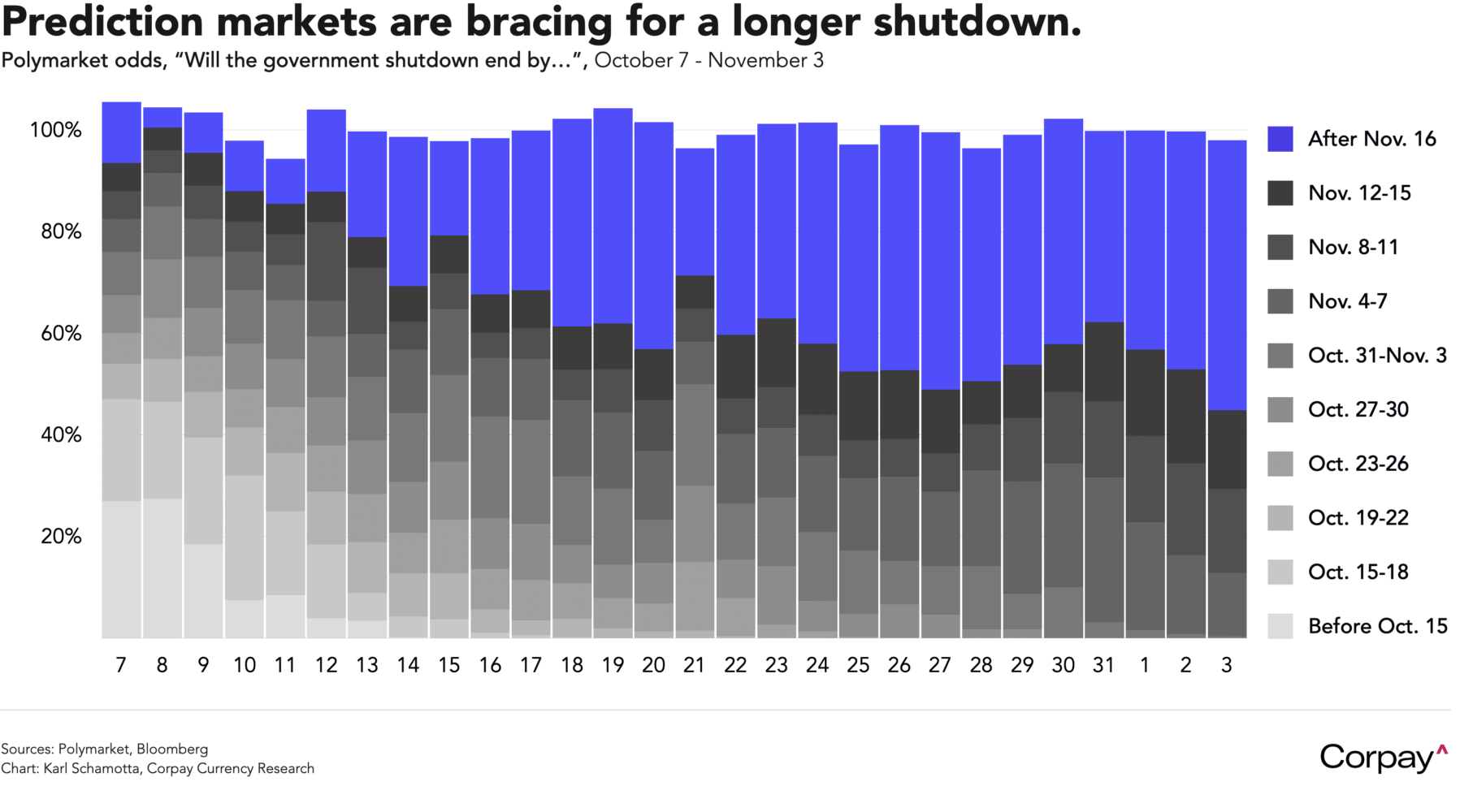

The US government shutdown is now in its 34th day and will on Wednesday become the longest ever. With leaders showing no sign of budging and polls pointing to an unusual level of apathy among voters, punters on Polymarket, a prediction market, are becoming convinced that the impasse will drag on past the 15th. The weekend’s expiration of Obamacare subsidies might change this dynamic, and staffing-related shutdowns at airports* could lead to a compromise in the coming weeks, but for now, investors will be left “driving in the fog” (to use Chair Powell’s words), relying on private-sector data and anecdotal evidence to feel the way ahead.

Here in North America, traders will have a wide assortment of second-tier data releases to chew on in the days ahead. On the US side of the border, the Institute for Supply Management’s manufacturing and services sector surveys, the Johnson Redbook retail sales report, Challenger layoffs, ADP private payrolls, and University of Michigan’s preliminary November consumer survey will all help calibrate views on the American economy—which to all appearances isn’t demonstrating a clear slowing bias. In Canada, a negative surprise in Friday’s employment report could add to the bearishness weighing on the loonie—particularly after last week’s disappointing growth data—while a more positive report might help alleviate some of the gloom**.

We think Wednesday’s Supreme Court tariff hearing will be light on tradeable insights for markets. After three lower court rulings against Donald Trump’s use of the International Emergency Economic Powers Act in imposing punitively-high taxes on American importers, investors will seek to evaluate the strength of the cases presented in oral arguments. But the highest-ranking justices in the country could then take many months to assess the evidence, weigh various options, and arrive at a verdict—and there is every likelihood that the administration will ultimately execute an end-run around any decision by implementing tariffs through other legal avenues.

The Bank of England’s Thursday decision could be a close-run thing. Data updates published since the Bank’s last meeting have illustrated a clear slowing in momentum across the UK economy, with economic growth barely remaining positive, wage gains ebbing, and headline and services price pressures weakening more than expected. Markets are bracing for a dovish shift in the balance of opinion on the Monetary Policy Committee and are putting nearly one-in-three odds on a rate cut—up substantially from early October levels—but conviction is low, given that policy changes embedded in the government’s November 26 Autumn Budget might carry major implications for growth and inflation. Against this backdrop, it is clear that violent moves could play out in currency markets around the decision itself, with the pound potentially vulnerable to a break through the 1.30 threshold against the dollar in the event of a dovish surprise—but also at risk of popping higher on a more confident and hawkish approach from policymakers.

*Previous shutdowns have ended when politicians found their travel plans disrupted. As Charlie Munger put it; “Show me the incentive and I’ll show you the outcome”.

**Although they often trigger big moves in currency markets, recent Canadian unemployment reports have been noisier than a baseball stadium during Game 7 of the World Series, and should therefore be given relatively short shrift in informing your views on the economy’s strength.