Last week’s modest recovery in the dollar is showing signs of exhaustion this morning as investors brace for a week dominated by speeches from Federal Reserve officials. Benchmark ten-year Treasury yields are holding near the 4.1-percent mark and stock market futures are pointing to incremental selling at the open after hitting new record highs in Friday’s session, while the euro and pound advance against the greenback amid a sluggish trading backdrop.

On the surface, this week’s macroeconomic calendar looks substantially less dangerous. A raft of purchasing manager indices, out tomorrow, should provide insight into how global economic conditions are evolving as tariff front-running effects begin to fade. A relatively-positive jobless claims number on Thursday might help reduce the perceived urgency for another rate cut, and Friday’s update in the Federal Reserve’s preferred inflation indicator—the core personal consumption expenditures index—could show underlying price pressures remaining elevated. Although we doubt tomorrow’s speech from the Bank of Canada’s Tiff Macklem on ‘global trade and capital flows’ will deliver any new market-moving insight, Friday’s July and August gross domestic product numbers might have an impact on expectations for the central bank’s October decision.

Noise levels will remain high, however, with the bulk of the Fed’s rate-setting committee set to venture out on the speaking circuit. At least eighteen appearances are scheduled, including (in rough order) New York’s Williams, Kansas City’s Musalem, Cleveland’s Hammack, Richmond’s Barkin, Governor Bowman, Atlanta’s Bostic, San Francisco’s Daly, Chicago’s Goolsbee, Governor Barr and Dallas’ Logan—and the volume could peak around today’s speech from Stephen Miran, along with tomorrow’s from chair Jerome Powell.

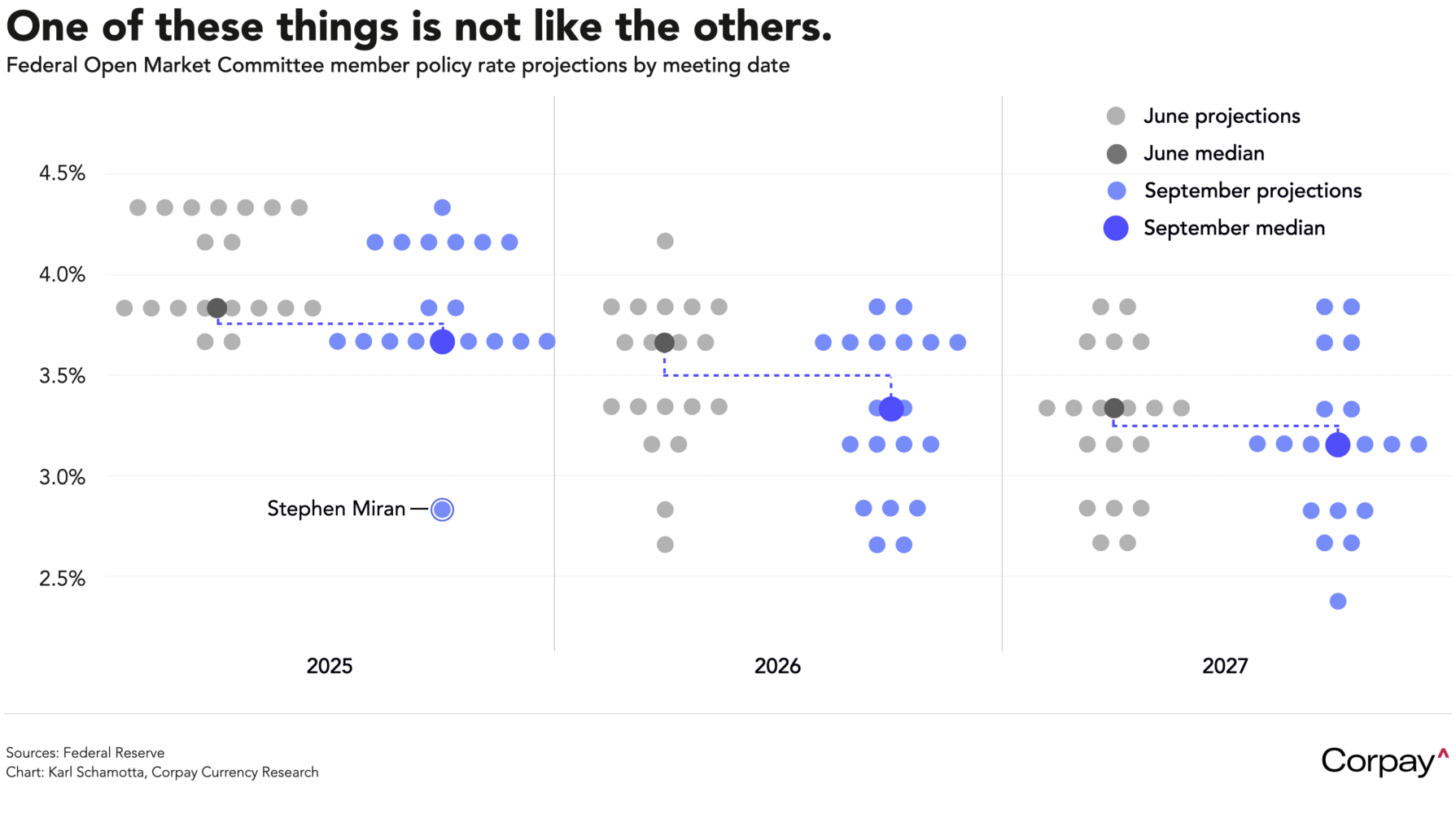

Miran’s views stand in sharp contrast to those of his fellow members on the central bank’s rate-setting committee, as well as the broader market consensus. The newly-appointed governor was the only member at last week’s meeting endorsing a larger-than-normal half-percentage-point rate cut, and also acknowledged submitting economic projections that would imply two additional half-point moves by year end, making for one of history’s more unusual Fed ‘dot plots’. In a CNBC appearance on the weekend, he said that President Trump had not directed him to ease policy, and promised to “give a full accounting for my economic views, and walk through in meticulous detail the economics and the arithmetic behind getting to those numbers” in today’s speech, which will be delivered at the Economic Club of New York around noon.

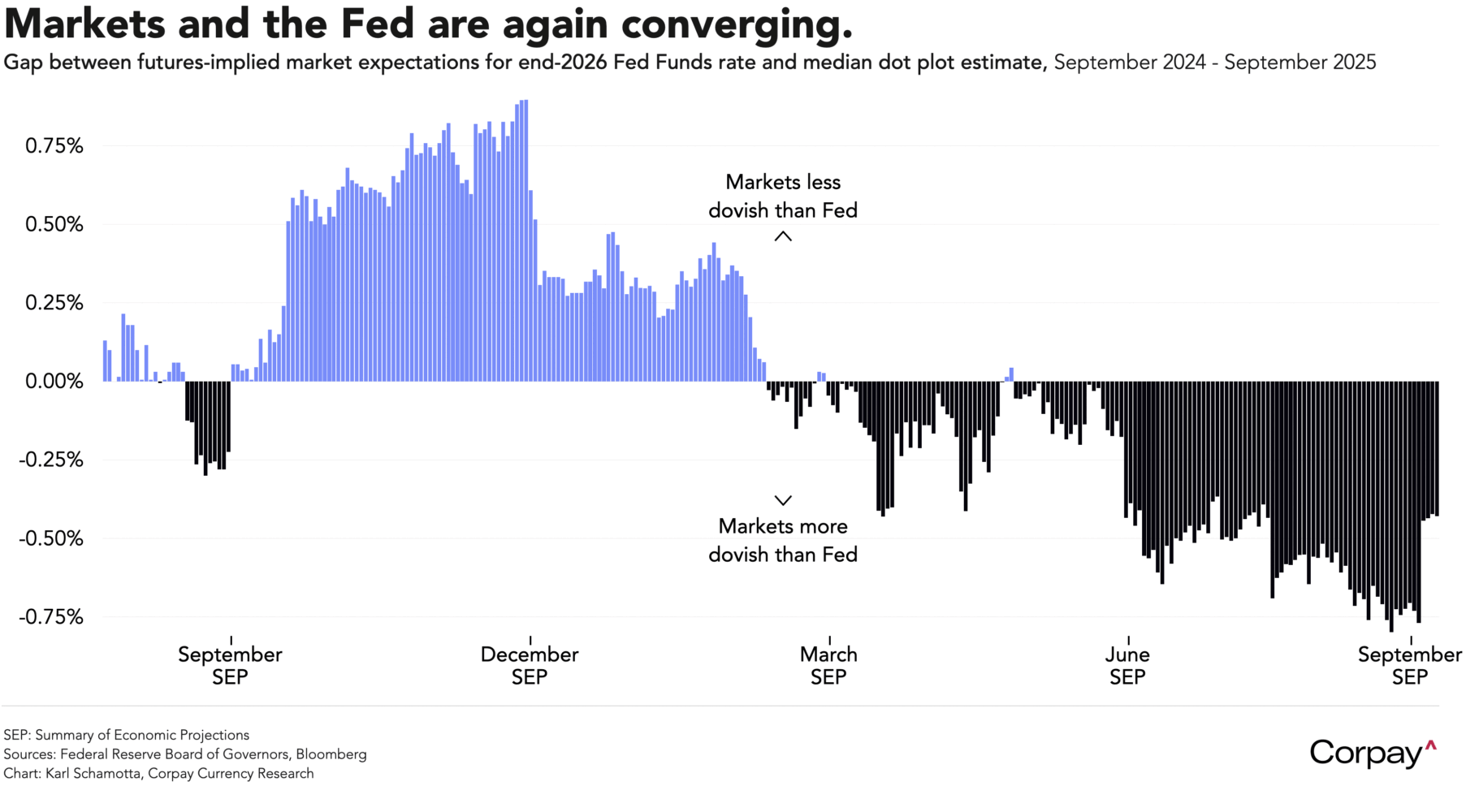

Chair Powell is likely to hew closer to the consensus in his comments on the economic outlook at the Greater Providence** Chamber of Commerce tomorrow. Speaking during last week’s post-decision press conference, Powell highlighted rising risks to the Fed’s employment mandate, but characterised the decision to ease borrowing costs as a “risk management” move, and said “We’re in a meeting-by-meeting situation”, with “no risk-free path ahead”. This aligns closely with the median expectation among his colleagues, who generally expect to cut rates three more times before the end of 2026, and isn’t materially distant from the four-and-a-half moves expected in markets.

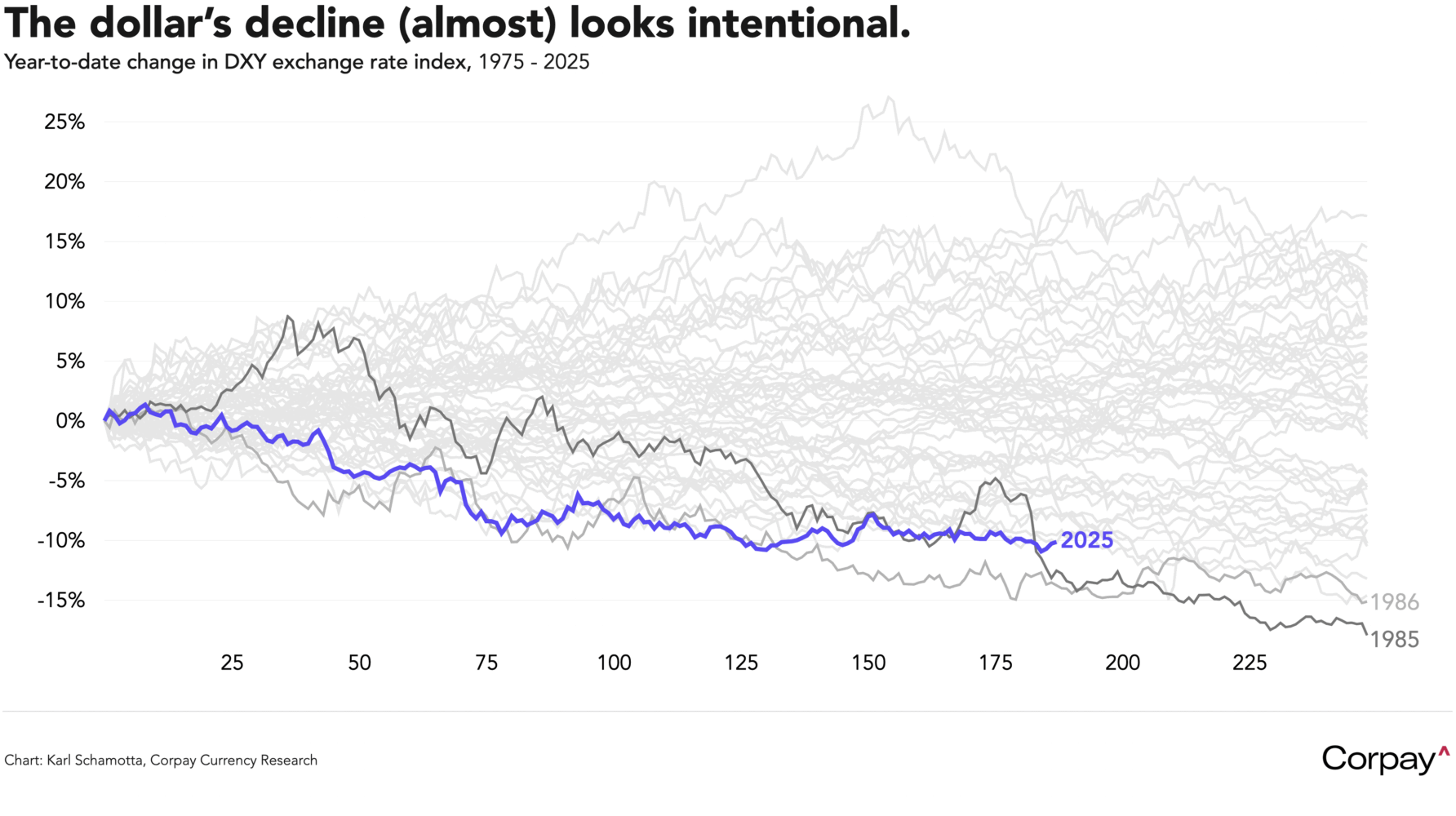

It is worth noting, however, that the dollar has declined in line with the new governor’s views on currency markets. In last year’s “A User’s Guide to Restructuring the Global Trading System,” Miran outlined some astonishingly destructive ideas—like an implicit default on US debt—but also expressed views on the greenback’s “exorbitant burden” that align well with the argument against global economic imbalances that many of us have advanced over the years. In its own eccentric fashion, the administration seems to have acted on this. Since 1975, the dollar has only suffered a steeper year-to-date decline during the engineered depreciation that followed the 1985 Plaza Accord. That makes today’s speech worth close attention.

**Yes, this is where a certain family-oriented cartoon character by the name of Peter Griffin resides. No, we cannot confirm whether Carter Pewterschmidt will be in attendance at this time.